Summary:

- The market discounted PayPal CEO Dan Schulman’s optimistic commentary in an early December conference. Notably, PYPL has collapsed back to its July lows.

- The Fed’s hawkish stance through 2023 could inflict further damage on e-commerce spending, impacting PayPal’s commitment to recover its operating leverage.

- But, investors need to ask whether they are ready to take the plunge. They lamented missing its July lows. Now, they have the opportunity to jump in.

- We encourage investors to consider PYPL’s well-battered valuations and its market leadership to add exposure.

Justin Sullivan

PayPal Holdings, Inc. (NASDAQ:PYPL) CEO Daniel Schulman’s commentary that lifted investors’ sentiments initially on PYPL over the past month hasn’t quite worked out.

In an early December conference, Schuman highlighted that PayPal’s Q4 EPS could “be slightly ahead” of its previous guidance. Therefore, it suggested that management is confident of a QoQ recovery in its adjusted EPS.

Accordingly, PayPal’s previous Q4 guidance suggested EPS of $1.19 (midpoint), predicated on revenue growth of 7%. Given that the company posted an adjusted EPS of $1.08 in FQ3, investors should be looking at better days ahead in 2023, with Q3’s metrics being the bottom.

Despite that, PYPL’s momentum has continued to collapse, falling about 10% since our previous upgrade. Moreover, we believe the market has likely assessed a worse Q4 e-commerce spending, as seen in the stock performance of Amazon (AMZN) over the past week.

Notably, AMZN has been battered close to the lows last seen in the COVID lows of March 2020, completing a remarkable round trip for the e-commerce behemoth. As such, we aren’t surprised that PYPL has also re-tested its recent July lows, marking a noteworthy collapse of nearly 40% from its August highs.

The critical question is whether PYPL’s valuation has been de-risked as we head closer to a potential recession. In addition, PayPal’s international exposure, particularly in Europe, has also been a significant cause of concern, as the region is likely already in a recession.

Schulman emphasized that his team has mapped out “a very conservative revenue and e-commerce outlook.” Despite that, he maintained his commitment to deliver a 15% growth in FY23 adjusted EPS, seeing progress in cost optimization and operating leverage.

Hence, despite the Fed’s hawkish stance, PayPal’s management remains confident that it could recover its operating leverage even as the macroeconomic environment could worsen in 2023.

Notably, Schulman highlighted the odds of the US economy going into 2023 is approximately evenly balanced, as he articulated:

I think there’s probably more than a 50% chance that we go into at least a shallow recession in the first part of the year. So we’re planning for muted growth, flat to likely down in terms of e-commerce overall, and having a cost structure that enables us to both invest and be sure that we can deliver at least 15% EPS growth. (UBS 50th Annual Global TMT Conference)

Hence, Schulman stated that PayPal has likely penciled in a 50% probability of a mild recession. However, it’s also helpful to note that yesterday’s (December 22) jobless claims data remains at low levels, which likely carried on the selloff from last week.

As such, it has also worsened the performance of consumer discretionary stocks such as e-commerce players, as Integrity Asset Management highlighted:

The economic figures were hotter than the market was hoping for, so now we have to contend with the notion the Fed will stay aggressive [in] raising rates. This, along with earnings reports from cyclical companies that suggest the forward outlook is weakening substantially, and a policy error by the Fed is becoming more likely everyday. This points to a risk-off market. – Bloomberg

Hence, given the Fed’s hawkish stance, we believe the market is likely sending a message to Schulman and his team that PayPal is over-optimistic in its economic projections.

Notwithstanding, Schulman’s commentary took place at a conference before the Fed’s recent FOMC presser. As such, it’s possible that PayPal’s forecasters could have adjusted their estimates subsequently.

Bloomberg Economics highlighted in October that the probability of a recession is 100%. In early December, the Conference Board highlighted that 98% of CEOs expect a recession over the next 12 to 18 months.

WSJ updated in an early December report indicating that European consumers have continued to cut back on spending given the impact of elevated inflation driven by the energy crisis.

Bloomberg updated recently that European consumers could face structurally higher natural gas costs through 2026. The IMF also highlighted that it believes the global economic outlook has worsened, seeing downside risks to its forecasts.

As such, we believe the headwinds have likely worsened for PayPal, and the market is likely betting that PayPal might need to adjust its FY23 outlook markedly.

Hence, the question is whether the recent battering has reflected these challenges (as the market is forward-looking).

We believe so. PYPL last traded at an NTM EBITDA of 10.7x, well below its all-time average of 22.6x. Its NTM P/E of 14.9x is also below the SPX’s NTM P/E of 16.7x.

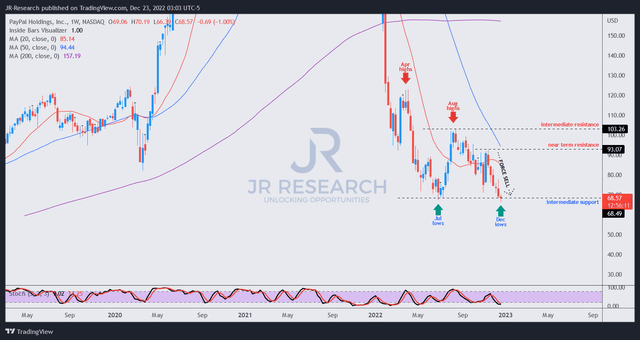

PYPL price chart (weekly) (TradingView)

With the steep selloff, PYPL seems to be forming a bear trap (still pending validation), as it re-tested its July lows.

We assessed that the price action is constructive, in line with its battered valuations. Hence, investors who missed July’s entry should find the current opportunity attractive to add exposure to the payments technology leader.

Maintain Buy with a reduced PT of $90.

Disclosure: I/we have a beneficial long position in the shares of PYPL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!