Summary:

- Pfizer has faced numerous challenges, including a decline in COVID-19 vaccine demand and high costs, but the worst is likely priced into the stock.

- The company is focusing on innovation and has ambitious plans to launch new products and indications, which could drive significant revenue growth.

- Pfizer’s investment in oncology and the use of AI in drug development are promising, and the company’s valuation suggests upside potential.

J Studios

Investment Thesis

I think it is safe to say that Pfizer Inc. (NYSE:PFE) is probably one of the least wanted stocks, not only in the pharmaceutical complex of stocks but in the broader view of the market.

Pfizer has been plagued by a myriad of issues that are posing severe headwinds for the company since the world emerged from the pandemic, causing acute decelerations in the company’s COVID-19 vaccine business. In addition, Pfizer has to deal with high costs across the board while building an innovation ramp for the next big drug that can drive their revenues once again. Moreover, the biggest headache for the company is patent cliffs, which are forcing Pfizer to lean more on their innovation ramp.

Yes, these are some serious headwinds currently in Pfizer’s way, but I believe the worst is priced into Pfizer’s stock. There are reasons for me to believe that the skies may clear up for Pfizer, leading me to rate this as Buy.

Summarizing Pfizer’s road so far

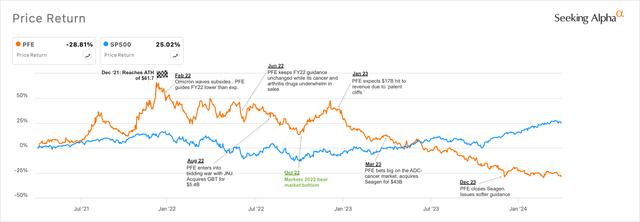

While reviewing Pfizer’s performance, I felt the manner in which Pfizer’s stock got obliterated over the past few years called for a trend analysis of the stock along with some major events that posed headwinds along the way for Pfizer. I have added these events to a chart below that highlights some major events for Pfizer’s stock.

Pfizer’s road into its bear market from its 2021 top (SA)

Looking at the chart itself, Pfizer was a pandemic winner until the company reached an ATH of $61.7 in December 2021, with Omicron fading. Through FY22, the company kept lowering that year’s guidance due to less than anticipated demand for its COVID-19 vaccines and products. As markets bottomed in October 2022, Pfizer ran higher in anticipation of some good news, only to hit another headwind in January 2023 when management guided FY23 revenues to decline by ~31% to ~$69 billion. Pfizer eventually ended up reporting $58.5 billion in revenue in FY23.

Last year, during the J.P. Morgan Healthcare conference, Pfizer also revealed that the expiration of pharmaceutical patents would cause ‘patent cliffs’ or loss of revenue for Pfizer to the tune of $17 billion in revenue between 2025 and 2030, slightly less than the $18 billion that analysts were expecting. But in that same conference, management revealed some of their ambitions.

In the next 18 months, the most important 18 months in the history of Pfizer because we are going to do something that has never been done before, we are going to launch 19 new products and indications. Most of them are new products, and some of them are indications — new indications of existing products. Those collectively starting from now all the way to the mid of ’24, we estimate that we’ll produce revenues of 2030 of approximately $20 billion. The analyst expectations on that is, surprise, surprise, slightly lower. So, they are at $16 billion on that, but there are not huge differences between the two.

Management also laid out their plans for launching products, which would drive about $25 billion in incremental revenue by the end of this decade.

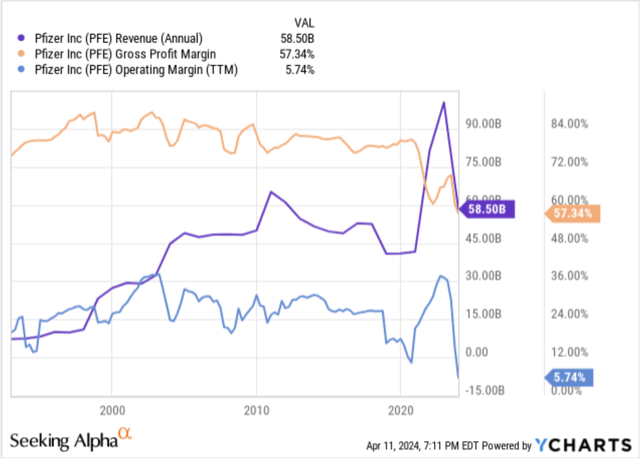

These plans are ambitious when taken out of context, in my opinion, especially when considering how the company has performed in terms of its revenue and margins.

Pfizer’s revenue and margins over the past three decades (YCharts)

The sharp declines seen in Pfizer’s revenue and especially in their operating margins seem concerning. But the concern is only valid if an investor completely discounts the potential for future growth that its innovation roadmap can bring.

Pfizer’s innovation-led strategy to revitalize growth

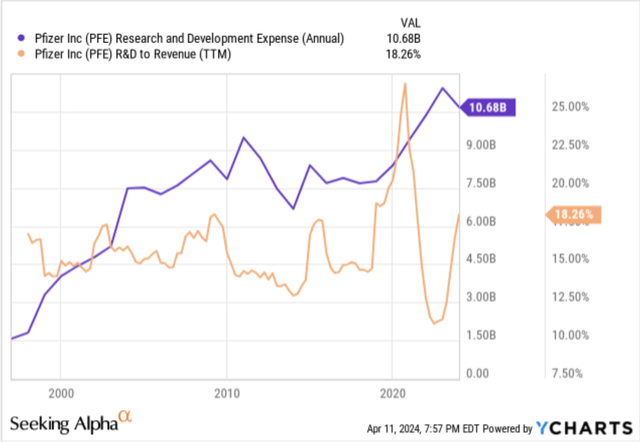

Pfizer’s first bet to tackle the decline in its growth has been to lean away from its reliance on COVID-19 medications and move into innovation. In response, the company has ramped up its spending on Research and Development, with a higher share of revenue now allocated towards R&D, as can be seen below.

Pfizer’s R&D spend and as a percent of revenue (YCharts)

At a recent Biopharma conference, management indicated they intend to spend even higher this year, ~$11.5 billion in R&D. Of that R&D spend, a fourth will be allocated towards oncology (related to cancer) whereas the remaining 60% is being allocated for other programs such as respiratory RSV vaccines, cardio-metabolic medicines, and sickle cell disease medication programs via their 2022 acquisition of Global Blood Therapeutics.

Oncology is a major focus for Pfizer, and I believe this could yield some major results for Pfizer, which is focused on reinventing their returns. A study by PwC projects oncology and respiratory pharma assets as one of the highest revenue-generating assets for the pharma industry.

In fact, I reviewed Pfizer’s Drug Product Pipeline and found that over half of their drug assets in the Phase 3 development phase are part of the Oncology area of focus, giving Pfizer a lead time of a year or two to launch these products if the trials are successful and FDA approvals are received on time.

The company is also using AI to increase the pace of drug validation and production. At an AWS presentation last year, Pfizer revealed how they built their own proprietary generative AI platform using Amazon’s AWS Bedrock ML ecosystem to identify and validate oncology targets during the development process.

Along with oncology, research by Standard and Poor projects that antibody-drug conjugates (ADCs) are another area of growth in pharma. Here as well, Pfizer has positioned itself for future growth with the acquisition of Seagen last year, while management also hinted at more acquisitions in the ADC space. Per my analysis of their acquisitions since the start of this decade, Pfizer has spent at least $70 billion on acquiring companies in all the right areas of pharma.

I expect these deals to provide a way for Pfizer to fast-track their innovation.

Valuation shows upside

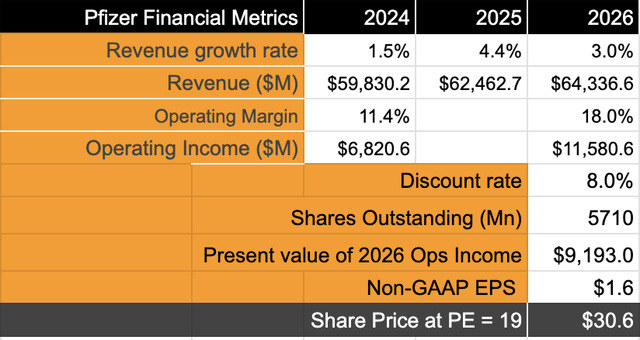

To value Pfizer’s stock, I will use base-case scenarios modeled close to analyst expectations. I do believe the expectations are quite pessimistic, and I have assumed slightly higher revenue expectations based on the number of products that they already have in the pipeline. These revenue numbers can be much higher if Pfizer is able to move its drug assets through the innovation pipeline, successful trials, and regulatory approvals into the market faster than anticipated. So far, markets appear to be pessimistic about that scenario.

Here are my assumptions:

-

A three-year horizon given elevated levels of uncertainty and pessimism around Pfizer.

-

GAAP Operating margin should be able to grow back to its longer-term average of ~30%. However, for now, I have assumed operating income will grow at a CAGR of 30%, mostly in line with expectations. Management has doubled down on reducing costs.

-

Discount rate of 8% higher than market expectations, to account for uncertainty.

Pfizer’s valuation (Author’s valuation)

Given these expectations, I see that Pfizer’s revenue is growing in line with the S&P 500’s longer-term revenue growth rates of ~3% but far outpacing the 8% earnings growth rates. Pfizer should be trading around the long-term PE of ~19x.

At 19x, Pfizer seems cheap, especially if I consider that it is trading at a discount to the S&P Indices Pharmaceuticals Select Industry Index (SPSIPH), which currently exchanges hands at 22x forward earnings.

The current valuation setup for Pfizer offers a 13.3% upside in the stock to a price of ~$30. Bear in mind that I have used conservative estimates to value Pfizer.

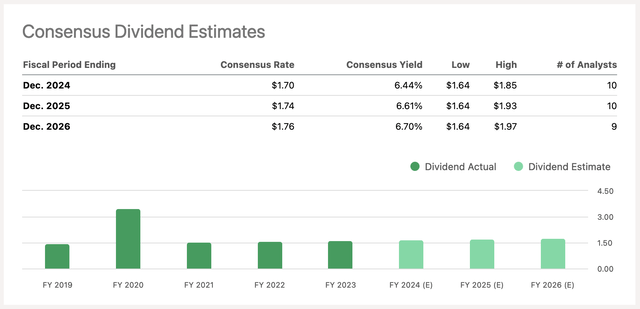

And the real kicker comes here when I add the stock’s dividend payout, which currently yields a handsome 6.6%, thus annualizing the total return at Pfizer to ~20%.

Consensus Dividend Estimates for Pfizer (SA)

Risks and Other factors to look for

Most of the bad news has been priced into pharma stocks, with the one exception being Medicare price negotiations. Negotiations are currently underway between the U.S. pharmaceutical companies and CMS.gov. Currently, Pfizer’s breast cancer treatment Ibrance and the blood thinner Eliquis are part of the negotiations, which are slated to run through August 1st this year, after which prices will be released on September 1st this year, just before the elections. This is still unknown and may not materialize this year itself, as pharma companies have threatened legal action.

Other risks include competition from other pharma companies in the oncology and RSV spaces, which could pose some headwinds for Pfizer.

These developments will be ongoing and something to watch out for, in my opinion.

Takeaways

The pharma industry faces some legitimate challenges that have posed headwinds for Pfizer and may continue to do so, but with most of those headwinds already priced in, I believe Pfizer’s path has gotten clearer. As markets evolve and consumers’ health priorities come into more focus, Pfizer’s innovative-led strategy and their current ramp to emerging areas of pharmaceuticals and medicine have put the pharma giant in a position of strength.

Despite headwinds, I believe 2024 could mark the start of a pharmaceutical renaissance for Pfizer, with most of the headwinds in the rearview mirror. I rate Pfizer as a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.