Summary:

- NextEra Energy’s 10% dividend hike is set to be matched every year until 2026.

- The electric utility is guiding for EPS growth of at least 7% per year over the next five years.

- Pending Fed rate cuts and a healthy policy environment for renewables will form levers for near and medium-term outperformance.

Gunther Fraulob

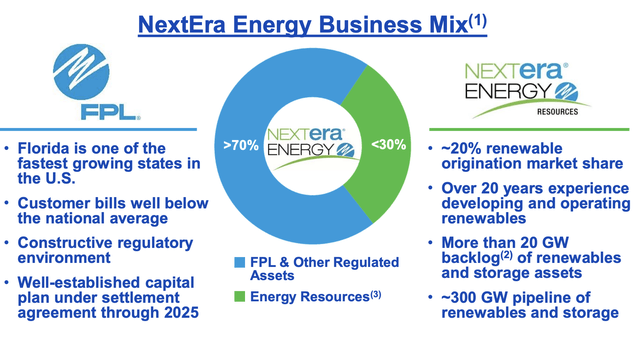

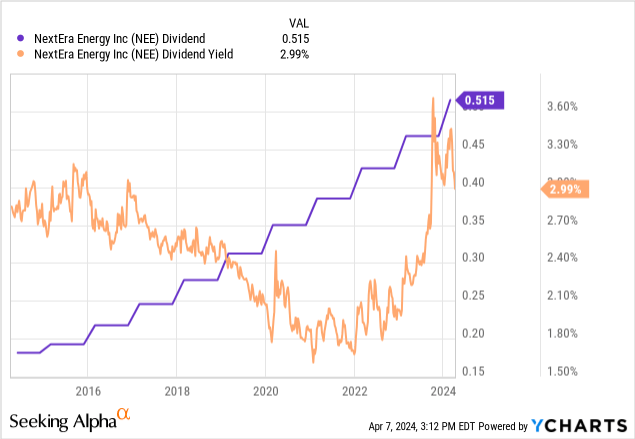

NextEra Energy (NYSE:NEE) is an incredible dividend growth machine. The electric utility last declared a quarterly cash dividend of $0.515 per share, a remarkable 10% hike sequentially and $2.06 per share annualized for a 3.2% dividend yield. NEE has also guided to grow its dividend by at least 10% per year for the next two years until 2026, cementing its status as an exceptional shareholder-aligned dividend aristocrat. This title is revered for companies that have consecutively raised their dividend every year for at least 25 years. At its $132 billion market cap, NEE is the largest electric utility in the US. The company has 72 gigawatts in operation and operates through Florida Power & Light (“FPL”) and NextEra Energy Resources (“NEER”).

NextEra Energy March 2024 Investor Presentation

NEER is a renewable energy juggernaut, commissioning a record 5.6 gigawatts of wind and solar renewable energy projects and storage in 2023 against a backlog that stood at 20 gigawatts. The company added 9 gigawatts to its backlog last year and is set to bring a significant portion of this online over the next two to three years. FPL is a rate-regulated electric utility that serves about 5.8 million customer accounts in Florida. The Sunshine State has experienced material population growth since the pandemic, growing by 1.9% to just over 22 million people in 2022. This meant the third-largest state was the fastest-growing for the first time since 1957.

Earnings Ramp And Operating Cash Flow

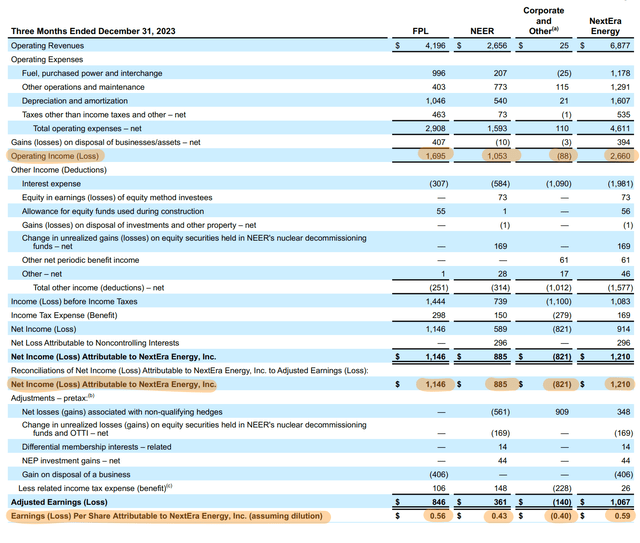

NEE’s renewable energy segment forms a core engine for NEE’s future growth, especially on the back of the 2022 Inflation Reduction Act (“IRA”) which provides investment and production tax credits to renewable energy projects and is essentially set to underwrite hundreds of billions of dollars in green energy spending over the next decade. The company recorded revenue of $6.87 billion during its fiscal 2023 fourth quarter, up 11.5% over its year-ago comp and beating consensus by $550 million.

NextEra Energy Fiscal 2023 Fourth Quarter Earnings Release

NEE’s adjusted net income at $1.07 billion, around $0.52 per share, was up from $1.01 billion and $0.51 per share a year ago. Full-year 2023 adjusted net income at $6.4 billion, roughly $3.17 per share, grew by 9.3% over 2022 adjusted earnings of $5.742 billion, or $2.90 per share. The company guided for 2024 adjusted earnings to come in at $3.23 to $3.43 per share, a growth rate of 5.05% over 2023 at the midpoint. NEE expects adjusted EPS to grow by 7% per year over the next five years so actual earnings might push the high end of its guidance range. NEE has built the largest renewable business in the world with a 20% renewable origination market share in the US and is set to be buffeted by the incredible IRA.

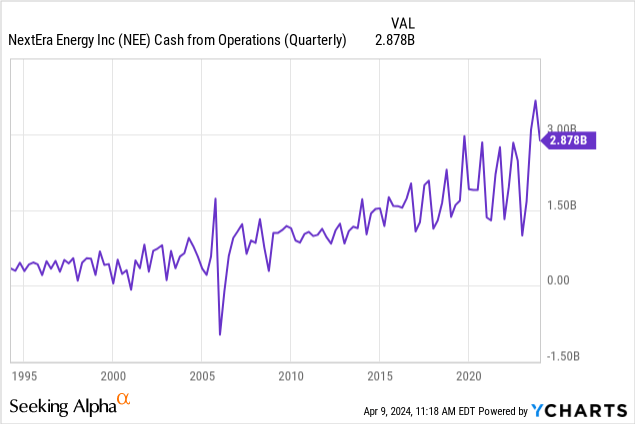

The utility’s fourth quarter cash from operations came in at $2.88 billion, with the full-year figure for 2023 at $11.3 billion against total dividends paid to common shareholders of $3.78 billion. NEE can cover its dividends through operating cash flow and adjusted net income. And with this set to grow by low single digits, shareholders in the electric utility are set to see consecutive bumper years of a double-digit dividend raise. Critically, pending Fed interest rate cuts and dampening inflationary headwinds are set to provide a boost to NEE this year with the market still pricing in at least three rate cuts of 75 basis points this year.

Dividend Growth, The Units, And The Future Of Energy

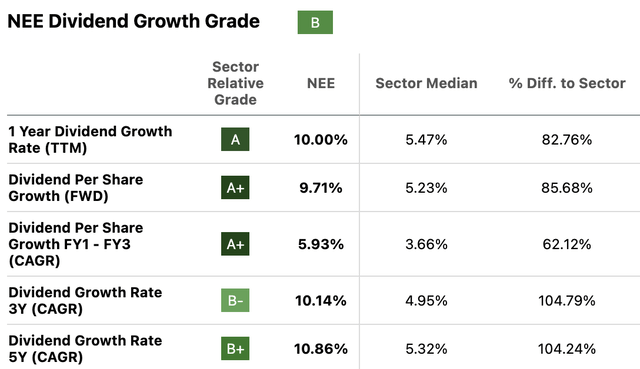

NEE’s dividend chart history is remarkable, with consecutive yearly hikes forming a baseline for common price accretion. The utility’s dividend growth history is beyond its peer group with its 3-year dividend growth compound annual growth rate at 10.14%, more than double its sector median. NEE also has 8.7% yielding corporate units (NEE.PR.R) that are set to mature in a few months on 9/01/2025.

The units have a settlement of 0.5626 shares per unit if the market price of NEE is equal to or less than $88.88 per share. Hence, 100 units at the current price of $40 per unit at $4,000 would get a settlement of 56.26 common shares which at the current price of $65.24 would have a $3,670 total cost. This means there are no clear benefits with the units if you wanted a backdoor way to buy more NEE shares, despite their substantially higher interim dividend set to be paid out for two more quarters.

US Energy Information Administration

Renewable energy storage is set for further growth as solar and wind energy continue to play a pivotal role in the energy mix of the US. These have seen their share of total generation rise over the last few years with expectations that they will grow to surpass coal in the near term. I am bullish on NEE against its outlook for dividend increases, pending Fed rate cuts, and the positive policy backdrop for renewables.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NEE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.