Summary:

- Micron Technology beat analysts’ revenue and earnings expectations the last time it reported earnings.

- The company is a beneficiary of the proliferation of Artificial Intelligence, which should drive multi-year growth.

- Its opportunities in the data center, PC, and smartphone markets position it for potential outperformance in the coming years.

aeduard/E+ via Getty Images

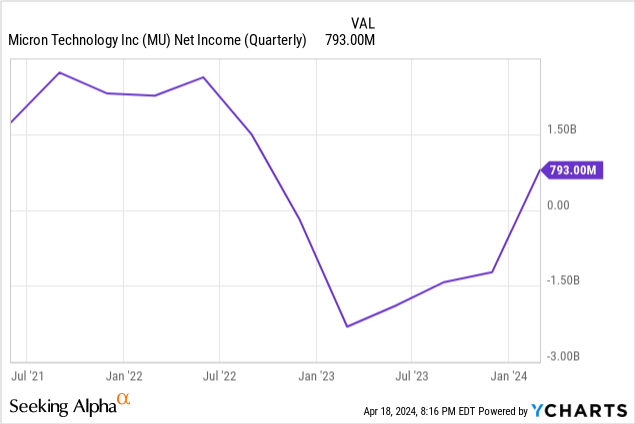

As of April 1, Bankrate highlighted Micron Technology (NASDAQ: MU) as the fifth-best performing S&P 500 stock in 2024, with a 38.1% return. Investors are optimistic that this cyclical memory semiconductor manufacturer may be near the beginning of a multi-year run higher because they are beginning to notice improvements in recent earnings results. The company reported second-quarter fiscal year (“FY”) 2024 earnings on March 20; the results surprised analysts and investors. Analysts expected the company to produce an adjusted earnings-per-share (“EPS”) loss of $0.24. Instead, Micron shocked the market with an adjusted EPS profit of $0.42 per share. The company also beat analysts’ revenue forecasts and gave guidance above analysts’ expectations.

Even better, management said the magic words that almost every investor wants to hear: Micron benefits from the proliferation of Artificial Intelligence (“AI”). Chief Executive Officer (“CEO”) Sanjay Mehrotra said on the second quarter Fiscal year (“FY”) 2024 earnings call, “We are in the very early innings of a multi-year growth phase driven by AI as this disruptive technology will transform every aspect of business and society.” Investors liked what they heard. The stock rose 14% the day after management released earnings.

Wall Street analysts expect Micron’s earnings to increase for at least the next two fiscal years. If those assessments are correct, investors have an opportunity to invest in a stock that could potentially outperform the market averages for the next several years due to the data center market’s continued thirst for memory chips used in AI applications and the expected rebounding demand for memory chips in the personal computer (“PC”), smartphone, and consumer electronics industry.

This article will discuss the memory market, examine Micron’s AI opportunity, look at the company’s fundamentals, discuss risks that investors should be aware of, discuss the company’s valuation, and explain why I consider Micron a buy.

The dynamics of the memory chip market

Memory chips are data storage devices that primarily come in three types: DRAM, NAND, and NOR. All three chip markets are commoditized, and memory prices mainly depend on supply and demand. When memory chip supply is high, and demand is low, chip prices collapse. When supply is low, and demand is high, chip prices can go through the roof.

1. DRAM

DRAM stands for Dynamic Random-Access Memory, a type of memory that loses stored data when the power is off. The DRAM market is an oligopolistic market dominated by Samsung (OTCPK:SSNLF), SK Hynix, and Micron. Of the top three manufacturers, Statista has Micron with the smallest market share of 22.8%, Samsung with the largest market share of 38.9%, and SK Hynix held down second place with a 34.3% market share as of the third quarter of 2023.

Micron 2023 10-K states the following about the DRAM memory market (Emphasis added):

Most commonly used in client, cloud server, enterprise, networking, graphics, industrial, and automotive markets. LPDRAM products, which are engineered to meet standards for performance and power consumption, are sold into smartphone and other mobile-device markets (including client markets for Chromebooks and notebook PCs), as well as into the automotive, industrial, and consumer markets.

Approximately 71% of Micron’s revenue in 2023 came from sales of DRAM chips. So, when the

personal computer (PC), consumer electronics, and smartphone markets collapsed in 2022 and 2023, demand for DRAM chips lowered, negatively impacting Micron over the last several years.

The good news is that analysts project that the balance in the DRAM market is starting to tip back in favor of memory manufacturers. Micron management forecasts that DRAM pricing will improve throughout 2024.

2. NAND flash memory chips

These types of memory chips retain data when turning off the power. NAND chips often wind up in Solid State Drives (SSDs). Five companies dominate the NAND flash memory chip market: Samsung, SK Hynix, Western Digital Corporation ((WDC)), Kioxia, and Micron. As of the third quarter of 2023, Statista had Samsung as the largest NAND manufacturer in the world with a 31.4% market share, and SK Hynix was second with a 20.2% market share. Micron was the fifth largest NAND supplier of the top NAND memory companies, with a 12.5% market share.

Micron’s 2023 10-K states the following about the NAND flash memory market:

NAND is used in SSDs for the enterprise and cloud, client, and consumer markets and in removable storage markets. Managed NAND is used in smartphones and other mobile devices, and in consumer, automotive, and embedded markets. Low-density NAND is ideal for applications like automotive, surveillance, machine-to-machine, automation, printer, and home networking.

Like the DRAM market, the NAND memory chip market has been in a drought over the last several years, suffering from a lack of demand. The good news is that Micron management also forecasts that NAND pricing will improve throughout this year.

3. NOR flash memory chips

These chips are similar to NAND chips, but are specialized chips with niche applications. Some people have never heard about NOR chips because the market for NOR chips is smaller than the DRAM and NAND market, and major news outlets rarely cover the NOR market. However, since one of the use cases for NOR chips is Internet of Things (“IoT) devices and automotive applications, you might hear more about this market in the future.

Micron’s AI opportunities in the data center

Micron can benefit from the proliferation of AI in three end markets for memory chips: data center AI servers, PCs, and smartphones. First, let’s discuss the company’s data center opportunities. CEO Sanjay Mehrotra talked about how AI will benefit Micron in the data center in the second quarter of FY 2024 earnings call:

Memory and storage technologies are key enablers of AI in both training and inference workloads, and Micron is well-positioned to capitalize on these trends in both the data center and the edge. We view Micron as one of the biggest beneficiaries in the semiconductor industry of this multi-year growth opportunity driven by AI. In data center, total industry server unit shipments are expected to grow mid to high single digits in calendar 2024, driven by strong growth for AI servers and a return to modest growth for traditional servers.

Generative AI workloads require much better performance from all components in a server, including memory chips, than traditional server workloads. Specifically for memory chips, generative AI servers demand much lower power consumption and faster data transfer between the memory and the processor. To satisfy these requirements, Micron is using the latest memory technology. For instance, in my recent article on Applied Materials (AMAT), I briefly discussed a new packaging technology for DRAM chips named high-bandwidth memory (“HBM”). I described HBM in the Applied Materials article as: “[stacking] DRAM dies on top of each other in a 3D structure instead of a 2D structure to stuff more memory into a smaller space.” I didn’t delve into HBM’s server applications in that article, but let’s discuss some benefits for server applications now.

HBM can transfer large volumes of data to the processor much faster than older memory chips based on older 2D packaging technology, allowing an AI to “think” faster. You could have the fastest processor in the world, but the velocity at which the memory can feed the processor information limits the speed at which AI algorithms produce answers.

An HBM chip cuts down the time it takes to train AI algorithms and allows near-real-time AI decision-making, which can be important for applications that require fast answers. HBM chips also enable users to employ sophisticated AI algorithms that may be impossible with standard memory chips. Last, HBM chips use less power, which has become more crucial as data centers grapple with power limitations when running the most advanced AI algorithms. In 2023, Executive Vice President of Global Operations Manish Bhatia discussed at the Deutsche Bank’s 2023 Technology Conference how he believed the company’s latest generation HBM product is far more advanced than anything its competitors have and should become the leading DRAM product in the server market (Emphasis added):

Hynix and — does have a position — strong position relative to the existing solutions for both HBM2E and the first generation of HBM3. Our product is really a leapfrog with HBM3E. The performance is 50% higher than today’s HBM3 solution. And even relative to recent product announcements by competitors, our performance is higher than that. Our power, we believe, will end up being lower than competitive offerings in HBM3E as well 2.5 times lower than previous generation on a power per bit basis. So, we really think our product will be differentiated and will be an industry leadership platform.

Micron just started shipments of its HBM3E product and generated revenue in its fiscal second quarter. The company had the following to say about HBM3E in its second quarter FY 2024 earnings presentation:

We commenced volume production and recognized our first revenue from HBM3E in fiscal Q2 and now have begun high volume shipments of our HBM3E product. Customers continue to give strong feedback that our HBM3E solution has a 30% lower power consumption compared to competitors’ solutions. Our HBM3E product will be a part of Nvidia’s (NVDA) H200 Tensor Core GPUs, and we are making progress on additional platform qualifications with multiple customers. We are on track to generate several hundred million dollars of revenue from HBM in fiscal 2024 and expect HBM revenues to be accretive to our DRAM and overall gross margins starting in the fiscal third quarter. Our HBM is sold out for calendar 2024 and the overwhelming majority of our 2025 supply has already been allocated.

Micron also manufactures data center SSDs for various data center needs. Some chips, like its 9400 NVMe™ SSD, prioritize high performance. On its product webpage, Micron states the use cases for the 9400 NVMe™ SSD as “online transaction processing, high-frequency trading, AI and performance-focused databases requiring extreme performance.” The 9400 may be Micron’s most powerful memory chip.

However, the highest performance is only one of many characteristics customers seek in an SSD. Some applications, like data warehouses and data lakes, require SSDs that can last a long time before failure (endurance). If you are unfamiliar with SSDs, they only have so many write and erase cycles before memory failure. Additionally, a data lake application requires an SSD to store and access massive amounts of data while keeping the costs of running the memory down. The second quarter FY 2024 earnings presentation highlighted Micron’s answer, its 6500 ION NVMe™ SSD. Micron’s management stated in its second quarter FY 2024 earnings presentation (Emphasis added), “During the [second] quarter, we grew our revenue by over 50% QoQ for our 232-layer based 6500 30TBs SSDs, which offer best-in-class performance, reliability, and endurance for AI data lake applications.” AI data lakes are repositories for information that a company may use to train AI algorithms or for advanced analytics.

As management’s above commentary highlights, revenue for this SSD application is brisk, up 50% sequentially. So, Micron’s AI server opportunity extends outside its main DRAM memory products to the NAND memory inside its SSDs.

Micron AI opportunities on PCs and smartphones

One reason Micron has forecasted rising prices for its DRAM and NAND chips in calendar 2024 is that industry analysts predict that the PC and smartphone market will return to growth this year due to an improving economy, an upgrade cycle, and the introduction of AI PCs and smartphones. CEO Sanjay Mehrotra said on the second quarter FY 2024 earnings call:

In PC, after two years of double-digit declines, unit volumes are expected to grow modestly in the low single-digit range for calendar 2024. We are encouraged by the strong ecosystem momentum to develop next-generation AI PCs, which feature high-performance Neural Processing Unit [NPU] chipsets and 40% to 80% more DRAM content versus today’s average PCs. We expect next-generation AI PC units to grow and become a meaningful portion of total PC units in calendar 2025.

Traditional central processing units (CPUs) do not have enough power to handle complex AI workloads. So, the new AI PCs coming down the pike by 2025 will use a specialized processor called an NPU. Next-generation AI computers require more DRAM bandwidth than traditional PCs because NPUs need faster data transfer from the memory to crunch AI data effectively. Micron will also benefit from the smartphone industry returning to growth while AI-capable smartphones begin making an entrance in 2024. CEO Sanjay Mehrotra also commented on smartphones during the second quarter earnings call:

Turning to mobile. Smartphone unit volumes in calendar 2024 remain on track to grow low to mid-single digits. Smartphones offer tremendous potential for personalized AI capabilities that offer greater security and responsiveness when executed on device. Enabling these on-device AI capabilities is driving increased memory and storage capacity needs and increasing demand for new value-add solutions. For example, we expect AI phones to carry 50% to 100% greater DRAM content compared to non-AI flagship phones today.

Micron appears to be at the beginning of a cyclical upswing that should be turbocharged by AI adoption in most of its key marketplaces — an excellent reason to consider buying.

The company’s fundamentals

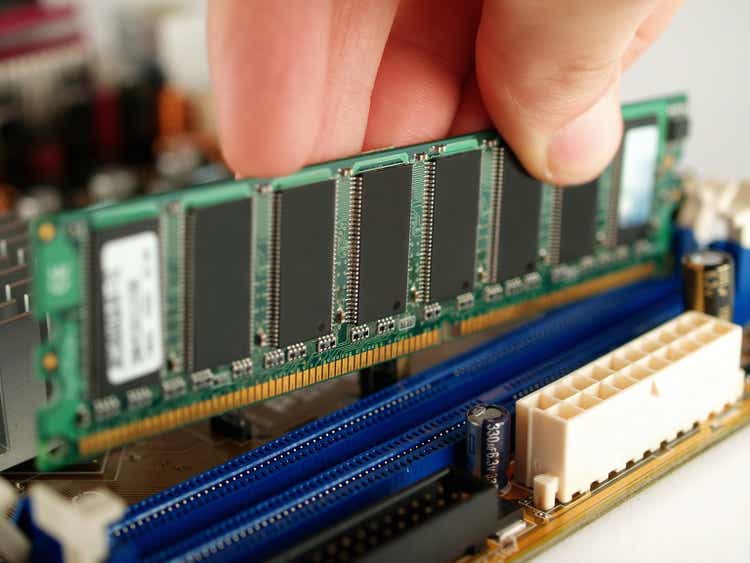

The following chart of Micron’s revenue over the last ten years shows the company’s quarterly revenue and revenue growth cycle up and down approximately every two years.

According to analysts’ quarterly revenue estimates, seen on the chart below, revenue growth should peak in the fourth quarter of FY 2024 at 84.19% and only begin to tail off in the fourth quarter of FY 2026 to reach $10.82 billion. If Micron hits its revenue estimates, it will surpass its highest quarterly revenue of $8.6 billion from the third quarter of 2022 to reach a record $9.16 billion in the third quarter of FY 2025. The likelihood of Micron hitting those revenue estimates is high, as I believe that the DRAM and NAND memory industry segments are beginning its upcycle with an additional boost from secular AI trends.

Seeking Alpha

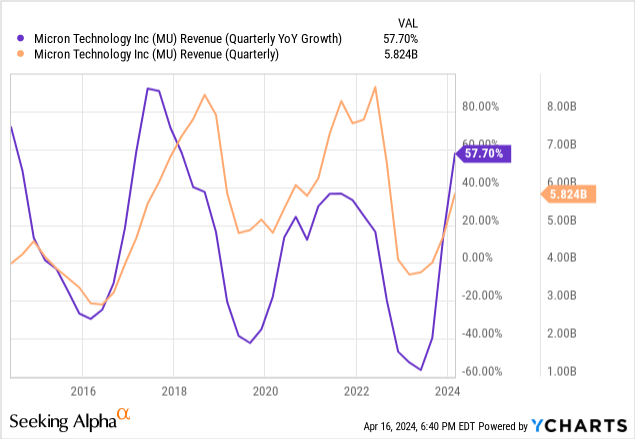

The following slide from its investor presentation shows the average selling price (“ASP”) increased by the high teens sequentially in DRAM and over 30% sequentially in NAND. Investors want to see ASP increase as it helps increase revenue, gross margins, and free cash flow (“FCF”). Additionally, the market is more willing to value Micron higher when ASPs are rising.

Micron Second Quarter FY 2024 Presentation.

Another important metric to follow is bit shipments, which can indicate market demand for a memory product category. DRAM bit shipments increased in the low single digits sequentially in the second quarter, showing that market demand for DRAM bottomed out and is potentially on the rise. On the other hand, NAND bit shipments showed a slight decline sequentially, indicating market demand may be nearing a bottom. It is essential to analyze bit shipments and ASP in conjunction with each other.

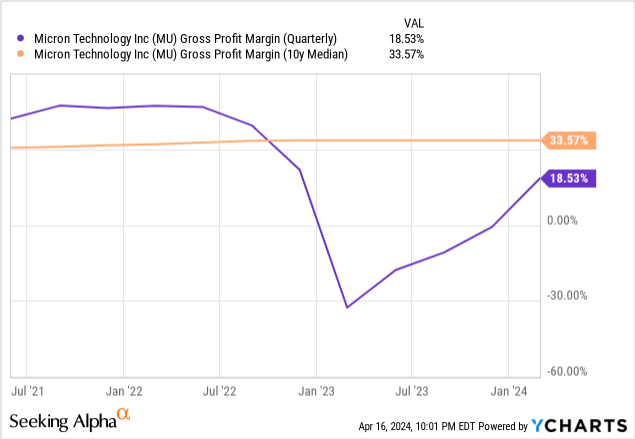

The following chart shows Micron’s quarterly GAAP (generally accepted accounting principles) gross margin rose to 18.53% in the second quarter of FY 2024, below its 10-year median of 33.57% and high of 58.87%. There is plenty of room for gross margins to improve if the company is indeed in an upcycle.

Micron’s management likes to emphasize non-GAAP metrics to highlight the company’s core profitability from memory chip operations by eliminating stock-based compensation, restructure and asset impairments charges, patent cross-license agreement gains, and other one-time costs. On the second quarter earnings call, Chief Financial Officer (“CFO”) Mark Murphy said the following about the company’s non-GAAP gross margins (emphasis added):

The consolidated [non-GAAP] gross margin for fiscal Q2 was 20%, up 19 percentage points sequentially driven by higher pricing [ASPs]. Fiscal Q2 gross margins benefited from $382 million associated with selling the remainder of previously written-down inventories. In the second fiscal quarter, underutilization charges were modest and related to our legacy manufacturing capacity. We expect to sustain these lower levels of underutilization charges moving forward.

The underutilization charges mean that Micron is not operating its manufacturing plants at full capacity. Not utilizing a plant’s full manufacturing capacity is costly, which can negatively impact margins. Ideally, investors want to see bit shipments going up and underutilization charges remain low, among other factors. However, there is a reason why Micron has underutilized its factories in 2023. The company is coming off a period where the industry was in memory chip oversupply, forcing industry players to work off inventory until memory chip pricing expectations were for higher prices. By the company saying that underutilization charges will be lower moving forward, it implies that the industry may soon shift to demand being higher than supply. In that case, the company may quickly ramp up chip manufacturing, and memory pricing may rise in the near to medium future. However, remain aware that future demand and pricing are still uncertain.

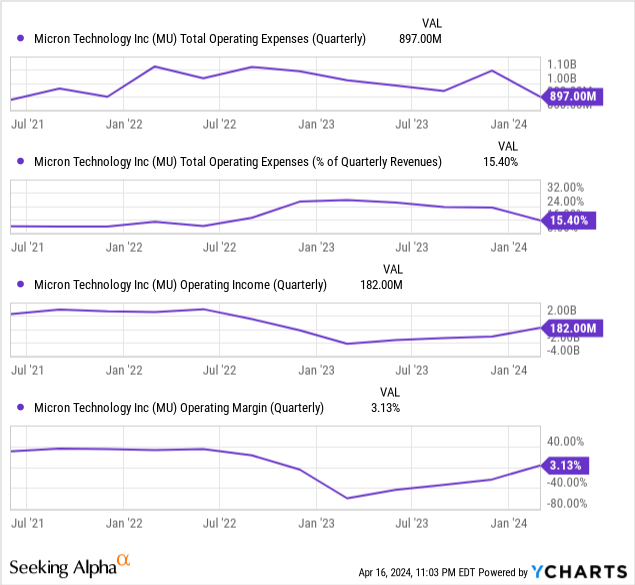

The following charts show that Micron’s GAAP quarterly operating expenses are coming down both on an absolute basis and as a percentage of revenue. As a result, operating margins have turned positive year-over-year to 3.13%. Operating income is $182 million.

CFO Mark Murphy discussed the company’s operating metrics in terms of non-GAAP numbers on Micron’s second-quarter earnings call (emphasis added):

Operating expenses in fiscal Q2 were $959 million, down $33 million quarter-over-quarter and in line with our guidance range. OpEx was modestly above the midpoint of our guidance range, as variable compensation expense was higher on an improved fiscal 2024 outlook. We generated operating income of $204 million in fiscal Q2, resulting in an operating margin of 4% and turning positive a quarter earlier than originally forecasted.

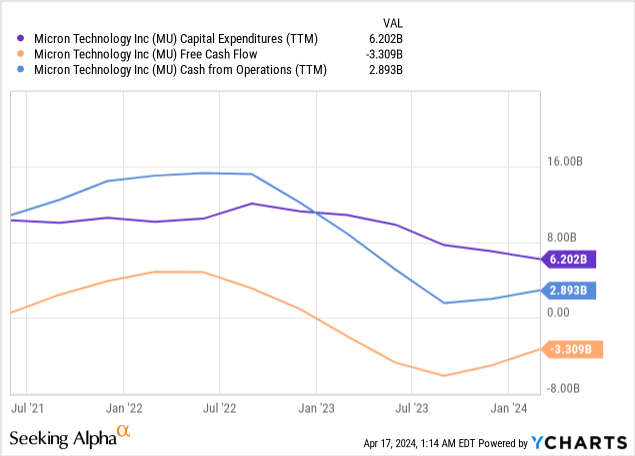

Although the company has turned profitable down to the net income line, it still has negative FCF. Manufacturing chips is a capital-intensive business. The chart below shows the company had $6.20 billion in trailing 12-month (“TTM”) capital expenditures (“CapEx”) as of the fiscal second quarter. At the same time, it only produced $2.89 billion in TTM operating cash flow. The company will continue producing negative FCF until Micron’s operating cash flow rebounds over capital expenditures.

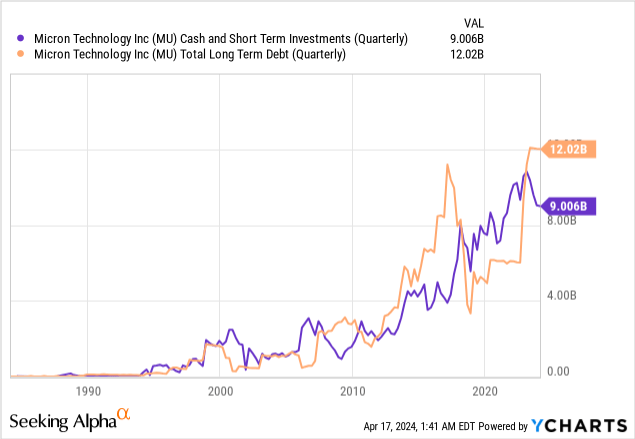

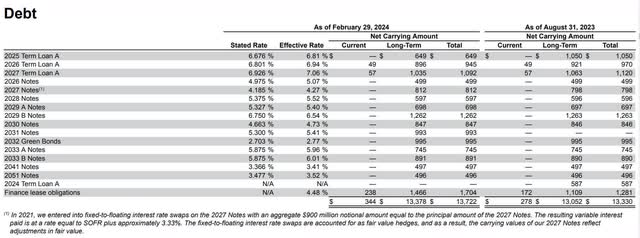

Management forecasts spending between $7.5 and $8.0 billion on CapEx. So, operating cash flow must grow an additional $5 billion before FCF turns positive on a TTM basis. Micron has around $9 billion in cash and short-term investments and around $12 billion in long-term debt — a significant amount of debt. As of January 2024, Fitch rated Micron’s senior notes as BBB with a stable outlook, which is a lower medium investment grade rating. It has a net debt-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) ratio of 1.29. Generally, a number below 3.0 means a company can pay off its debts. The company has a net debt-to-equity ratio of 10.8%, which means Micron has more equity than debt — a good thing.

Although Micron has a great deal of debt, the table below shows that most of that debt is due two or more years out. The extended maturities should provide time for the company to generate FCF for debt repayment. When the company goes into an upcycle, it can push out a substantial amount of FCF over two or three years. For instance, the company produced $3.41 billion, $8.52 billion, and $3.40 billion in annual FCF in 2017, 2018, and 2019, respectively. As long as the memory chip industry goes into an upcycle and the Federal Reserve eventually lowers interest rates (reducing the cost of debt servicing), Micron should be able to pay down this debt.

Micron Second Quarter FY 2024 10-Q

Investors should continue monitoring the company’s debt moving forward. Until now, I have mainly discussed Micron’s ability to pay down its debts if everything goes right. However, a cyclical company with a debt level this high has risks.

Risks

Although the memory market appears to be headed up, there is no guarantee. Micron’s 2023 10-K acknowledges the risk of the memory market remaining in a drought:

In recent periods, average selling prices for our products have been below our manufacturing costs and we may experience such circumstances in the future. Average selling prices for our products that decline faster than our costs have recently had an adverse effect on our business and results of operations, and in future periods could have a material adverse effect on our business, results of operations, or financial condition.

Micron has high fixed costs, and if DRAM and NAND memory prices stagnate or decline, its margins could flatline or rapidly shrink. If the company fails to expand margins and generate FCF over the next several years, the high debt could negatively impact its operations and hurt its financial stability. Micron has more risks than just its debt.

The memory chip industry has several unattractive aspects. It is highly commoditized and intensely competitive. The market largely determines prices for memory chips based on supply and demand. It can be hard for Micron or any of its competitors to develop a technological competitive advantage that lasts much beyond a few years. The cyclical nature of commoditized industries may be unattractive for some investors who seek steady growth. The company is currently trying to claw its way out of a downcycle within the memory industry.

If the normal dynamics of attempting to rebound from the last several years of a downturn were not enough, on May 21, 2023, China’s Cyberspace Administration (“CAC”) told Micron that it was a cybersecurity risk and could not sell memory products to companies that CAC determined were critical information infrastructure operators in China. On June 16, Seeking Alpha published an article that quoted Micron management as saying, “We now believe that approximately half of that China HQ customer revenue, which equates to a low-double-digit percentage of Micron’s worldwide revenue, is now at risk of being impacted.” Micron is unlikely to make up that loss of revenue immediately, and it may slow the company’s recovery from this cyclical downturn.

Valuation

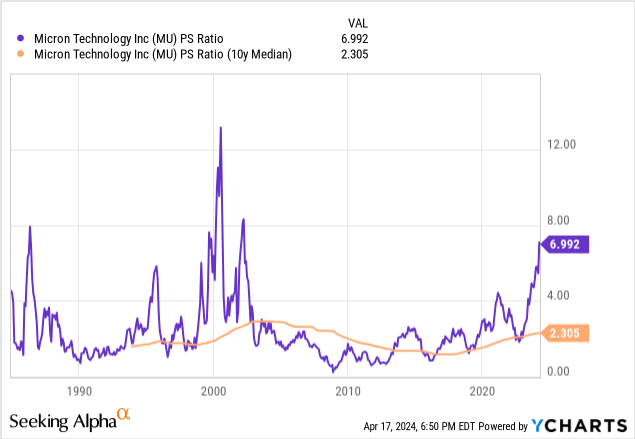

Based on traditional valuation metrics, the stock looks overvalued. Seeking Alpha quant rates the valuation an F. Micron trades at a price-to-sales (P/S) ratio of 6.99, which is well above its median P/S ratio of 2.30 over the last ten years.

However, it would be best to be cautious of using backward-looking TTM ratios to value a cyclical company. Investors sometimes anticipate a cyclical market like semiconductors turning higher and start bidding up the prices of stocks in the industry while TTM numbers may still be depressed. As a result, when a cyclical company is at the bottom of its cycle and has a valuation ratio with a rising numerator and a stagnant denominator, it may look overvalued. A better way to value a stock like Micron is by valuing its potential future performance. Let’s look at Micron’s forward P/S ratio for FY 2025, which ends in August 2025, and compare it to a few other semiconductor manufacturers’ P/S ratios one year out in the table below.

| Companies | Forward (1-year) P/S ratio | Estimated (1-year) revenue growth rate | Net Income (“TTM”) |

| Advanced Micro Devices (AMD) | 7.69 | 25.79% | $854 million |

| Texas Instruments (TXN) | 6.56 | 29.03% | $6.51 billion |

| Qualcomm (QCOM) | 4.41 | 9.24% | $7.76 billion |

| Micron | 3.74 | 40.49% | -$3.76 billion |

| Intel (INTC) | 2.37 | 11.38% | $1.68 billion |

| Western Digital (WDC) | 1.39 | 29.13% | -$2.25 billion |

Data Source: Seeking Alpha

Analysts expect Micron to grow revenue the fastest one year out, but the market values that growth less than AMD, Texas Instruments, and Qualcomm. The likely reason is that Micron has yet to show that it can produce steady profitability after the severe downturn. Investors likely want to see Micron generate several more quarters of growing profitability before bidding up the stock price much further.

Although analysts estimate Micron’s profitability will grow in the potential oncoming upcycle, there is more uncertainty about Micron producing profits a year out than Qualcomm. I believe the stock is appropriately valued at current prices until the market can confirm that Micron is in an upcycle, which may take several more quarters of seeing DRAM and NAND prices rise and factory underutilization trend down.

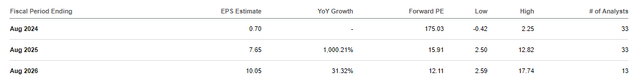

Let’s compare Micron’s forward price-to-earnings (P/E) ratio to its earnings growth rate.

Seeking Alpha

If Micron hits its EPS estimates, the company will produce a 31.32% annual year-over-year EPS growth rate in FY 2026. As of April 17, 2024, its forward FY 2026 P/E was only 12.11. When a company’s forward growth rate exceeds its forward P/E, I often consider that stock undervalued. If investors valued Micron’s FY 2026 P/E at its 2026 forward growth rate, the stock would trade at $301, up 159% over Micron’s April 17, 2024 closing price of $116.33. That stock price may look unrealistic today. However, if the market sees Micron’s DRAM and NAND business hitting all cylinders, investors could potentially drive the stock price that high. Never underestimate investors’ aggressiveness in driving a cyclical stock’s price higher during a cyclical upturn. The key takeaway is that the market may value Micron’s revenue and earnings growth much higher than today a year or two from now if they see the memory market in an upcycle.

Why investors should consider buying the stock

If you are interested in this stock, don’t expect it to immediately jump higher. The stock price could stall and even go lower, if investors’ expectations of an improving DRAM and NAND market fail to show up in Micron’s results. However, suppose you have an investing thesis that includes the Federal Reserve reducing interest rates, the smartphone and the PC market recovering in 2024 and 2025, and AI driving massive growth for Micron, and that thesis plays out favorably. In that case, this company has high potential upside from current prices. Consider putting this company on your buy list and holding it for the next two years. I rate Micron a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.