Summary:

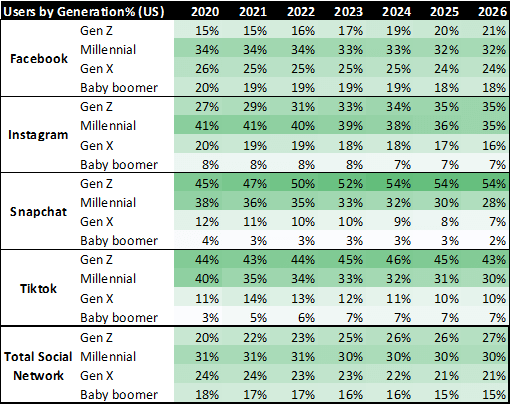

- Facebook’s Gen Z and Millennial user% of total is lagging significantly behind TikTok and Snapchat by 28 ppts and 35 ppts respectively; Facebook will likely continue to lose popularity.

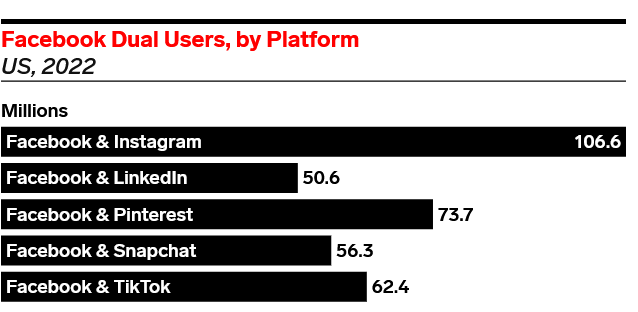

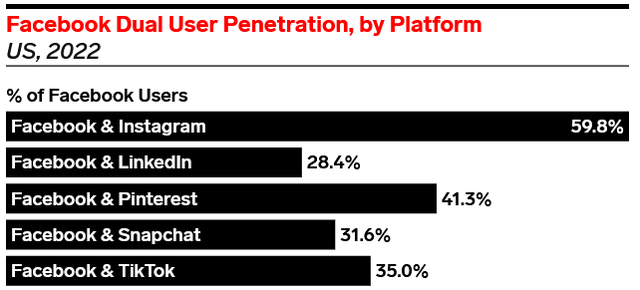

- Advertisers may continue to shift budgets away to optimize for ROAS, considering 107 million (or 60%) of Facebook users overlapped with Instagram and Meta’s absence from CTV.

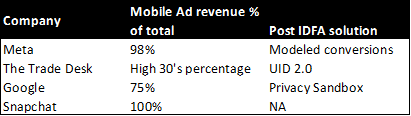

- Meta was hit hardest by Apple iOS privacy changes.

hapabapa

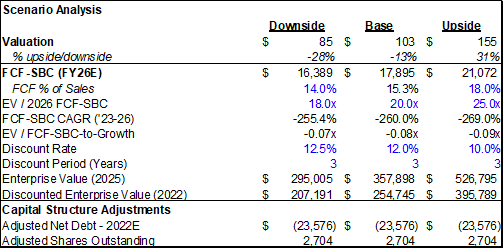

I am bearish on Meta’s (NASDAQ:META) capability to regain growth momentum for its ads business. My valuation using 2026E EV/(FCF-SBC) multiple shows $100 (base case, -13%), $150 (upside case, +31%), and $85 (downside case, -28%). This valuation has assumed a flattish topline and continued pressure on its profitability (23% Op Margin in 2026E, a 320 bps decrease from its Op Margin in 2022E).

Facebook’s Gen Z and Millennial user% of total is lagging significantly behind TikTok and Snapchat by 28 ppts and 35 ppts respectively; Facebook will likely continue to lose popularity.

According to eMarketer, Facebook’s users are highly concentrated on Gen X and Baby boomer relative to other Social Networks. If we compare Facebook with Snapchat and TikTok, Facebook’s presence in Gen Z and Millennial is way behind for the current year, and for the future.

As Technology continues to evolve, it might be hard to tell who will be the ultimate winner/leader (e.g. Snapchat or TikTok or other new entrants), but it appears unlikely for Facebook to maintain its dominant position in Social Networks. Therefore I expect Facebook MAU to remain flat with decreasing engagements and thereby decreasing Ads ARPU in future years. In my forecast I assumed a ’22-26E CAGR of 1.5% in Meta’s MAU, and a blended Advertising ARPU of $38 in 2026E, down from $40 in 2022E.

eMarketer

Advertisers may continue to shift budgets away to optimize for ROAS considering 107 million (or 60%) of Facebook users overlapped with Instagram, as well as Meta’s absence from CTV.

According to eMarketer, there are varied levels of overlapping in users between the social networks. Advertisers wanting brand awareness and brand lift will go after incremental reach, which means the less overlapping the better reach. Facebook currently has over 100 million users that are overlapped with Instagram, and 50-70 million users that are overlapped with users from other Social Networks.

The user overlapping compounded with decreasing user engagements on the Facebook platform could put Meta at a disadvantage in gaining Ads budgets.

Furthermore, the growth of digital advertising is primarily led by Connected TV. Advertisers are moving more aggressively to adopt CTV as it allows advertisers to use smarter audience targeting and optimize for their campaign goals. Meta is absent from CTV, and likely will see more budget shifting away.

Meta was hit hardest by Apple IOS privacy changes

As shared by Forbes, “Apple’s privacy changes on iPhone have cut the average mobile advertiser’s return on investment by almost 40% and caused them to drop mobile ad spend by 25%, according to a mobile measurement company’s data.” Meta’s CFO claimed ” we believe the impact of iOS overall as a headwind on our business in 2022 is on the order of $10 billion, so it’s a pretty significant headwind for our business. And we’re seeing that impact in a number of verticals.”

Meta is hit hard as it has 98% of revenue on Mobile Ads. Unlike players who are able to leverage other solutions or assets such as TTD’s UID 2.0, exclusive 1P audience data based on their unique touch points (eCommerce, search, map, etc.) with the audience, etc. Meta has to rely on modeled conversions (data science) to make up for the loss of IDFA (Identifier for Advertisers).

eMarketer

How would Ad business affect Meta’s stock valuation?

I modeled the above concerns into Meta’s stock valuation, mainly in the form of flat revenue YoY, and operating margin decrease YoY. My base case indicates $103, -13% from its current price, and my best case suggests $155, +31% vs its current price. Note that $155 is about 46% of where Meta was at the beginning of 2022.

my own stock valuation

Conclusion

Meta has been a great company since its inception. However the 18-year-old Facebook is not gaining as much traction from new generations as it did in the past. As TikTok and others redefine social networks, and as Advertisers embrace full-funnel digital advertising, Meta is facing challenges of user engagements with its social platform and advertising budget shifting away post IDFA. Investors could hold off until there are signs for Meta to get back to its growth trajectory.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.