With The Commoditization Of EVs, Tesla Is Now An Overvalued Car Company

Summary:

- Amidst declining deliveries, Tesla is cutting around 10% of its workforce signaling future challenges.

- Elon Musk is betting big on Robotaxis as it is difficult to compete against Chinese-made EVs on price.

- Tesla is trading at a premium valuation to other automobile manufacturers and even relative to other EV pure plays.

Anastasiia Yanishevska/iStock Editorial via Getty Images

I received a fair amount of criticism in my last article about Tesla (NASDAQ:TSLA). The stock’s recent price action though has validated my bearish thesis. Since I last wrote about TSLA, it has fallen by roughly 42%. In the past, any dip in Tesla’s stock had been an opportunity to accumulate more. The stock would usually soar to new highs soon after. In my view though, this time is different. I believe that TSLA stock remains overvalued, especially amidst the challenges faced by the company. The stock could decline further to new lows.

Q1 Preview: Tesla Facing Challenges

Recently, CEO Elon Musk has announced a series of layoffs in Tesla. The company slashed headcount by up to 20% in some departments, according to a TechCrunch article. In total, Tesla is cutting around 14,000 workers or 10% of its workforce in the US, Europe, and China (i.e. all of its major markets).

Management has tried to “happy talk” the situation by claiming it was a “company-wide restructuring” to reduce cost and increase productivity for its “next phase of growth”. But the fact that many high performers and senior employees were cut signals that this may have been driven by financial necessity. The depth and severity of the cuts, for me, are quite alarming. According to the same article;

Many of the laid-off employees were high performers, according to two sources who spoke to TechCrunch on condition of anonymity. One source expressed shock at the number of talented employees cut and noted that many of those affected were working on projects that have fallen lower on Tesla’s priority list. The source declined to specify which projects.

I believe a layoff like this could signal that the company’s upcoming Q1 2024 results could be disappointing. As stated in an advanced announcement, in Q1 2024 the company delivered approximately 387,000 vehicles out of 433,000 vehicles produced. Tesla delivered 8.5% fewer vehicles than it had at the same time last year. This number was a big miss compared to the 454,200 expected by Wall Street. The Gap of nearly 50,000 between delivered vehicles and produced vehicles could signal weaker demand as vehicles were unsold. For the official Q1 2024 earnings results, I would take a close look at Tesla’s profit margins as well as its cash flow from operations.

Robotaxis take Priority

In order to boost the company’s long-term sales and, in my opinion, to try to bring back some hype for its stock, Tesla announced the unveiling of its Robotaxi on August 8th.

The company had sunk millions of dollars of research into its autonomous driving effort yet so far has little to show for it. With A.I. developing at an exponential rate, Tesla’s management is betting big that this technology can bring Robotaxis to market a lot sooner than people expect.

The Tesla Robotaxi is designed for self-driving from the ground up, according to Electrek. It may not even have a steering wheel or pedals. The company plans to use its new “unboxed” method to manufacture these units at an affordable cost. Tesla is making such a big bet on self-driving that the company is potentially delaying or even shelving its Model 2. The lower-cost EV, which is targeted to be priced around $25,000, was once seen as a pivotal product for the company’s overall growth.

The departure of Drew Baglino, Tesla’s SVP of Powertrain and Energy, leads credibility to this rumor. According to TechCrunch, he was a key executive that would be important to the Model 2 project. In the TechCrunch article, Sandeep Rao, head of research at Leverage Shares, theorized “Baglino was in charge of powerdrives and new battery projects, and there’s a sense that there isn’t a whole lot of innovation that’s sustainable at this point, which is probably why Baglino is leaving,”

It’s not surprising to me though why Elon Musk would put all his focus on Robotaxis to the possible detriment of all other projects. In my view, he is in a bit of a “Catch-22”. There was a time when Tesla was the dominant force when it came to electric vehicles. But that time has passed, the firm is facing intense competition from traditional automakers and new players. The company’s share in the EV market in 2022 was 62%. This dropped to 55% in 2023.

The story or hype around Tesla stock during its last bull run was that it was developing the Model 3 which is a low-cost unit that would allow Tesla to dominate the market. Now the Model 3 is here and even cheaper Chinese vehicles are causing Tesla to cut prices, hurting its margins. New Chinese players could be operating with around a 30% cost advantage. There are Chinese EVs right now with cars priced as low as $10,000, far cheaper than the $25,000 target price tag of the Model 2. Chinese EVs are so cheap that the US government is rightly worried about the effects of “dumping”. In my view, trying to outcompete Chinese firms on low-cost manufacturing is a losing battle.

Hype or Return to Fundamentals

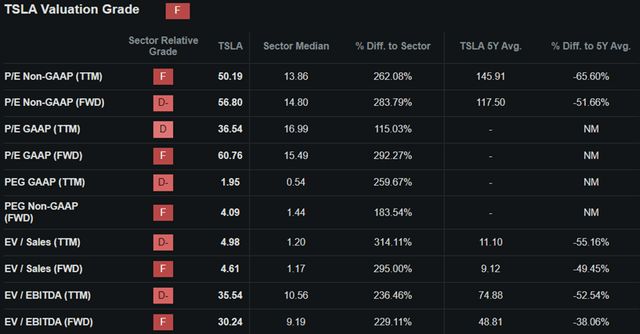

If you’ve watched the history of Tesla’s stock, you’d know that it has been long untethered to fundamentals. There was always some kind of story around its dominance over EV and battery tech that gave the stock multiples of value above traditional car companies. Even with the recent share price decline, Tesla is still trading at a forward P/E multiple of 57x and a market capitalization of $500 billion. That is much higher than the sector median of 15.5x.

Relative Valuation (Seeking Alpha)

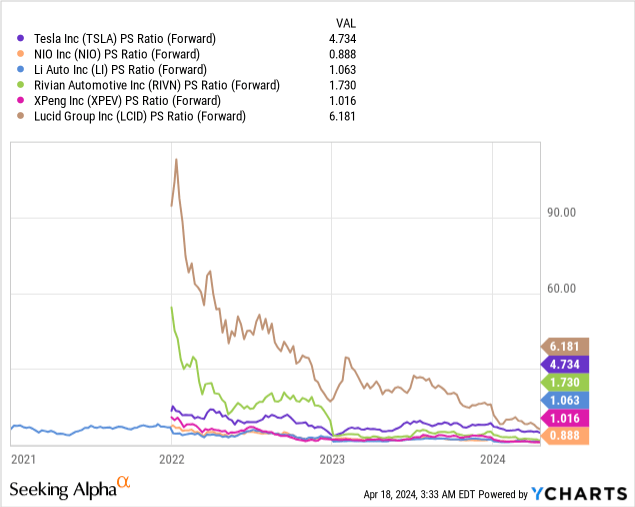

Tesla is trading at a premium valuation even relative to other EV pure plays. Looking at the forward Price-to-sales ratio, Tesla is trading way above the major Chinese EV players and is only more expensive than Lucid (LCID). Now that EVs are getting more common and the market is getting saturated, is it time to look at Tesla as an “automotive stock” and not anymore as a “disruptive technology stock”?

Management is hoping not as that might tank the stock price of TSLA hence the big bet on Robotaxis. Will this work as it has in the past? In my view, not anymore as even within the autonomous driving space, Tesla faces intense competition from multiple players.

Much has been said about Musk using camera systems exclusively for its self-driving. Competitors such as Waymo (GOOG) and Cruise (GM) use a combination of LiDAR, ultra-sonic, radar, and cameras. You can make the argument that the latter two are further along than Tesla as their focus has been on Level 4 autonomous driving as opposed to Tesla’s Level 2 FSD. Robotaxis would need to reach Level 5 autonomy.

As electric vehicles become more “commoditized” it is difficult for me to justify Tesla’s premium valuation over other electric vehicle manufacturers. The risk to this thesis though is Elon Musk suddenly blowing everyone away with its self-driving advancements come August. The competition in this space makes that unlikely though. Given the slowdown in the overall EV industry and the specific challenges that Tesla faces, I am bearish on TSLA stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.