Summary:

- 3M Company is in a rut with stagnation in some business lines and legal concerns. But I’m looking past that for a blue chip whose price reflects that.

- MMM’s flexibility, brand reputation, and sustainable competitive advantage, plus its gradual momentum in my YARP analytical system makes this worth a small position.

- I discuss my views on stock “ratings” and how MMM is a case for putting those in their proper perspective.

jetcityimage

The stock market doesn’t work the way it used to, and 3M Company (NYSE:MMM) is my latest evidence. It is also why, as the title of this article states, I firmly believe that rating a stock buy, sell or hold, while helpful in some ways, is easily misinterpreted. Back when I was an investment advisor and was somewhat limited in the extent to which I could speak my mind about a lot of topics, I had to keep such opinions to myself. And, while they are just that – my opinions – I’m not holding back now.

Specifically, I see in 3M a stock that transcends a bottom line opinion. As described below, I conclude 3 things about the state of affairs at this Dow Industrials component stock:

- It is not a permanent part of my long-term stock watchlist, but it is close. I have always put the Dow stocks on a pedestal compared to companies that by their nature can’t dig themselves out of a hole if one occurs. Because it usually does. That’s the business cycle.

- MMM is clearly in a rut, with a combination of stagnation in some of its mature business lines, some legal concerns, the spinoff of its healthcare division, new leadership and oh yeah, that fact that it is a stodgy old Dow Industrial, and not a FAANG stock. But I am not evaluating this stock based on current issues, but rather their capacity to endure when things don’t go right. And I suspect astute Seeking Alpha readers will know what I mean when I say that I’m not the first investor to see opportunity in out of favor companies.

- The way I manage my stock portfolio involves identifying a core group of 40 stocks, replacing them slowly when needed, but driving total return by being willing to raise or lower my position size in a range of 1% to 5% for each of those 40 stocks. It is not an index, but is has some of the guardrails that have helped indexing become the majority of managed equity assets over the course of my 30+ year career.

So in the current environment, I could call MMM a buy, a hold and a sell at the same time. I’ll settle on hold for this report, simply because it reflects my view that MMM is not as attractive as several other stocks in my basket, but is reaching an extreme to the downside where I am willing to hold a modest piece of it in my portfolio. And I am doing so with the expectation that my target position size will be higher 6-12 months from now than it is now, as the dust settles here.

My stock research approach: feel free to put it on a post it note

My stock research is about 3 things. First, finding companies which are of long-term quality, leaning on sources like the quantitative ratings supplied by Seeking Alpha. Next, I use the proprietary approach I created and have described in recent articles, known as Yield at a Reasonable Price (YARP), which looks at the history of a stock’s dividend yield in the way fundamental analysts look at histories of P/E, P/S and other metrics as a valuation and risk measure for a stock. And most importantly, I am a chartist since I was 16, “only” 44 years ago. I am price trend and quantitatively based, and that’s my bread and butter if you will. Frankly, the combination of Seeking Alpha quant ratings and my pair of non-fundamental skill sets (YARP dividend analysis and charts) has been a reliable system for my own use now, and my managed asset base then. And while MMM is nowhere near my favorite stock “right now,” I put it in the category of “don’t ever ignore it or count it out.”

The pages of Seeking Alpha are filled with sharp analyses of the fundamental and operational details of large cap stocks like this one. So, since I readily admit to not being a fundamental analyst, I’ll refrain from trying to add value that way. Because it won’t! That said, somehow I have survived since the 1990s as a professional investor, managed 3 mutual funds and a 9-figure client asset base using this approach. So I certainly understand and expect that the more classic balance sheet/income statement crowd will question my opinions. I welcome that, since that’s what makes a market.

So, in the case of MMM, here’s a summary of one of the great American businesses that hails from St. Paul, Minnesota, and is now in its 123rd year of operation. MMM’s 4 main segments are Safety and Industrial, Transportation and Electronics, Consumer, and the aforementioned lame duck, healthcare.

This incomplete list of products and solutions convinces me that this company has the flexibility and brand reputation that few do, and that is a sustainable competitive advantage, albeit not at the grow rates of the past:

Abrasives and finishing for metalworking, autobody repair, closure systems for personal hygiene products, masking (like we used during the pandemic), and packaging materials, electrical products for construction companies, structural adhesives and tapes like the iconic post it notes and scotch tape, ceramic solutions, attachment/bonding products, semiconductor production materials; data center solutions, and reflective signage for highway, and vehicle safety, consumer bandages, braces, supports, and consumer respirators, home cleaning products, paint accessories, picture hanging, and stationery products.

I simply have a hard time believing that a company that has that many ways to win will lose so much and so often that the stock is not at least worthy of being in my top 40. Currently yielding over 5.5% and selling at half its price from 3 years ago, MMM shows me some of the signs of a great company at a more than reasonable price. I’ll turn to my main stock metrics in a moment but I’ll summarize this defense of this blue chip Dow Industrials component by saying I am proud to represent those who could imitate those highway billboard that say, “we buy ugly houses.” In this case, my summary position is that “I buy ugly stocks…I just don’t weight them too heavily until their price becomes a catalyst that signals to me that the market is ready to re-discover it. This is the case with many industrial stocks, after 3 years of FAANG-domination.

The YARP analysis of MMM

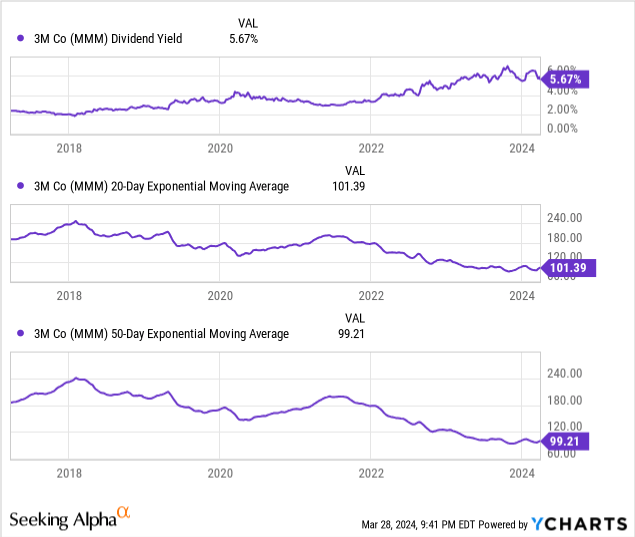

MMM is in the zone I call “higher risk but very high potential reward. The dividend yield is toward the upper range of the past 7 years, and its trend indicates to me that the stock has not truly made the “turn” I need to take a more sizeable position. But it has dropped enough so that I want it on my 40-stock list, which will compel me to own at least a 1% position, but certainly nowhere near the 5% maximum position I will hold at cost on any stock.

The 20-day and 50-day moving averages are low and hinting at a bottom, but the stock’s recent trading activity has been chaotic. There is obviously a bull-bear/trader-investor situation going on here, and while it may not resolve next month, I think it will be a different story 6-12 months from now, and especially beyond that time frame. This is the stock market, where even fortress-like businesses can see their prices fall 30%-50% while they continue going about their business from a long-term standpoint. There’s a tradeoff here, just as there in among the stocks in my portfolio. I am looking for a mix, and that mix will typically have some recent “losers” down as this one is.

Technical price chart of MMM: long-term undervalued. Very undervalued.

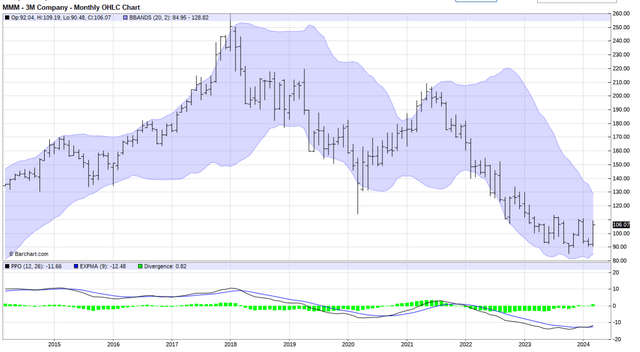

I did not want to sift through the recent volatile trading action, since this is a stock I’m entering at the low end of my position size range. But that’s a chart of monthly prices below, and the lower section of the chart, the PPO indicator (like a MACD but in percentage, not dollar terms) tells me this: there’s at least 100% upside potential here, but measured in a set of perhaps 4-5 bumpy years. Or, just a bumpy 6-12 months until much of the current woes fade from investors’ radars like has been the case with so many blue chip stocks throughout history.

Up until this point, I have used words to describe the “quality” aspect of MMM that leads me to place it in that top 40 stocks I’m holding at least a small position in, as part of my total portfolio that includes a trio of ETF-based strategies a ton of T-bills, and some options around the edges for both tail risk protection and return enhancement.

Picture the total portfolio to be akin to a multi-manager hedge fund, except that I’m the manager of 100% of it. And, it is constructed and rotated based on a few decades of my learning experiences, and a view of how modern investment markets should be navigated. That is, not at all like the past.

MMM: a dollar for 50 cents, literally?

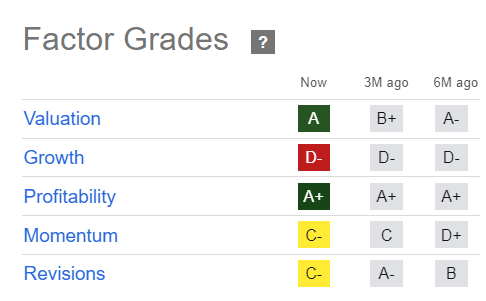

Here are those Seeking Alpha quant factor grades I have found to be an excellent guide. One of my key uses of that system is to reduce my list of hundreds of potential stocks to own to one that removes the “riff-raff” which I define that as companies that don not grade out well for Profitability. As shown below, MMM’s recent troubles have not caused that rating to budge. And its valuation is A, which at 11x trailing 12 month earnings, makes MMM worth the risk of taking a modest position here. This is not a growth business right now, and it has not been a high growth stock for decades. However, that’s the tradeoff I see to get the higher yield and the upside that comes from being overdone on the downside, price-wise. The stock is off 50% in 3 years, so that’s the proverbial Wall Street saying of trying to buy a dollar for 50 cents. To some that’s a phrase they hear when they are young bucks in the investment business. For me, it is something I learned in my 20s and never forgot about. And here it is, right in front of me, in a Dow 30 component.

Seeking Alpha

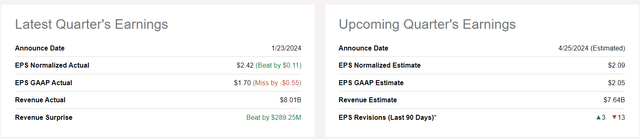

Here’s an earnings snapshot and a look at the next announcement in about 4 weeks. The key data point to me is those 13 analyst EPS revisions downward. To some, bad news means sell. Me? I inch closer. But with the risk management approach that says owning 1% or so is acceptable, but owning 4-5% of my YARP stock portfolio in MMM right now is out of the question. I take the conservative path at ever fork in the road. But imagine what even a slight earnings beat and better than expected outlook would do to this situation?

Final thoughts: and yes, they are unusual!

I have not owned MMM in a while, but I’m stepping in for “small size” here, and thus I officially rate it a hold, not a buy for that reason. And as noted at the top of this report, situations like this: contrarian blue chip name, out of favor with so many who drive Wall Street, yet showing early signs via my YARP methodology that just a modest price jump from here could make this a much more prominent holding for me.

That all adds up to my being glad I treat equity investing as a portfolio construction activity, not something akin to sports betting or horse race handicapping, as so many now do. Buy, sell or hold? For MMM, in a way, a piece of all three. Because, if the process is something I’m comfortable with, the labels don’t matter.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.