Summary:

- On April 16, Johnson & Johnson released financial results for the first three months of 2024, which were within my expectations.

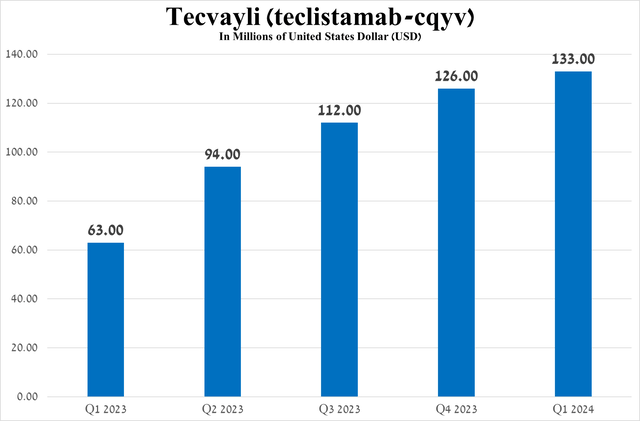

- Tecvayli sales were $133 million in the first quarter of 2024, up 111% year over year.

- Despite increased competition in the global autoimmune disease therapeutics market, the sales growth rate of most of its blockbusters has pleasantly surprised me.

- As a result, I am upgrading Johnson & Johnson’s rating from ‘Buy’ to ‘Strong Buy’.

Guido Mieth/DigitalVision via Getty Images

Johnson & Johnson (NYSE:JNJ), headquartered in New Brunswick, New Jersey, is one of the largest pharmaceutical companies in the world and also holds a leading position in the oncology drugs market.

Investment thesis

Since the publication of my last article in early 2024, the company’s share price has declined by about 4% relative to the price level, after which I expected a resumption of the upward trend.

Meanwhile, institutional and retail investors continue to be somewhat skeptical about Johnson & Johnson’s business prospects despite significant progress in the commercialization of its oncology and immunology products, as well as maintaining the high pace of development of its portfolio of product candidates.

In my assessment, the key contributors to improving the company’s financial position are next-generation medications such as Tecvayli, Erleada, Darzalex, Tremfya, and Uptravi, which will be able to offset the damage from the launch of Stelara biosimilars in 2025, as well as reduce the impact of financial risks, a detailed analysis of which was presented in my previous article.

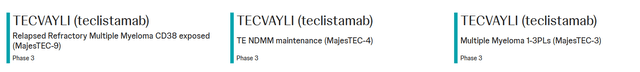

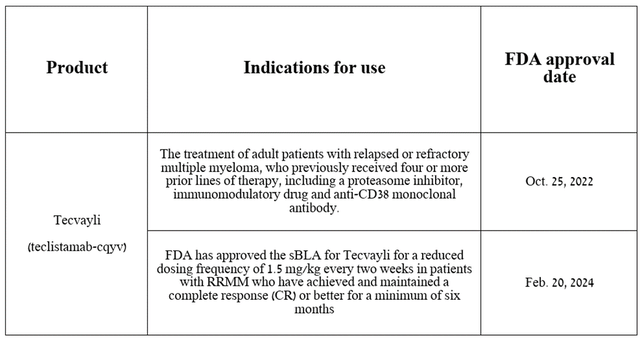

To begin this article, I want to focus on the analysis of Tecvayli (teclistamab-cqyv), a bispecific antibody that received its first FDA approval in late October 2022 for the treatment of certain patients with relapsed or refractory multiple myeloma (RRMM).

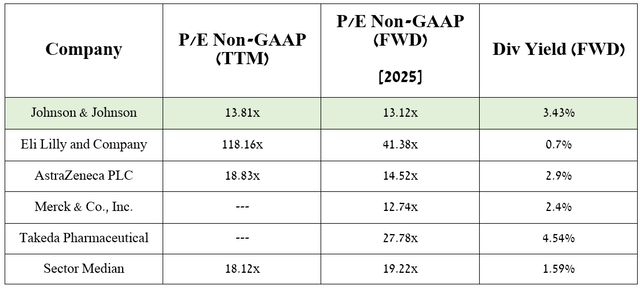

Source: table was made by Author on Johnson & Johnson press releases

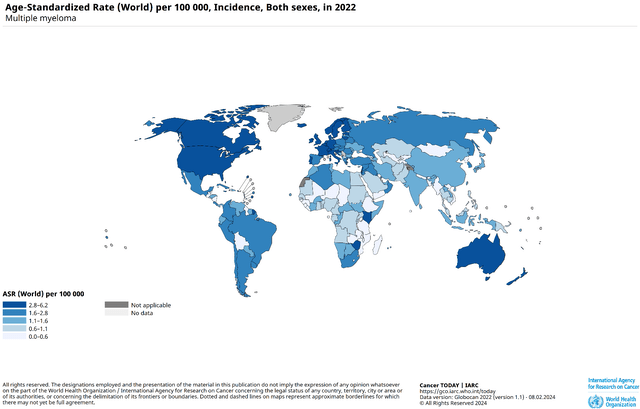

Multiple myeloma is characterized by the uncontrolled growth of mutated plasma cells in the bone marrow and, according to the Global Cancer Observatory, is most common in North America, where drug prices are significantly higher than in other regions, thereby presenting a significant commercial opportunity for Johnson & Johnson.

Source: Global Cancer Observatory

The mechanism of action of Tecvayli is based on its ability to draw CD3+ T cells in close proximity to BCMA+ cells, which ultimately leads to the lysis of BCMA+ cells, as well as the activation of T cells, which play a key role in the destruction of tumor cells, as well as the activation of others cells of the immune system, including natural killer cells, contribute to a more effective fight against multiple myeloma.

Its total sales were $133 million in the first quarter of 2024, an increase of 111.1% year over year, and more importantly, demand for it continues to grow quarter over quarter, mainly due to its competitive advantages relative to Pfizer’s Elrexfio (PFE), expanding geographic use, and maintaining elevated demand in the USA.

Source: graph was made by Author based on 10-Qs and 10-Ks

Moreover, on February 20, 2024, the FDA approved a new dosing regimen for the company’s potential blockbuster drug, reducing its dosing frequency from every week to once every two weeks, which will not only help accelerate its long-term sales growth but also improve quality of life patients.

Due to its universal mechanism of action, encouraging efficacy in phase 1/2 clinical studies, and an acceptable safety profile, Johnson & Johnson continues to develop Tecvayli to treat a larger population of patients with RRMM.

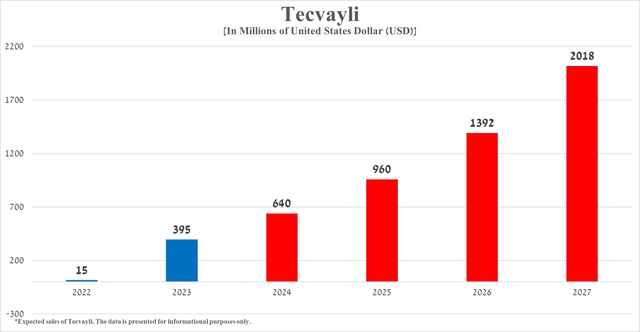

According to my assessment, based both on Tecvayli’s historical sales growth rate, its expected label expansion over the next four years, and the release of additional data supporting its sustained efficacy and safety relative to ‘gold standards’ in the treatment of multiple myeloma, its total sales will reach $2.02 billion in 2027.

Source: graph was made by Author based on 10-Ks

As a result, I am upgrading Johnson & Johnson’s rating from ‘Buy’ to ‘Strong Buy’.

Prospects for Johnson & Johnson’s business development in 2024

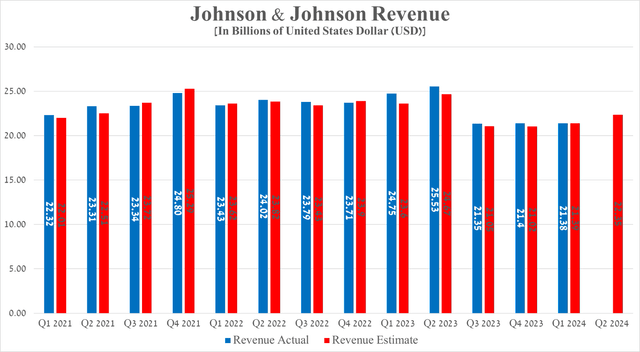

Johnson & Johnson’s revenue for the first three months of 2024 was $21.38 billion, down slightly quarter-on-quarter.

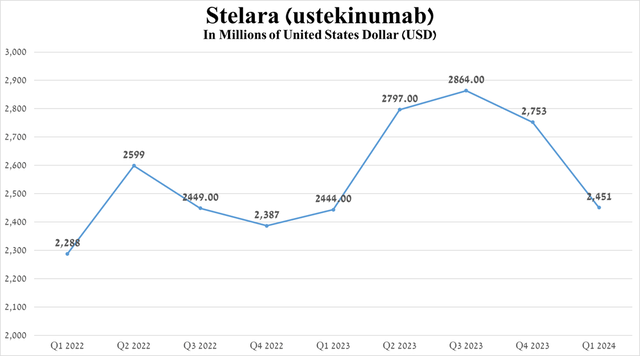

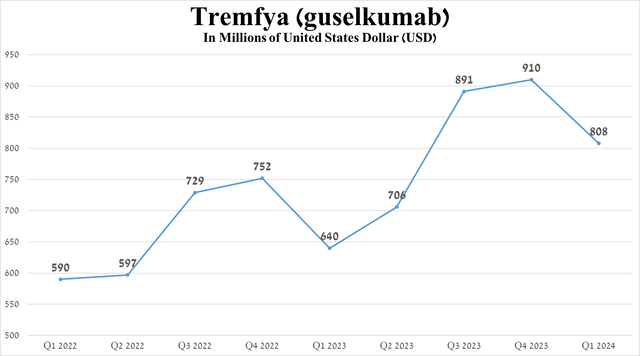

In my assessment, the main reason for the flat growth in revenue in the first quarter of 2024 is primarily due to a sharp drop in sales of Stelara (ustekinumab), caused by both increased competition in the autoimmune disease therapeutics market, as well as switching patients to Tremfya, a more effective medication whose key patents expire only in 2035 and 2036.

Source: graph was made by Author based on 10-Qs and 10-Ks

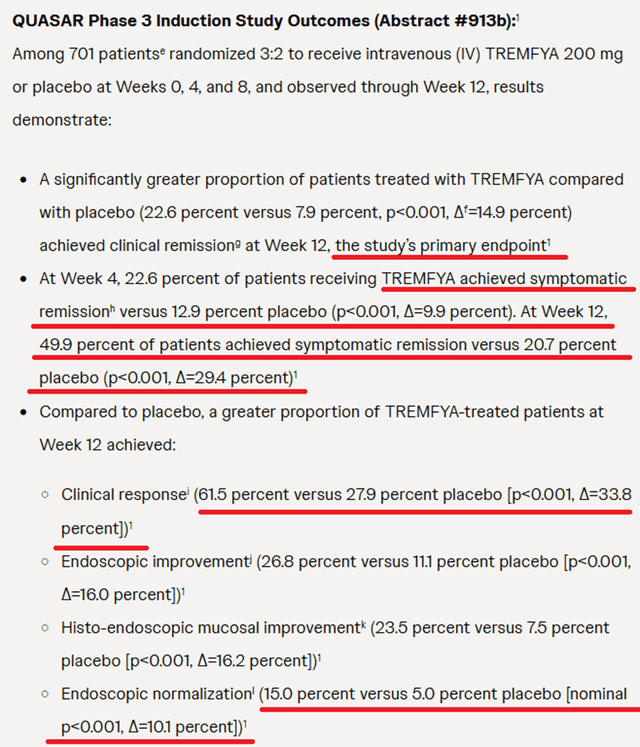

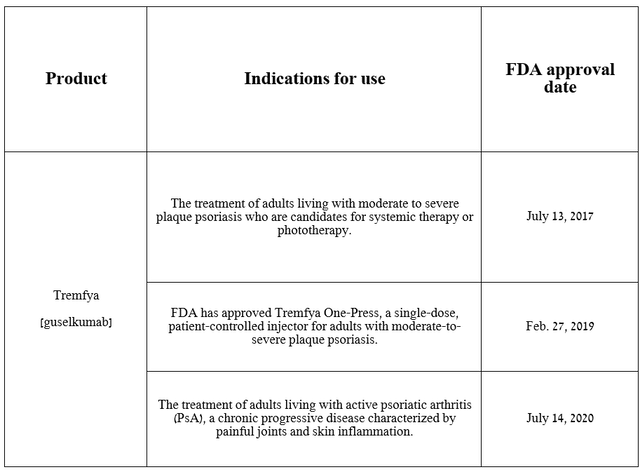

Tremfya (guselkumab) is a monoclonal antibody that selectively blocks interleukin-23 (IL-23). The FDA has approved it for the treatment of widespread diseases such as moderate to severe plaque psoriasis and psoriatic arthritis.

Source: table was made by Author on Johnson & Johnson press releases

On March 11, 2024, Johnson & Johnson submitted an sBLA to the FDA seeking approval for this blockbuster drug, which demonstrated extremely high efficacy in a pivotal clinical trial evaluating Tremfya in the treatment of patients with moderate to severe ulcerative colitis.

Its total sales were $808 million in the first quarter of 2024, up 26.3% from the first quarter of 2023, due to its higher efficiency relative to Bristol-Myers Squibb’s Sotyktu (BMY), Novartis’ Cosentyx (NVS), and AbbVie’s Humira (ABBV), as well as the expansion of the global psoriatic arthritis treatment market.

Source: graph was made by Author based on 10-Qs and 10-Ks

Considering Seeking Alpha’s data, Johnson & Johnson’s revenue for the second quarter of 2024 is projected to range from $21.9 billion to $22.67 billion, which is about 4.5% more than the previous quarter.

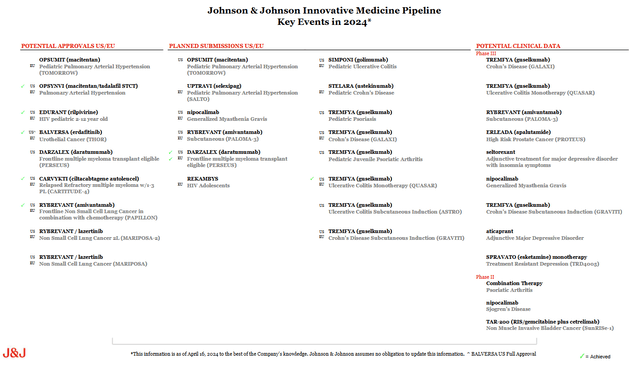

In addition to growth in sales of key FDA-approved drugs, I believe that an additional factor that will have a positive impact on Johnson & Johnson’s operating profit and revenue growth is a more aggressive R&D policy aimed at launching drugs with breakthrough technologies for the treatment of cancer and cardiovascular diseases.

According to my estimate and analysts’ expectations, thanks to commercial products, nipocalimab, milvexian, and potential label extensions for Carvykti and Darzalex, the company’s EPS in 2025 will reach 13.12x. As a result, this indicates that it is trading at a discount to many of its peers, and given its growing dividend payout year-on-year, Johnson & Johnson represents an attractive asset for conservative investors.

Risks

Before moving on to the conclusion, I would like to note the following financial risks that may affect the price of Johnson & Johnson shares in the medium term. These risks include the launch of Stelara’s biosimilars in 2025, whose sales accounted for about 11.5% of the company’s total revenue, Carvykti’s sales slightly falling short of analysts’ expectations due to increased competition in the multiple myeloma drugs market, ongoing legal battles over talcum powder lawsuits and increasing geopolitical tensions between Israel and Iran.

Takeaway

On April 16, the company released financial results for the first quarter of 2024, which were within my expectations. Sales growth rates for most of its key blockbusters and approved drugs between 2022 and 2023 were impressive, thanks in part to their label expansions and competitive advantages relative to current “gold standards” in the treatment of cancer, neurological, and cardiovascular diseases.

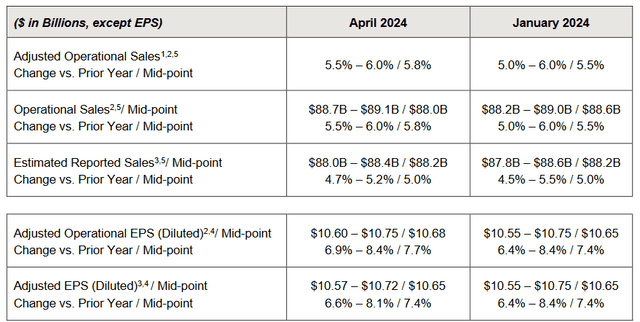

As a result, Johnson & Johnson management raised its full-year 2024 guidance, thereby providing additional confidence in its ability to achieve its goals despite the ongoing saga around the talcum powder lawsuits, the negative impact of the Inflation Reduction Act, as well as increased competition in the immunology drugs market.

In addition, as investment theses, I highlight the increase in the company’s dividend payments from year to year, the quarterly growth of operating income, and the active resort to a share repurchase program.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.