Summary:

- AT&T is experiencing a stock breakout while overcoming a network outage that will impact Q1’24 results.

- The network outage resulted in bill credits and lost customers, but the impact is expected to be temporary.

- AT&T’s focus on generating free cash flow, repaying debt, and reducing interest expenses is driving the stock’s rally.

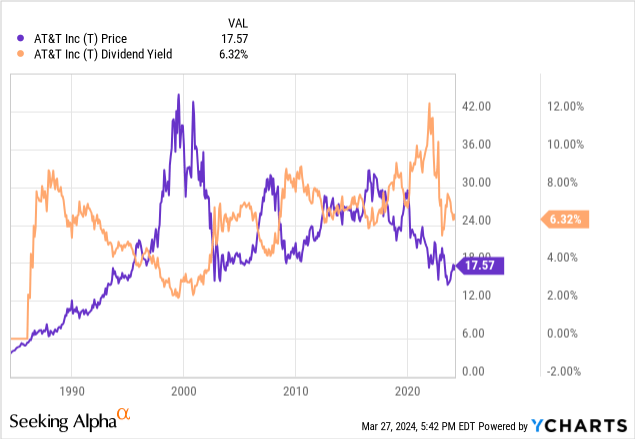

- The stock still offers a large 6.3% dividend yield despite a payout ratio heading towards only 45% this year.

jetcityimage

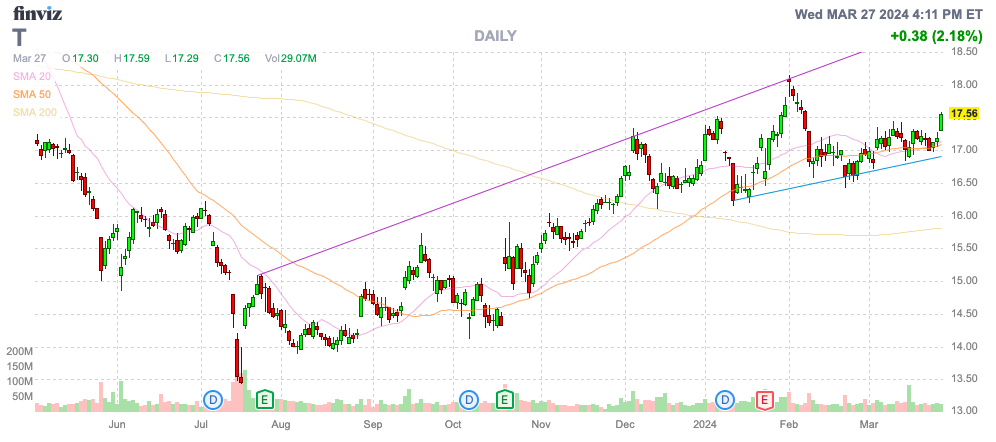

AT&T (NYSE:T) is climbing to new recent highs, with the stock in breakout mode after a brutal few years. The wireless giant is even overcoming a network outage that will impact Q1’24 results reported in a few weeks. My investment thesis remains Bullish on the stock for now while riding the trend higher due to the new focus on free cash flow generation and repaying debt.

Source: Finviz

Outage Impact

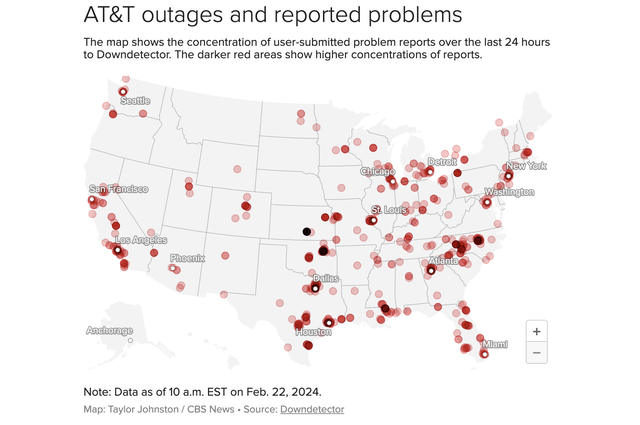

Back on February 22, AT&T wireless users faced a widespread network outage that impacted service. The wireless giant is issuing a $5 per account bill credit, and the company expects to lose customers over the network issue.

Downdetector showed wireless users reporting problems throughout the country. The largest outage reports came from Texas with Houston, Dallas and San Antonio with the most reported problems along with Chicago.

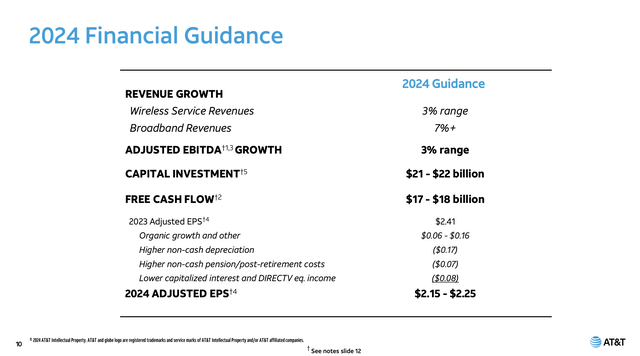

AT&T doesn’t have a lot of growth targeted for the business, so any reductions to expectations completely eliminates growth rates. J.P. Morgan forecasted a $100 million hit to revenues and lowered adjusted EBITDA targets to $44.74 billion for the year for 3% growth.

Patterson Advisory Group estimated the $5 refund would cost the company $140 million in credits based on 28 million consumer postpaid accounts. In addition, the company suggested business accounts would be handled separately, and these accounts probably felt a much bigger impact.

Opensignal has suggested the company saw a 12% increase in week-over-week subscriber share loss. The bigger impact to the business would naturally be AT&T losing a material amount of subscribers due to the outage with peers T-Mobile (TMUS) and Verizon Communications (VZ) the beneficiaries.

J.P. Morgan lowered Q1 postpaid phone net adds to 300,000, which would still be a solid number. The wireless giant is set to report Q1’24 earnings before the open on April 24 and a big focus will be on whether the network outage caused AT&T to lose a meaningful amount of subscribers, which appears unlikely.

Focus On Cash Flows

As our previous research highlighted, the investment focus is whether AT&T will finally take a massive free cash flow machine and turn the amount into repaying debt and boosting the balance sheet. The stock was due to rally, as long as the telecom company doesn’t engage in empire building again after spinning off Warner Bros. and DirecTV to focus on the telecom business.

Considering the February outage hasn’t repeated in March, the market is back to focusing on the 2024 financial guidance. After all, the bill credits and lost customers are only a blip on the investment story, quickly forgotten over time.

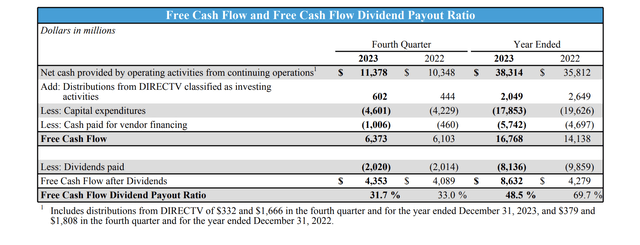

AT&T produced nearly $17 billion free cash flow in 2023 and the guidance is for $17 to $18 billion in free cash flow this year. The EPS midpoint target is $2.20 and the consensus estimates are at $2.21 for an 8.4% dip from last year.

Source: AT&T Q4’23 presentation

The stock still has upside considering the dividend yield is still at 6.3%, even after this rally off the lows. As long as management focuses on paying the current dividend and using cash flow to repay debt, thereby boosting cash flows by reducing interest expenses now above $7 billion annually, the stock is likely to continue rallying.

AT&T had a dividend payout ratio of only 49% in 2023. The company will pay $8 billion in dividends this year, and the midpoint of the free cash flow estimate will lead to a payout ratio pushing down towards only 45%.

Source: AT&T Q4’23 presentation

The wireless giant would have $9+ billion in FCF remaining after making the dividend payouts and spending at least $21 billion on capital investments in the year. The spending levels will dip from nearly $24 billion last year due to reductions in aggressive 5G network spending.

AT&T cut the net debt balance by a little over $3 billion last year, with the ending balance still up at $129 billion. If the company just focuses on running the business and further cuts debt in 2024, the stock will continue rising.

The BoD can even use cuts in interest expenses to funnel cash into dividend hikes going forward. Ultimately, though, AT&T needs to find a way to invest in the business to create new revenue streams, such as how operating data centers and cloud computing was a missed opportunity in the past.

The key here is for the wireless giant to repay debt and work on new revenue streams, while avoiding the trap of buying large conglomerates hard to integrate and difficult to get DoJ approval. The market will award lower debt and more innovation, with higher stock prices rewarding shares on top of a juicy current 6.3% dividend yield.

The stock could rally to $22 for over a 25% gain and still offer investors an attractive 5% dividend yield. Such a move could provide a 30% total return in the next while still leaving a stock with a yield attractive compared to U.S. Treasuries and savings accounts.

Takeaway

The key investor takeaway is that AT&T is starting to breakout after a tough few years. The big question is whether management can patiently repay debt and enjoy the fruits of generating strong cash flows while focusing on business opportunities to return the business to growth. As long as this continues to happen, AT&T has decent upside and will continue to rally knowing a 5% dividend is based off sub-50% FCF payouts.

The stock was too cheap when AT&T became a buy in the $14 to $15 range in 2023 and now investors should continue riding the stock higher.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market to end Q1, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.