Summary:

- Netflix shares sank after its Q1 earnings release, driven by its decision to stop reporting subscriber counts starting in FY25.

- Though most investors are reading this as a reduction in transparency and potential cover for sub weakness, I think the move will help reduce Netflix earnings volatility going forward.

- Netflix added 9.3 million subscribers in Q1, with 2.5 million coming from the U.S. and Canada.

- Revenue is expected to continue accelerating in Q2, driven by a favorable response to pricing increases and a strong content slate.

Onfokus/iStock Unreleased via Getty Images

Some stocks are destined for volatility with each and every earnings release. That is certainly the case for Netflix, Inc. (NASDAQ:NFLX), which sees outsized swings in both the positive and negative directions every quarter. Even if it weren’t for today’s overly volatile macro environment, Netflix would still be swinging wildly on subscriber additions data versus expectations.

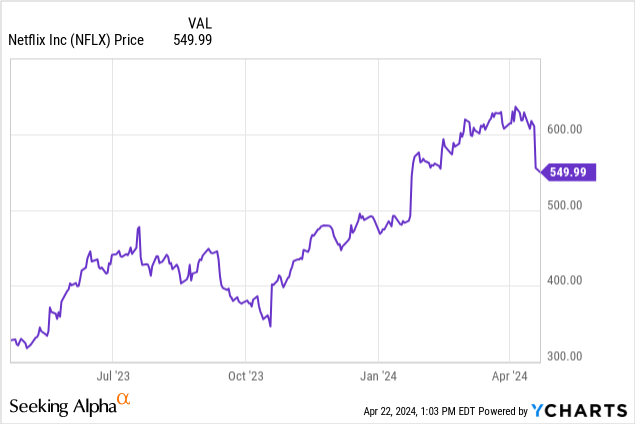

Netflix has fallen about 10% since reporting Q1 results, though the stock is still up nearly 20% on the year:

Elimination of subscriber reporting may be a good thing

I last wrote a bullish note on Netflix in February, touting the company’s earnings growth and a reasonable valuation that didn’t fully appreciate the company’s recent tailwinds from strong net subscriber adds, advertising opportunities and pricing increases.

Since then, the major news item that came alongside Netflix’s Q1 earnings report was the company’s decision to stop subscriber reporting. Many investors took this sign of lower transparency as a forward-looking indication that Netflix won’t have good things to report on subscriber counts anymore.

Yet, I view it as the opposite. Subscriber data is notoriously fickle. We’ve unfortunately entered into a streaming era where subscribers switch constantly between which streaming services they are active on, and that’s usually dependent on the content slate. Furthermore, with price increases and diversification of plans (with more subscribers mixing into higher-ARPU family plans), as well as the addition of advertising-supported plans, Netflix has made the decision (which I concur with) that subscriber adds just aren’t a perfect measure of the underlying business anymore.

The company will continue to report subscriber adds through FY24, but will stop reporting the metric next year in Q1’25. Writing on the decision in the Q1 shareholder letter, management wrote as follows:

We are also developing new revenue streams like advertising and our extra member feature, so memberships are just one component of our growth. In addition, as we’ve evolved our pricing and plans from a single to multiple tiers with different price points depending on the country, each incremental paid membership has a very different business impact. It’s why we stopped providing quarterly paid membership guidance in 2023 and, starting next year with our Q1’25 earnings, we will stop reporting quarterly membership numbers and ARM.

We’ll continue to provide a breakout of revenue by region each quarter and the F/X impact to complement our financials. For guidance, we’ll add annual revenue guidance on top of what we already provide today: our annual operating margin and free cash flow forecast and forecasts for quarterly revenue, operating income, net income, and EPS. We’ll also announce major subscriber milestones as we cross them.”

In my view, this decision actually removes major quarterly lumpiness that can add too much volatility to Netflix post-earnings and distract from real underlying earnings. Rest assured, however, that subscriber stats still held up well through Q1:

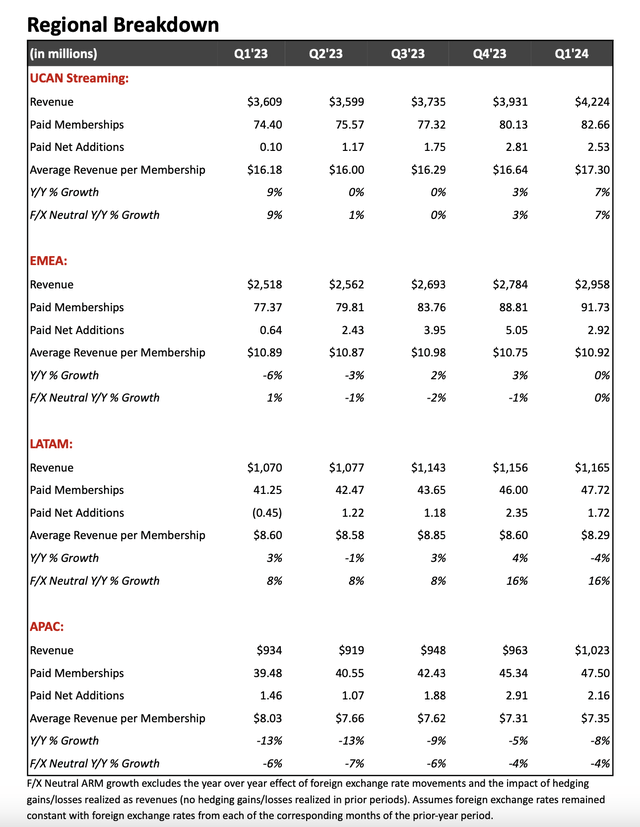

Netflix subscriber breakdown (Netflix Q1 shareholder letter)

The company added 9.3 million total subscribers (ending Q1 with a base of 269.6 million subs, up 16% y/y), versus just 1.7 million in net adds in Q1 of last year. Yet in particular, as shown above, the best news is that 2.5 million of these adds came in the U.S. and Canada, the region with the highest average revenue per sub.

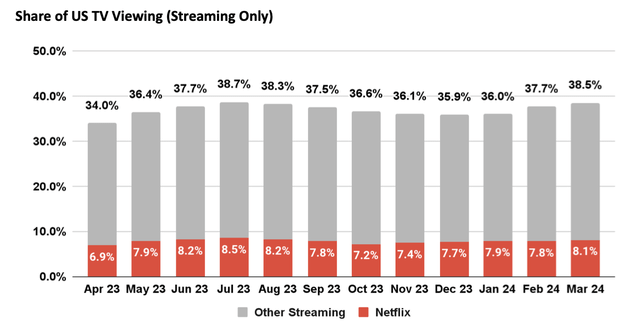

We like as well that Netflix’s share of all U.S. TV viewing has been steadily increasing since September 2023, indicating that the competitive landscape has, at worse, stabilized with Netflix gaining a tiny portion of incremental share:

Netflix share (Netflix Q1 shareholder letter)

All in all, I remain bullish here. Take the post-earnings dip as an opportunity to buy.

Q1 download

When we tune out the subscriber noise, we find that Netflix performed tremendously well in Q1:

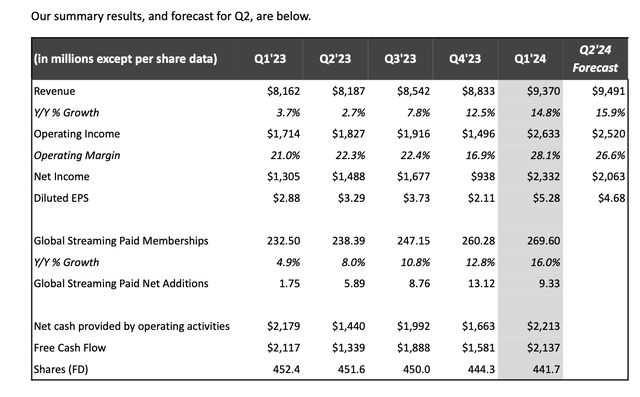

Netflix Q1 results (Netflix Q1 shareholder letter)

Revenue grew 14.8% y/y to $9.37 billion, well ahead of Wall Street’s expectations of $9.28 billion (+13.6% y/y). Revenue growth also accelerated 230 bps versus 12.5% growth in Q4 and has been accelerating for three straight quarters now. Management further expects revenue growth to accelerate one more point to 15.9% y/y growth in Q2.

This is a net impact of the company’s recent string of price increases coupled with steady subscriber gains/low churn – again emphasizing why revenue growth, and not subscriber growth alone, is the more important part of the holistic Netflix story to focus on.

And despite the strong performance in the back half of FY23 that will be difficult to beat, the company is still projecting double-digit growth for the entirety of FY24. Per CFO Spence Neumann’s remarks on the Q1 earnings call:

So our growth in the back half of ’24 is really kind of comping off of those harder comps. And at the high end of our revenue forecast, our growth in the second half is consistent with our growth in the first half, even with those tougher comps. And it’s still early in the year. We still got a lot to execute against. We also, as you see in our letter, there’s been some FX that with the strengthening dollar, that’s a bit of a headwind. So we’ll see where that goes throughout the year.

But we’re guiding a healthy double-digit revenue growth for the full year, which is what we set out to deliver and that’s what’s reflected in the range. And I guess maybe it’s in the question, I guess, seeded and this is a little bit of like what’s really kind of the outlook for our growth of the business, not just the back half of this year, but into ’25. And it’s too early to provide real – specific guidance, but we’re going to work hard to sustain healthy double-digit revenue growth for our business.

And we really like the kind of opportunity ahead of us. We’re so small in every aspect. We’re only 6% roughly of our revenue opportunity. We’re lesser than 10% of TV share in every country in which we operate. There’s still hundreds of millions of homes that are not Netflix members and we’re just getting started on advertising.”

Operating margins, meanwhile, soared to 710 bps y/y. This was driven by both incremental revenue from price increases as well as the timing of content spending. This helped drive pro forma EPS to $5.28, with an astounding 83% y/y earnings growth, while also beating Wall Street’s expectations of $4.54 with a 16% upside.

Key takeaways

In my view, Netflix’s surprising news of ending subscriber reporting unfairly overshadowed a very good Q1 release that featured strong revenue and subscriber growth. Meanwhile, at current post-earnings share prices near $550, the stock trades at a reasonable ~27x forward P/E (based on FY25 consensus EPS estimates of $20.54). Given that Q2 earnings growth is still projected at 40%+, I’d say Netflix still has plenty of upside. Stay long here and buy the dip.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.