Summary:

- Johnson & Johnson’s shares have experienced minimal growth over the past five years, in contrast to some of its competitors in the pharmaceutical industry.

- The company aims to focus on innovative medicine and medtech, projecting 5-7% growth between 2025 and 2030.

- Johnson & Johnson faces challenges such as lawsuits and patent expirations, but its medical devices and oncology divisions offer potential for growth.

- In this post, I provide comprehensive product-by-product revenue forecasts and discounted cash flow analysis to help readers precisely break down the investment opportunity.

- If you would like to take a good look “under the hood” of Johnson & Johnson and know what the business will look like in 2030, read this post.

Adam Gault/OJO Images via Getty Images

Investment Overview

Johnson & Johnson (NYSE:JNJ) shares traded at a value of ~$10 at the beginning of 1995, $65 at the beginning of 2005, $105 in early 2015, and having reached highs of >$170 in 2022, presently trading at $154 – up just 11% across the past five years, and down 2% across the past 12 months.

The picture painted may be one of plateauing long-term growth, slowly turning into a steady downtrend, although JNJ remains the world’s third-largest Pharmaceutical globally by market cap valuation, and a “dividend king,” increasing its dividend every year for 61 years straight – current payout of $1.19 per quarter translates to a yield of ~3.1%.

Compared to the scarcely believable growth of rival Pharmas Eli Lilly and Company (LLY), and Novo Nordisk A/S (NVO), whose share prices are up >500% and >400% respectively over the past five years, and whose valuations are respectively ~$740bn and ~$570bn (despite posting lower revenue figures than JNJ in 2023), thanks to their “miraculous” diabetes and weight loss drugs, tirzepatide and semaglutide, JNJ’s performance over the past few years looks positively pedestrian.

JNJ has itself had an eventful last year or so, spinning out its best-known division, consumer health, into a new entity, Kenvue Inc. (KVUE), which began trading in May last year, and whose shares are down ~20% since listing.

JNJ wants to reinvent itself as a “two-sector company focused on innovative medicine and medtech,” as CEO Joaquin Duato – appointed in 2022 – put it on the Q4 2023 earnings call with analysts , and the company has made some bullish forward projections – for 5% – 7% growth between 2025 and 2030.

By my calculations that means JNJ – whose total revenues fell from $94.9bn in 2022, to $85.2bn last year, owing to the Kenvue spinout, expects to generate in the region of $120bn of revenues by 2030 – a bold target, and that arguably represents the lower end of guidance.

The only way JNJ can reverse the stagnant-to-falling trend of its share price trajectory is to meet these targets, in my view, but are they achievable?

While JNJ faces other significant headwinds – such as the ~50,000 lawsuits it faces, accusing the company’s talc powder of causing cancer – which it is trying to settle via an $8.9bn payout from another spinout company, LTL management, which is in the process of (trying to) declare itself bankrupt (see my previous note on JNJ for more detail) – in this post, I am going to take a deeper dive look at the challenge JNJ faces meeting its long-term revenue and profitability guidance and use some discounted cash flow analysis to establish a target share price.

Let’s begin, however, by looking at the company’s 2023 earnings results.

JNJ At The End Of 2023 – Earnings & Guidance Review

As mentioned, JNJ posted $85.2bn of revenues in 2023, which represents like-for-like 6.5% annual growth. In Q4 2023, its innovative medicine division grew revenues by 9.5% year-on-year, and its medtech division grew revenues by 9.1% – a pretty solid performance.

Across the year as a whole, earnings on a GAAP basis fell from $16.4bn in 2022, to $13.3bn, down 19%, while earnings per share (“EPS”) fell from $6.14 to $5.2. On an adjusted basis, JNJ says earnings increased from $23.8bn to $25.4bn, while non-GAAP EPS rose from $8.93 per share to $9.92 per share.

In 2024, JNJ expects to see adjusted operational sales growth of 5-6%, which translates to top-line revenues of $88.2bn – $89bn and is forecasting adjusted EPS of $10.55 – $10.75, up 6.4% – 8.4%.

This ought to set the business up fairly well in terms of meeting its longer-term goals – now let’s see how achievable they may be, and what may need to happen for total revenues to challenge ~$120bn by 2030.

Immunology, Infectious Disease, and Neuroscience

Johnson & Johnson – Long-Term Revenue Projections (my table and estimates)

In the table above, I have laid out historical product by product revenues by product, then product by product revenue expectations to 2030. If a cell is highlighted grey, it means a product is not yet launched, and if highlighted red, that product is patent-expired, meaning it faces generic competition and its revenues will almost certainly decline, at a rate of ~25% per annum.

The worst news for JNJ is that its biggest-selling product, Stelara, indicated for a range of autoimmune and inflammatory conditions such as Crohn’s Disease, ulcerative colitis, and plaque psoriasis, is set to lose patent protection after 2024. The good news is that JNJ has managed to fight off generic market entrants this year, but long term, its revenues will decline. I have modelled for a more modest 15% per annum decline, but the drop-off could be more severe.

On the plus side, Tremfya, an IL-23 inhibitor, may gobble up a large chunk of lost Stelara revenues in the coming years, while two new assets, nipocalimab, acquired via JNJ’s $6.5bn buyout of Momenta Pharma in 2020 – and JNJ-2113, an oral peptide agonist of IL-23 – indicated respectively for hemolytic diseases, i.e., myasthenia gravis, and anti-inflammatory – have the potential to drive up to ~$5bn in peak revenues between them, I estimate.

That means that, I estimate, JNJ’s flagship immunology division may be unlikely to grow between 2025 – 2030 due to the patent expiry of Stelara, but if management executes its plans, it ought not to shrink either.

It seems unlikely that JNJ’s COVID vaccine will make a significant revenue contribution going forward, but HIV drugs Edurant and Prezista appear to be well established in their markets and capable of achieving “blockbuster” annual revenues for the rest of the decade, although with the likes of Gilead Sciences, Inc. (GILD) and GSK plc (GSK) innovating in this space, they will face fierce competition. As such, I don’t maintain long-term growth expectations across this division as a whole.

JNJ is promising big things from its neuroscience division going forward, with the launch of new major drugs in seltorexant and aticaprant anticipated, which management has suggested could earn between $1 – $5bn each. I have estimated each will earn ~$2.5bn by 2030. With Spravato, ADHD targeting Concerta, and Invega Sustenna, indicated for schizophrenia, this division could deliver some exciting growth for JNJ, I believe, although treating CNS conditions is a tricky business, with patients subjective around which therapies suit them best.

Oncology, Pulmonary, Cardiovascular

JNJ product revenues projections to 2030 (my table and estimates)

Alongside Neuroscience, if JNJ is going to hit its growth targets it is going to have to extract maximum value from its Oncology division, which accounted for 21% of company revenues in 2023, the same contribution (give or take a few hundred million) as immunology.

We can see the heavy focus on Multiple Myeloma, which pitches JNJ in direct competition with Bristol Myers Squibb Company (BMY), also heavily reliant on revenues from this source. There may be room for both companies’ products, however, given this is forecast to be a $30bn market by 2026.

With imbruvica sales falling due to government pressure on pricing, and Zytiga losing patent protection, JNJ will be hoping that recently launched MM therapies Talvey and Tecvayli can achieve “blockbuster” (>$1bn revenues per annum) status, while management has high hopes for rybrevant in NSCLC – it expects an FDA approval this year, in combo with lazertinib, its EGFR tyrosine kinase inhibitor.

Cell therapy Carvykti has been a solid performer since launch, with expansion potential, and erleada showed strong growth last year in prostate cancer. As such, I am optimistic – as JNJ management is – around the oncology division, which I estimate may grow by $10bn in terms of top line revenues by 2030.

I am giving JNJ the benefit of the doubt in the hypertension space – United Therapeutics Corporation (UTHR) is a ferocious competitor in this space, I believe, but the strong growth of Opsumit and Uptravi appears undeniably impressive, and two new product launches add ballast to a growing division.

Within cardiovascular, I am less optimistic – xarelto’s best days are likely behind it now as the blood-thinner heads towards patent expiration, and this division does not seem to be a strong focus for JNJ.

Medical Devices

Medical Devices Division forecast to 2030 (my table and estimates)

Finally, Medical Device performance was given a strong lift in 2023 thanks to JNJ’s integration of Abiomed – a company it acquired in 2022. Seemingly, every segment posted a year-on-year gain – perhaps thanks to the easing of pandemic pressures, which kept patients away from elective surgeries – and JNJ is a market leader in this field, alongside Medtronic plc (MDT).

I may be being optimistic assuming a flat 5% per annum growth annum across all segments, but I am following management’s guidance here, and I believe it is fair to say that every segment offers a growing market opportunity, thanks to an aging population, product innovations, and economies of scale.

Reaching A Share Price Target With Discounted Cash Flow Analysis

In the final part of this post, I will share my discounted cash flow (“DCF”) analysis, beginning with the income statement.

Income statement forecast (my table and assumptions)

I have plugged in my revenues forecast into an income statement as shown above. My total revenues of $90.3bn for 2024 is slightly higher than management’s guidance, albeit not by much, and the overall growth rate of 5% is at the lower end of long-term guidance. I have eased operating costs as a percentage of revenues over time and reduced interest expense payments – JNJ is not a heavily indebted company – as CFO Joseph Wolk told analysts on the Q4 2023 earnings call:

We generated free cash flow of more than $18 billion in 2023. At the end of the year, we had approximately $23 billion of cash and marketable securities and approximately $29 billion of debt for a net debt position of $6 billion.

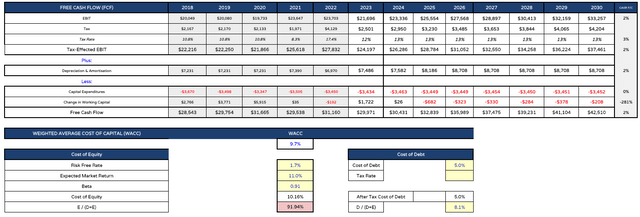

JNJ free cash flow forecast (my table and estimates)

As shown above, I take EBITDA and add back tax and depreciation, and as we can see, I’d expect JNJ to generate some substantial cash flow in the coming years, rising to $42bn by 2030.

Pharmaceutical companies are almost always profitable, in my experience, although there is long-term pressure on margins from the government, who has long sought to rein in margins and reduce the prices of drugs. JNJ will inevitably feel some headwinds from this. Just yesterday, President Biden was celebrating the impact of the Inflation Reduction Act, stating “finally, finally, we beat Big Pharma!”

There are many different levers you can pull when it comes to a fair weighted average cost of capital (“WACC”), but I typically like to get to somewhere near 10% for pharma companies so I can contrast and compare, and because that is generally what the numbers tell me.

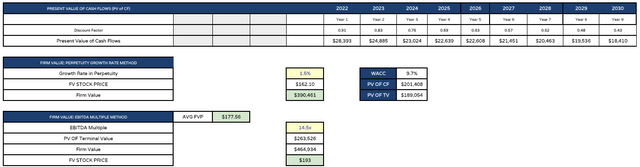

JNJ share price target estimate DCF (my table and assumptions)

Finally, the share price target I reach – an average of the growth rate in perpetuity method and EBITDA multiple methods – is $177/$178 per share.

That represents a 15% premium to the current traded price, but am I confident that this target can be reached?

Unfortunately, when I consider what management needs to achieve to deserve a “fair value” share price of $178 today, I see many potential hurdles and stumbling blocks.

The biggest issue is competition. Pharma is relatively unique in that, unlike, say a car manufacturer, that does not have to make the best car to make sales, drugs that are not deemed “best in class” do not sell, because why would a physician prescribe an inferior drug?

It is not an option for a Pharma to undercut the price of a superior drug with an inferior one, the industry does not work like that, so as impressive as much of JNJ’s drug development pipeline is, there is competition in every space and some projects will be less successful than others.

From AbbVie in immunology, from Gilead / Lilly / GSK in HIV, from Bristol Myers Squibb in oncology, from AbbVie again (plus a number of smaller entities) in CNS, there is no guarantee that every one of JNJ’s drugs will perform according to management’s expectations. Certainly, some may outperform, but when I scan the portfolio for a >$10bn per annum drug to take on Stelara’s mantle, I am not sure I see one at the present time – although keep an eye on JNJ-133.

Does that mean shareholders need to consider selling JNJ stock? I would say “not yet,” as while there are clouds on the horizon – the talc litigation, the stelara patent expiry, and intense competition, there are also multiple areas in which JNJ may outperform, and an advantageous financial position not shared by most other pharmas.

As a self-proclaimed “dividend king,” when JNJ stock falls in value, its dividend yield increases, so with that hedge in place, and with management’s road map in our hands, I would say that there is no immediate risk to the value of Johnson & Johnson’s shares, but in terms of the upside opportunity in play, with so many hurdles to overcome, it may take another 12 months or more before any upside kicks in.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV, BMY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.