Summary:

- Microsoft Corporation surpassed Apple as the most valuable company by market cap, with a 57% increase in market value in 2023.

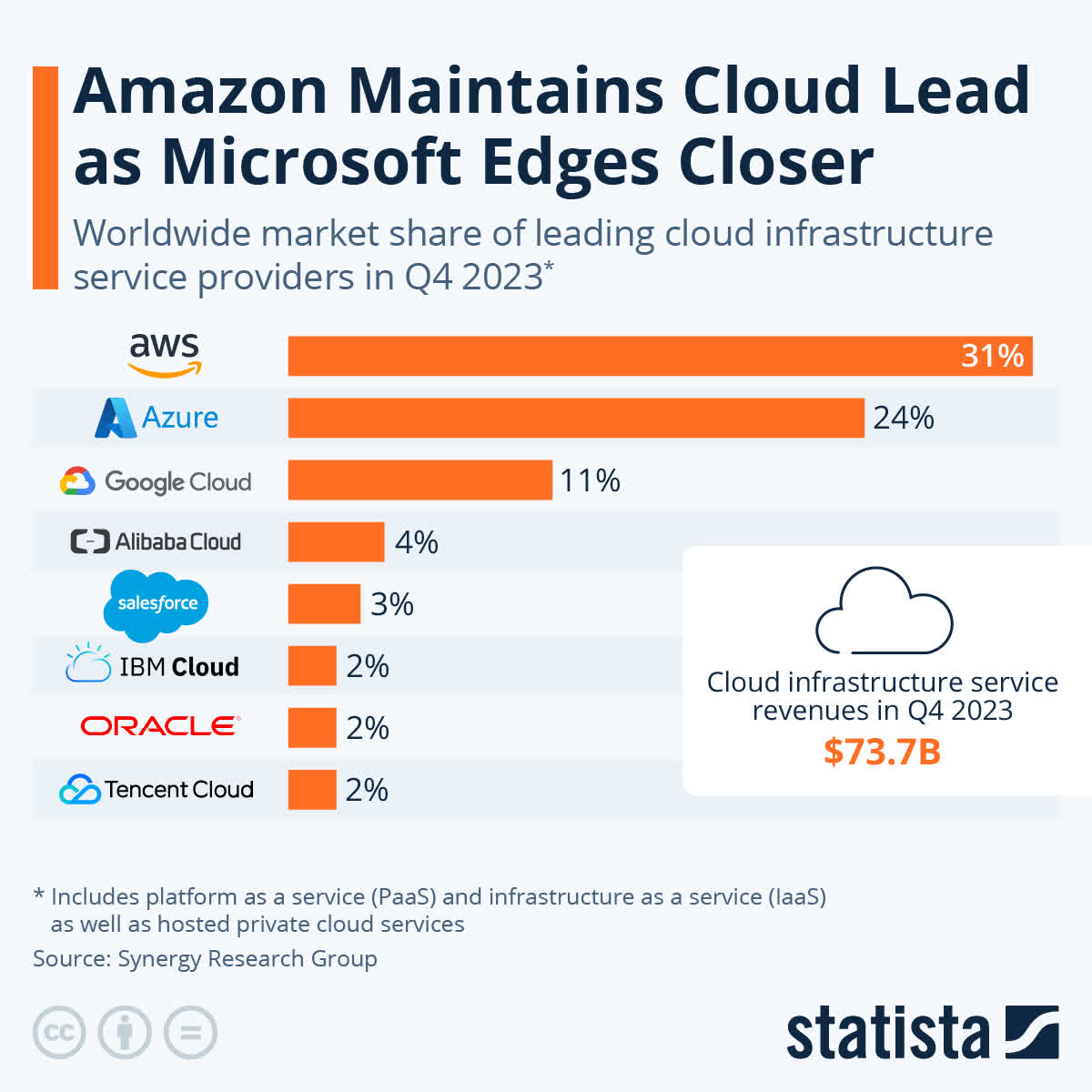

- The company is making strides in the cloud computing market, ranking second behind AWS.

- Microsoft’s investments in AI, including a $13 billion investment in OpenAI, position it to compete with Google and enhance its core business.

- Activision Blizzard’s acquisition strengthens Microsoft’s gaming empire in pursuit of market share in mobile gaming.

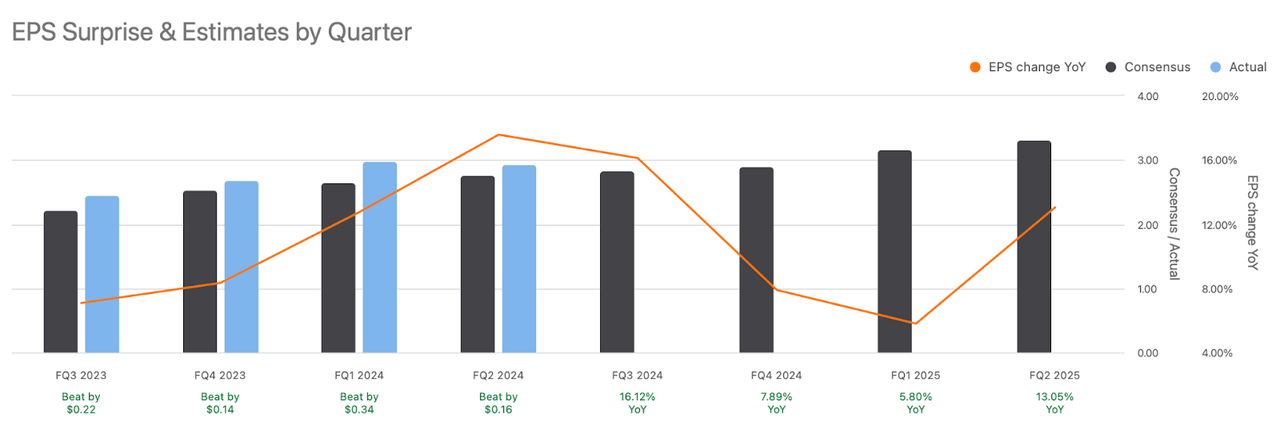

- Microsoft’s upcoming Q3 earnings are projected at $60.87 billion with an EPS of $2.84, focusing on AI and cloud growth amidst challenges in the PC and Office sectors.

Jean-Luc Ichard

Investment Thesis

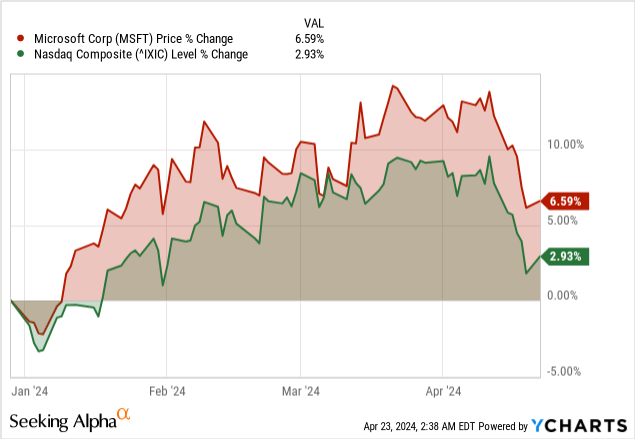

Microsoft Corporation (NASDAQ:MSFT) completed an impressive 2023, achieving a 57% increase in market value, which exceeded Apple (AAPL) as the most valuable company by market cap. This significant milestone aligns well with Microsoft’s long-standing influence in the computing sector. Its Windows operating system has been a cornerstone technology for decades and is now installed on nearly two-thirds of computers worldwide.

The software giant has made a mark in almost all significant transitions from the dot-com era in the information technology sphere. Its dominance in computer operating systems has been the primary catalyst for expanding its influence into almost all facets of the software world around the globe. Likewise, having made a mark with Windows and other Office software, the company is also making a name for itself in the multi-billion cloud computing arena.

Besides being the second most important cloud computing player in the market, it is flexing its muscles in the multibillion-dollar gaming industry with the Xbox video game system. Growth pursued on Windows, cloud infrastructure, and gaming is why the company is immensely profitable and one of the most coveted stocks in the tech space.

Finally, Microsoft is entering the AI race, having pledged over $13 billion in an investment in the parent company of ChatGPT, OpenAI. With that investment, the company has a front-row seat on some of the biggest innovations around AI that are likely to incredibly shape its core business, which has been lagging Alphabet’s Google for years.

Moreover, its aggressive acquisition strategy has allowed Microsoft to spread and strengthen its footprint into some of the fastest-growing markets and segments. As a result, in 2023, the stock was up more than 60%, outperforming the 25% gain of the S&P 500 (SP500).

Microsoft Robust Revenue Growth

Steady financial results, fuelled by the AI frenzy, have been one of the main catalysts behind Microsoft stock’s impressive run over the past year. The software giant has delivered better-than-expected results, signaling growth in its key business segments.

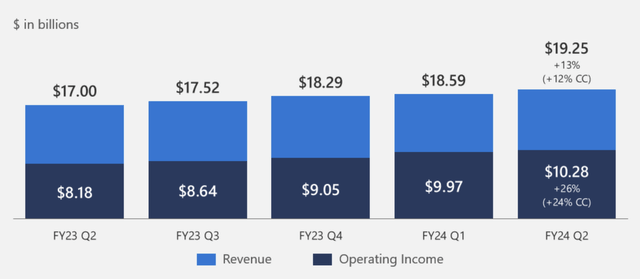

For its fiscal second quarter, which ended December 31, 2023, Microsoft delivered a 17.6% year-over-year (YoY) revenue increase of $2 billion. The increase came as the company posted a 13% increase in Productivity and Business Processes revenues at $19.2 billion, driven by Office 365 Commercial revenue growth of 17%. The segment’s office consumer products and cloud service revenue also increased by 5%, while LinkedIn revenue increased by 9%.

Additionally, revenue in Microsoft’s Intelligent Cloud unit was up 20% YoY to $25.9 billion, attributed to a 22% increase in server products and cloud services revenue. Similarly, Azure and other cloud services revenue were up 30%.

Chart showing Intelligent cloud segment revenue growth (Microsoft)

Moreover, the gross margin in the Intelligent Cloud unit was up by 20% in the quarter, driven by improvements in Azure as operating expenses decreased by 8% and operating income grew by 40%.

On the other hand, revenue in the Personal Computing segment, which includes Windows devices, Xbox content, and services, was up by 19% to $16.9 billion. The increase was driven mainly by a 615 rise in Xbox content and services revenue, as Windows commercial and cloud services revenue increased by 9%.

Finally, gross margin in the Personal Computing segment grew by 34%, attributed to the net impact of the Activision Blizzard acquisition, as operating income also increased by 29%. Amid the robust revenue increase in the three business segments, Microsoft delivered a 33% increase in operating income, totaling $27 billion. Thus, net income increased 33% to $21.9 billion, translating to diluted earnings per share of $2.93.

What To Expect in Q3

Microsoft is set to report fiscal Q3 FY 2024 financial earnings post-close this Thursday, April 25th. Analysts are looking for a small step back in sales to $60.87 billion after last quarter’s $62.02 billion. This, of course, would still represent a 19% YoY gain. EPS is set to rise to $2.84 from the prior quarter’s $2.93, a large 27% YoY jump.

Key Areas of Focus:

- Cloud Segment: The company’s Intelligent Cloud business has been a robust growth driver. According to company guidelines, revenues from this segment are expected to rise by $26- $26.3 billion for the third quarter. Azure, Microsoft’s cloud platform, would lead this surge, with CFRA analysts expecting a 29% uptick, of which six to eight percentage points will be tied to the AI channel.

- AI Developments: The AI section will probably be under the spotlight in the next report. Even more noteworthy will be Microsoft’s strategic partnership with OpenAI and the deployment of AI technologies such as ChatGPT across its ecosystem. The analysts also expect a large contribution to the revenue profile from AI, which, according to them, can be meaningful for the market standing and growth in the next five years.

- Challenges: Soft segments remain devices and Office commercial products, which have declined due to reduced PC market demand. These are expected to continue underperforming, with the estimates pointing at a low double-digit revenue reduction for Q3.

Microsoft AI Boost on Search and Cloud

The company’s better-than-expected earnings results in recent quarters reflect it’s emerging as a winner in the AI race. Following its multi-billion investment in ChatGPT developer OpenAI, the company expects the revolutionary technology to be a key driver of its future growth.

The integration of natural language capabilities from OpenAI early last year was the most unambiguous indication that Microsoft was ready to take on Google search through generative AI. With the integration, the company can now offer better search, more complete answers, and a new chat experience as it looks to take on Google search on user experience.

By leveraging generative AI capabilities, Microsoft hopes to answer more complex questions and solve tasks in the internet search business. Additionally, Bing search allows people to write emails, create travel itineraries, and easily create quizzes through the search engine interface.

Microsoft has also made it easy for people to look for information like sports scores and stock process recipes on the search engine homepage. Feeling threatened, Google responded by launching its chatbot, Bard, and integrating it into the race to enhance its Google search tool further.

With AI poised to change how people search for information online, Microsoft has a chance to take on Google, which has dominated the search business for years with a market share of more than 90%. In addition to strengthening Microsoft’s edge in the search business, AI is also strengthening the company’s cloud computing solutions. Thanks to this technology, Azure can now handle all sorts of cloud computing duties with one version of the software built for AI applications.

The company has been adding graphics processing units to its data centers, allowing clients to run all AI models on Azure. Thanks to the integrations, Microsoft now has 53,000 Azure AI clients. One reason cloud infrastructure accounts for 29% of the company’s total revenue is the growing number of AI clients.

Microsoft registered a 33% increase in cloud services revenue in its fiscal second quarter, primarily due to AI-enhanced Azure, enabling businesses to harness big data’s power. Tools like Azure Machine Learning and Azure Cognitive Services allow organizations to analyze vast amounts of data quickly.

Similarly, AI Azure capabilities enable organizations to automate repetitive tasks, streamline workflows, and optimize resource utilization. The tools are also being used to create enterprise-specific AI chat applications, attracting interest from big clients such as Heineken, printer maker Lexmark, and AT&T.

While Amazon’s (AMZN) AWS remains the most dominant cloud provider, Microsoft is slowly closing the gap thanks to its artificial intelligence capabilities. While the company does not disclose revenue figures for its cloud infrastructure, analysts believe they are about three-quarters the size of Amazon from half five years ago.

Finally, in the most recent earnings call, CFO Amy Hood reiterated that 6% of revenue growth in the Azure and cloud services division came from AI. This means that revenue in Azure increased by 30% in the quarter, compared to 13% for AWS. Microsoft remains the second-largest player in the multi-billion cloud computing market, with a 24% market share, behind AWS, which has a 31% market share.

Chart showing cloud infrastructure market share (Statista)

Microsoft Burgeoning Gaming Opportunity

While the focus has been on AI and its impact on Microsoft’s core business, gaming is also emerging as an essential aspect of the business, poised to generate significant long-term value. Following the acquisition of video game publisher Activision Blizzard for $69 billion, Microsoft has beefed up its gaming operations by gaining access to known titles like Call of Duty.

With Activision Blizzard in play, Microsoft can now add new titles to Xbox, therefore pursuing more share in the mobile gaming space and driving more subscribers into purchasing Xbox subscriptions and Game Pass. Therefore, Activision Blizzard is already significantly impacting Xbox business revenue, having jumped by 61% in the second quarter, with 55% of the growth from the game publisher.

AI-Driven Growth Poised to Unlock 31% Upside

After rallying by more than 42% over the past 12 months, Microsoft stock is trading 34 times forward earnings. Given how AI accelerates growth in the core business, the company has what it takes to command a premium earnings multiple. If Microsoft were to trade at 35 times forward earnings over the next three years and generate close to $15 a share, its stock could trade at about ~$525 a share.

Additionally, Microsoft has proven its ability to return value to shareholders, which explains why it might command a high valuation in the future. For instance, in the second quarter ended December 31, 2023, the company returned $8.4 billion to shareholders, with $2.8 billion on share buybacks and $5.6 billion through dividends.

Bottom Line

Microsoft has been among the most valuable companies for years owing to its massive empire around software, gaming, and devices. The company has also been enormously profitable in offering some of the most sought-after products and solutions leveraged by enterprises and regular customers. Having made a name as a software giant with Windows OS, the company is already strengthening its edge in cloud infrastructure and gaming.

Likewise, it is one of the companies spearheading the artificial intelligence race as it continues integrating various tools to enhance its search tool and cloud solutions. The robust revenue growth that has come into play despite the stiff competition in multiple sectors underlines the company’s edge and ability to generate value. While the stock trades at 34 times forward earnings, it looks undervalued owing to its solid underlying fundamentals and massive AI opportunity. Microsoft is a solid long-term play for any investor eyeing exposure to the burgeoning AI landscape of cloud computing and gaming.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.