Summary:

- Affirm’s stock has fallen 33% since the start of the year, correcting from a triple-digit growth in 2023, but far away from pandemic’s valuation.

- The company’s operating losses cover half of its revenue and seems too far away from profitability, while displaying an elevated PS ratio.

- High take-rates, potential prudence bias, and well-financed competition are other aspects that support the sell rating.

B4LLS

The stock of Affirm Holdings (NASDAQ:NASDAQ:AFRM) has risen substantially in the last year with a performance of 216%, then of falling around from peak-to-trough ~94% after the pandemic hype ended and demand for Peloton machines deteriorated. Nonetheless, the stock hasn’t had a great start of the year and since the end of December, the shares have corrected by -33%. In this analysis, I will explain why I am bearish and rate this company with a sell. For that, I will draw the main points of what I like and dislike about the business, their valuation, and risks associated with my bearish thesis. In addition, I will briefly discuss the company overview and where they stand in the buy now, pay later market.

Company Overview

Affirm is a US company dedicated to offering the so-called buy now, pay later (BNPL) service to over 17 million active clients in the United States and in Canada via PayBright. The company has 2,171 directly hired employees, in the US, Canada, Spain, and Poland. Nonetheless, I have learned from someone I met, that this company outsources part of its back-office functions in Latin American countries, such as Colombia, via a business process outsourcing (BPO) company named Foundever, enjoying the same US time-zone and benefitting from cost savings.

As of their last earnings, the company achieved $1.91 billion in revenue and a gross margin of 62%, which vanishes after subtracting operating expenses and incurring in an exorbitant operating loss of $893 million. All data mentioned before was presented in a trailing twelve months (TTM) period.

Affirm

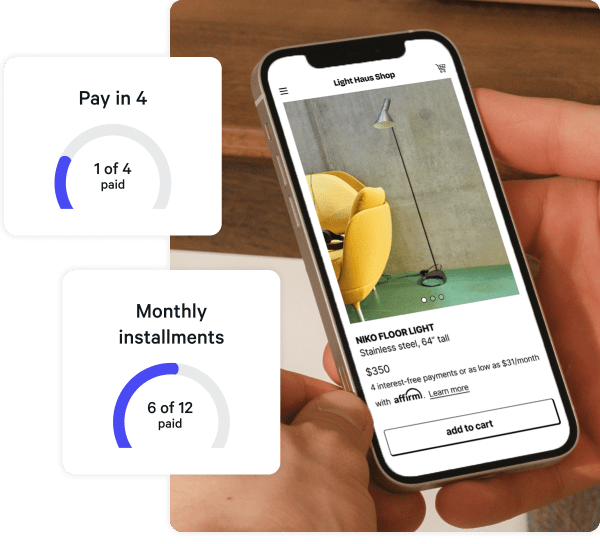

To access Affirm’s loans, a user has to choose between a payment plan of making four payments without interest in 2 months, or a loan with fixed interest up to 12 monthly installments. For example, if a user buys an $800 laptop, he could choose between paying four times $200 every two weeks or pay $72.21 every month at a 15% APR. The interest-bearing loans, go up to 36% and are dependent on the client’s credit riskiness. Previously, the company gave clients the possibility to earn reward points on their purchases thoroughly the Affirm Rewards Program. Nonetheless, the company totally discontinued this program in February of this year.

After around two years, the fintech recently regained its large-cap status, then of falling below the $10 billion range in a dropdown that made the company plummeted from a stunning $47 billion market cap to a $2.5 billion market cap. The new large-cap status will allow long only mandates to include Affirm in their portfolios. But at the same time, mid-cap funds that currently hold Affirm will have to get out of the position depending on their policies.

Large institutional holders of Affirm include the Morgan Stanley Inst Discovery (MSKLX) mutual fund, which alone holds 8.59% of the portfolio in Affirm’s stock, making it the second-largest position. Also, the Counter Global team at Morgan Stanley, holds the stock in the Insight and Growth funds.

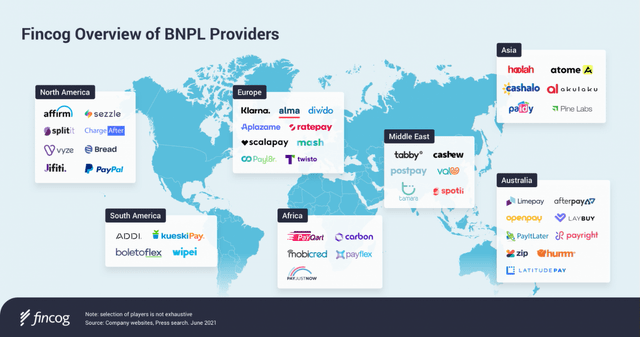

Buy Now, Pay Later Market

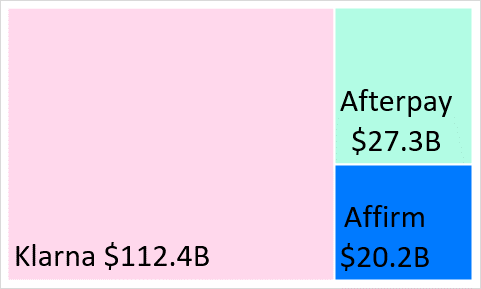

The buy now, pay later service is fragmented within a vast number of companies globally. However, Klarna, Afterpay (owned by Block), Affirm, and Pay in 4 (by PayPal), are the leading firms. In terms of global presence, Affirm has dedicated its efforts to run operations in the United States, Canada and Australia. Nonetheless, the company ceased operations in the latter country last year. Failing to compete against Afterpay, Zip, and the same Klarna in that country.

BNPL Market (Author’s Compilations | Data: IR of Companies)

In terms of gross merchandise volume (GMV), Klarna clearly outpaces Affirm. Although Klarna is still a private company, it has a global presence in 34 countries, including emerging markets such as Mexico. Currently, Klarna is moving around 5.6x more in GMV than Affirm and consolidates itself as the market leader. In addition, Klarna is in talks with banks for a potential IPO in Q3 2024.

Why I Don’t Like Affirm?

There are several reasons why I am bearish on the stock, and I will point out all of them one by one.

1. They Are Giving Too Much

To start, Affirm offers loans with no penalties for late payments, and interest is calculated on a simple basis. For the client, this is great, but from my point of view, the company is giving too much and is not providing financial pressure to clients to pay debts on time. For example, it’s technically the same to pay on time than paying with 29 days overdue, as it won’t hit the threshold required to be reported to the credit agency. Also, compared to classical credit cards, a fixed loan means higher duration, therefore increasing Affirm’s capital requirements based on Basel III.

The way Affirm is able to offer non-interest-bearing loans, is by charging a high fee to merchants, with the aim of increasing the average order per customer due to easiness in financing. Although based on their surveys, the BNPL model helps merchants increase sales, in my opinion, these fees are extremely high. The fees vary, but on average, they are around 5% for pay in four arrangements. Knowing that most of these items are consumer durable or travel, I am curious to know what would happen in a recession. And also, from the side of clients, the demand of these high-ticket durable goods tends to perform poorly during weak economic periods. Knowing so would merchants continue to accept these high take rates in a recession? I think that during times of economic distress, less merchants would continue to accept Affirm or any other BNPL provider.

2. Cash Burning Machine

Even though Affirm has been reducing absolute operating loss to total revenue, the truth is that this ratio remains too elevated for holding their stock in the long term. Even more, when this is a company that doesn’t have other businesses with positive cash flows to support the BNPL cash burning activities, which is potentially the case with Block and PayPal. Therefore, introducing dilution or debt increases risk.

For example, in December 2023, TTM by quarter, the company registered $1.914 billion in revenues and $893 million in operating losses, resulting in a ratio of absolute operating loss to total revenue of 47%. It did improve from the year prior when the ratio was at 78%, but two years prior it was still high at 60%. Again, if these were to be a conglomerate with subsidiaries to support these large losses, this component shouldn’t be as alarming, but Affirm stands on its own, and seems too far away from earning a positive free cash flow when competition is more present than ever.

If you would like to go more into detail about the structural unprofitability of Affirm, check the article from Seeking Alpha’s analyst ASB Capital who performed a great job illustrating the scenario.

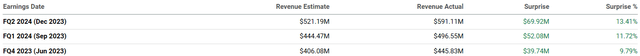

3. Potential Prudence Bias?

Another aspect that makes me cautious is that in the last three quarters, the company has beaten revenue estimates every time by double-digit growth. Yes, that sounds marvelous, but those high levels of repeated surprises make me believe that management is too conservative in giving guidance. Guidance given serves as anchored data for analysts to come up later with estimates that are currently being beaten by double digits. Additionally, in the 13 quarters Affirm has reported revenues, in 12 of those occasions, revenue estimates were beaten. Take this view as you want, but it’s just an observation that makes me cautious.

Full disclosure: I didn’t discuss about earnings since the company is extremely unprofitable and those estimates at these levels have little to no value in my opinion.

4. Regulation

Last, regulation. BNPL is a fairly new concept, and the Consumer Financial Protection Bureau (CFPB) is planning to issue guidance to oversee lenders. They are pointing out that these companies are heavily relying on consumers’ personal data to induce more purchasing and debt accumulation in a way that threatens consumer privacy and is not seen with other types of companies. CFPB Director, Rohit Chopra, added that BNPL companies also lack in consumer protection compared to traditional credit cards. This per se is normal within innovations, but it indeed adds uncertainty looking forward, and it was worth pointing out.

Positive Aspects

Even though I am bearish on Affirm, not everything is black and white, and there are some positive attributes to highlight about the company.

- Partnership with Amazon Business for B2B purchases via Affirm.

- Shopify is a major shareholder and owns 6.34% of the company.

- 30+ delinquency rate of 2.4% isn’t that bad for a sub-prime lender.

- YoY revenue growth at 29.4% (not as “positive” after accounting for expenses)

- Launch of debit card that allows BNPL purchases at any merchant.

Valuation

Unfortunately, I couldn’t find a reliable method to value this company for the following reasons.

- Affirm doesn’t have reliable peers. Klarna is still not public, and Afterpay and Pay in 4 are not big representatives of Block’s and PayPal’s sources of revenue. And even though SoFi offers this same solution, it’s not a BNPL big player and definitely not their core feature.

- Justified price-to-sales formula can’t be used when earnings are negative.

- DCF can’t be run with negative free cash flow or no dividends.

- Historical price-to-sales ratio is full of outliers from absurd pandemic valuations.

Nonetheless, on an absolute basis, their price-to-sales ratio currently stands at 5.2x, which is 99.6% higher than the sector’s average. My question is, does a company that incurs losses of $893 million in operations, which represents 46.6% of their revenues, justify a price-to-sales of that size? There is no theoretical formula to verify this when earnings are negative, but for comparison, a consolidated company, such as Fiserv, trades within that same range. Even worse, when companies that a small part of their revenues come from BNPL solutions trade at around half the multiple, which is the case for PayPal and Block, for example.

One could argue that during the pandemic, this company even traded at 56.3x PS ratio and that now it’s cheap at only 5.2x PS ratio. In my opinion, the 5.2x PS ratio is also pretty high, considering the large amount of money that they are losing. All of this still takes into account the high revenue growth encountered.

Risks Of My Thesis

Definitely, I see some risks that could make my bearish thesis not play out. One of them could be an M&A deal from a larger company acquiring Affirm, as this would boost the share price. Currently, they only offer a single solution, and this could be a target for a company that wants to explore the BNPL solution inorganically. But to be honest, I’m not sure which company would like to add a loss of $893 million in operations to their statements. So if that happens, the offer would probably need to arrive from a company that brings enough synergies to reduce those high expenses.

Another risk could be that the company does make accelerated progress towards reducing its gross and operating margin discrepancies, which would accelerate the company’s path to profitability. However, the company stands at an unfavorable position compared to their direct competitors. Currently, Block and PayPal enjoy from other segments that could finance potential losses from the BNPL features, but this is definitely not the case for Affirm. Also, even though Klarna remains unprofitable, they are very close from profitability with net losses accounting for only 2.6% of the revenues. Therefore, the risk of the bearish outlook for Affirm is that the company ends up reducing its gigantic losses quicker than expected.

In my belief, I mentioned that this company could suffer heavily in a recession since the financed purchases are mainly durable goods with high-ticket prices. I could be completely wrong on this one, and maybe people during a recession could start boosting their BNPL purchases rather than using traditional credit cards. Nonetheless, the difference in grace period between a credit card and Affirm’s Pay in 4, it’s not significant enough for someone with access to a credit card to give up the benefits. Or at least I think so.

Conclusion

To add a last comment, I believe that buy now, pay later solutions could work best in pay-in-full cultures such as the Dutch and the German. Smart people could buy items with BNPL, while keeping their available balances in high-yield savings accounts such as Wise or Revolut, for example. But I believe that in the United States, credit cards are just a superior alternative for short-term financing in most of the cases.

Good luck to anyone holding the stock. All the best, and remember that this is just my personal opinion. I remain more than open to further discussing my points of view in the comments section.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.