Summary:

- NIO stock has fallen 31% in the past three months due to intense competition in the EV space. But I believe nothing is over for NIO – read on.

- NIO delivered 50,045 EVs in 2023, surpassing goals, and expects a rebound in deliveries in 2024, having a robust cash balance of $7 billion, sufficient for future investments and scaling.

- NIO will prioritize gross profit margin for its brand products while focusing on volume for the mass market brand.

- I believe that the company has growth prospects, as its direct costs should fall as the operations scale up and sales should increase once the firm starts delivering new models.

- I think nothing is over for NIO, despite the stock updating new lows. I reiterate my “Buy” rating, despite my first call aging badly so far.

Andy Feng

My Thesis

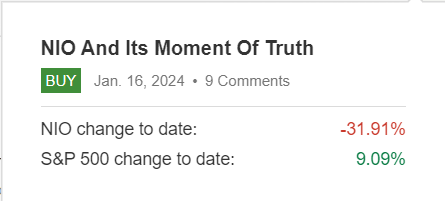

I initiated coverage of NIO Inc (NYSE:NIO) in mid-January 2024, about 3 months ago, with a “Buy” rating – in that time the stock has fallen a whopping 31%, while the S&P 500 Index (SP500) (SPY) has risen 9%:

Seeking Alpha, Oakoff’s NIO article

It seems like one of the major risks for the company actually played out during this time: the intense competition in the EV space pushed the company to adjust its sales guidance downward recently.

Considering NIO’s current lack of profitability, this kind of adjustment resulted in some adverse effects. On the bright side, this led to the NIO stock becoming even cheaper. And, speaking of innovation, I think the latest corporate happenings suggest that today might be a bargain. Nothing is over for NIO as many bears suggest – let me explain.

My Reasoning

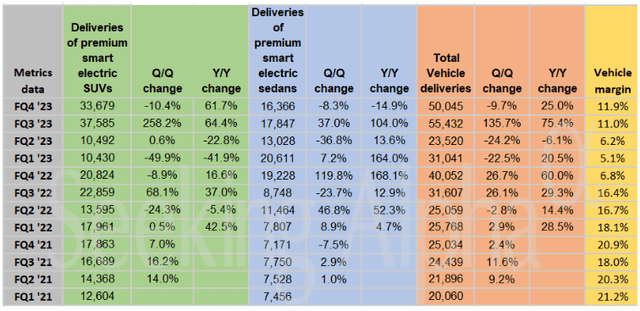

In Q4 2023, NIO delivered 50,045 premium smart EVs, marking a 25% increase YoY. For the entire year of 2023, cumulative deliveries reached 160,038 units, surpassing NIO’s initial goals by over 30.7% compared to 2022. Looking ahead to 2024, NIO’s management said they anticipate a rebound in deliveries, with expectations of 32,000 units (the mid-range) in Q1 2024 alone. Scheduled for delivery in Q1 2025 with a price tag of 800,000 yuan (~$111,210), the new ET9 boasts advanced features such as NIO’s in-house developed AD chip and SkyRide Chassis System, which is “the world’s first integrated hydraulic fully active suspension that enables transient adjustment of stiffness, damping, and height,” according to NIO. Additionally, the company plans to build 1000 new battery swap stations and 20,000 chargers by the end of 2024, further solidifying its position in the market. This is quite a long process, but I expect it to bear its first fruits next year as its infrastructure keeps developing.

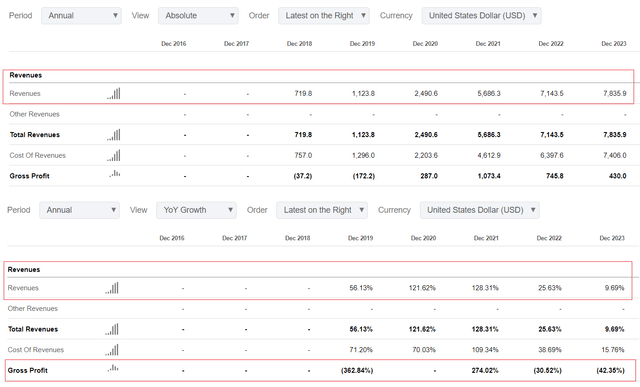

The main reasons for NIO stock’s decline are the slowdown in sales growth and the dip in margins, which is what delaying the company’s process of becoming profitable.

Seeking Alpha, NIO’s financials, Oakoff’s notes

If we look at the recent trend in NIO’s deliveries and pay attention to the consolidated vehicle margin, we’ll see an improvement from 6.8% last year to 11.9% in Q4. But the absolute value of this metric is still much lower than it was in 2021:

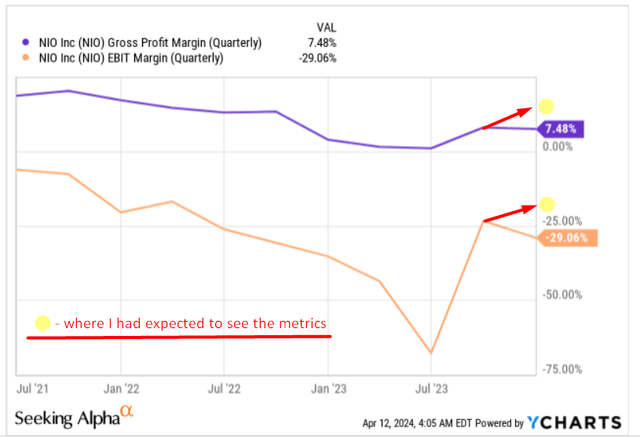

The recovery is going down slower than initially expected. As a result, NIO’s revenues saw YoY growth of only 6.5% YoY, dipping by 10.3% QoQ. Gross profit surged by an impressive 105.7% compared to Q4 2022, but experienced a 16.0% decrease from Q3 2023, with a gross margin of 7.5%. NIO’s loss from operations increased by 36.8% QoQ, while the net loss also rose by 17.8% from the previous quarter. So the new improvement trend in the company’s margins that I noted last time, and my expectations that the trend would continue, have vanished into thin air within a single quarter.

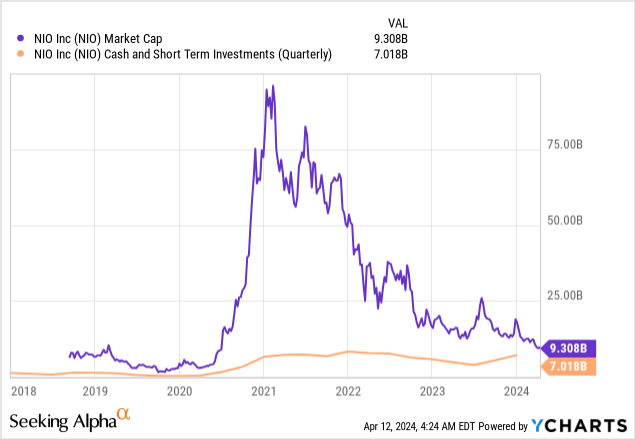

What NIO has no problem with, on the other hand, is its robust financial position, with cash and cash equivalents totaling ~$7 billion as per the latest report. NIO’s recent strategic investment from CYVN Holdings strengthened its cash balance significantly, supporting future investments in core technologies and sustainable development initiatives. These reserves of funds are sufficient for ~2.5 years of the same operating costs that NIO reports today on a TTM basis (based on my calculations). If NIO continues to expand its battery swap infrastructure in China, I think it will therefore have sufficient reserves for further scaling.

I believe that swift charging of electric vehicle batteries should address the limitations of charging infrastructure and increase the convenience of owning electric vehicles – especially for luxury car drivers who may not be used to waiting too long for charging. This assumption of mine is indirectly confirmed by the results of a recent study in which analysts conclude that the global battery swapping mode of electric vehicles market will grow from $2.45 billion in 2022 to $45.8 billion in 2030, at a remarkable CAGR of 44.2% during the forecast period (2023-2030).

Roughly speaking, if a potential investor buys NIO now, he/she will be investing directly in the development of this market while paying a premium for the existing technologies and the potential growth expected from the launch of sales of the company’s new model early next year.

Also, NIO plans to unveil its 2nd brand for the mass market in Q2 this year, with the first product launching in Q3 and mass release starting in Q4. The management says they’re targeting ~200,000 total units for the full year 2024, representing a 25% growth after all the initiatives and improvements. NIO will prioritize gross profit margin for its NIO brand products while focusing on volume for the mass market brand. So I expect that the company’s current margin decline to be a temporary phenomenon and that the negative market reaction is an opportunity to average down.

Risks Are High – Consider Them First!

First of all, I urge everyone to independently weigh all the risks surrounding NIO and its peers today. Since my last bullish call the stock has fallen significantly, so I have lost my high conviction in NIO, although I certainly think the company has good growth prospects (which explains my reiterating the rating today).

The biggest risk to my thesis is a continued slowdown in sales growth in the absence of improvement in margins. The combination of business growth and margin growth is the most important thing the market expects from NIO for its stock to soar. At least that is what I personally expect. For now, this remains just a prospect and I have no direct evidence that NIO will be able to achieve this in the coming quarters given the current competitive EV battle.

Among other things, it is important to understand that on a TTM basis, the company spends about $3.6 billion in OPEX and generates only $430 million in gross profit. If costs do not come down shortly, NIO will have to look for money again, so the risk of dilution is quite high.

Your Takeaway

Despite the major risks surrounding NIO, I believe that the company has growth prospects, as its direct costs should fall as the operations scale up and sales should increase once the firm starts delivering new models. The company is under tremendous competitive pressure, but being in the luxury electric car segment (a rather narrow, undercovered niche) and developing battery swap technologies, I think NIO has every chance to significantly increase its market capitalization in the next few years. I think nothing is over for NIO despite the stock updating new lows.

I reiterate my “Buy” rating despite my first call aging badly so far.

Good luck with your investments!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NIO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.