Summary:

- McDonald’s stock has had a 3.54% total return since our last call to sell, underperforming the S&P 500.

- The company’s high leverage and inflation are pressuring its cash flow.

- Increasing labor costs and shift to automation will pressure margin that increasing prices is not a viable option.

M. Suhail

Investment Thesis

Review

Last year in March, we initiated coverage on McDonald’s Corporation (NYSE:MCD), giving it a sell rating of $263.73. The report titled “McDonald’s: Higher Leverage, Inflation Indicate A Near-Term Peak”. We predicted that the company’s cash flow would be impacted by the receding restaurant traffic indicated by peaked restaurant inflation due to the normalization of consumer spending at fast-food dining. Combined with its high leverage, near-term peak performance was expected.

A year later, the stock performance of the company has returned 3.54% after hitting its low at $250 in November last year. Meanwhile, for the same period, the S&P 500 changed by 31.47%.

Updates

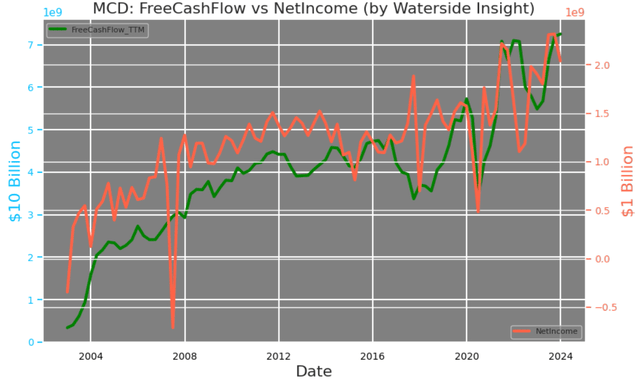

Financial-wise, McDonald’s has pulled its free cash flow and net income back to the growth trend line.

McDonald’s: Free Cash Flow vs Net Income (Calculated and charted by Waterside Insight with data from company)

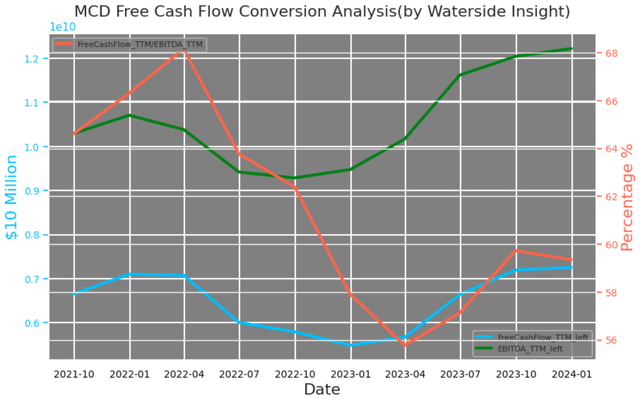

Cash flow conversion from EBITDA on a TTM basis also improved by about four percentage points since a year ago, although still trailing the peak it achieved in 2022 at 68%

McDonald’s: Free Cash Flow Conversion (Calculated and charted by Waterside Insight with data from company)

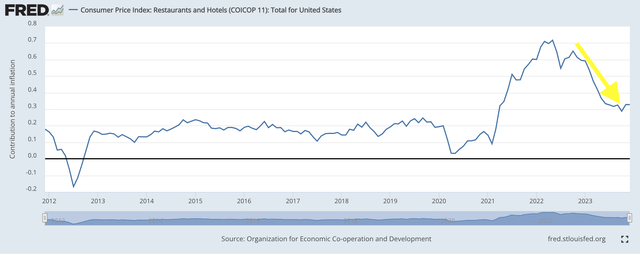

A year ago, we accurately predicted that Restaurant Inflation would decline, and it has indeed happened, declining by almost 50% from its peak. This was one of the reasons why we expected that McDonald’s performance might peak. We anticipated that consumers would return to their usual dining habits after the post-COVID dining out rush, resulting in less traffic at McDonald’s. However, the inflation index has now stalled at a level that is still around 30% higher than pre-pandemic levels. This is due to wage pressure, which is not the “good” type of inflation that can help boost the company’s performance.

US Restaurant and Hotel Inflation (FRED)

California passed a landmark wage law that will lift pay for low-income employees throughout the state to a $20/hr minimum. This change will be a ripple effect across all McDonald’s restaurants. One of the adaptations of automation is to reduce workload. In response to this change, Californian restaurant chain owners may opt for either reducing work hours or changing salaried managers into hourly employees. Meanwhile, they are considering increasing drive-through AI Chatbot applications. You could be talking to a mic with no real people inside that window next time to pull up at the drive-thru. The company already has a partnership with IBM in automating the voice ordering assistant system. It recently announced that it will also partner with Alphabet Inc.’s (GOOG) (GOOGL) Google Cloud to test generative AI’s ability in its restaurants worldwide.

McDonald’s is faced with the challenge of increasing its revenue without raising prices, as that would reduce foot traffic to its restaurants. One way it is tackling this issue is by introducing new menu items. In California, it will be adding bagels to the breakfast menu, which is a popular item among fans. Additionally, the company is partnering with Krispy Kreme Doughnuts to roll out doughnuts to the pastry selection menu nationwide. However, consumers may still feel the pinch of the higher costs. As its CEO mentioned in the earnings call,

You see the pressure with the U.S. consumer is that low-income consumer. So call it, $45,000 and under. That consumer is pressured.

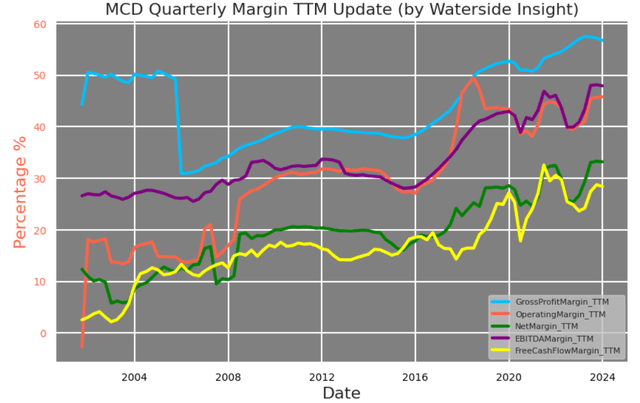

That consumer section has always been the bread and butter for McDonald’s. You be the judge whether the $18 Big Mac Meal makes sense. But unless the company changes its business model to appeal to only middle-class consumers and raises prices to offset costs, its margins could be compressed or at least stalled. Most of its margins have seen more than 50% increase since 2016, and have stayed within a range of 10 bps since 2020. From a year ago, this has been an improvement of about 8bps for its operating margin and EBITDA margin.

McDonald’s: Margins (Calculated and charted by Waterside Insight with data from the company)

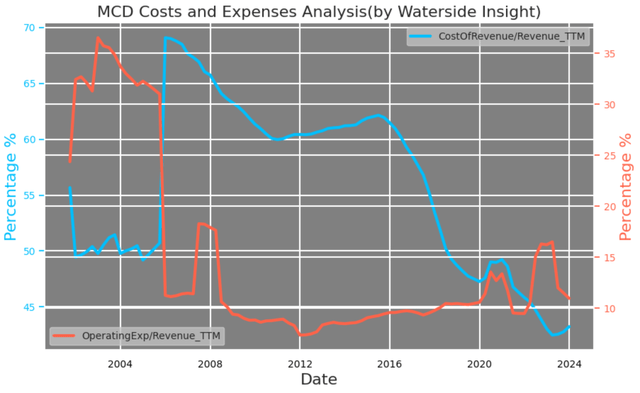

The margin improvements are mostly due to cutting costs and expenses. The cost of revenue and operating expenses are at the lowest ever for the company.

McDonald’s: Costs and Expenses (Calculated and charted by Waterside Insight with data from the company)

It appears that McDonald’s may have reached the limit of how much they can reduce costs. As a way to cope with the changes in California, the company is planning to launch a marketing campaign specifically for that state, with a budget of approximately $15 million. This is unprecedented for McDonald’s to run a marketing campaign in one state, but it could be a precursor of how they plan to handle the ripple effect of rising labor costs throughout the rest of the country. In addition to this, the company may also increase spending on marketing to increase foot traffic, as well as on adapting to new technology, which could lead to an increase in capital expenditures. McDonald’s has already announced plans to expand its business by opening new restaurants, which could lead to a growth of 12-30% higher CapEx beyond 2024. All of these factors combined may mean that the company is close to reaching a peak in its free cash flow growth in the near future.

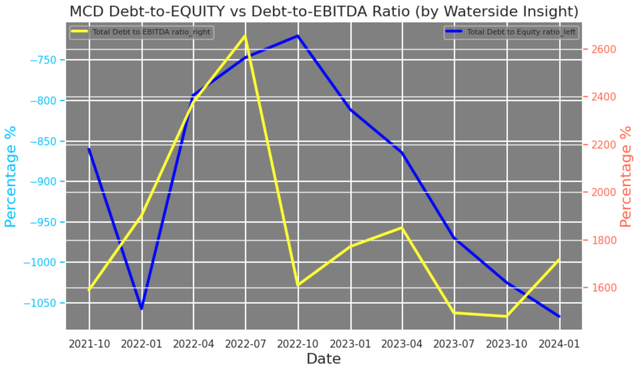

McDonald’s debt ratio regarding EBITDA has maintained at around where it was a year ago, but compared with its total equity, the ratio has declined substantially by more than 25% from negative 8.6x to now negative 11.3x.

McDonald’s: Debt Ratios (Calculated and charted by Waterside Insight with data from the company)

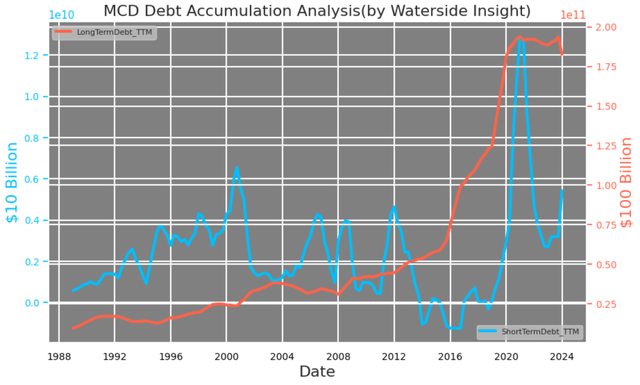

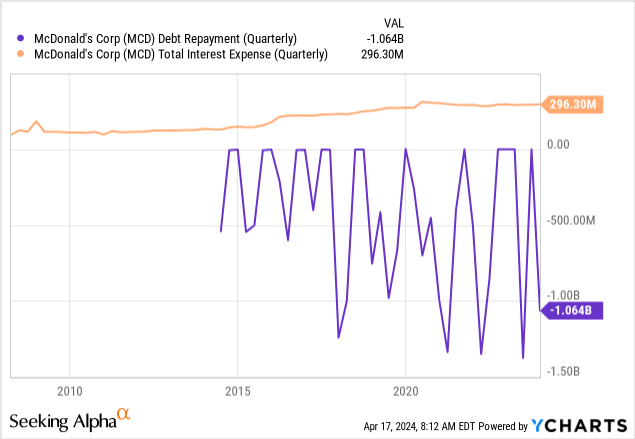

McDonald’s long-term debt has been leveled out and stayed at its current levels since 2020, and it has paid down a large portion of its short-term debt borrowed in 2021. But in the past year, this short-term borrowing is creeping back up.

McDonald’s: Debt Accumulation (Calculated and charted by Waterside Insight with data from company)

McDonald’s interest expenses are now about 30% or higher of its regular debt repayment on a quarterly basis. It is not convincing to us that the debt burden doesn’t matter, especially with the borrowing still increasing. The debt-to-EBITDA ratio didn’t increase much, mostly because of the rising earnings, not necessarily by substantial debt reduction. Should earnings stall, these ratios could deteriorate quickly. Even if that doesn’t happen, there is limited room upward to borrow for the company.

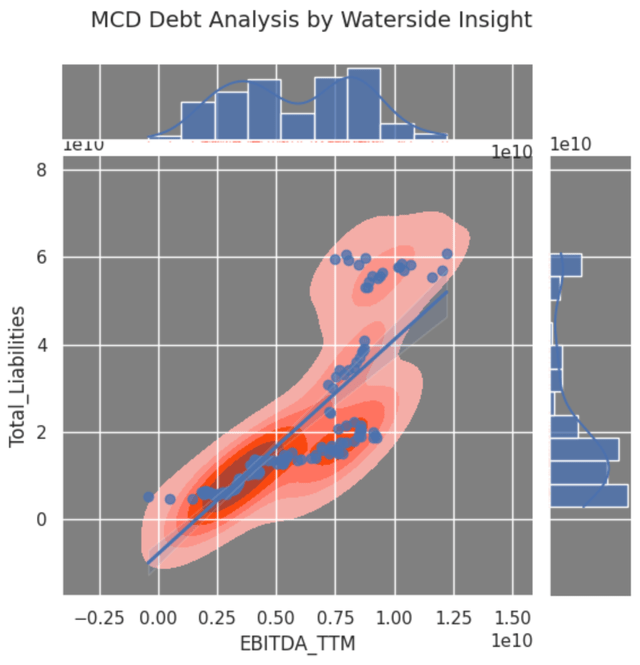

We have found debt to be effective in boosting McDonald’s earnings based on historical data. But since 2016 the company went into negative equity by increasing borrowing, this effectiveness has formed a new cluster. Unable to raise its total liabilities level much higher, the likely EBITDA it can maintain is at or around $1 billion on a TTM basis instead of its current level of $1.3 billion. In other words, another earnings near-term peak could be in place for the company.

McDonald’s: Debt vs. EBITDA (Calculated and charted by Waterside Insight with data from the company)

By now, we haven’t yet followed up on McDonald’s carbon footprint, which was discussed in our previous article. Although the company has established a code for responsible product sourcing, its elephant-sized carbon emissions need to be addressed effectively with more measures. We expect more spending will also be allocated in that matter.

We think McDonald’s has done a good job at improving its revenue growth and free cash flow over the past year. However, it’s been eight years since the company first had negative equity. At present, McDonald’s primary focus should not be on chasing short-term earnings or margins, as its reputation for effective management is already well-established. Instead, the company needs to adapt to the rapidly changing labor and supply cost landscape, while also prioritizing green initiatives and reducing its debt. This will help McDonald’s to maintain its brand appeal, while also establishing a foundation for sustainable growth.

Financial Overview & Valuation

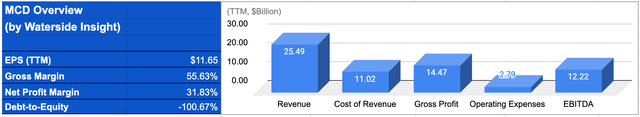

McDonald’s: Financial Overview (Calculated and charted by Waterside Insight with data from company)

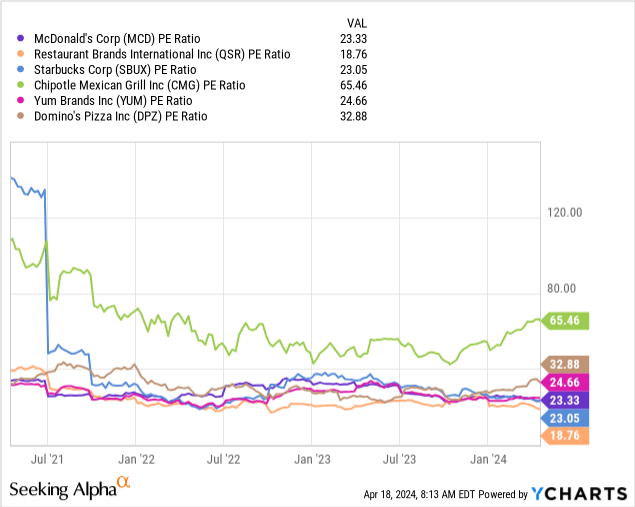

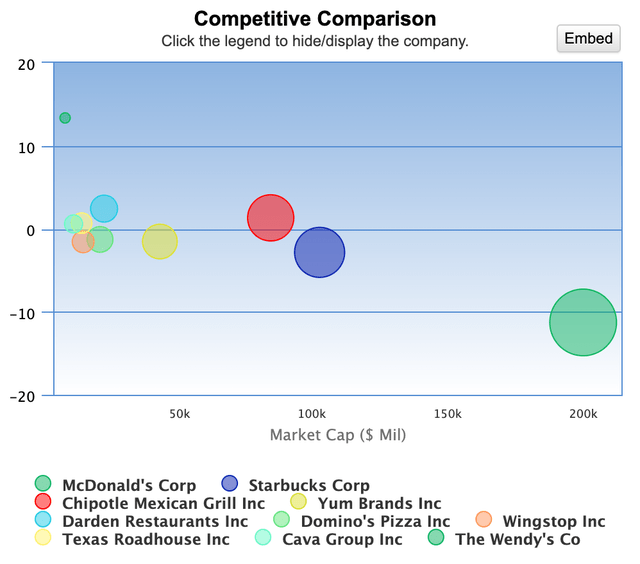

We previously suggested McDonald’s fair price should be at $190.46 while the bullish case is at $208.56. The current price is still above our projection. From a relative value point of view, McDonald’s PE ratio is right in the middle among its peers.

Although McDonald’s is in the same business as other companies, such as Burger King, Wendy’s, and Chipotle, its debt-to-equity ratio is significantly higher than all of them. The need to acquire land and restaurant space applied to each one of these companies, but McDonald’s has accumulated much more debt. The company is facing a peak in its performance and needs to make a lot of adaptations to accelerate into the next growth phase, such as cost reduction, automation, climate impact minimization, and so on. However, the high debt load has constrained its ability to boost further earning growth. Therefore, we expect earnings to be stagnant or decline in the near term, which makes its PE ratio to be on the rich side.

McDonald’s: Debt-To-Equity Ratio Peer Comparison (Gurufocus)

There is a potential risk to the thesis, which could come from macroeconomic factors. Assuming that the Federal Reserve begins to cut interest rates this year, while the economy remains stable with consistent growth momentum, McDonald’s may experience a boost both in demand and lower interest rate expenses. This could extend its growth from the past year, but is unlikely to lead to another phase of growth. As a result, its stock price will either remain range-bound or flatten out. However, we believe that if the Federal Reserve does, in fact, cut interest rates under these conditions, it would likely be a mistake and the policy would need to be reversed quickly.

Conclusion

McDonald’s recently improved its financial performance, which has a backdrop of macro uncertainty and long-term changes coming to the fast food industry. Our thesis from a year ago predicted that the company’s performance would peak in the medium term, and upon review, we still expect peak performance in the near term. However, we anticipate that the company will need to adapt and change to sustain this level of success. At present, the stock price is overvalued by 20-30%, and we maintain a sell rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.