Summary:

- Centene Corporation is a managed health insurance services provider and an American success story.

- The company is a leading Medicaid-managed care corporation servicing millions of low-income individuals across all 50 states.

- Centene’s market cap has grown to $42 billion, and its valuation metrics suggest potential for long-term growth and profitability.

PeopleImages

My father used to tell me that success demands you have 75% common sense, 15% smarts to build on the momentum you create from your efforts, and 10% good luck. Managed health insurance services provider Centene Corporation (NYSE:CNC); appears to enjoy all three ingredients. The company is a true American success story worthy of our Buy rating as an investment opportunity.

Profile

The histories of Centene Corp and Medicaid are intertwined. Until 1965, veterans and the poor received limited government help paying medical and healthcare bills. There was the G. I. Bill. Public hospitals are supported by cities, and states, with supplements of federal dollars under the relatively new Social Security Act improved access. Until the 1960s, privately purchased insurance covered the self-employed. Employers started including healthcare coverage as a benefit, and it became an integral stipulation of union contracts.

In 1960, the Kerr-Mills Act established a new federal program to cover the costs of medical care for the elderly and the income-deficient. 5 years on, a mishmash of programs merged into Medicaid and Medicare to include families with children and disabilities; the publicly supported programs grew, like the U. S. Maternal and Child Health Care Clinics and WIC for pregnant women and children when I was a consultant to the U. S. Surgeon General in the 1970s.

Adding to the puzzle parts of medical care programs operating at all levels of government came along the Affordable Care Act passed in 2010. A century later, industry lobbyists and political ideologues still oppose government spending, management, and oversight of medical care. Others with a capitalist spirit saw the growing industry as an opportunity to bring care to the needy and profit for their companies and investors.

Elizabeth Brinn of Milwaukee, Wisconsin, is a victim of the Matilda Effect. She founded Managed Health Services as an NGO in 1984 after growing up in a children’s home. Within a short time, the corporate structure was changed to a publicly traded corporation delivering 3 main products – Medicaid, Medicare, and the Health Insurance Marketplace – to persons of lower income in all 50 states. The company fully supports Elizabeth’s original mission through its Centene Foundation.

Centene is the nation’s largest Medicaid-managed care corporation. Its products and services directly address the needs of governments and special populations; it claims to be “the number one carrier in the nation on the Health Insurance Marketplace.”

- Medicaid–We partner with state governments to provide health coverage to millions of eligible low-income adults, children and pregnant women.

- Medicare–Our Medicare Advantage and Medicare-Medicaid plans provide access to personal, local care, and promote health and independence.

- Health Insurance Marketplace–We provide affordable, comprehensive plans for individuals and families who may not qualify for Medicaid or other government coverage.

- Military & Veterans–Our Federal Services division provides high-quality, cost-effective managed healthcare programs and behavioral health services to public sector employees and beneficiaries.

27.5M clients are enrolled in Centene managed care programs; that is 1-in-15 across all 50 states as of the end of 2023. The growth in the federal government’s spending on these 4 program areas, we expect, will bode well for Centene over the next two years.

Industry Growth

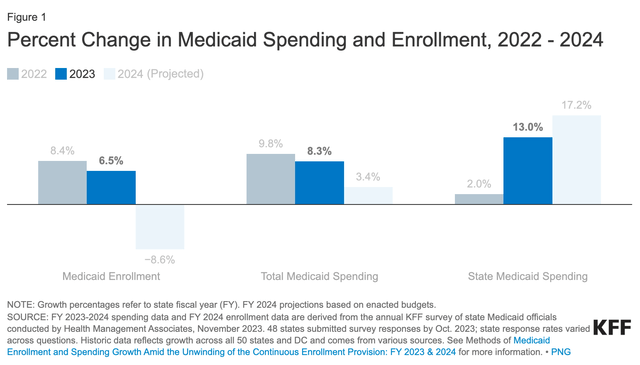

Medicaid’s enrollment as of April 2023 totaled 94.5M. That represents an increase of 23M (32%) from 2019. Medicaid enrollment has annually grown on average 6.5% to 8.4%. Medicaid renewal rates run about 34% on average. Medicaid and Medicare are the primary financing and access portals for medical care for 20% of low-income Americans. It is the major source of care for racial minorities, claims KKF, an independent source we respect for health policy, research, and news.

Medicaid is a major source of coverage for births, Black, Hispanic, American Indian or Alaska Native and Native Hawaiian or Other Pacific Islander populations, some lawfully present immigrants, low-income children, working-age people with disabilities, and people needing long-term services and supports.

KFF shows the change in spending and enrollment; forecasts bode well for Centene:

Medicaid Spending & Enrollment (KKF,org)

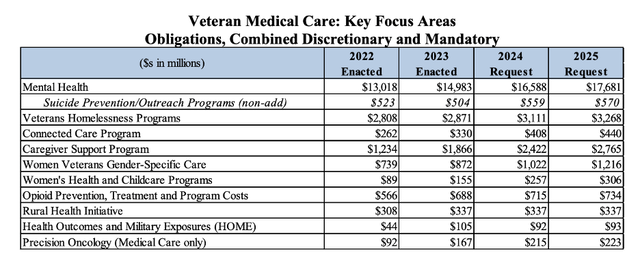

Likewise, federal spending on veteran medical care is raised under the new budget agreement:

Spending on Care for Vets (Veteran’s Admin.gov)

Valuation

Centene’s last earnings report was released on February 6. The next earnings report will be announced on April 26, ’24. Highlights from the last report include:

- FY ’23 diluted EPS of $4.95 compared to its adjusted EPS of $6.68, or +15% from $5.78 in FY ’22.

- 2023 health benefits ratio of 87.7%, consistent with 2022.

- It executed a $1.6B buyback of shares in 2023.

- Sold Circle Health and Operose Health.

- Centene total enrollment growth was modest to 27.47M in ’23 versus 27.06M Y/Y with enrollment in Medicaid decreasing but Commercial and Medicare enrollment up.

- Centene increased 2024 premium and service revenue guidance by $2.5B.

The company’s market cap has grown to $42B. The downturn in Medicaid enrollment doesn’t surprise us with the nation’s unemployment rate dropping below the threshold of 4%; more individuals and families moved from aid to work becoming income ineligible. The growth in enrollment in SSI which offers better benefits than Medicaid and Medicare attracts big numbers away from other government programs; being self-administered, SSI might be a competitor for companies like Centene.

Shares sell today near their 52-week high by recognizing Centene will experience long-term growth and profitability making it a Strong Buy opportunity for investors. Share price performance in our opinion will continue outstripping the average momentum of the healthcare sector median because the customer base is potentially ~350M Americans and their demand for national healthcare insurance continues to grow. 43% of American adults are not adequately covered and costs keep rising.

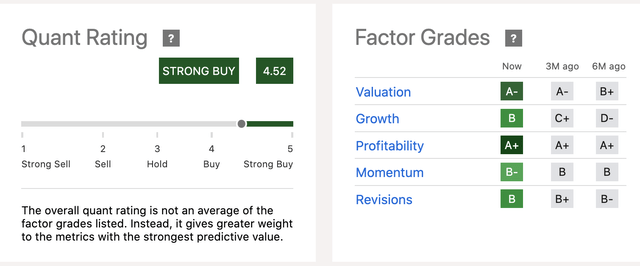

Currently, the Seeking Alpha Factor Grades are excellent. This includes Valuation even after the stock price climbed 48.6% over 5 years, 24.33% over the last 12 months, and 5.75% YTD and is closing the third week in March ’24 about 3.5% from its 52-week high.

Centene’s valuation metrics substantially beat the healthcare sector’ medians suggesting there is room for the average target share price to rise to about $90 per share in 2024. With a PE at 11.6 x $6.65 EPS, the stock sells at a fair value; $81 will be a fair value if the high estimate EPS consensus among analysts of $6.87 is met.

Half of the analysts at S A rate the stock a Buy to Strong Buy, and the other half assess Centene at Hold. We conclude the high grade for Centene’s Momentum is undergirded by ratings of Buy and Strong Buys for its peers. The state of the industry is healthy and prosperous.

Briefly, total cash to total debt is a wash. Free cash flow per share was reported be $13.35 in February’s report. Cash from operations topped $8B. The levered/unlevered Beta is a mere 0.54.

S A’s Quant Rating has its assessment at a full-blown Strong Buy:

Quant & Factor Grades (Seeking Alpha)

Risks

The few risks we foresee for Centene investors is first to stabilize the gross profit margin and raise it from 9.28% at the end of FY ’23 to +15% as it has hit during some quarters. The sector median gross profit is 56.8%. Net income was a hearty $2.7B, or about 1.9% versus -4.63% for the sector median. Throughout 2023, insider buying was strong but insiders began selling shares in greater numbers beginning in September ’23 when the share price rose from $61 to $78 each. Insiders sold $1.7M in the last 3 months. Hedge funds also sold 128.3K shares in the last quarter.

Three extrinsic events make us uneasy about the Strong Buy rating, at this time. First, a study from the World Economic Forum reports that “education is a critical component to driving uptake in adoption of health insurance amongst young people.” The growing diversity of the population who can education less-afford higher education and the concomitant high dropout rate from high schools puts a damper on the high growth Centene and others experienced the last few years.

Second, the insurance industry faces a digital transformation; we do not see it talked about on the company website nor hear about it as a challenge from management.

Third is the political challenge managed care companies face. S A just reported on President Biden issuing a slew of Executive Orders clamping down on junk health insurance plans. Centene ought to initiate a self-evaluation study and release it shareholders to calm investor skittishness that can develop if his administration pursues this tactic pre or post-November. Candidate Trump still pursues dispensing the Affordable Care Act, cuts, and following up on changes to Medicaid that can undercut Centene.

Foresight

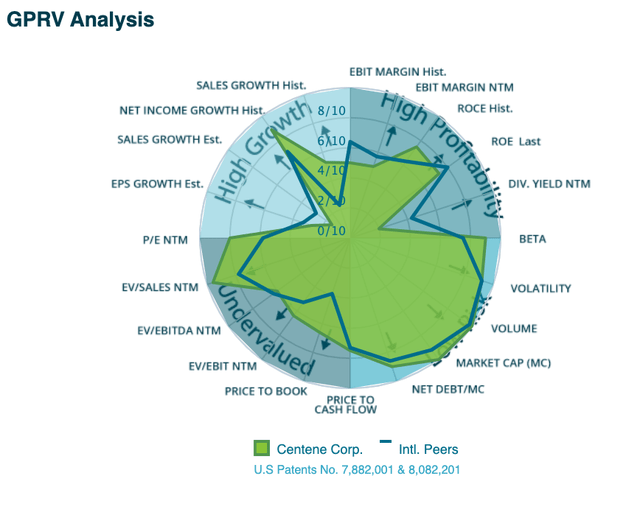

We are bullish on Centene Corporation believing it is well-positioned to grow and for the share price to move-up. We agree and appreciate the visualization from Infront Analytics of our characterization:

Pictorial of Centene Potentials (InfrontAnalytics)

Paying a dividend can be more attractive to retail value investors than adding $4B to the company’s stock buyback program. Insider selling and other risks make us more damper our enthusiasm and self-assurance that the stock is worth a Strong Buy, so we will assess the stock a Buy opportunity, at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.