Summary:

- Eli Lilly’s stock price rise continues unabated in 2023, backed by strong topline growth in 2023 and a sunny outlook for 2024.

- Its diabetes treatments look particularly encouraging, with Mounjaro’s 11x revenue increase last year and a great start to Zepbound at the end of 2023.

- While its market multiples look stretched for now, over the medium to long term, they too look better and the stock’s exceptional long-term performance is hard to ignore.

Siarhei Khaletski/iStock via Getty Images

The biggest pharmaceutical stock by market capitalisation, Eli Lilly (NYSE:LLY) continues its unabated upward journey. Not only has it more than doubled its price in the past year, but it’s up by 33.6% in the first quarter of 2024 (Q1 2024) as well. Here I look at whether there’s more upside to it, especially as its market multiples are looking rather stretched now.

Winning in the Diabetes market

The company’s gains in its diabetes segments certainly give room for hope. It’s estimated that one in every 11 people in the world suffers from diabetes. Diabetes patients are expected to increase by 55% to 612 million from now to 2040. This translates into a huge market for type 2 diabetes treatments, which is estimated to grow to over USD 60 billion by 2030.

Diabetes treatments see higher-than-average growth

Eli Lilly’s main focus is on exactly this high-potential market, with its diabetes and weight management treatments accounting for a ~58% share in total revenue in 2023. At 36%, the segment’s revenue growth in 2023 also far outstripped the already notable jump in Eli Lilly’s total revenue growth of 19.6%, up from under 1% in 2022.

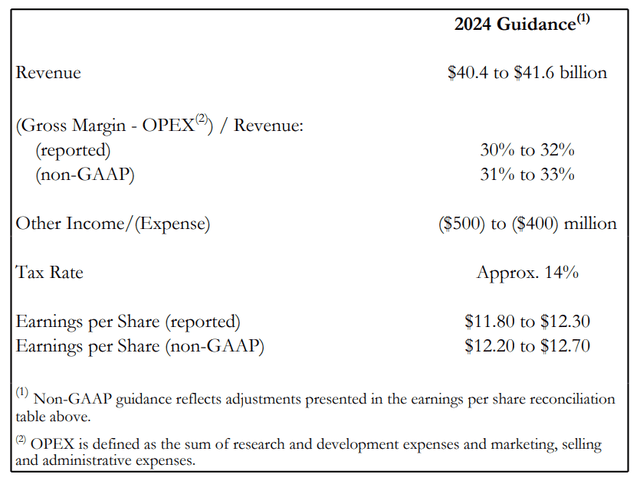

Product wise revenues (Source: Eli Lilly)

Mounjaro picks up the slack for Trulicity

Its type 2 diabetes and weight management treatment Mounjaro, has seen particularly notable performance. Its revenues have grown by 10.7x in the year, reflecting fantastic success after it was approved by the US Food and Drug Administration [FDA] in May 2022. This treatment alone accounts for 15% of Eli Lilly’s revenues in 2023 and is second only to Trulicity, also a type 2 diabetes management treatment (see table above).

It’s worth noting that Trulicity, which contributed to 21% of the revenues in 2023, actually saw a contraction of 4% in the number on both supply shortages and lower realised prices. But Mounjaro’s popularity more than made up for that.

Zepbound promises further gains

Moving into this year, Eli Lilly has another winner at hand. Zepbound, an injectable weight management treatment, was approved by the US FDA in November last year. It came to market in December 2023, and in just that one month, it garnered USD 175.8 million in revenues.

This already translates into 0.5% of the company’s total 2023 revenues. By extension, if it had been in the market all through 2023, it would have contributed to almost 6% of total revenues. It’s interesting to note that Zepbound’s early success exceeds that of even Mounjaro, which saw average monthly revenue for the seven months in 2022 after its approval of ~USD 70 million.

Watch for the impact of acquisitions

Eli Lilly is hardly stopping here. Last year it also acquired Versanis Bio, a clinical-stage company that is also developing treatments for obesity and obesity related complications.

The acquisition cost was relatively small for the company, in that it could go up to USD 1.9 billion if development and sales milestones are met, besides the upfront payment. This is 5.6% of the company’s 2023 revenues and 37% of its net income.

There’s no way of knowing yet whether or how much its treatments would succeed, but the fact that the company is adding to its portfolio of already successful treatments in the segment makes them worth watching out for.

The oncology focus

The company’s second-biggest segment by share of revenue, oncology, lags slightly behind. It grew by a 17.5% increase in 2023, a below average increase. Recently, it also saw negative results for its successful breast cancer treatment Verzenio’s effectiveness in also treating prostate cancer.

It’s still a segment to watch, though, considering that Verzenio has otherwise done very well in the past year, with 56% growth. It far outpaced growth in any other key treatment, save Mounjaro. Also, Eli Lilly itself is betting on the segment, with two acquisitions completed in Q4 2023.

The first is its USD 1.4 billion purchase of POINT Biopharma, which has clinical and preclinical stage cancer treatments in the pipeline. And the second is the France based Mablink, which is developing a new kind of cancer treatment for up to USD 1.7 billion. While neither of these treatments is revenue generating at present, the fact that two of the three acquisitions in the past year are in oncology makes it a segment to look out for.

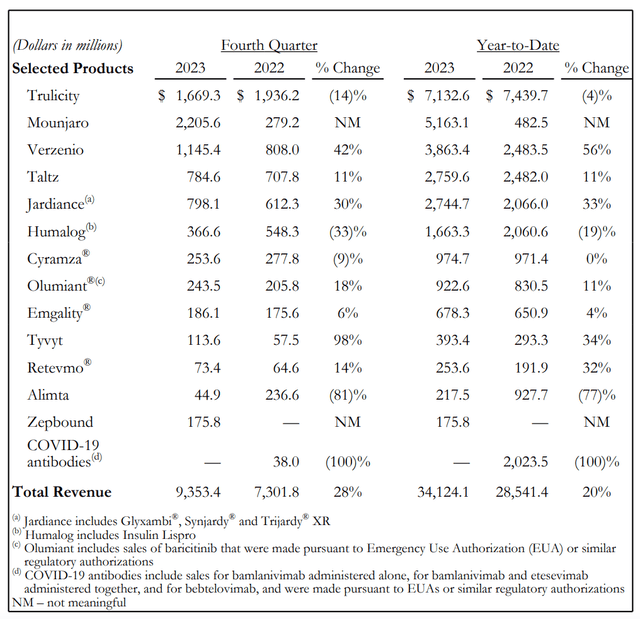

Positive outlook for 2024

The company is certainly positive about its prospects going forward. It anticipates 20% revenue growth at the midpoint of its forecast range of USD 40.4-41.6 billion in 2024. It also expects impressive increases of 107.6% in GAAP earnings per share [EPS] if it comes in at the midpoint of the guidance range (see table below) and a 97.6% rise in non-GAAP EPS.

Part of the reason for the exceptional expected rise is a weak base. In 2023, the company saw a 16% decline in GAAP EPS and a 21% fall in non-GAAP EPS due to a drag from in-process research and development changes for acquired companies. These charges account for any incomplete projects of these companies, which were related to Versanis Bio as well as immunology company Dice Therapeutics and cancer treatment company Emergence Therapeutics.

The market multiples and long-term returns

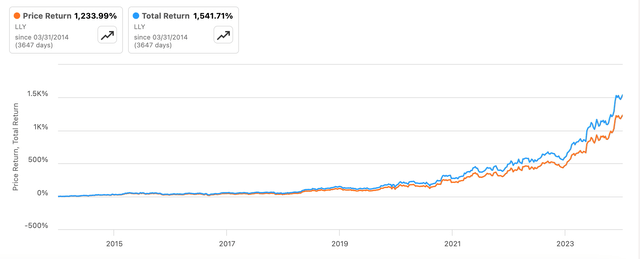

If the EPS estimates come in at the midpoint of the guidance provided, LLY’s GAAP forward price-to-earnings (P/E) ratio comes in at 64.6x and the non-GAAP forward P/E is at 62.5x. Both figures far exceed the corresponding five-year average ratios of 37.9x and 35.5x respectively.

These are stretched valuations, of course. But I’m inclined to look at Eli Lilly through the lens of long-term returns. Its price and total returns at 1,234% and 1,542% just can’t be ignored.

Price and Total Returns, 10y (Source: Seeking Alpha)

Even its current trailing twelve months [TTM] dividend yield, which is at an underwhelming 0.6% needs to be seen in the context of a rising price. Even just the yield on cost over the past year is at 1.5%, which brings it to the average for healthcare stocks. But the real juice is in the long-term yield on cost, which rises to a significant 8.8% for an investment made 10 years ago.

Considering this, its long-term P/E doesn’t look bad at all. According to analysts’ estimates on Seeking Alpha, LLY’s projected earnings for 2033 put the forward P/E at 14.9x. But even two years from now, for 2026, the P/E already subsides to sub-average levels of 33x and only reduces from there.

What next?

That said, right now, Eli Lilly is not an investment for short-term gains. Its price has risen a lot in recent months and its current valuations just can’t be justified. Especially not as it comes out of a year when its earnings shrank and it had an upset with the further expansion of Verzenio to prostate cancer treatment.

At the same time, the company also has a lot going for it. Its diabetes segment, which includes weight management treatments, is doing particularly well. Not only has Mounjaro performed well, pulling up total revenue growth to double digits, but the new weight management injectable Zepbound had a very promising launch last December too.

The company’s outlook for 2024 is then justifiably sunny. The expected increases in EPS increase are particularly encouraging as they indicate the potential for yet another year of dividend rise after they’ve already risen consistently for the past nine years.

If Eli Lilly continues to perform, as analysts believe it would, the company’s forward P/Es would also subside significantly starting from 2026 and going up to 2033. This means it’s still a good medium-to-long-term buy. From this perspective, I’m going with a Buy rating on it.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LLY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—