Summary:

- AMAT experienced some challenges in the latest earnings due to delayed projects and ICAPS market.

- Semiconductor industry has a strong momentum to recover in 2024 and resilient demand fundamentals.

- The article will go through key inflections of GAA, HBM, advanced packaging, backside power delivery, innovative pattern-shaping, eBeam tools, ICAPS, and their application for AMAT.

- I am rating Applied Material with a Strong Buy rating, based on 65%upside potential.

zorazhuang

In my previous write-up on Applied Materials (NASDAQ:AMAT), I suggested that the company could emerge as a main beneficiary of the gradual transition to advanced process technology amid the rapid development of AI. Since then, the stock price has surged by 44.6%, and with this article, I am lifting the AMAT stock to a Strong Buy rating based on the calculated 65% upside potential. I believe that Applied Materials could further excel with its broadest industry-leading portfolio, enabling the company to dominate the key technology inflection points amid the expected normalization of the semi-industry demand profile. The article will walk you through the industry outlook and financials, as well as the main technology inflection, namely GAA, HBM, advanced packaging, backside power delivery, innovative pattern-shaping, eBeam tools, ICAPS, and their application for the company’s growth and profitability.

Technology inflections leader

The global semiconductor market is about to showcase more encouraging dynamics in 2024 on the background of the forecasted 13.1% rebound in chip sales. The industry is already growing, and if we take the WSTS expectations for granted, it implies that chip sales could grow by 1.8% sequentially through the year. The most striking growth should come from the memory market, up 44.8%, and the company is well positioned to progress in this area. Overall, the main drivers for the semi-industry remain the continued spread of AI and high-performance computing technologies, machine learning, the deployment of 5G networks, IoT, VR/AR, and the expanding use of semiconductors in the automotive industry. The executives were also positive in the latest earnings call about the prospects:

In our discussions with customers, we’re hearing that overall market dynamics are improving. There is a reacceleration of capital investment by cloud companies, fab utilization is increasing across all device types and memory inventory levels are normalizing.

I believe that Applied Material could be the main beneficiary of the trends described above and will be able to further increase its market presence thanks to its broadest semiconductor equipment portfolio, which could enable the company to catch a broad range of technological inflection points. Meanwhile, the company already dominates some key inflections, but let me discuss the financials first.

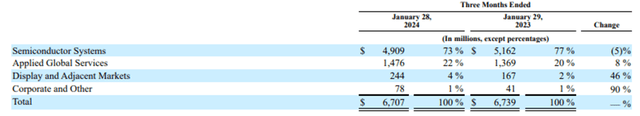

AMAT reported flattish first-quarter revenue of $6.7 billion and a 5% increase in EPS to $2.13 (non-GAAP), both exceeding analyst expectations.

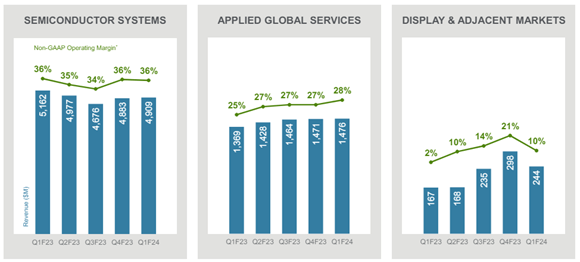

Revenue breakdown (company reports)

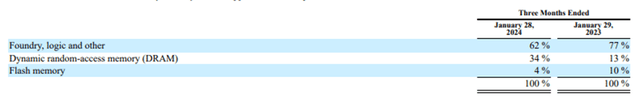

Semiconductor Systems revenue was down by 5% YoY, following the weak performance of the flash memory division. However, DRAM business marked record sales, driven by high-bandwidth memory (“HBM”) production rump up. The latter is a crucial part for high-performance computing, required to handle the growing AI workload. Although the HBM shapes a very small part of DRAM market, it is expected to grow significantly in the coming years, and Applied could benefit from this inflection strongly due to the strong advanced packaging technologies for connecting finished IC dies. Moreover, the company has a leading position in DRAM memory market, which according to forecast, is expected to rebound substantially in 2024.

While the DRAM revenue share advanced almost 3x times in the revenue-mix to 34%, the foundry/logic sales decreased in share to 62%, which means that the revenue from the division decreased 23.4% YoY to $3 billion, and is a bit concerning performance at first sight.

Total revenue by end-markets (company reports)

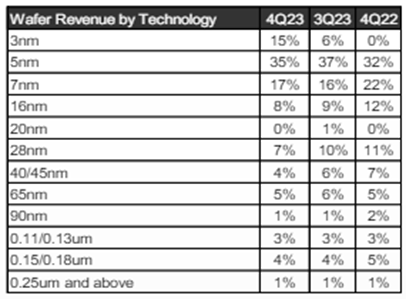

The possible explanation for this could be the mentioned delay of some important projects on the earning call due to the grant funding postponement, which most likely affected TSMC (TSM), whose participation in the AMAT’s net revenue fell below 10% from 27% a year ago. While those projects are expected to take place at some stage, the point is that Applied Materials has a leading position to profit from the shift to GAAFET (gate-all-around) transistors. The latter inflection is a key point for the dimension shrinkage needed for performance improvement in AI data centers, and the company anticipates capturing over 50% of the spending for the process equipment used in this new transistor module. Let’s now turn to the TSMC’s revenue by technology breakdown in order to gain more clues regarding the secular shift to lower nodes.

Wafer revenue by technology process (TSMC)

The share from advanced technologies (7nm and below) reached 67% of Q4’23 total wafer revenue, a prominent advance compared to 54% a year ago, which could unlock significant profitability gains for TSMC and hence for AMAT in the future.

Concerning the ICAPS (IoT, Communications, Automotive, Power, Sensors), the company didn’t see any growth or expect to see any in the 2024 year. Meanwhile, new vehicle registrations in the EU and US are resiliently growing since modern cars and BEVs have higher semiconductor content. Add to this IoT, which is in early adoption, and the ICAPS market could benefit the company for many years to come, despite the declining share of trailing-edge technologies.

Moving forward, the services business (“AGS”) generated $1.5 billion in revenue (+8% YoY), growing for the 18th consecutive quarter. This was due to the continued increase in the installed base and very high renewal rate of subscriptions. AGS provides a recession-resistant feature for the company’s financial performance, since it grew even in the semi-market downturn cycle. Going forward, I believe chip makers will become increasingly reliant on AGS since the transition to lower nodes requires more advanced and complex WFE (wafer fab equipment) fabrication solutions. In addition, fab performance optimization, upgrades, spares, services, and consultations are crucial for yield improvement and cost optimization, especially for advanced chips.

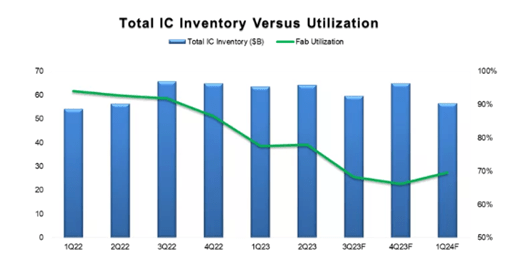

Ship inventory and utilization (Semi.org)

I would also like to stress the point that AGS was growing even amid the persistent drop in fab utilization rates over the past two years, which only started to increase in the first quarter of 2024. With the ongoing normalization of the semiconductor market, I expect the fab utilization rate to grow to 80% in the back half of the year, which justifies the management’s belief that AGS has the opportunity for double-digit growth this year.

Unveiling potential profitability gains

Now let’s have a look at profitability and how it could evolve, taking into account the above-mentioned developments.

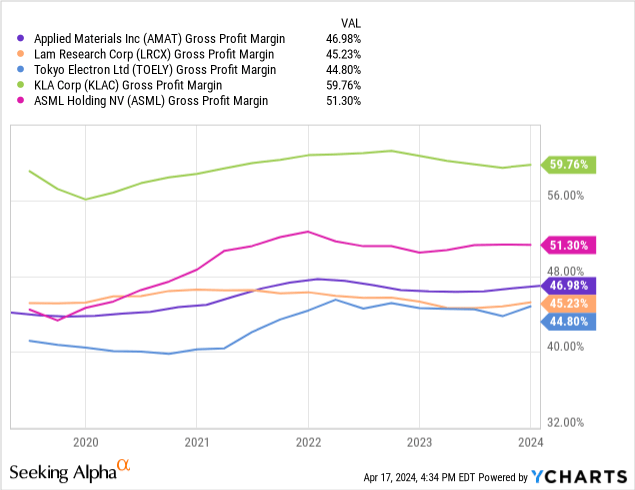

AMAT’s gross profit margin improved through 2023 and settled at 47%, slightly outperforming Lam Research (LAM) and Tokyo Electron (OTCPK:OTCPK:TOELY) by this measure. The latter two are the most appropriate competitors to AMAT from a products and services portfolio overlapping point of view. Going forward, I believe that Applied Materials could easily touch the 50% gross profit line in 2024 due to the following few factors.

Firstly, the operating leverage improvement could come as a consequence of the decreased share of lower-margin display segment in the overall product mix.

Segment profitability (company presentation)

Meanwhile, the performance in higher-margin AGS remains strong, and going forward, the segment has strong growth prospects that we already discussed. Regarding the semiconductor systems business, profitability gains could be earned with the transition to more advanced processing nodes. The latter is the main growth factor for the segment, and since TSMC dominates in this area, the company could be a good indicator. Recall that TSMC’s share of advanced processes accounted for 67% of total wafer revenue, and the share has been consistently increasing. Since the lower nodes require more complex solutions, it means that WFE could grow at a faster rate than semiconductor revenues. And given the share of TSMC in the company’s quarterly revenue, my estimations revealed that the amount of advanced process revenue in the AMAT’s total sales was about 9%. The figure is surprisingly low, given that in my previous article I estimated it to be around 23%, and it could be an additional reason for the quarterly decrease in the semi-systems segment.

Ultimately, we can suggest that AMAT still derives a small portion of revenue from lower nodes, which may unlock significant growth opportunities and profitability gains in the coming years. Moreover, the company is positioned in the best possible way for the secular die size shrinkage due to its leading position in backside power delivery, which enables up to 30% area savings, as well as in innovative pattern-shaping (Sculpta). The latter is a breakthrough technology and an effective alternative to EUV multi-patterning. Of course, we cannot overlook high-NA EUV, which removes the need for double patterning. However, according to reports, high-NA machines cost significantly more than using current low-NA tools for the 3nm and the upcoming 2nm processes. It is expected to become reasonable for the 1nm process, which is unlikely to be mass-produced in the current decade. As a result, I believe that AMAT already has technologies in place to dominate the leading-edge nodes down to 1nm.

Finally, the company also operates industry-leading eBeam tools for defect and patterning control. The main market provider of such tools is KLA Corporation (KLAC), and given the company’s highest gross margin of 59.8% among the leading WFE manufacturers, I believe that Applied Material could strengthen its profitability, especially amid the expected rapid growth of the latest CD-SEM metrology system. The latter could also benefit the company with the adoption of high-NA EUV.

Attractive valuation perspective

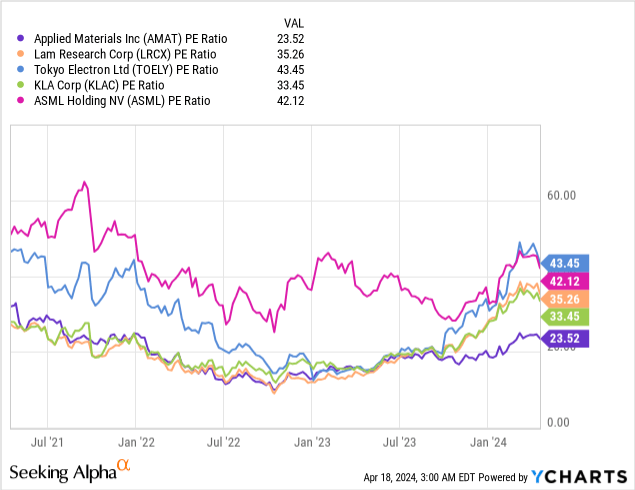

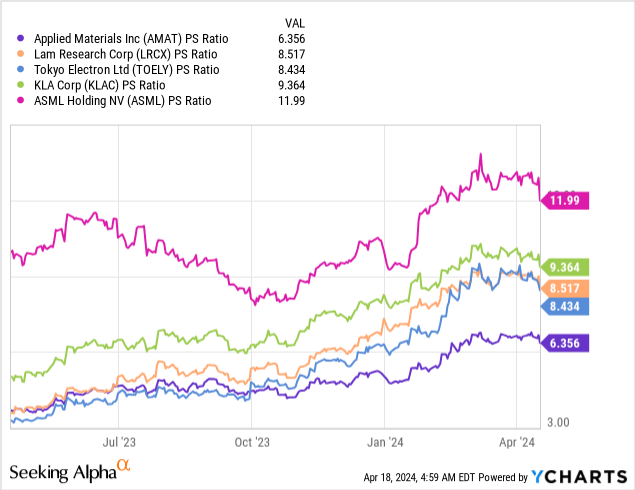

Looking at the valuation of AMAT stock against the comps in the face of Lam Research, Tokyo Electron, KLA Corp. (KLAC), ASML Holding (ASML), we could notice some interesting trends. Let’s begin with the P/E ratio.

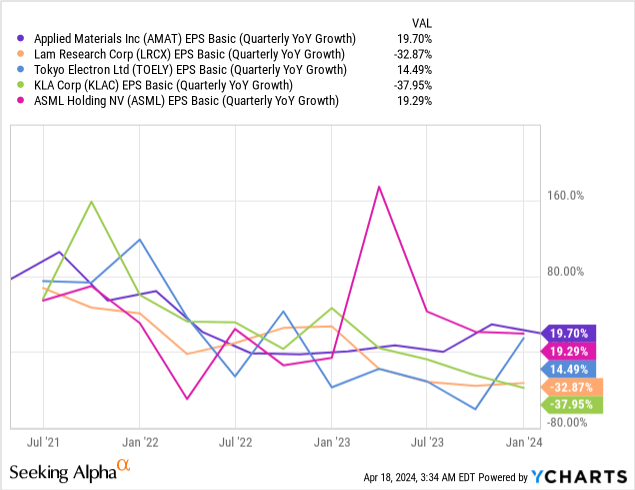

Applied Material is trading at 23.5x trailing P/E, which is the lowest among the selection and represents a 39.2% discount to the peer median of 38.7x. Applying the letter figure to the company’s TTM EPS of $8.50 implies that the equity value per share should be $329, or a 65% upside potential from current SP levels. It should be noted the pattern of the valuation, where all comps, apart from ASML, have been moving in line since the beginning of 2023 until the back half of the year. Since then, AMAT has prominently lagged behind. The possible explanation for this could be that investors didn’t price in the following chart.

Applied Materials delivered the strongest EPS (GAAP) growth of 19.7%, but the price didn’t follow suit. Moreover, the chart clearly exposes the company’s strong points. What I mean is that AMAT’s leading position in the fab equipment market’s inflections and broadest portfolio make the company’s EPS growth pattern resilient, looking like a moving average.

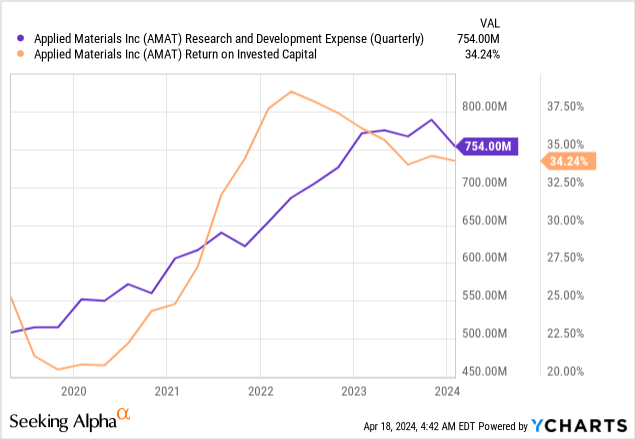

In addition, AMAT is dedicating significant funds for innovations, and we actually see how in 2022 ROIC displayed a sustainable increase in R&D expenses from the previous years and is yet to reflect the record 2023 investment. The pattern clearly says that the company is not cutting back on innovations and is targeting technology leadership.

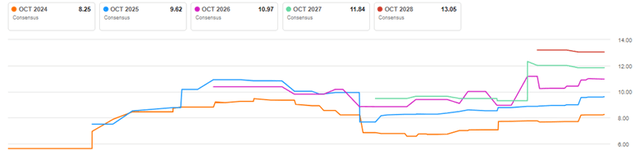

Switching to Seeking Alpha’s earnings estimates screener, we can identify that AMAT stock’s forward PE stands at 24.2x (higher than the trailing), and it’s not because the market expects negative earnings growth, but the estimates are on a normalized basis. The chart below stipulates a 2.5% EPS growth for Applied Material in the 2024 fiscal year, and in my view, the forecast is somewhat missing the key inflections we discussed previously.

Consensus EPS revision trend (Seeking Alpha)

However, the 2027 EPS estimate was significantly revised upwards, which is the period where the 2nm process should be in mass commercialization, and it is interesting why the consensus thinks that AMAT won’t benefit in the same manner from the prevailing advanced nodes.

Moving forward, the PS ratio picture looks broadly the same. AMAT is trading at 6.4x trailing PS, prominently below the comps’ valuation.

The market is pricing a 1% increase in 2024 total revenue, most likely because of the ICAPS market. However, like the management stressed during the earnings call, “Applied Materials outperformed our markets in 2023 for the fifth consecutive year and we delivered strong results in the first quarter of 2024.” I don’t see the reasons why AMAT may not deliver stronger growth. ICAPS? Yes, but the following factors could offset the sluggish ICAPS. Namely, the technology leadership in the main inflections and normalization of the semiconductor market’s demand profile. Add to this the increasing complexity of lower nodes, which means that spending on advanced WFE could outperform semiconductor revenue. As a result, I expect up to 10% revenue growth for the current fiscal year, up to $29 billion, concluding that AMAT deserves a Strong Buy rating.

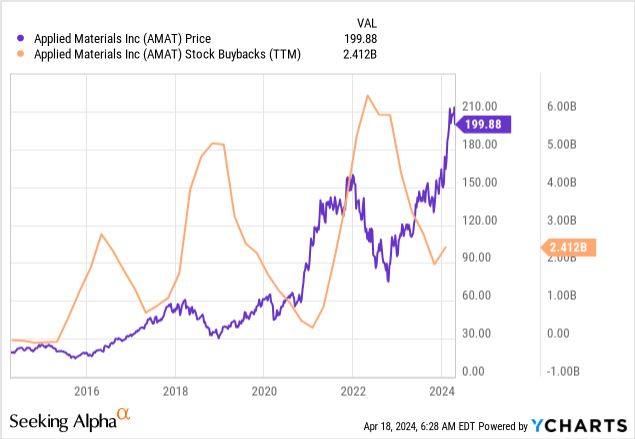

In addition, AMAT raised its quarterly dividend payment per share to $0.40 and dedicated a significant amount of funds to stock buybacks. Given the positive factors for AGS, which stand behind the dividend policy, the segment could generate sufficient operating profit to power dividend increases.

The chart also delineates the management’s confidence in the stock, triggering massive stock repurchases during the seatbacks of the stock price.

Risk factors are broadly balanced

Last time, I pointed out that the main risks for the semi-industry are associated with further monetary actions by the Fed, while at this point, the further actions could merely benefit the industry, in my view. However, it still remains to be seen how the federal investigation into AMAT involving China shipments will unfold. The imposition of fines and increased control over the company’s export operations cannot be ruled out, which could pressure Applied Material’s business.

On the upside, there are some projections for the key inflections that should be tracked. If the company reveals in the next earnings season good progress towards achieving $1.5 billion in revenue in FY24 from advanced packaging and 4x growth of its CFE eBeam technology, my thesis on AMAT will merely gain ground.

Investment takeaways

I decided to upgrade the AMAT’s rating to Strong Buy as the semi-industry seems to have come past the cyclical downturn and is set to fully recover in 2024. The main growth factor for Applied Materials remains the secular transition towards leading-edge process nodes, which require increasingly advanced WFE systems. This is dictated by the rapid proliferation of AI technologies and high-performance computing needs. The path goes through some key technology inflection points, discussed in this article, at which AMAT holds leading positions. Namely, the company is in the best position to grow in DRAM process equipment, including HBM, due to market leadership and the expected rebound of memory chip sales. Applied Material is expecting to share at least 50% in GAA, backside power delivery, and advanced packaging, which are the main determinants for the transition to lower nodes. The company’s breakthrough pattern-shaping technology could be an efficient alternative for EUV double patterning until the transition to high-NA EUV, for which the company has clear leadership in eBeam offerings.

Still, the company is going through some challenges, including the ICAPS market and project delays. However, I believe that the growth prospects outweigh current weak points, and AMAT could become the main beneficiary once ship manufacturers expand advanced chip technologies into mass production. The latter trend would noticeably strengthen the company’s profitability and provide lucrative growth for AGS’s business.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.