Summary:

- Micron’s doomsayers have returned as they finally realized its previous “low” valuation multiples are justified, given the company’s cyclical operating model.

- But they should have promulgated their pessimism when MU was much higher in H1’22, as its valuations were at much lower levels, not now.

- With Micron’s forward estimates significantly de-risked, this is the time for semi investors to be excited, not dismayed.

- As MU falls back to its September lows, investors who lamented they missed its previous bottom have been proffered another fantastic opportunity to add.

- But are you ready to take the plunge when given the opportunity, with the steep pullback?

bunhill

We gleaned so much fear over Micron Technology, Inc.’s (NASDAQ:MU) FQ1’23 earnings release in the media and among analysts that the doom and gloom have continued to persist.

We discussed in our previous article highlighting that the demand/supply dynamics could be challenged by Samsung (OTCPK:SSNLF). It was also addressed during Micron’s earnings commentary, as CEO Sanjay Mehrotra accentuated that the industry needs to work in unison. He articulated:

So the industry is oversupplied, and we do believe that actions need to be taken as reflected in Micron’s actions with respect to supply reduction. And of course, the rate and pace of the industry supply cuts would affect the recovery of the industry in terms of bringing supply and demand balance closer together. What we can tell you is that if the industry supply growth in calendar year ’23 is negative and — for DRAM and flattish for NAND, it will accelerate the recovery in the industry. (Micron FQ1’23 earnings call)

So, forget about the growth in automotive for now. In fact, Micron did well in auto in Q1, reporting revenue growth of 30% YoY. However, it was not enough to offset the weakness in its main PC and mobile markets that we previously warned about in May. Coupled with the slowdown in data center/cloud and industrial segments, it has significantly battered its operating performance.

So, the question is whether Samsung would play ball here. DIGITIMES highlighted recently that Samsung could potentially cut production even as it attempts to take share as its arch-rivals cut back:

Analysts said earlier that against successive production cuts by its peers, Samsung tends to expand supply, aiming to have its market shares rise sharply when market demand recovers in the second half of 2023. But some industry observers believe that Samsung will eventually have to reduce production to avoid losses. – DIGITIMES

Therefore, it’s possible that Samsung’s reluctance to pull back could worsen the downturn for Micron in the near term. However, Taiwan-based memory module makers suggest that “contract prices for DRAM and NAND flash chips have limited room for further drops.” However, they also highlighted that Micron’s malaise implied that a worsen downturn cannot be ruled out:

The memory market is deteriorating faster than expected, which will result in a rapid increase in the number of inventory turnover days, and the current industry’s downturn will last longer and may stretch into 2023. – DIGITIMES

We think that observation is spot on, as CFO Mark Murphy also addressed it in the call. Murphy reminded investors that Micron’s inventory Days Inventory Outstanding (DIO) is expected to peak in FQ2, but inventory dollars could only peak in FQ3, given the industry’s oversupply.

Hence, even though contract prices could bottom out in 2023, profitability margins will likely remain under pressure. As such, we believe Micron has likely forced analysts to de-risk their estimates markedly to allow the company sufficient breathing space to recover.

But the question remains to what extent Micron has planned for Samsung to “cooperate,” which remains a critical determinant in Micron’s recovery cadence. Also, Mehrotra has not ruled out further writedowns, if necessary, as he articulated:

We have taken our actions in terms of CapEx reduction, in terms of underutilization, in terms of adjusting the technology node cadence. And we do believe that with the supply actions, the industry environment will improve. I do see that in fiscal year ’24, the revenue, the profit and the free cash flow profile would be much better than ’23. And of course, again, will be a function of how quickly the supply adjusts to demand. (Micron’s earnings call)

As such, MU’s forward estimates have also been slashed further in anticipation of a tepid recovery through 2023.

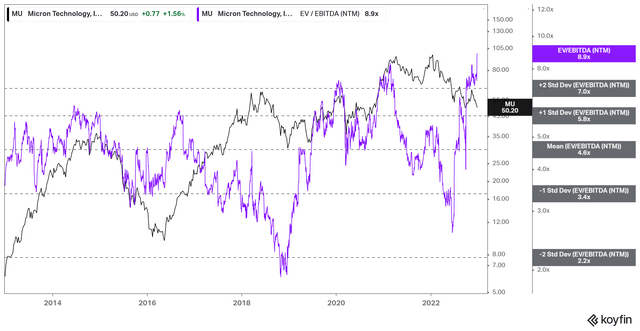

MU NTM EBITDA multiples valuation trend (koyfin)

As seen above, MU’s NTM EBITDA multiples have surged above the two standard deviation zone over its 10Y average. However, investors need to analyze MU’s valuation in the proper context. We have consistently highlighted that MU is a cyclical semiconductor play. Hence, we assessed that MU’s outlook had been significantly de-risked with the surge in its valuation.

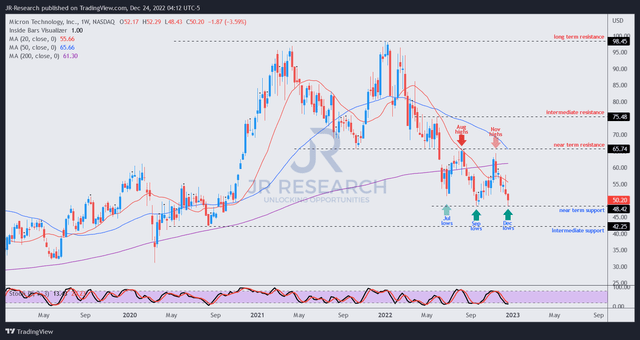

MU price chart (weekly) (TradingView)

But could MU potentially bottom out here? MU re-tested its September lows at the recent pullback. The market had likely anticipated a lackadaisical FQ1 card, as it formed its recent top in November, drawing in buyers.

Therefore, we are confident that the constructive re-test has given investors another opportunity to take the plunge on MU if they missed its September lows.

Upgrade from Buy to Strong Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!