Summary:

- We have been adding to the stock slowly over the past two years, taking it back to a significant position in the portfolio.

- Many PayPal investors had incorrectly assumed their artificially elevated growth rates during the COVID-19 period would continue for years and were surprised when the normalization occurred.

- What sets PayPal apart is that the total company remained quite profitable as it pursued this aggressive growth in one side of the business.

- We continue to maintain a larger position in PayPal stock in anticipation of this turning point, and we are confident it is coming.

JasonDoiy

The following segment was excerpted from this fund letter.

PayPal (NASDAQ:PYPL)

PayPal has been a long-standing holding for Wedgewood, since 2015. After taking some of our gains around the company’s COVID-19-fueled peak in 2021, we have been adding to the stock slowly over the past two years, taking it back to a significant position in the portfolio.

We would like to update you on our current thinking.

Like most “COVID-19 stocks”, a variety of companies (e.g., Amazon) benefited from artificially high growth rates due to the COVID-19 lockdowns and subsequent stimulus; fundamentals at PayPal saw a normalization as the world returned to normal through 2021-2022. Similar to most of those companies, many PayPal investors had incorrectly assumed their artificially elevated growth rates during the COVID-19 period would continue for years and were surprised when the normalization occurred, leading to a decline in the Company’s admittedly overheated stock. The big difference between PayPal and many of these stocks (e.g., Amazon once again) is that PayPal still has not recovered from this broad normalization period.

When fundamentals at a previously loved company take a negative turn – as happened with many of the COVID-19 stocks when artificially high growth rates were normalized – we generally see investors tend to look past the obvious culprit and do their best to uncover other problems that may be problems at all. In this case, it seemed that a few bears could see the culprit that seemed rather clear to us – namely, the very rational normalization in growth rates after a period of wildly inflated growth. Certainly, we observed this phenomenon around the post-COVID-19 normalization, when not just at PayPal but at almost all the COVID-19 beneficiaries experienced a sharp decline. The impact of this event in the significant downturn in technology stocks as the market adjusts to a new normal.

In PayPal’s case, the winding down of the company’s long-standing relationship with eBay also coincided with this period of normalization, contributing a bit more to the bust side of the boom/bust cycle everyone else was experiencing. The eBay situation had been coming for years, as anyone paying attention should have known – still, the timing of the final closure of the compounded the already negative PayPal stock sentiment.

Investors then began to propose a variety of additional theories about what was going wrong. Many of these theories can be categorized under the broad heading of “share loss,” where a variety of smaller payment platforms, digital wallets, ancillary service offerings all were (and still are) considered existential threats to PayPal.

Before the Federal Reserve’s significant rate hiking program, the Buy Now Pay Later (BNPL) providers were one of the theoretical issues for PayPal, for example. Setting aside the questionable business case of borrowing money in order to lend it to consumers at zero percent – a business case that became even more questionable as the cost of borrowing rose significantly – there was plenty of noise around PayPal losing share to BNPL providers, because investors could see outsized growth rates from those providers, whereas PayPal’s growth rates were relatively lower. Obviously, smaller companies with mathematically have an easier time showing faster growth rates than larger companies due to growing from a lower base. More to the point, this also doesn’t mean the large companies have necessarily “lost share” in the industry, if they continue to grow along with the broad industry.

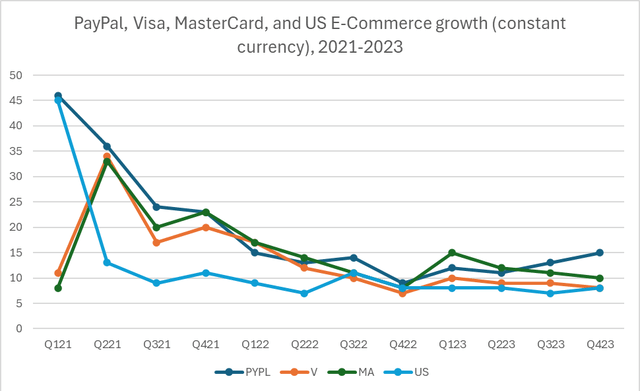

To track broad industry growth for PayPal, we follow the Company’s total payment volume (TPV) growth in relation to Visa, MasterCard and broad U.S. e-commerce growth, among other things. As you can see in the chart below, PayPal routinely tracks at or near the top end of these broad industry trends, so arguments regarding share loss is puzzling to us.

Source: Company reports, U.S. Census Bureau

We need to emphasize too that one of the primary drivers of the investment case here is the payments market is still growing strong, and a large market growing at such rates has room for more than several players to succeed. A smaller player growing at a higher growth rate than PayPal means neither that PayPal is neither losing share, nor that PayPal is unable to continue as a successful business.

Another component of the negative sentiment around the Company was uncertainty around the leadership of the Company. Long-time CEO Dan Schulman and CFO John Rainey both announced their retirements during the post-COVID-19 deceleration period. The Company spent a significant amount of time finding their respective replacements. Further confusing matters, some investors (including us) had been fans of the company’s management team and hoped the Company would name replacements who would continue the long-time strategy of growing profitably; others hoped to see more growth-oriented leadership (or, in our thinking, growth that does generate much bottom-line profitability, common enough in large-cap tech). The Company named a CFO replacement, Blake Jorgensen, who had medical issues and had to leave almost immediately after his arrival. Subsequently, the Company has appointed replacements for both major roles. Alex Chriss joined as CEO from Intuit toward the end of 2023 and Jamie Miller joined as CFO from Ernst & Young shortly afterward. Although it is obviously early in this new leadership team’s tenure, everything we have been hearing from them leads us to believe they will continue the company’s successful long-term strategy of building lasting profitable growth.

Although the negative commentary around the company has wandered from topic to topic, perhaps the most recent commentary has been some concern around the import of Company’s declining profitability within their merchant services. We also agree this is one of the issues raised by the broad market on PayPal’s current fundamentals that matters most. It definitely is true that the Company’s margin on transactions has been declining over the past few years as it aggressively expanded its Braintree service, a payment platform for merchants that can accept almost all major forms of digital payments. While Braintree is unlikely ever to be more profitable than the company’s flagship PayPal button on a transaction margin basis, its profitability has been artificially low while the company has expanded significantly, with the company sacrificing pricing to build a large beachhead of share in this service.

Notionally, we are not fans of companies sacrificing margins to grow; however, what sets PayPal apart is that the total company remained quite profitable as it pursued this aggressive growth in one side of the business. We also would note that Venmo is another growing service that is less profitable than the core PayPal branded business, and the market absolutely loved Venmo not so long ago.

We would be much more concerned with the Braintree growth, and its impact on total company profitability, if we expected the current growth rates and margins to continue into the many years ahead. However, the company has made it clear that it is at or near the end of the initial beachhead phase of its Braintree strategy. New CEO Alex Chriss has been addressing this topic specifically, saying they now have a solid position in the industry, they will be taking more normalized pricing, and they also will be expanding a variety of higher-margin ancillary services they can now roll out to their established customer base. We believe this will lead to improving transaction margins in the next several quarters and will begin to remove this particular concern for the market.

Overall, the overwhelmingly negative sentiment in the stock of late, has given us the opportunity to reload our position in the stock. We continue looking at the fundamentals: for example, the company reported +23% earnings per share growth and +13% TPV growth for 2023, growing at or near the top end of the digital payments market. Perhaps the crisis embedded in PayPal’s current stock valuation is not so dire. Because the market ultimately acts as a brutal weighing-machine, thus we are strong believers that reality does win eventually, and the reality of the Company’s improving fundamentals will eventually be reflected in a more appropriate higher stock valuation.

We will admit we were a bit taken aback when the company provided its initial outlook for flat 2024 earnings per share growth versus 2023, announced on its fourth quarter earnings report in early February. It was difficult for us to see what would cause such a slowdown in the Company’s growth rates while the Company was talking about initiatives to improve profitability – especially in the Braintree business.

So, while the market beat the stock up again, our impression is that this guidance was quite conservative. Not surprising, in the couple of months since the Company provided this initial guidance, the management team has been presenting at investor conferences, acknowledging their conservativism. Trends within the business have remained steady in relation to the healthy 2023 trends. The Company continues to implement improved margin plans at Braintree and to push innovations that will be helpful to Braintree’s platform of consumer, small business payors, and merchants. The Company is also cutting headcount by +9%, and management will buy back at least as much stock as it did last year, representing another -8% reduction in share count. All of which we expect to be supportive of notably better results than management’s initial 2024 guidance.

It is our experience these “wandering bear thesis” stories tend to come to an end at a point that is often difficult to predict. Shorter-term investors tend to move in a herd, meaning a stock can move meaningfully in a short time once the tide turns – that is, as both financial expectations and the multiple the market applies to those expectations rise simultaneously.

We would highlight similar enough dynamics that played out at Meta Platforms, which has been one of our largest holdings for some time. Meta Platforms was a significant COVID-19 beneficiary; the boost to its e-commerce customers led to significant advertising growth rates for the company. With hindsight clarity, they too saw the broad normalization that most everyone else experienced. However, it is important to recall at the same time the normalization was happening, the Company was dealing with a few additional issues – most importantly, changes Apple had made to make it more difficult for the Company to target ads to Apple hardware users, plus seemingly out of control out-sized billion-dollar capex spending. Just as we are seeing with PayPal now, as Meta Platforms investors started looking past these concerning issues, valuation improved noticeably from very low levels. In the fullness of time, the tide turned in sentiment of a secular fundamental turn because the company made some good choices on expense control and capital allocation. The result was rapid and significant move in the stock as reported earnings continue to rebound sharply.

Per our three-decade playbook, it is important to have significant positions in these types of situations before the turning point arrives. While we are certainly not forecasting a similarly-sized move in PayPal stock as in the booming stock of Meta Platforms, we continue to maintain a larger position in PayPal stock in anticipation of this turning point, and we are confident it is coming.

|

The information and statistical data contained herein have been obtained from sources, which we believe to be reliable, but in no way are warranted by us to accuracy or completeness. We do not undertake to advise you as to any change in figures or our views. This is not a solicitation of any order to buy or sell. We, our affiliates and any officer, director or stockholder or any member of their families, may have a position in and may from time to time purchase or sell any of the above mentioned or related securities. Past results are no guarantee of future results. This report includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions or forecasts will prove to be correct. These comments may also include the expression of opinions that are speculative in nature and should not be relied on as statements of fact. Wedgewood Partners is committed to communicating with our investment partners as candidly as possible because we believe our investors benefit from understanding our investment philosophy, investment process, stock selection methodology and investor temperament. Our views and opinions include “forward-looking statements” which may or may not be accurate over the long term. Forward-looking statements can be identified by words like “believe,” “think,” “expect,” “anticipate,” or similar expressions. You should not place undue reliance on forward-looking statements, which are current as of the date of this report. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. While we believe we have a reasonable basis for our appraisals and we have confidence in our opinions, actual results may differ materially from those we anticipate. The information provided in this material should not be considered a recommendation to buy, sell or hold any particular security. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.