Summary:

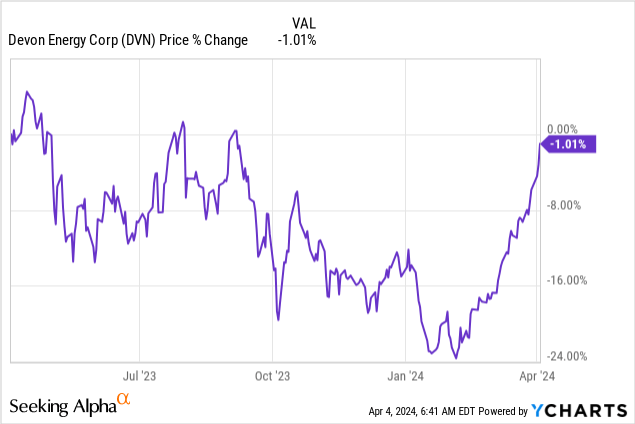

- Devon Energy’s shares are surging due to increasing demand for U.S. shale oil and rising petroleum prices.

- The demand outlook is generally favorable and petroleum prices have soared to $85 per barrel.

- Free cash flows are still strong and FCF margins have risen to ~20% in the last two quarters.

- However, the stock is now trading at a premium to its historical valuation and the risk profile is unappealing at this price level.

FabioFilzi

Shares of Devon Energy Corporation (NYSE:DVN) are in a big uptrend as demand for U.S. shale oil is increasing and WTI petroleum prices have risen to the $85 per barrel price level as a result. Devon Energy has seen strong free cash flows throughout FY 2023 and the price outlook, given the war in Ukraine and uncertainty relating to Red Sea shipping, is favorable. The macro setup is still beneficial, but the risk profile, given the sharp upward revaluation, has deteriorated. Because shares of Devon Energy have revalued massively higher in Q1, I am updating my rating on the independent E&P company to hold!

Previous rating

I recommended Devon Energy as a strong buy — A Strong E&P Play With Attractive Capital Returns — at the beginning of the year because of the company’s strong free cash flow that was supported by high petroleum prices. Recently, OPEC+ members have further extended voluntary supply cuts to the end of the second quarter, which added to positive price momentum for petroleum prices. Given that Devon Energy’s shares have soared as a result and I see limited upside potential, my new rating for DVN is hold.

OPEC+ price actions lead to upside revaluation

Petroleum prices went into a new up-leg lately after a number of OPEC+ members decided to extend voluntary supply limitations. In March, OPEC+ countries announced supply cuts amounting to 2.2M barrels of petroleum per day with Russia saying that it would cut production by an additional 471,000 barrels per day in the second quarter.

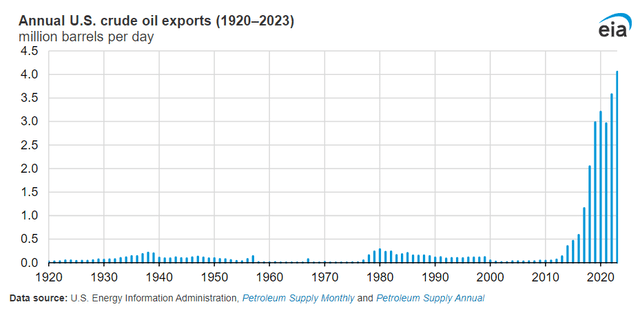

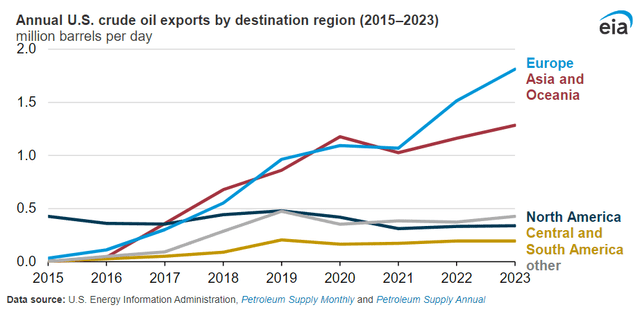

These price actions are set to be supportive of petroleum prices in the short term. Besides OPEC+’s decisions to adjust its output levels, demand prospects from Europe are also improving: U.S. energy exports have been booming in the last couple of years, partly because of sanctions on Russia related to the country’s invasion of Ukraine as well as recent Houthi attacks on sea lanes in the Red Sea which is causing additional uncertainty about crude oil supplies. This environment has led to a sharp uptick in petroleum pricing which supports Devon Energy’s free cash flow.

U.S. Energy Information Administration

According to the U.S. Energy Information Administration, U.S. crude oil exports averaged 4.1M barrels per day in 2023, showing a 13% year-over-year increase. Europe has emerged as a major recipient of U.S. crude oil exports which is also underpinning petroleum prices.

U.S. Energy Information Administration

Devon Energy has been able to translate the growing demand for petroleum into significant free cash flow. The E&P company generated $2.7B in free cash flow in FY 2023 on revenues of $15.3B which calculates to an impressive free cash flow margin of 17%. Due to uncertainty in the Red Sea, the ongoing war in Ukraine, and OPEC+’s price support, the price picture is still favorable for Devon Energy, resulting in the company’s free cash flow margins growing to 20% in the last two quarters.

|

Q4’22 |

Q1’23 |

Q2’23 |

Q3’23 |

Q4’23 |

Growth Y/Y |

|

|

Revenues ($M) |

$4,299 |

$3,823 |

$3,454 |

$3,836 |

$4,145 |

-4% |

|

Operating Cash Flow ($M) |

$1,911 |

$1,677 |

$1,405 |

$1,725 |

$1,737 |

-9% |

|

Capital Expenditures |

-$804 |

-$1,012 |

-$1,079 |

-$882 |

-$910 |

13% |

|

Free Cash Flow ($M) |

$1,107 |

$665 |

$326 |

$843 |

$827 |

-25% |

|

FCF Margin |

26% |

17% |

9% |

22% |

20% |

-23% |

(Source: Author)

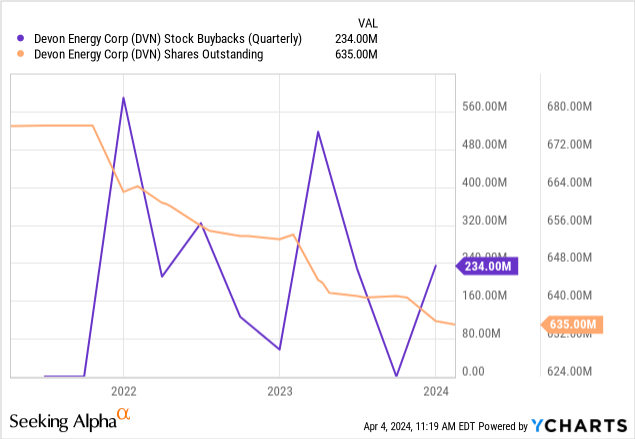

A large part of this free cash flow is making its way back to shareholders as the company is buying back a ton of its shares in the open market. The amount of shares outstanding has declined by 6% in the last three years and more stock buybacks can be expected in FY 2024.

Devon Energy’s valuation

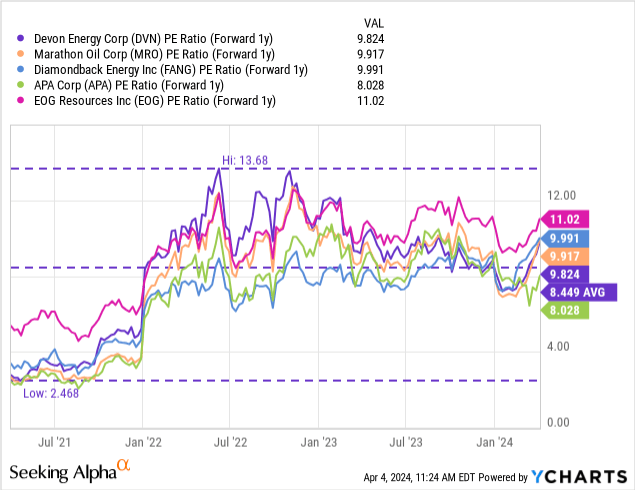

Devon Energy is currently valued at a price-to-earnings ratio of 9.8X which is about 16% above the company’s 3-year average P/E ratio of 8.5X. Rivals in the E&P sector include Marathon Oil Corporation (MRO), Diamondback Energy, Inc. (FANG), APA Corporation (APA), and EOG Resources, Inc. (EOG) which trade at P/E ratios between 8.0-11.0X with the industry group average being 9.8X… which is equal to Devon Energy’s FY 2025 P/E ratio. Given that Devon Energy’s shares trade near the 3-year average P/E ratio and on the same level as the industry group P/E, I believe the E&P company is about fairly valued right now (at about $53). The sharp upside revaluation in Devon Energy’s shares is the main reason why I am downgrading the shale player to hold.

Risks with Devon Energy

The biggest risk for Devon Energy, as I see it, is a potential downturn in the global economy as well as a resolution to the situation in the Red Sea… all of which would lead to lower petroleum prices and thereby hurt the free cash flow prospects (total return potential) of Devon Energy. What would change my mind about DVN is if the E&P company reported either a massive improvement in its free cash flow margins (resulting in a potential buy rating) or saw a significant decline in its realized petroleum prices (resulting in a potential sell rating).

Closing thoughts

Although Devon Energy has seen a sharp upward revaluation in its share price since my last coverage in January I think that changing demand patterns (demand from Western countries for U.S. shale products is growing) as well as OPEC+ supply limitations are broadly favorable for Devon Energy and the U.S. crude oil sector. The company obviously also has stock buyback potential in a rising-price world. However, shares of Devon Energy now appear to be about fairly priced based off of earnings, relative to their historical valuation average as well as its industry group, and I therefore see an unattractive risk profile for investors at this price level!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DVN, MRO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.