Summary:

- The pricing environment for DRAM and NAND products deteriorated sharply in the last quarter.

- As a result, Micron is seeing steep declines in revenues and gross margins.

- Micron’s forecast for FQ2’23 is very light as well. With earnings estimates declining sharply, the stock is at risk of further revaluation to the downside.

vzphotos

Micron (NASDAQ:MU) reported its results for the first fiscal quarter of FY 2023 on Wednesday which showed a deteriorating price environment that resulted in lower average selling prices and shipping volumes for the firm’s DRAM and NAND products. Unfortunately, due to the weakening market fundamentals, especially in the DRAM market, Micron has reported a significant drop in its top line as well as a contraction in gross margins. The firm’s outlook for FQ2’23 is also everything but great with Micron forecasting a potential quarter over quarter revenue drop of up to 12%. Earnings risks are material and the company may continue to suffer from a down-turn in the PC market in the near future as well as from earnings revisions!

Deteriorating pricing environment leading to disastrous results

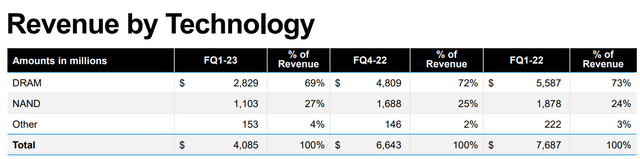

The market environment seriously deteriorated in the last quarter due to falling demand for Micron’s DRAM and NAND products which has resulted in a significant drop off in revenues in both of Micron’s business segments: DRAM revenues, which were responsible for 69% of Micron’s top line in FQ1’23, skidded a massive 41% quarter over quarter and 49% year over year to $2.83B. NAND revenues dropped off 35% compared to FQ4’22 and 41% year over year to $1.10B. As you can see in the percentage figures above, Micron’s decline sharply accelerated in the last quarter.

Micron’s FQ1’23 consolidated revenues were $4.09B, showing a decline of 39% quarter over quarter and 47% year over year. As I will discuss further below, the revenue outlook for FQ2’23 is also very disappointing… which indicates more pain for Micron’s shares.

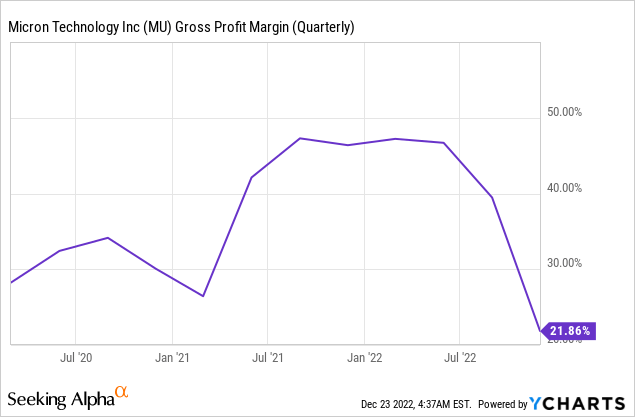

The memory maker also saw a significant contraction in its gross margin, a very important key metric for chip and memory makers. Micron’s gross margin dropped from 40.3% in FQ4’22 to 22.9% in FQ1’23, showing a quarter over quarter drop of 17.4 PP. The steepness of the gross margin decline attests to the challenges of the new pricing environment which Micron finds itself in right now. The gross margin trend clearly shows that margins have peaked…

Deterioration driven by vanishing consumer demand and lower ASPs

As a memory maker, Micron depends on a large number of device shipments for revenue generation. The PC market, however, has seen a steep decline in the third-quarter with global consulting firm Gartner estimating that global PC shipments dropped 19.5% year over year.

The PC market is seeing a slowdown because consumers upgraded their workstations during the pandemic to prepare for remote working and studying. The resulting down-turn in the device market (which includes laptops and mobile devices) is a big problem for OEMs as well as part suppliers and chiefly explains the new pricing environment.

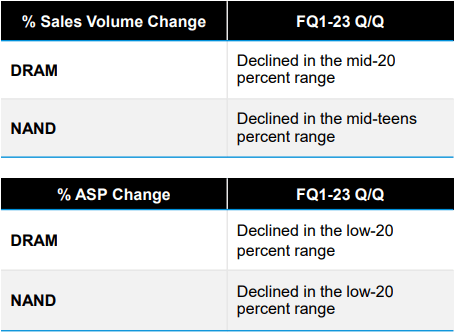

The decline in consumer demand has weakened the pricing power of firms such as Micron considerably in the last quarter. DRAM and NAND average selling prices/ASPs declined in the low 20-percent range which demonstrates an exceptional rapid down-turn. On top of that, shipment volumes also declined rapidly, with DRAM seeing a larger volume draw-down than NAND (mid-20 percent range for DRAM vs. mid-teen percent range for NAND). Since DRAM accounts for near-70% of consolidated revenues, the deterioration of fundamentals in the DRAM business weighed more heavily on Micron’s results, but both segments clearly see a cyclical correction.

Source: Micron

Micron’s counteractions to cushion the blow

Micron has said that it will cut 10% of its staff and lower its operating expenses to respond to changes in the operating environment, delay the start of wafer production for DRAM and NAND by approximately 20% and lower capital spending. Micron lowered its FY2023 CapEx guidance from $8.0B to $7.0-7.5B, but I believe further budget cuts are likely as the down-turn in the PC market accelerated in the third-quarter and could get worse before it gets better in the latter half of FY 2023. It is because of this acceleration of the down-turn in the PC market (see my Intel article that I linked to) that I think the market/pricing environment will continue to remain very challenged for Micron in the foreseeable future.

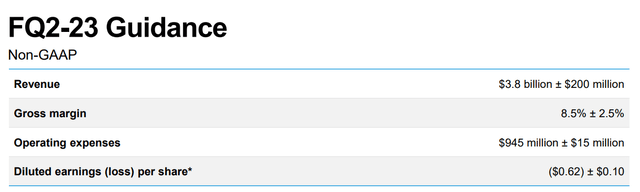

Guidance for FQ2’23

Micron expects to generate revenues between $3.6B and $4.0B in FQ2’23 which means the company could see a quarter over quarter drop in its top line of up to 12% and a year over year drop of up to 51%. Micron’s gross margin is also expected to remain under material pressure as both pricing and volume shipments are expected to remain weak in the short term: the memory maker now expects a FQ2’23 gross margin of only 8.5% +/- 2.5%.

Valuation and risks

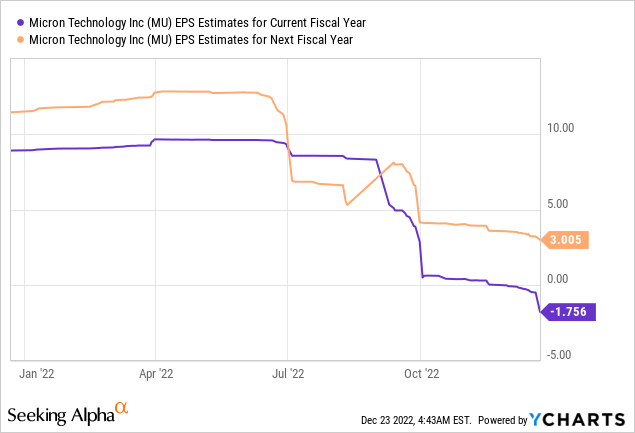

Micron has significant revenue and earnings risk in the short term and earnings estimates must be expected to continue to trend down strongly in the near term. Micron’s earnings estimates for FY 2023 have fallen sharply lately and, given the very poor forecast for FQ2’23, the company is likely going to see consistent pressure on its estimates in the coming months.

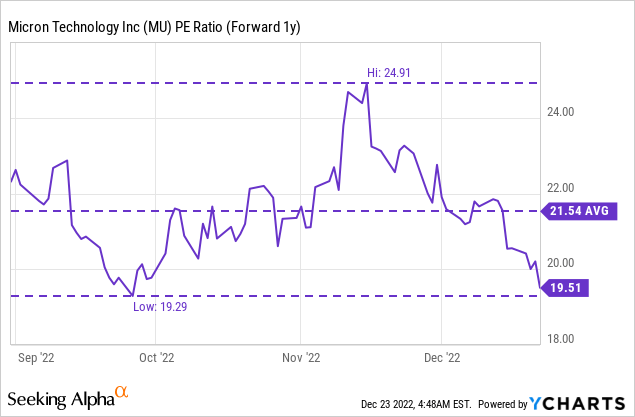

Lower earnings estimates for FY 2023 are set to result in a reset of Micron’s P/E ratio which is why I believe investors can’t trust Micron’s current forward P/E ratio of 19.5 X. A 50% decline in EPS, which is entirely possible for a cyclical memory maker in a recession, would double Micron’s P/E ratio. So, although Micron is trading well below its 1-year average P/E ratio, I believe the valuation itself is not a strong reason to buy Micron.

Key risks for Micron include revenue and gross margin pressure, weaker average selling prices (especially in DRAM), cyclical declines in DRAM and NAND shipments as well as continual EPS revisions for Micron’s FY 2023.

Final thoughts

Micron’s shares have likely not bottomed yet and it might get worse before it gets better. Micron’s earnings sheet for FQ1’23 was a disaster and it showed steep revenue declines as well as a scary contraction in gross margins. Consumers have begun to cut back on spending, creating a much weaker pricing environment for Micron in both DRAM and NAND segments. The outlook for the second fiscal quarter is also not exactly great and calls for an up to 12% quarter over quarter decline in Micron’s top line. Since the pricing environment can be expected to remain weak in at least the next few quarters, I believe the risk profile for Micron is skewed to the down-side here!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.