Summary:

- AGNC Investment and other mortgage REITs may face headwinds due to an inflation acceleration in March.

- The risk profile for leveraged mortgage REITs has deteriorated as the Federal Reserve is likely to delay federal fund rate cuts.

- The inflation report indicates that AGNC’s interest expenses will remain high, putting pressure on its net interest income and book value.

Dilok Klaisataporn

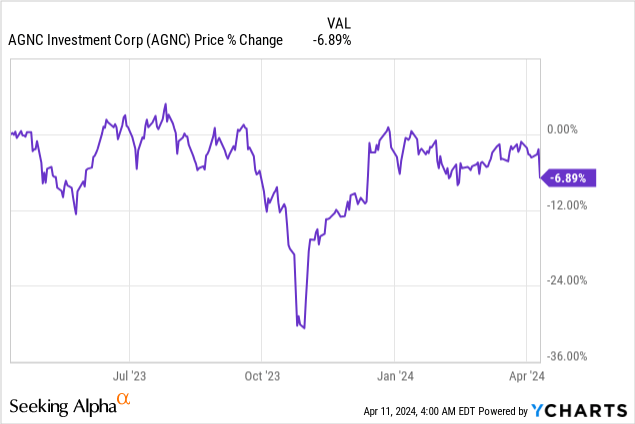

AGNC Investment Corp. (NASDAQ:AGNC) and other mortgage REITs with considerable investments in rate-sensitive mortgage-backed securities were expected to be the beneficiaries of the Federal Reserve’s rate pivot in FY 2024. With inflation for the month of March coming in hotter than expected on Wednesday, the market is adjusting its expectations for cuts to the federal fund rate, which I suspect will be a considerable headwind for AGNC’s valuation. Prospects for book value growth as well as higher for longer funding costs may hurt AGNC in the short term as well. Because of the inflation update, I believe the risk profile for highly leveraged mortgage REITs has deteriorated, and I am downgrading AGNC’s shares to hold.

Previous rating

I specifically recommended AGNC and Annaly Capital Management, Inc. (NLY) at the end of last year — A Top Mortgage REIT Buy For 2024 — because of the potential for lower funding costs that would boost the net interest income of mortgage REITs. The inflation report for March, which showed an acceleration of inflation growth month over month, unfortunately changes the outlook for AGNC, as well as for the broader mortgage REIT sector. My new rating is hold.

Inflation acceleration is changing the risk matrix for AGNC

Consumer prices rose 3.5% in March, according to the latest inflation numbers, which means inflation accelerated compared to the previous month: in February, consumer prices increased 3.2% in February which itself represented an acceleration of the 3.1% inflation rate in January. The acceleration of inflation is a problem for mortgage REITs that own large, rate-sensitive mortgage-backed security portfolios, like AGNC.

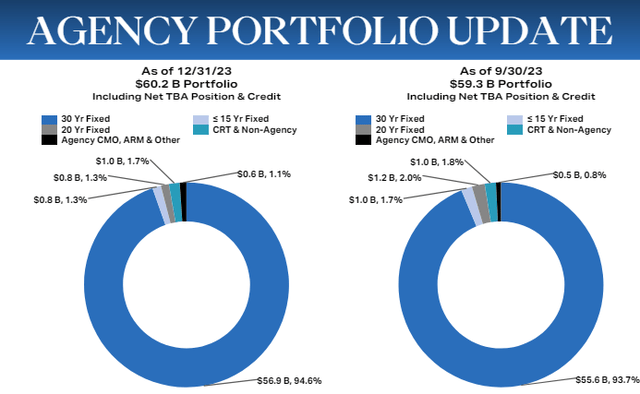

AGNC owned $60.2B of agency mortgage-backed securities at the end of FY 2023, showing $0.9B Q/Q growth. The mortgage REIT buys these mortgage securities with debt which makes AGNC and other leveraged mortgage REITs vulnerable in a high-rate world.

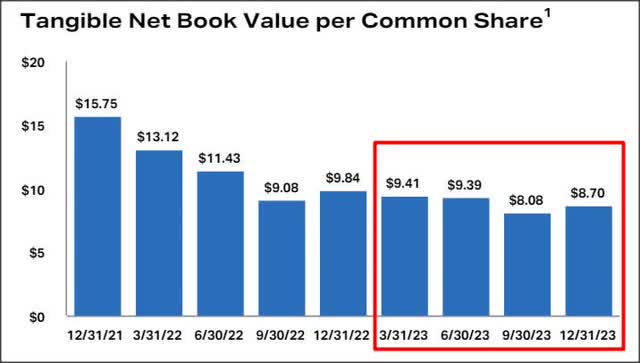

In the last two years, the Federal Reserve’s aggressive tightening policy hurt AGNC considerably as higher interest rates weighed on the valuation of the company’s mortgage-backed security portfolio. AGNC’s tangible net book value declined drastically once the Federal Reserve started to adjust its federal fund rate upwards two years ago in a bid to control surging inflation.

In FY 2022 AGNC’s tangible net book value declined 38% which then declined another 12% in FY 2023. AGNC’s book value stabilized in the second half of last year, largely in anticipation of the Federal Reserve ending its tightening policy, thereby providing relief to mortgage REITs that have seen a considerable increase in their funding costs in the last year. The uptick in inflation in March changes this trajectory, however.

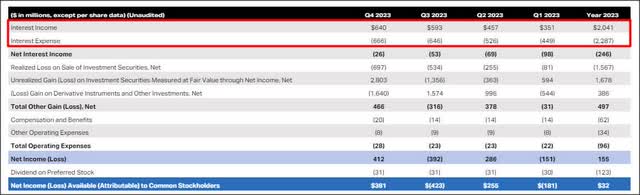

The immediate consequence of the latest inflation report is that AGNC’s interest expenses will remain high in the short term. In the fourth quarter, the mortgage REIT had $666M in interest expenses, showing 107% year-over-year growth. The REIT’s interest income increased only 84% year over year to $640M, resulting in growing net income and book value pressure for AGNC Investment. This pressure is now likely to persist, limiting the REIT’s upside revaluation potential, in my opinion.

AGNC Investment’s valuation

Accelerating inflation is a considerable headwind for AGNC’s near-term earnings potential, as it potentially delays federal fund rate cuts that would have helped the mortgage REIT’s net interest income.

With inflation coming in hotter than expected, the Federal Reserve is all but guaranteed to delay the end of its tightening policy, possibly into 2025. As a result, I believe AGNC’s prospects for book value growth have been greatly diminished this week.

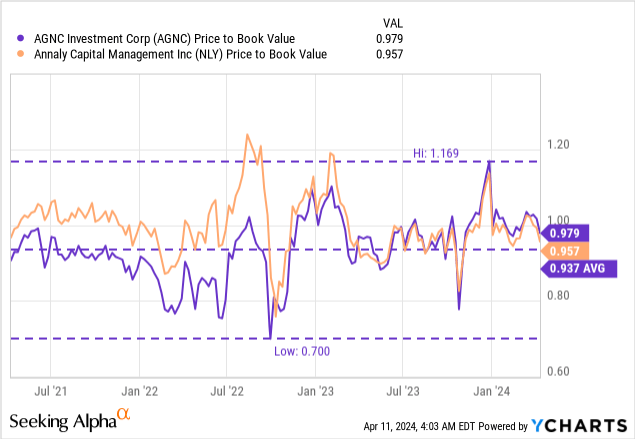

Shares of AGNC are currently valued at a price-to-book ratio of 0.98X, although they have most recently traded at up to a 17% premium to book value. Mortgage REITs are typically valued based on their book values since they own large portfolios of mortgage-backed securities, mortgage servicing rights, and commercial real estate securities that are required to be marked to market by accounting regulations.

For context, Annaly Capital is valued at a P/B ratio of 0.96X, and the same arguments I made about AGNC here apply to the largest mortgage REIT as well. I already rated Annaly Capital a hold in my work in February: Don’t Run After This 14% Yield (Rating Downgrade).

Due to resurging inflation, I expect growing pressure on AGNC’s book value, given the delayed interest rate trajectory, and I would not be surprised to see AGNC return to a larger discount (~10%) to book value in the short term. As a result, I see considerable valuation risks for AGNC, especially as there is no serious doubt about the Federal Reserve’s plan to lower the federal fund rate. However, at a large enough discount to book value, say 20%, I would consider buying shares (~$7.63) in an opportunistic, short-term focused manner.

Risks with AGNC

AGNC’s shares have started to revalue in December, largely because the Federal Reserve guided for up to three cuts to the federal fund rate in FY 2024. With these rate cuts now being more and more unlikely, I believe the risk profile has deteriorated significantly and the 16% yield has become more risky for dividend investors. Should the market, against expectations, see a material moderation of inflation in the coming months, then the Federal Reserve may go ahead with its three federal fund rate cuts in FY 2024. This would also change my outlook on AGNC’s book value prospects and likely result in a positive rating change.

Closing thoughts

The inflation update was very bad news for AGNC as well as the mortgage REIT sector in general. Higher for longer inflation implies that the Federal Reserve will not push to implement federal fund rate cuts in FY 2024 which in turn implies growing pressure on those mortgage REITs that own portfolios consisting of rate-sensitive mortgage-backed securities. Additionally, higher for longer interest rates imply that mortgage REITs won’t get any relief in terms of funding costs which should be both a headwind to profitability as well as AGNC’s valuation factor. With an unfavorable inflation update having deep implications for AGNC, I believe a change in rating to hold is justified!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NLY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.