Acuity Brands: Scalable Business Attracts Analysts, Thanks To AI And Growth

Summary:

- Acuity Brands has a scalable business model and is targeting a double-digit growing market.

- Recent acquisitions indicate potential inorganic growth for AYI.

- The incorporation of artificial intelligence capabilities could lead to improved lighting experiences and performance.

Yuji Sakai

Acuity Brands, Inc. (NYSE:AYI) presents a scalable business model, and targets a market growing at a double-digit. Recent acquisition of assets acquired from Current Lighting Solutions, LLC, and the acquisition of KE2 Therm Solutions indicate that AYI may also be growing inorganically in the coming years. Besides, if the company offers further information about how artificial intelligence capabilities could offer better lighting experiences and improve performance, I believe that many new analysts may study the business model. There are some risks from rapid technological changes or failed internationalization efforts; however, the company looks cheap right now.

Acuity Brands

Acuity Brands is an industrial and technological company with a presence in regional markets. The company has 18 production facilities, with six of them located within the United States, seven in Mexico, three in Canada, and two in European territory. The infrastructure is completed with third-party contracts and various forms of outsourcing, especially with regard to the logistics of distribution and entry of raw materials.

On this point, it is good to highlight that particularly in Mexico, the company has managed to have some of its production facilities declared as Maquiladoras, allowing the entry of raw materials without paying taxes and with tax benefits. This means that the bulk of the company’s manufacturing is currently in this country as a result of the industry installation policies that the Mexican government established, mainly for the North American economy.

There are two segments that the company uses to organize its activities: the lighting controls segment and the intelligent spaces segment. Both segments offer services or products related to luminaires, either for the application of individuals or for the organization of spaces and events.

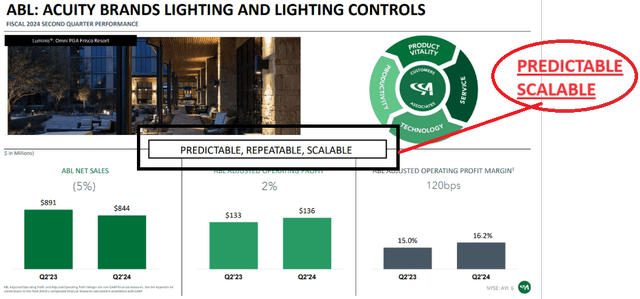

The luminaire controls segment includes luminaire solutions for residential, commercial, and architectural purposes, along with luminaire control systems and components that are combinable for system management. Most of these products are based on low-consumption LED technology. Among some of the brands that stand out, we can name eldoLED, Eureka, Gotham, and Healthcare Lighting. I believe that the most interesting thing about this business model is the fact that it is described as predictable and scalable. It was noted in a recent presentation given to investors. Under my best-case scenario, I assumed that management was correct about the scalability of the business model.

Investment analysts out there will most likely appreciate that future FCFs may be quite predictable. In the last presentation, the company noted an increase in quarterly adjusted operating profit of close to 2% y/y.

Source: Presentation To Investors

Customers in this segment are electronic product installers and distributors, original manufacturers, retail distributors, and home improvement centers, to name a few. Customers in this segment are entirely concentrated in the United States, and in some cases, these customers move products through the international market.

On the other hand, the smart spaces segment is aimed at the design and installation of lighting spaces, as well as the development of software for their control and adjustment. These control software is not limited only to lighting capabilities, but also covers ventilation systems and other associated residential facilities.

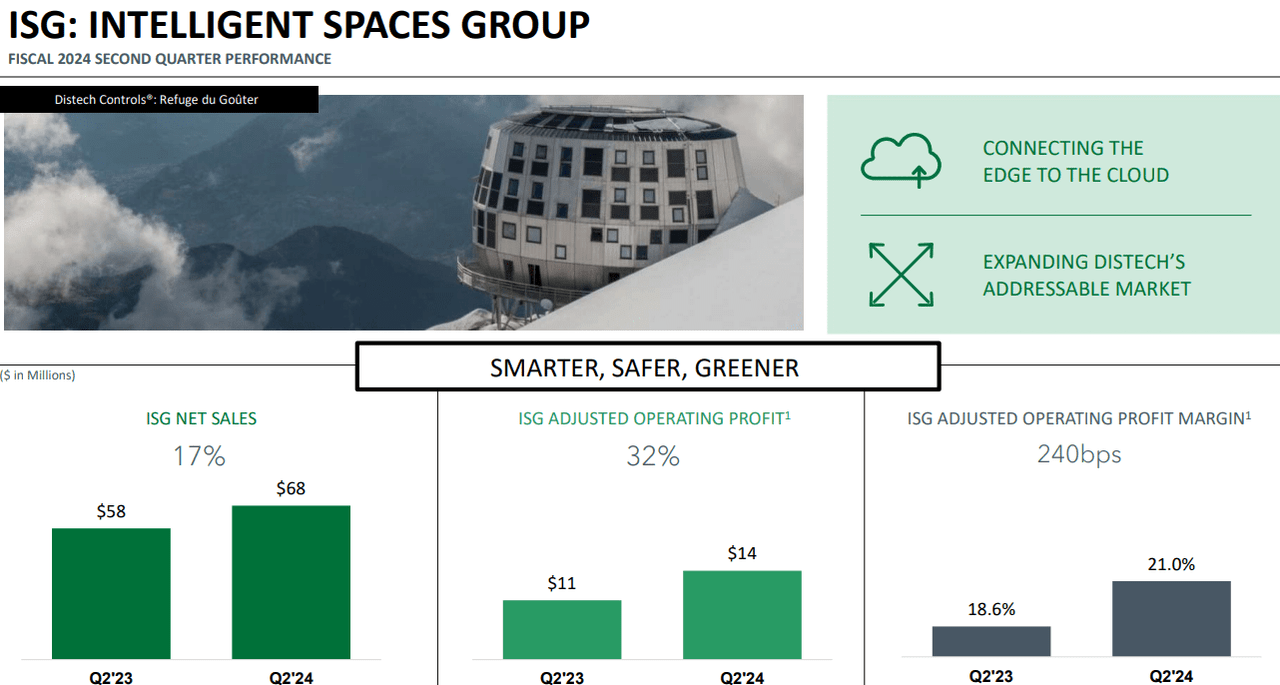

Clients are varied, and go beyond system integrators. They also reach airports, retail stores, and commerce in general that need to develop the lighting capabilities of their interiors. Clients are also located within the United States, although in this case, the service also extends to a lesser extent towards international presence. Net sales obtained from this business segment are not large. However, ISG net sales offer double-digit net sales growth and an adjusted operating profit margin of close to 32%. In my financial model, I mainly had a look at the luminaire controls segment business because it is the largest business segment.

Source: Presentation To Investors

Recent Earnings Increase, And EPS Revisions Increased

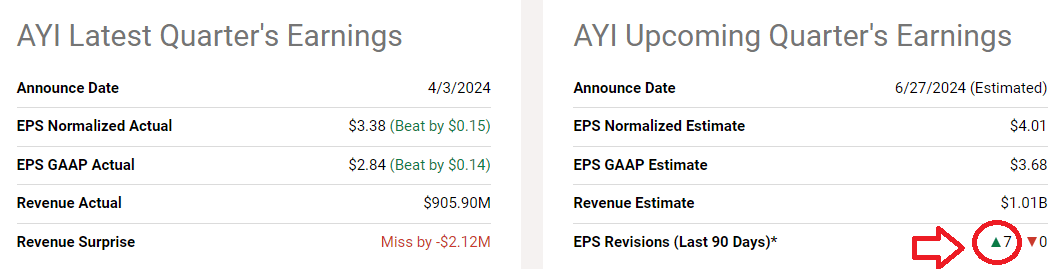

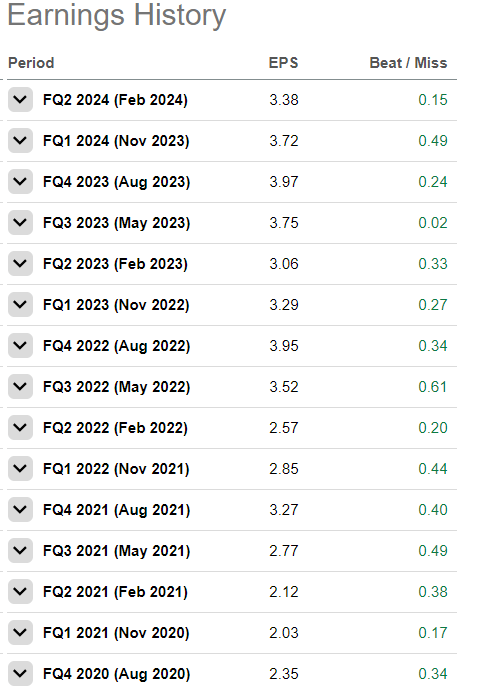

Recent EPS GAAP was better than expected, however the most interesting is the fact that seven different analysts increased their expectations in the last 90 days. Given this level of optimism out there, I believe that we may see demand for the stock in the coming years.

Source: Seeking Alpha Source: Seeking Alpha

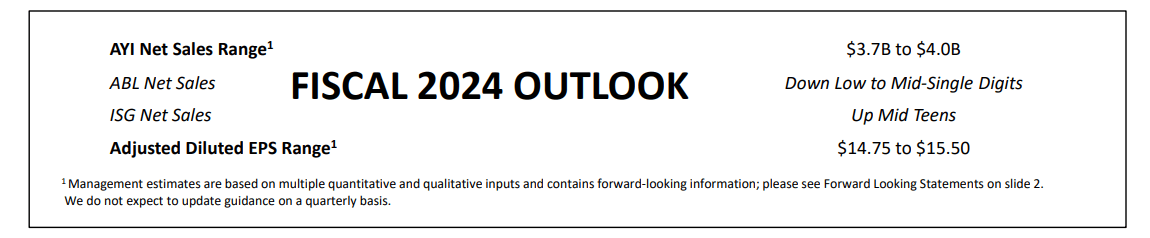

The recent outlook given for the year 2024 includes net sales close to $3.7-$4 billion and adjusted Diluted EPS close to $14.75-$15.5 per share. With the outlook given for the year 2024 and expectations about 2024 delivered by other analysts, I believe that we could see stock price improvement in the coming quarters.

Source: Presentation To Investors

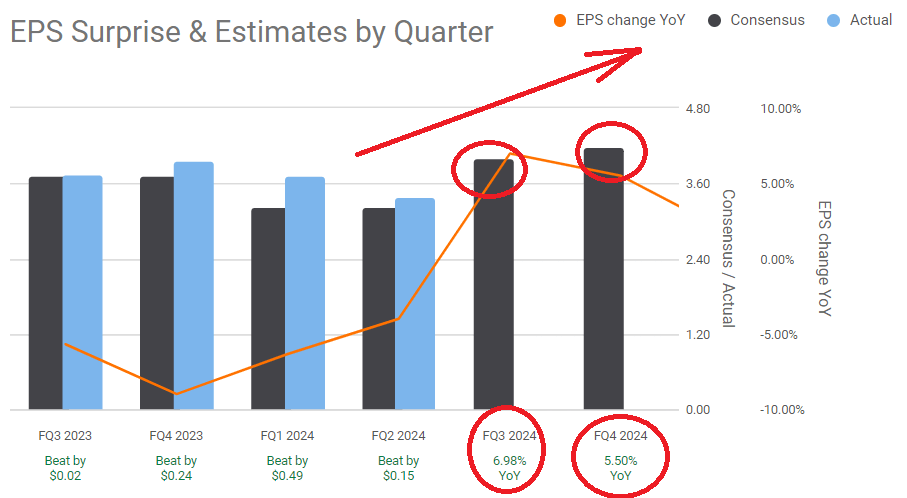

Given the previous earnings history, in my view, it is likely that Acuity Brands reports better than expected EPS. In this regard, take a look at the table below.

Source: Seeking Alpha

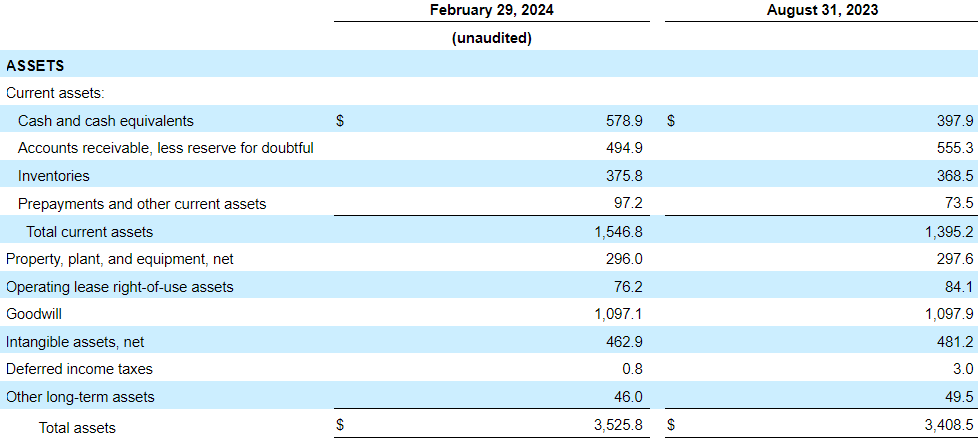

Balance Sheet: $578 Million In Cash To Buy Its Own Shares, Or Buy New Targets

As of February 29, 2024, the company reported $578 million in cash, with total current assets of $1.54 billion and total assets worth $3.52 billion. The current ratio is larger than 2x, so I believe that there is sufficient liquidity to run further operations. The asset/liability ratio is also larger than 2x, so I believe that the balance sheet appears quite stable.

Source: 10-k

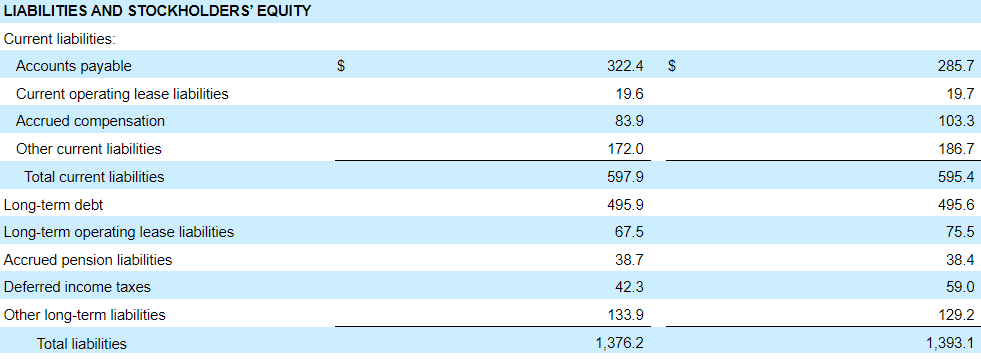

I appreciate quite a bit that long-term debt does not seem significant. With $322 million in accounts payable, I believe that providers are financing the business model of Acuity Brands. The long-term debt stands at $495 million.

Source: 10-k

Assumption 1 About Inorganic Growth: May Accelerate Future Net Sales Growth

The company’s growth strategy is based on a hybrid model based on the organic scale of its sales along with the possibility of strategic acquisitions to expand productive margins. I believe that the international expansion of services is one of the objectives, which may bring significant organic growth. In this regard, the company’s expansion in Mexico and the manufacturing facilities in this country may bring significant net sales growth in the coming years.

There are several acquisitions that may bring significant net sales growth in the coming years. The assets acquired from Current Lighting Solutions, LLC, and KE2 Therm Solutions, Inc. may bring technological know-how, new customers, and efficiency efforts.

On January 19, 2024, we acquired certain assets related to Arize® horticulture lighting products from Current Lighting Solutions, LLC. Source: 10-Q

On May 15, 2023, using cash on hand, we acquired all of the equity interests of KE2 Therm Solutions, Inc.. KE2 Therm develops and provides intelligent refrigeration control solutions that deliver the precision of digital controls to promote safety, efficiency, and reliability, while delivering cost savings to the customer. Source: 10-Q

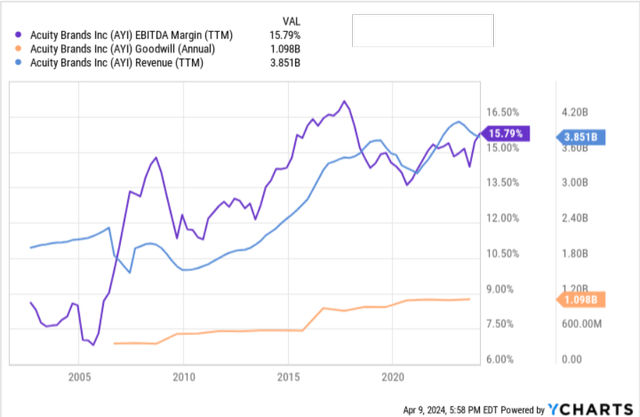

In my view, if the business model is scalable, new acquisitions will most likely enhance EPS generation, and enhance FCF margin growth. In this regard, it is worth noting that, in the past, revenue, goodwill, EBITDA margin, and FCF margin grew together.

Under my best-case scenario, I assumed that new acquisitions may be reported. Given the total amount of cash in hand seen in the balance sheet, I do think that Acuity Brands could execute new acquisitions. The company reported $578 million in cash.

Assumption 2: The Lighting Market May Accelerate Acuity’s Total Net Sales Growth

I believe that the Lighting Control System market growth could enhance Acuity’s net sales growth. There are experts out there expecting net sales growth close to 16.8% from 2023 to 2032. Under my best-case scenario, I included median net sales growth of close to 7%-8%, which, I believe, is a conservative figure. Given the growth of the market, I think that net sales growth close to 7%-8% is realistic.

The Lighting Control System Market Size was valued at USD 33.2 Billion in 2022 and is projected to reach USD 154.7 Billion by 2032, demonstrating a Compound Annual Growth Rate of 16.8% from 2023 to 2032. Source: Ameco

Assumption 3: Repurchase Of Shares Could Lower The WACC

Acuity Brands is acquiring a significant number of shares at the current point in time. In my view, it means that the Board of Directors may think that the stock is not expensive. I believe that further acquisition of shares may lower the cost of capital, and may bring other investors to acquire shares. In the best-case scenario, I assumed that the repurchase of shares could lead the WACC to be close to 9%. The company reported $578 million in cash, which AYI could use to repurchase shares.

During the first six months of fiscal 2024, we repurchased 0.4 million shares of our outstanding common stock for $67.6 million. We expect to repurchase shares on an opportunistic basis subject to various factors including stock price, Company performance, market conditions, and other possible uses of cash. Source: 10-Q

Assumption 4: Artificial Intelligence May Improve Certain Product Offerings, And Enhance Net Sales Growth

In the last 10-k, the company noted that certain products recently incorporated artificial intelligence capabilities, which I believe could bring significant improvements in terms of efficiency. As a result, the company may receive further demand for their products, which may bring further net sales growth. Under my best-case scenario, I also assumed that further AI capabilities may enhance the margin obtained by Acuity Brands. Hence, the operating margin may accelerate.

We have begun incorporating artificial intelligence capabilities into certain product offerings. These features may become important in our operations over time. Our competitors or other third parties may incorporate AI into their products more quickly or more successfully than us, which could impair our ability to compete effectively and adversely affect our results of operations. Source: 10-k

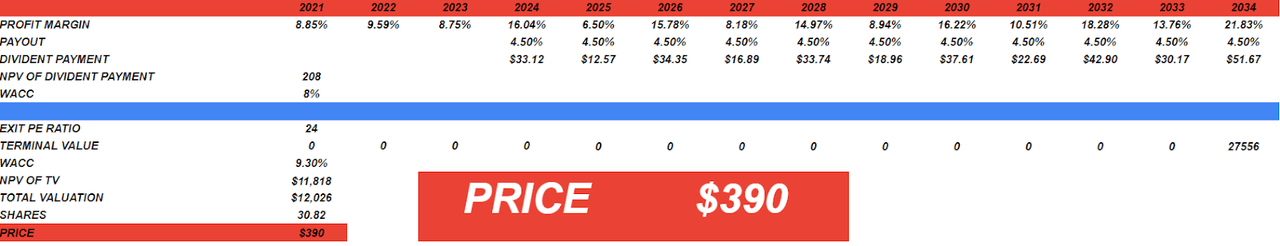

My Best-Case Scenario Implied A Valuation Of $390 Per Share

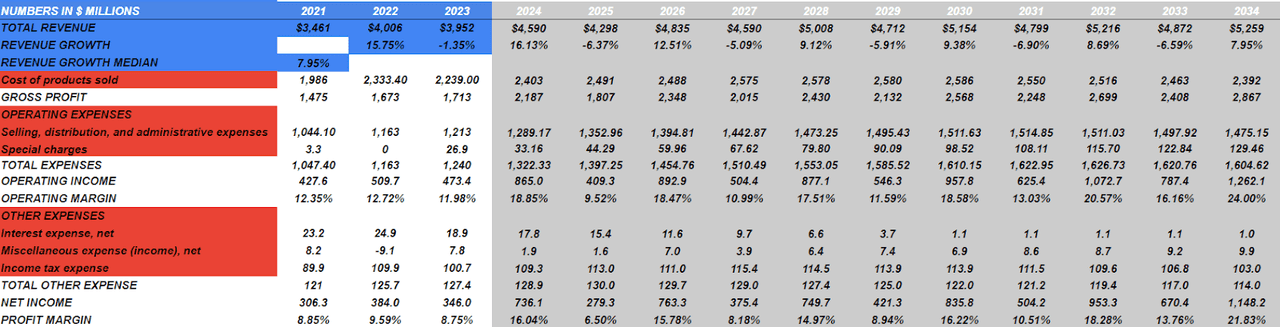

Under my best-case scenario, my assumptions are correct. I expect 2034 total revenue to be close to $5.259 million, presenting 2034 revenue growth of 7.95%, and having a median revenue growth of around 7.95%. With the cost of products sold close to $2.392 million, I expect 2034 gross profit of $2.867 million.

In addition, subtracting 2034 operating expenses, among which we have the selling, distribution, and administrative expenses of $1,475 million, accompanied by the special charges close to $129 million, gives us total expenses close to $1,604 million, leaving the operating income close to $1,262 million along with 2034 operating margin worth 24%. Also, with interest expenses of about $1 million and 2034 income tax expense of $103 million, I obtained 2034 net income of $1.148 million, with a profit margin of 21.83%.

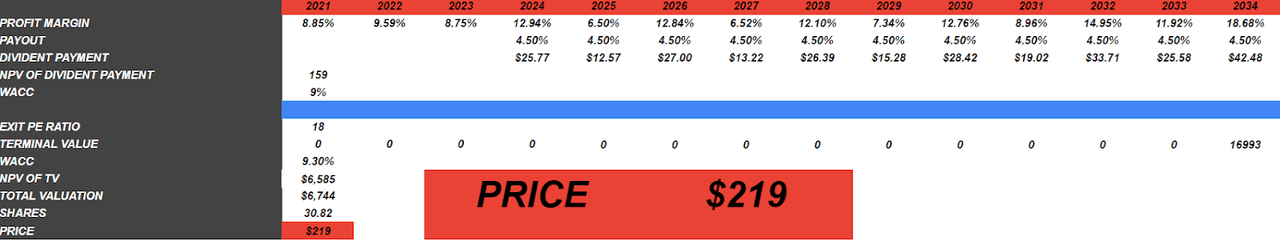

I foresee a payout of 4.50%, which is close to the payout reported by Acuity Brands, which implies 2034 dividend payment of $51.670 million, resulting in the NPV of dividend payment of $208 million.

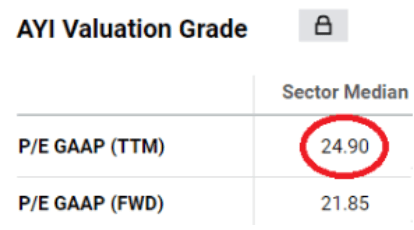

Also, with a WACC of 8% and taking into account PE ratio of 24x, the NPV of the terminal value would be close to $11 billion, closing with a total valuation of $12 billion, which would imply a fair price of $390 per share. Note that the sector median PE TTM GAAP is close to 24x, so I am not really thinking out of the box here.

Source: Seeking Alpha Source: My Financial Model

Bearish Case Expectations

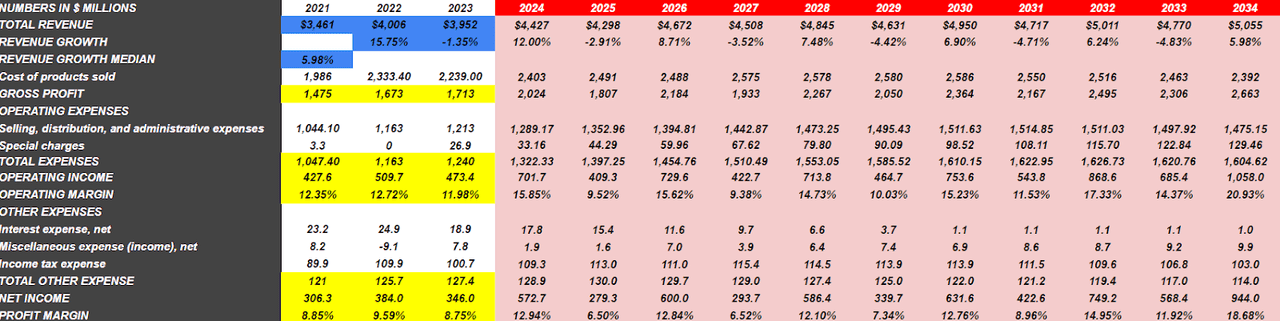

Under this case scenario, some of my assumptions are not correct. In a less encouraging case, the total revenue will be $5055 million, and 2034 revenue growth could be close to 5.98%, with a median revenue growth of 5.98%. To generate these profits, the company would have the cost of products sold close to $2392 million, which leaves us with a gross profit of $2663 million.

I also foresee that the operating expenses will have selling, distribution, and administrative expenses of $1475 million, with the special charges of $129 million, thus giving us total expenses of no less than $1604 million, ending in the operating income of $1058 million and the operating margin being 20.93%.

Additionally, we have other expenses, which will consist of the interest expense, net of $1 million, added to the miscellaneous expenses very close to $9.9 million and the income tax expense worth $103 million. Under this case scenario, I estimated that the net income would be $944 million, accompanied by a profit margin close to 18.68%.

I expect the payout to be close to 4.5%, having an approximate 2034 dividend payment of $42.48 million, giving the NPV of dividend payment of about $159 million.

Note that I assumed a WACC of 9% and an exit PE ratio of 18x, resulting in the terminal value of $16993 million. The NPV of terminal value is calculated to be around $6585 million, resulting in the total valuation of $6744 million and a fair price of $219 per share.

Competitors, And Risks

The domestic lighting markets are highly competitive. In addition to traditional businesses within this industry, in my view, it must be taken into account that the increase in artificial intelligence and automation technology is transforming this landscape due to the emergence of software that competes with Acuity as well as specific service providers within this market.

Without a doubt, the company’s ability to adapt to technological development in the industry and competitive market conditions play a fundamental role in its growth and operating margins. In any case, according to my analysis, the greatest risk that the company currently experiences in the short term is the regulatory situation in Mexican territory, since if the tax benefits that have been granted to it cease, it will have to orient its productive model in another sense, today largely concentrated in this country.

On the other hand, the company’s recent investments in artificial intelligence tools may not give the expected results. In addition, a part of its services is supported by the capabilities of third parties, generating latent risks in the event of the termination of contracts or complications in this sense.

Conclusion

Acuity Brands recently delivered better than expected EPS and beneficial 2024 outlook. Moreover, many analysts increased their EPS expectations in the last 90 days. Considering the expected growth of the lighting control market, recent acquisition assets acquired from Current Lighting Solutions, LLC, and the acquisition of KE2 Therm Solutions, I believe that we could expect significant net sales growth in the coming years. In addition, the recent mention of artificial intelligence capabilities in the last annual report could bring new efficiency and demand for the products. I do see risks from failed international expansion, changes in regulations in new or existing jurisdictions, or emerging alternative technologies. With that, I do believe that Acuity Brands trades quite undervalued at this point in time.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AYI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.