Summary:

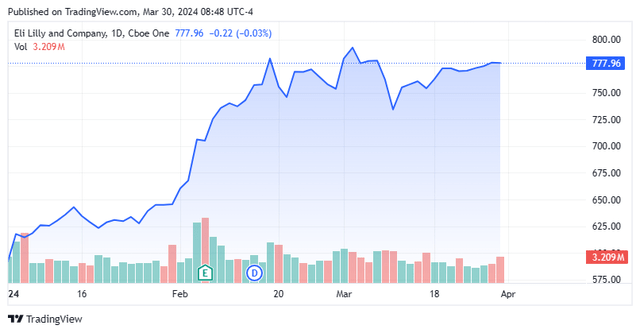

- Eli Lilly’s stock has surged in the first quarter of 2024 due to the success of its weight loss products in the pharma market.

- A huge rally has powered the shares to a gain of 130% over the past 12 months and the stock to a $700 billion market cap.

- In the article below, three key threats that could result to some significant profit taking in the stock are highlighted.

jetcityimage

Few large cap stocks have rewarded its shareholders more in the first quarter of 2024 than that of drug giant Eli Lilly (NYSE:LLY). The shares are up by a third year to date and some 130% over the past 12 months. The rally has been powered by the company’s new weight management products in what is a huge new market in the pharma space.

The stock has achieved a massive $700 billion market capitalization. The equity also seems to be forming a top over the past six weeks. In addition to that technical ‘red flag‘, there are three other key reasons to believe at least a significant bout of profit taking is on the horizon.

Valuation:

Let’s start with the obvious, valuation. The rally has left the shares valued at nearly 125 times the $6.32 a share (non-GAAP) in profit the company made in FY2023. Even more incredibly the stock is valued at more than 24 times the just over $32 billion worth of revenues Eli Lilly delivered last fiscal year, almost uncharted territory when it comes to historical valuation measures for Big Pharma.

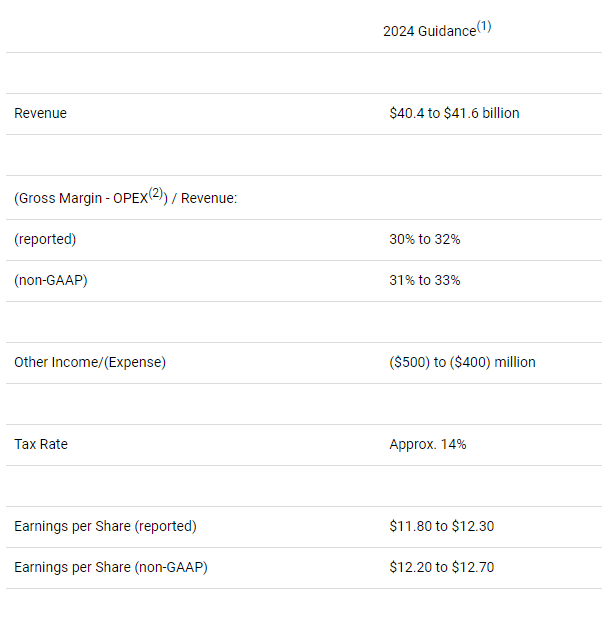

FY2024 Initial Guidance (Q4 Press Release Via Second Alpha)

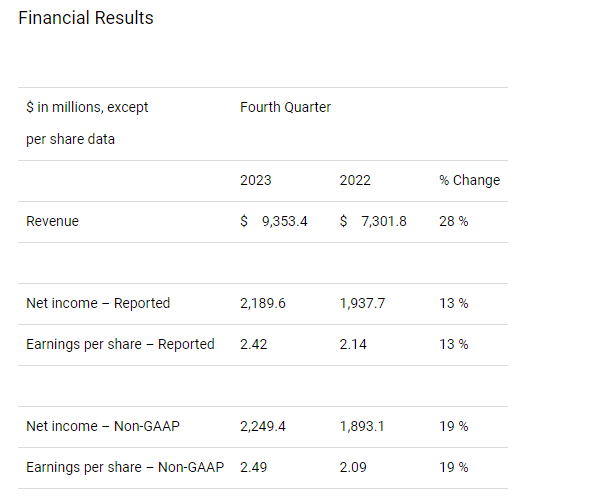

The current analyst firm consensus has Eli Lilly nearly doubling profit to $12.49 a share in FY2024 on the back of 21% to 22% profit growth. Management has guided to $12.20 to $12.70 of earnings in FY2024 after stellar fourth quarter results.

Q4 Press Release Via Seeking Alpha

Analysts also project just over $18.00 a share in earnings in FY2025 as sales growth accelerates to 24% to 25% for the year. That leaves LLY valued at just under 43 times FY2025E EPS and a still whopping 15 times FY2025E revenues.

Competition:

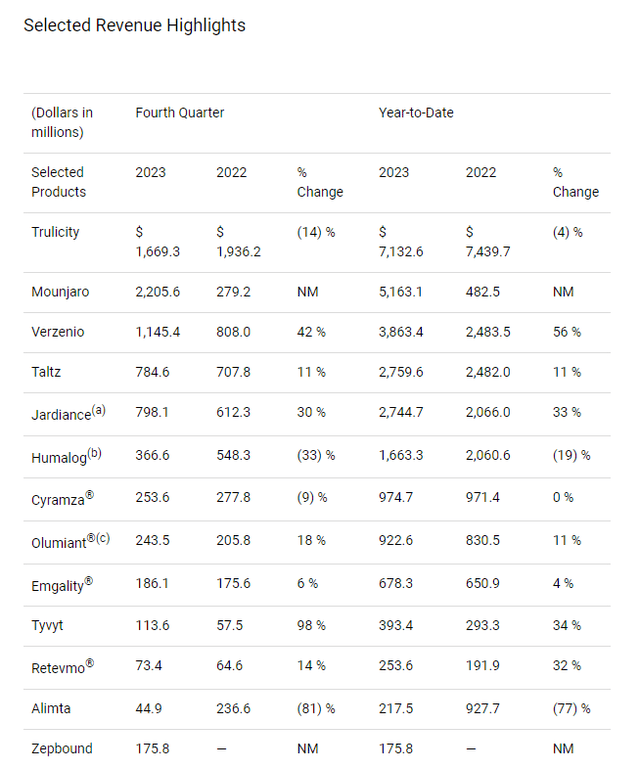

Right now, Novo Nordisk (NVO) and Eli Lilly have this huge and expanding market to themselves. Eli Lilly with Mounjaro (a diabetes and weight loss treatment) and Zepbound and Novo with the recent entry of Wegovy and the off-label use of blockbuster Ozempic. Ozempic sales were up 60% year-over-year in FY2023. Overall, the company had $33.7 billion in sales in 2023, 90% of which came from Wegovy and Ozempic

Zepbound is off to a wonderful start booking over $175 million of sales in December, its first full month of launch. The product also just beat Wegovy in weekly prescriptions this month. Both companies are also developing oral versions of this new class of drug, which are currently delivered via injection. The new drugs will be more convenient and more effective based on study data.

However, a huge market invites new competition. Many potential new entrants are targeting the weight loss arena. These include the likes of Altimmune, Inc. (ALT) which recently released trial data from a mid-stage study of its dual GLP-1/glucagon dual receptor agonist pemvidutide. More impressive, were early-stage data Viking Therapeutics (VKTX) released this week around its oral once-daily obesity therapy VK2735. The company is also in mid-stage development of this candidate as an injectable version. Early data sent the stock significantly higher last week. I recently highlighted Viking as a potential takeover target for a larger firm wanting to gain a foothold in this huge market.

Increased Congressional/Regulatory Scrutiny:

Medicare recently expanded coverage to include GLP-1 agonist drugs such as Zepbound and Mounjaro. That significantly boosted the potential market for this class of drugs. However, that also means a significant new cost of taxpayers in an age where the annual federal government deficit is running near the $2 trillion range, even during an economic expansion.

This means these drugs are going to come under increasing congressional and regulatory scrutiny, especially in an election year. Senator Bernie Sanders fired one of the initial salvos on this front last week as he put Ozempic and Wegovy in the spotlight noting these weight loss drugs’ ‘outrageously high price has the potential to bankrupt Medicare, the American people and our entire health care system‘. He further called on Novo Nordisk to lower the cost of these drugs to what they list for in Canada ($300 a month, compared to $1,000 a month in the United States).

I expect this movement will pick up steam in the months ahead. In addition to generating negative headlines that may negatively impact investor sentiment, this could also eventually lead to lower prices and margins for the sector, as least for what is covered by government programs. Health insurers could also start to increasingly push back on list prices as well.

FY2023 Revenue Breakdown (Q4 Press Release via Seeking Alpha)

In conclusion, Eli Lilly is a fine company and the launches of Mounjaro and Zepbound have been impressive and are addressing a huge and growing market. The company also has a staple of established drugs in its product portfolio and has plenty of potential in its pipeline including targeting other huge markets like Alzheimers and NASH. However, after the stock’s massive run, the shares do seem very vulnerable to some short-term profit taking. If we get any hiccup in the overall market, I could easily see the shares giving back 15% to 20% of their recent gains. Goldman Sachs maintained its Hold rating and $650 a share price target on LLY earlier this month. That seems a much more reasonable entry point.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VKTX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Live Chat on The Biotech Forum has been dominated by discussion of lucrative buy-write or covered call opportunities on selected biotech stocks over the past several months. To see what I and the other season biotech investors are targeting as trading ideas real-time, just join our community at The Biotech Forum by clicking HERE.