Nvidia Has Rarely Been Cheaper, Long-Term AI Trend Remains Robust

Summary:

- NVDA has rallied by another +92% to its peak, well outperforming the wider market at +10%, before the recent pullback as we enter the uncertain Q1’24 earnings season.

- Despite so, investors may still add NVDA after this drastic pullback, with it likely to be well-supported at $620s as the market digests peak AI hype and prolonged inflationary pain.

- The sell-off has been overly done, since TSM continues to report growing HPC revenue share while guiding AI processors to be the largest growth contributor over the next few years.

- NVDA’s CUDA platform remains the clear differentiator for most developers/ programmers, with a migration to competitors being more time-consuming and requiring additional developer intervention.

- Combined with the accelerating R&D expenses and growing generative AI market share, we believe that NVDA remains a Buy at every dip, especially when the market is most bearish.

We Are

We previously covered Nvidia Corporation (NASDAQ:NVDA) in December 2023, discussing why we had raised our long-term price target for the stock, thanks to its profitable growth trend, (likely to be) lifted trade restrictions to China, and raised consensus forward estimates over the next few years.

Combined with Fed Chair Powell’s dovish stance in the FOMC meeting and the increased likelihood of a pivot in 2024, we believed that the lifted market sentiments might contribute to the accelerated corporate demand for generative AI services, and consequently, NVDA’s growing AI chip sales/ market share.

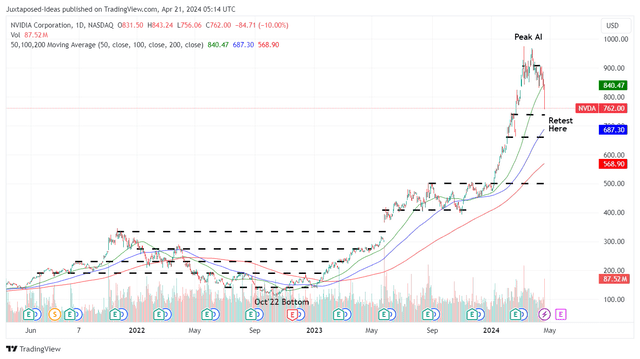

Since then, NVDA has rallied by another +92% to its peak, well outperforming the wider market at +10% over the same time period, before the recent pullback as we enter the uncertain Q1’24 earnings season.

Despite so, we shall discuss why investors may still add NVDA after this drastic pullback, with the stock likely to be well supported at its previous trading levels of $620s as the market digests the peak AI hype and prolonged inflationary pain.

With the management still guiding excellent FQ1’25 guidance and the market trend pointing to durable long-term generative AI demand, we believe that NVDA remains well poised to retain its AI market leadership.

The NVDA Investment Thesis Looks Even More Attractive After The Recent Pullback

NVDA 3Y Stock Price

With NVDA already pulling back by -19.7% since the recent peak, it remains to be seen where the next floor may be, with the company only set to report its next earnings call by May 22, 2024.

Part of the pessimism may be attributed to Taiwan Semiconductor Manufacturing Company Limited’s (TSM) cautious commentary/ lowered forecast for the “overall semiconductor market growth in 2024.”

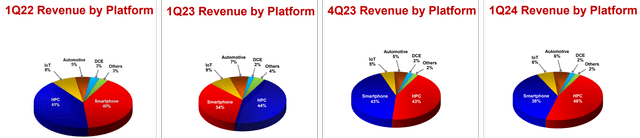

TSM’s Revenues By Platform

However, we believe that the sell-off has been overly done, since most of the headwinds are attributed to the elongated smartphone replacement cycle and demand destruction observed in the automotive/ EV market as borrowing costs remain elevated.

As TSM continues to report growing revenue share for HPC at 46% in Q1’24 (+3 points QoQ/ +2 YoY), it is apparent that generative AI demand remains more than healthy, as similarly highlighted by the foundry’s CEO in the latest earnings call:

We expect several AI processors to be the strongest driver of our HPC platform growth and the largest contributor in terms of our overall incremental revenue growth in the next several years. (Seeking Alpha)

The same has been highlighted by the NVDA management, based on the FQ1’25 revenue guidance of $24B (+8.5% QoQ/ +233.7% YoY) and adj gross margins of 77% (+0.3 points QoQ/ +10.2 YoY) at the midpoint, well exceeding the consensus revenue estimates of $22.03B (inline QoQ/ +206.3% YoY).

The expanding gross margins are not surprising indeed, given that NVDA’s chips are clearly more expensive than its competitors, nearly four times of Advanced Micro Devices’ (AMD) MI300x and Intel’s (INTC) newly launched Gaudi 3 (price unspecified).

However, we believe that NVDA may very well be the clear winner for many years to come, with the AI chips market also being big enough to accommodate multiple players.

This is attributed to NVDA’s CUDA platform being the clear differentiator for most developers/ programmers, where AI workloads typically run more efficiently instead of those offered by AMD’s OpenCL/ ROCm, with a migration to the latter being more time-consuming and requiring additional developer intervention.

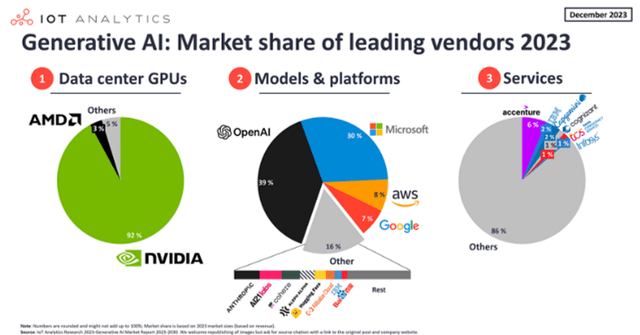

NVDA’s Generative AI Dominance

With NVDA already commanding 92% of the generative AI chips market by December 2023, it appears it may also command the lion’s share in the AI parallel computing platform and programming model thus far, further aided by OpenAI’s LLM training on its GPUs.

Therefore, while there may be numerous reports of chip competition from the Big-Tech peers and a new consortium between Qualcomm (QCOM), INTC, and Google (GOOG) (GOOGL), we are not overly concerned indeed.

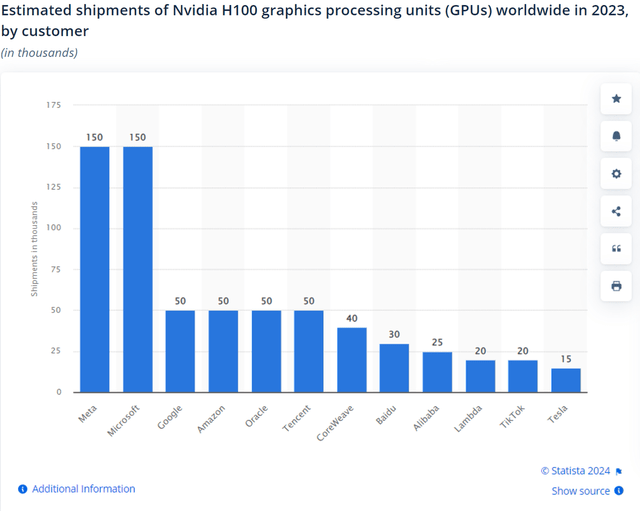

NVDA’s H100 Estimated Shipment In 2023

The same robust demand has been observed with Meta (META) and Microsoft (MSFT) in 2023, with the two accounting for the bulk of NVDA’s H100 orders at a hefty estimated sum of $5.25B each, based on the 150K in shipment and $35K in average price.

Despite so, META has put in another big order for approximately 200K units in 2024, to make up approximately 600K units of H100 equivalent in compute capability, further underscoring why NVDA remains the top choice for most Big Tech companies as the generative AI race continues.

MSFT and OpenAI are also reportedly working on a $100B data center project through 2030, with NVDA expected to supply up to $10B worth of chips amongst others, further demonstrating the long-term demand for generative AI offerings in general.

In addition, NVDA’s latest launch, the New GB200 Grace Blackwell Superchip, has firmly put the company in the forefront of the AI race, with it supposedly well outperforming AMD’s MI300X while consuming less power.

As the H200 production ramps in H2’24 and the Blackwell chips set to launch in 2025, it is apparent that Jensen Huang is not resting on his laurels, as similarly observed in the accelerating FY2024 R&D expenses of $8.67B (+18.2% YoY/ +207.4% from FY2020 levels).

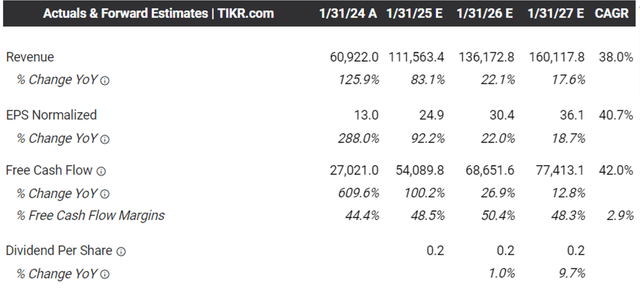

The Consensus Forward Estimates

Perhaps this is why the consensus has further raised their forward estimates, with NVDA expected to generate an accelerated top line at a CAGR of +38% through FY2027.

This is compared to the previous estimates of +22.9%, while building upon the historical CAGR of +36.5% between FY2017 and FY2024.

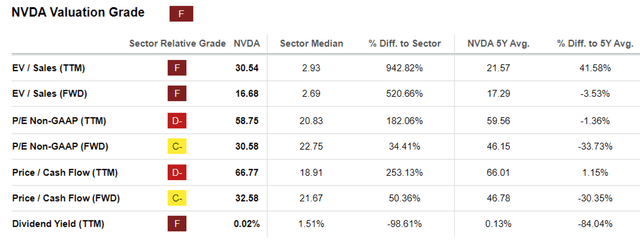

NVDA Valuations

With market leaders rarely being cheap and NVDA’s FWD P/E valuations of 30.58x clearly discounted compared to its 5Y historical means of 46.15x, we believe that investors may continue to add the stock after this pullback.

This is especially since NVDA is inherently cheaper when compared to its direct peers, such as AMD at 40.78x and INTC at 25.26x. This is due to the former’s projected bottom-line expansion at a CAGR of +81.2% between FY2023 and FY2027, compared to AMD at +20% and INTC at +12.5% over the same time period.

So, Is NVDA Stock A Buy, Sell, or Hold?

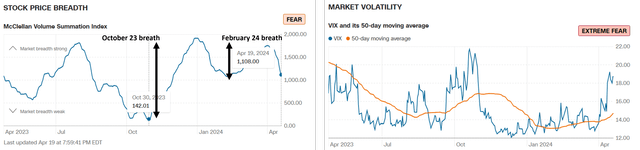

Market Volatility Index

For now, with the McClellan Volume Summation Index already moderating by -647 points to 1,108x and the VIX Index jumping by +5.93 points to 18.71x, it appears that the bears are currently in control after the immense market-wide rally since the October 2023 bottom.

Much of the pessimism is also attributed to the rising March 2024 CPI, with the Fed’s path to a 2% inflation target likely to be prolonged, and it’s remaining to be seen when the Fed pivot may occur. For now, most of the market has priced in zero rate cuts through July 2024, with it only expected to occur by the September 2024 FOMC meeting.

As a result of the near-term uncertainty, we may see the tech correction occur for a little longer, potentially nearing the same breadth as observed between July 2023/ October 2023 and another -20% downside for NVDA from current levels, if the February 2024 bottom does not hold.

However, due to the numerous promising factors as discussed above, we believe that NVDA’s recent pullback is temporal as the market digests the uncertain macro news and ongoing geopolitical turmoil, with the insatiable generative AI demand being here to stay.

For now, based on the FY2024 adj EPS of $12.96 (+288% YoY) and 1Y P/E mean valuations of 38.15x, it is apparent that NVDA still trades at a notable premium of +54% compared to our fair value estimates of $494.40, despite the recent correction.

Then again, based on the consensus FY2026 adj EPS estimates of $36.10, there seems to be an excellent upside potential of +79% to our long-term price target of $1.37K.

As a result of the relatively attractive risk/ reward ratio, we believe that NVDA remains a Buy at every dip, particularly one as deep as the current one.

There is no specific recommended entry point for now, since it depends on individual investors’ dollar cost average and risk appetite, especially due to the growing pessimistic sentiments in the stock market.

However, we believe that there is money to be made when the market is most bearish, as similarly termed by Sham M. Gad here: Invest Significantly at the Maximum Point of Pessimism.

The same had occurred when we strategically loaded up during the September 2022 bottom, with NVDA already recording an impressive +429% return since then, well out performing the wider market at +22.1% over the same time period.

Interested investors may monitor the stock’s movement over the next few weeks, while adding at its previous support levels of $620s for an improved margin of safety.

Maintain long NVDA.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD, INTC, MSFT, GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.