PayPal: A Good GARP Stock Made Even Better By Buybacks

Summary:

- PayPal Holdings, Inc. stock prices have remained stagnant recently, but its earnings have been improving, with projected growth in the next few years.

- At ~13x P/E, it is simply a good GARP opportunity (growth at reasonable price) considering its scale, differentiating business model, and growth potential.

- The company’s aggressive share buybacks further enhance the opportunity.

PM Images

A good GARP opportunity

The stock prices of PayPal Holdings, Inc. (NASDAQ:PYPL) have gone nowhere in the recent 1~2 years. As shown in the chart below, the price of PYPL stock has been largely sideways in the past year. I cannot blame the market, as there are indeed uncertainties surrounding the future of PYPL’s business (I will revisit this toward the end).

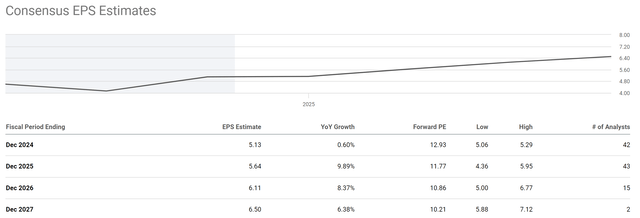

While its prices stagnate (for now), PayPal’s earnings have been improving over the years. As seen in the next chart below, consensus EPS estimates for PYPL’s future earnings growth point to a slight growth of 0.60% for FY 2024 to $5.13. Thus, the implied forward P/E ratio is 12.9x. Looking further out, the EPS is expected to grow at a much faster rate: 9.89% in FY 2025 and 8.37% in FY 2026. If these growth rates materialize, its implied P/E would fall to 11.77x in 2025 and only 10.86x in 2026.

In the remainder of this article, I will argue why such growth is very likely, thus making PYPL a good GARP opportunity (growth at a reasonable price). In particular, I will discuss how its buyback could make the opportunity even more attractive.

Growth catalysts

My view is that there are plenty of catalysts at work to support the projected growth in the next 3~5 years thanks to PYPL’s differentiation business model. The most important differentiating factors in my view are its two-sided network and its multiple payment platform. PayPal operates a two-sided network, connecting both consumers and merchants on a single platform. This fosters trust and convenience for both parties. Merchants benefit from access to a large pool of potential customers, while consumers enjoy a familiar and secure payment experience across various online stores. Also, beyond traditional credit card processing, the PayPal platform offers various payment options like person-to-person transfers (through Venmo) and credit lines. This flexibility caters to diverse consumer preferences and spending habits, and is especially important as we enter the digital payment era.

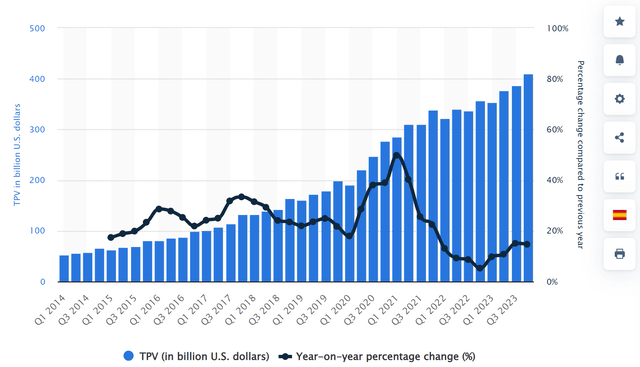

Thanks to these factors, PayPal has established brand recognition that fosters a network effect. Consumers are more likely to trust and use a platform they recognize, further attracting merchants who want to tap into that established user base. Its model is also highly scalable, helping PYPL to reach a global user base and grow its transaction volume rapidly (see the next chart below).

Looking ahead, I see plenty of opportunities for PYPL to maintain rapid growth, and the top 3 growth areas in my mind are the penetration into high-growth markets, adaptation of new technologies, and the spread of digital wallets. PYPL already boasts a global presence, but further inroads into high-growth markets, particularly in developing economies with rising internet penetration and mobile phone usage, could significantly boost its user base and transaction volume. In terms of new technologies, the payment industry is constantly evolving with new technologies like blockchain and the rise of cryptocurrencies.

I view PYPL as one of the best-positioned companies to capitalize on these new technologies by integrating their technologies into its platform. Finally, an expanded digital wallet offering can help PYPL users to be better engaged (and potentially become locked in) within the PYPL ecosystem.

Share buybacks

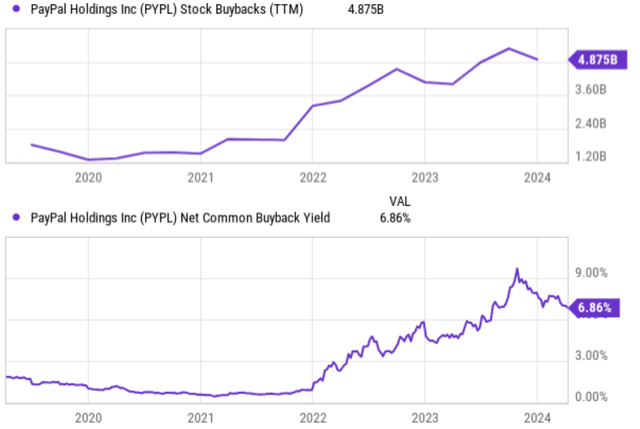

The GARP opportunity is further enhanced by the share buybacks. The company is aggressively buying back stock. As a recent example, in the third quarter of 2023, management repurchased roughly 23 million shares of common stock, notably reducing the outstanding share count over the past year or so.

To better contextualize things, the chart below describes PYPL’s stock buybacks (top panel) since 2020 and its net common buyback yield (bottom panel). As seen, PYPL has repurchased a total of 4.875 billion dollars of its common stock in the trailing twelve months this year. Such an amount translates into a net common buyback yield of 6.86% on a TTM basis, handily beating the “high dividend yield” stocks most dividend growth investors pursue.

Then bear in mind that share buybacks, specially made at reasonable valuations like PYPL’s 12.9x P/E now, are far more potent for shareholder returns. Such large-scale buybacks indicate PYPL’s management confidence in the growth of the business, their view on the valuation of the stock, and PYPL’s capital allocation flexibility. While a cash dividend can (and often does) indicate a lack of growth, CAPEX investment opportunities, and overvaluation.

Stock buybacks are also way more tax-efficient for both the company and the shareholders. With a stock buyback, shareholders don’t realize any capital gains or losses until they actually sell their shares. This allows them to defer paying taxes on any appreciation in the stock price. In contrast, with cash dividends, first, they are taxed twice. First, it is taxed at the company and then shareholders owe taxes again as income once they receive the payment – regardless of whether they reinvest the dividend or spend it.

Other risks and final thoughts

Now risks. PayPal Holdings, Inc. is facing several challenges common to other payment stocks, such as increased competition from other payment processors and a slowdown in the growth of e-commerce. These challenges could keep weighing on its stock price and keep it range bound.

I also see a few risks that are more particular to PYPL compared to many of its peers. PYPL almost depends on e-commerce exclusively. Although I believe e-commerce is where the future is, such dependence does create some concentration risks. PYPL could also face challenges in successfully monetizing its free digital wallet service and attracting users to higher-fee services. Finally, it is also at an earlier state of integrating its acquisitions like Venmo into the core PayPal platform. The process could be more complex and take longer than expected, leading to user adoption and/or cost issues.

All told, my overall conclusion is that the positives outweigh the negatives, and thus I rate PayPal Holdings stock as a BUY under current conditions. Again, the gist of my buy thesis is that it is simply a good GARP opportunity. The opportunity is further enhanced by large-scale buybacks.

Going forward, I expect suspect that buyback activity will continue. The robust earnings growth as just mentioned, the healthy balance sheet, and good amount of cash reserves, and very manageable long-term debt obligations all gave management the capital allocation flexibility to do so. By shrinking the share counts (at reasonable P/E ratios), these buybacks could make the EPS growth rates even higher than consensus projections.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.