Summary:

- End-market demand continues to remain strong across all major geographies, contributing to the company’s strong backlog exiting FY22.

- The company is focusing on winning higher-margin projects, which should help in margin growth.

- Increased investments in infrastructure globally as well as a strong backlog level and high-margin projects, should help the company deliver growth in the coming years.

niphon

Investment Thesis

AECOM (NYSE:ACM) has meaningfully outperformed the broader markets since my previous bullish article, gaining over 11% versus the S&P500’s (SPY) decline of ~10% during the same time period. Despite recessionary pressure and forex headwinds, AECOM benefited from healthy end-market demand and delivered good financial results for FY22. The company’s Think and Act Globally strategy has helped it to improve its backlog and win higher margin projects. The company is well-positioned to see good revenue growth given its healthy backlog of $40.2 billion at the end of FY22. Moreover, the outlook for global infrastructure investment remains strong, with the Infrastructure Investment and Job Act (IIJA) in the U.S. expected to flow in FY23 as well as several other infrastructure investment initiatives globally such as in Australia and Canada. The company should benefit from continued healthy end-market demand, global infrastructure investments, higher backlog and win rates in coming years and should deliver good revenue growth. For margins, the company should benefit from higher-margin projects in its backlog along with improved efficiency. Hence, I believe AECOM is a good buy and should outperform in the near future.

AECOM: Revenue Outlook

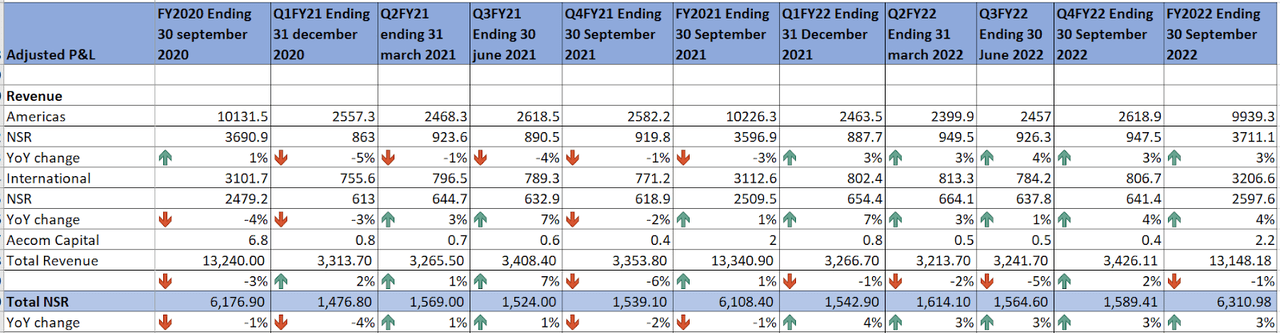

In the fourth quarter of fiscal 2022, AECOM reported revenue growth of 2% Y/Y to $3.4 billion benefiting from healthy market conditions despite recessionary pressure. Net Service Revenue (NSR) which is a better indicator for Aecom’s growth outlook, increased by 3% YoY or 7% Y/Y on a constant currency basis to $1.6 billion. The design business which accounts for approximately 90% of total NSR, reported 9% organic NSR growth. The growth was attributed to the company’s continued high project-win rates and improved backlog execution.

Aecom’s historic Revenue and NSR (Company Data, GS Analytics Research)

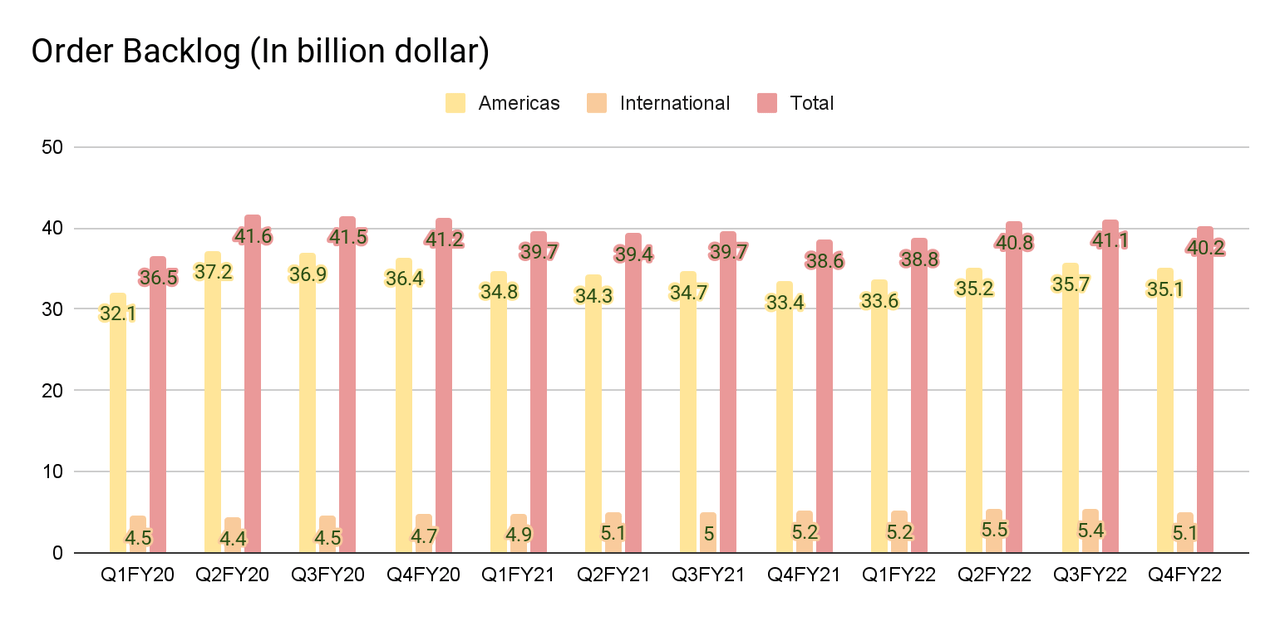

Backlog, an indicator for future revenue growth, continued to grow at healthy levels. The backlog in design grew by 9% YoY with a book-to-burn ratio of 1.2x in the Americas design business. Exiting the fourth quarter of FY22, the company’s backlog was $40.2 billion, reflecting a Y/Y growth of 4% (or 8% on a constant currency basis.) However, the contracted backlog was down 8% Y/Y due to delays in the conversion of some awards by the end of the year. The company expects the conversion of delayed awards to the contracted backlog in the first quarter of FY23, thereby driving significant growth in the contracted backlog from the current quarter onwards.

Higher backlog and win rates along with a healthy pipeline of order opportunities can be attributed to AECOM’s Think and Act Global strategy. The Think and Act Global strategy focuses on expanding the company’s market share through program management and advisory services to support clients globally by having a connected team of technical experts spread across the globe. Moreover, the strategy also focuses on investing in digital AECOM to improve its client relationship through investments in digital transformation and being digital with both internal businesses and external, and to support the activities and accelerate work by adopting global digital delivery solutions. One such example of the digital AECOM is the newly launched digital tool in the water business, PipeInsights. The PipeInsights tool is a digital tool that enables clients to inspect and quickly develop solutions for their aging underground infrastructure. Unlike many other tools, this tool is able to deliver a solid, actionable plan within hours instead of months and accelerates the client’s ability to move quickly with confidence to the next level of repair and replacement. Lastly, the Think and Act Global strategy focus on allocating the company’s resources to the highest-returning growth opportunities.

Aecom’s Order Backlog (Company Data, GS Analytics Research)

In addition to the healthy backlog and improved win rates, AECOM’s end markets remained healthy, despite recessionary pressures, due to increasing infrastructure investment globally. This includes the Infrastructure Investment and Job Act (IIJA) and Inflation Reduction Act (IRA) in the U.S. and the commitment of sizeable infrastructure investments by the Australian and Canadian Governments. Moreover, the end markets benefited from increased demand for sustainable, resilient infrastructure and investments in the energy transition as well as accelerating investments by clients to address supply chain issues in a post-COVID environment (eg, reshoring manufacturing by the U.S. companies.)

The company’s Think and Act Globally strategy and healthy end market demand have helped it win big projects that should boost future growth prospects. For the Transportation business, in the Americas segment, the company won a 9-figure contract for high-speed rail in the transportation market. Likewise, in the International segment, it won a tunneling project in Australia and got selected for Northeast Link in Melbourne, Australia. In Canada, it won several projects including a 16-kilometer Ontario Line South to Metrolinx. In its environment business, it was awarded the multiyear NAVFAC Atlantic contract by the U.S. Navy and a program management contract for San Diego Gas & Electric’s strategic undergrounding program to reduce wildlife risk and promote public safety in the environment business. Moreover, the company is also gaining share with the Federal Emergency Management Agency (FEMA). In its federal business, the company has increased its Indefinite Delivery, Indefinite Quantity contract (IDIQ) capacity to over $100 billion. IDIQs are contract vehicles that provide an indefinite quantity of services over a specified time period. IDIQs reduce costs by eliminating the need for multiple bidding processes and save time by eliminating the need to place a contract for every single task or delivery order. This increased capacity should create a good long-term tailwind for the future growth of the company as it puts AECOM in a good position to address any potential demand from the U.S. government.

Looking forward, I believe, the company has significant growth potential. AECOM’s improved backlog execution and increased win rates along with a good pipeline of projects and opportunities should benefit the company in delivering future revenue growth. Furthermore, IIJA funding is expected to translate into revenue in FY23 and beyond. This along with several other global infrastructure investment initiatives and a healthy demand, should be a tailwind for the company’s revenue growth in coming years. While foreign currency headwinds are expected to continue in the near term, these tailwinds should help it deliver increased NSR in FY23 and beyond.

ACM Margin Outlook

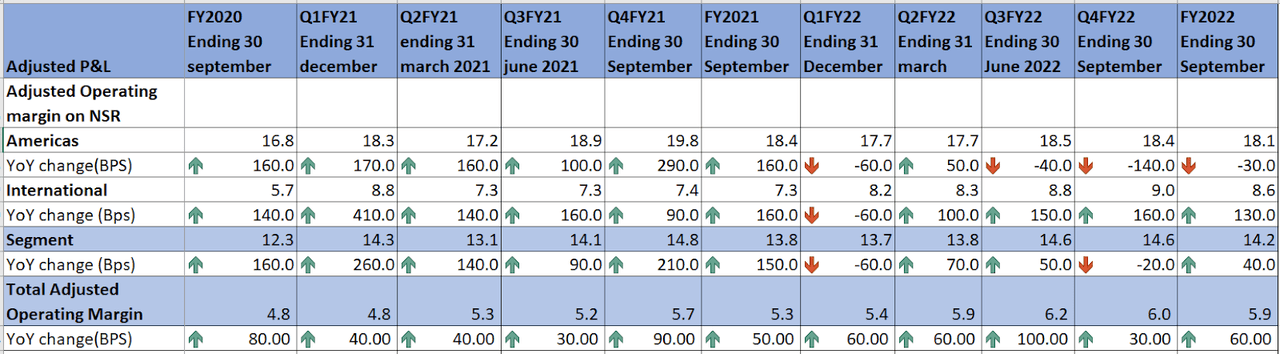

ACM’s segment adjusted operating margin, which excludes AECOM Capital, was down 30 bps Y/Y to 14.6% in the fourth quarter of FY22. In the Americas segment, the adjusted operating margin declined by 140 bps YoY to 18.4%. The decline in margins resulted from increased business development investments in the Americas segment in the fourth quarter. However, the decline in segment adjusted operating margin was partially offset by growth in the International segment’s adjusted operating margin by 160 bps to 9.0%. The increase in the international segment was a result of improved efficiency and a higher margin backlog.

Aecom’s Historic Adjusted Operating Margin (Company Data, GS Analytics Research)

The company has improved its bidding process by being more selective and disciplined in recent years and, as a result, the margin profile of its backlog has improved. Looking forward, I believe these higher-margin projects in the company’s backlog should support margin growth in the coming years. In addition to winning higher-margin projects, the company’s continued emphasis on exiting lower-return projects, in order to prioritize the highest-returning opportunities, should also help it deliver margin growth. While FX should continue to be a near-term headwind, the company expects to deliver a 40 bps improvement in segment-operating margin in fiscal ’23. Management has given a longer-term target of a 15% plus for segment-adjusted operating margin which I believe is achievable.

Valuation and Conclusion

AECOM is currently trading at a P/E of 22.38x FY23’s consensus estimate of $3.78. The company is trading relatively cheaper than its peer Tetra Tech (TTEK) which is trading at a P/E of 30.55x FY23’s consensus estimate of $4.87. Looking forward, given its revenue and margin growth prospects in FY23 and beyond, I believe the company is a good buy. AECOM should benefit from increased global infrastructure investment and higher demand in its major end markets along with its higher-margin backlog and healthy win rates.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is written by Saloni V.