Summary:

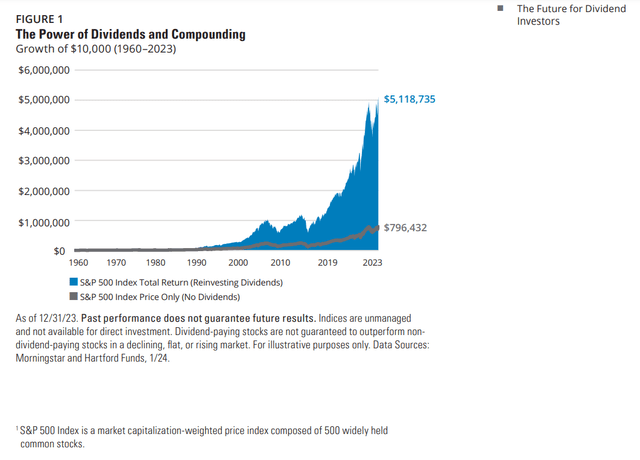

- Empirical evidence suggests that reinvested dividends are the biggest driver of long-term total returns.

- NextEra Energy’s revenue came in below the analyst consensus for the first quarter, while adjusted diluted EPS outperformed expectations.

- The Dividend Aristocrat’s 3%+ payout is well-covered by earnings and should keep growing at a healthy rate.

- Based on the dividend discount model and my fair value P/E multiple, NEE could be 15% discounted.

- The stock could be set up for double-digit annual total returns over the next few years.

Growing stacks of coins symbolizing the power of compounding. J Studios/DigitalVision via Getty Images

In my view, the importance of dividends to my investing strategy can’t be overstated. Dividend growth investing is the core of my investing strategy for many reasons.

The growing stream of passive income that my portfolio provides to me is one thing that I especially appreciate. Another similar reason that I am a devoted dividend investor is because of just how much of total returns have been powered by reinvested dividends over the long haul.

Hartford Funds – The Power of Dividends

A $10,000 investment in the S&P 500 (SP500) index made in 1960 would have been worth just shy of $800,000 to conclude 2023, without considering dividends. When accounting for reinvested dividends, this amount was more than six-fold higher at $5.1 million. That means nearly 85% of all total returns over a full investing lifetime were powered by reinvested dividends.

Intuitively, this makes sense. Reinvesting dividends allows an investor to build positions in stocks. Spread throughout a diversified portfolio, building these positions will allow greater ownership stakes in equities that grow in value over time. The big winners within a portfolio will generally more than compensate for the losers.

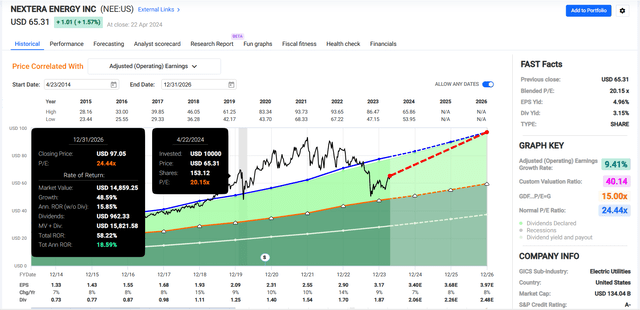

Another dividend stock in my portfolio that I believe to be high-quality is NextEra Energy (NYSE:NEE). When I last covered the company in January, I was impressed by the company’s track record as a Dividend Aristocrat, the future growth outlook, the A-rated balance sheet, and the apparent undervaluation.

Today, NEE shared its financial results for the first quarter. So, I wanted to take the opportunity to review why I will be upping my weight from 0.7% to above 1% within the next couple of weeks.

Briefly, these results further proved to me that the growth story for NEE is intact. The company also has the financial strength needed to fund its future growth plans. Lastly, the share price relative to fair value remains compelling to me. Without further ado, let’s dig into the details of NEE’s fundamentals.

The Leading Utility In A Flourishing Service Area

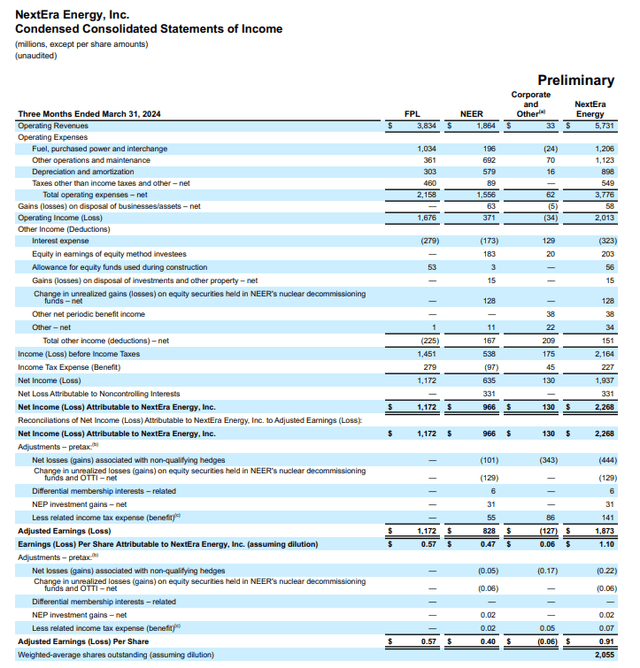

NEE Q1 2024 Earnings Press Release

NEE’s financial results were mixed in the first quarter. However, I was pleased with the results overall. The company’s operating revenue decreased by 14.7% over the year-ago period to $5.7 billion during the quarter. This came up $750 million short of the analyst operating revenue consensus per Seeking Alpha.

So, why am I not bothered by NEE’s topline revenue miss?

The costs of the company’s fuel inputs used to generate electricity were less than the prior year period. This led to NEE receiving lower rates from customers, which partially explained the revenue decline. Recently approved customer bill reductions stemming from 2024 fuel savings should result in average customer bills roughly 37% below the national average. Moving forward, this should shield NEE from much of the scrutiny that utilities receive from regulatory agencies at times.

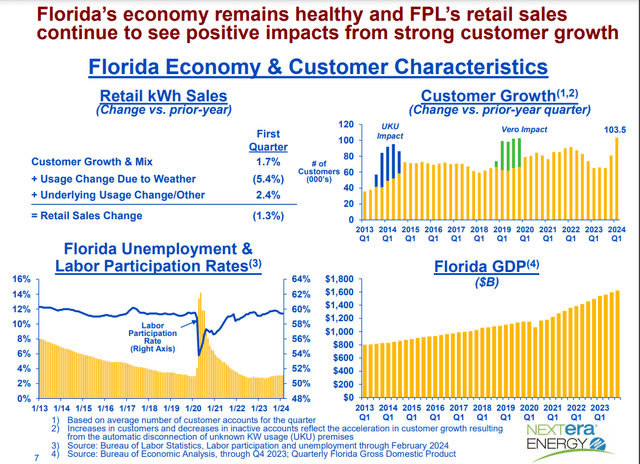

NEE Q1 2024 Investor Presentation

The other part of the equation that weighed on operating revenue was a 5.4% reduction in customer usage for the first quarter. This was due to weather patterns that were unfavorable to the company. So, accounting for the 1.7% growth in the company’s customer base and a favorable underlying usage change, retail sales were down 1.3% over the year-ago period.

The company’s adjusted diluted EPS surged 8.3% higher over the year-ago period to $0.91 in the first quarter. This was $0.13 ahead of the analyst consensus according to Seeking Alpha. Lower fuel costs and otherwise careful cost management led NEE’s non-GAAP net profit margin to expand by 770 basis points to 32.7% during the quarter. That is how the company’s adjusted diluted EPS moved higher as operating revenue moved lower.

Looking forward, Florida’s continued GDP growth and a labor participation rate that has recovered to pre-COVID levels are positives. This is important to note because the company’s operations served over 12 million people in Florida, which is over half of the state’s growing population base. That should keep driving growth in the customer base in the years to come. In turn, this should help the demand for NEE’s electricity to grow as well.

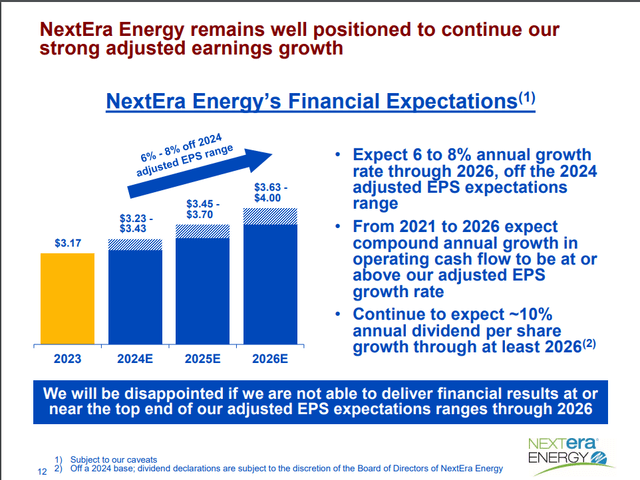

The electric utility believes that it can generate 6% to 8% annual growth through 2026 off of its 2024 guidance of $3.23 to $3.43 in adjusted diluted EPS. The FAST Graphs analyst consensus is also in line with these expectations, with 7% adjusted diluted EPS growth expected for 2024, and 8% for 2025 and 2026, respectively.

The path to this level of growth for NEE in the future is the same as how it accomplished it in the first quarter. The company’s regulatory capital employed, or its rate base climbed by 11.5% from $59.2 billion in Q1 2023 to $66 billion in Q1 2024. This was made possible through continued investments in expanding NEE’s infrastructure network to serve growing electricity demand.

NEE Q1 2024 Investor Presentation

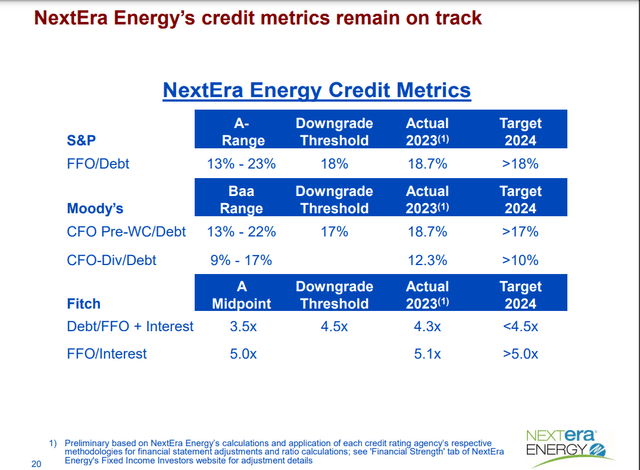

Just as I noted in my previous article, NEE has the financial ability to fund its $65 billion to $70 billion capital spending plan for 2024 through 2026. Across the board, the company’s debt metrics were healthy enough to maintain the investment-grade credit ratings needed to make future capital spending possible.

As measured by S&P, NEE’s FFO/debt ratio was 18.7% in 2023. This was comfortably above the 18% needed to keep its A- credit rating. For this year, the company expects the FFO/debt ratio to remain above 18% as well (unless mentioned otherwise, details in this subhead were sourced from NEE’s Q1 2024 Earnings Press Release and NEE’s Q1 2024 Investor Presentation).

Shares Remain Cheap After The Rally

Since I last covered NEE three months ago, shares have rallied 12%. For context, the S&P gained 3% in that time.

Even though interest rates likely won’t begin meaningfully coming down until next year, the market’s anticipation of this is helping sectors like utilities. Yet, I think shares are still an attractive value here.

My inputs into the dividend discount model show shares to be worth $82 apiece: A $2.06 annualized dividend per share, a 10% discount rate, and a 7.5% annual long-term dividend growth rate. As I’ll discuss in further detail below, NEE just extended its 10% annual dividend growth target to 2026. So, this annual dividend growth rate is adjusting for higher dividend growth for the next few years and a slowdown to around 7% beyond that time.

NEE’s 3.2% dividend yield alone can drive at least a large minority of total returns. Thus, that’s why I think the dividend discount model could be a helpful valuation method.

The other valuation method that I’m using is the P/E ratio. Per the $67 share price (as of April 23, 2024) the company’s current-year P/E ratio is just below 20. This is well below the 10-year normal P/E ratio of 24.4 per FAST Graphs.

Now, the days of zero interest rate policy are probably gone for good. Or, at least for the foreseeable future. So, I don’t think a return to a multiple of 24 is realistic. But I do believe that as interest rates come down 150 to 200 basis points, the potential for a return to a P/E ratio of 22 is fair. Using the FAST Graphs analyst consensus of $3.40 in adjusted diluted EPS for 2024 (the upper end of company guidance), this gives a $75 fair value.

I have confidence in using this $3.40 forecast because of NEE’s first-quarter results. The significant growth in the company’s rate base should also translate into high-single-digit annual EPS growth for the remaining quarters this year.

Averaging these fair values together, I get a fair value of $79 a share. That would represent a 15% discount to fair value.

Visibility Into Dividend Growth Has Been Extended

NEE Q1 2024 Investor Presentation

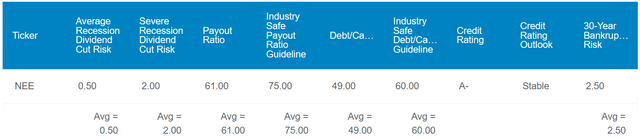

NEE’s 3.2% forward dividend yield isn’t exceptionally high versus the utility sector’s median 3.9% forward dividend yield. This earns it a D+ grade for forward dividend yield from Seeking Alpha’s Quant System.

However, NEE updated its financial expectations to include 10% annual dividend growth through 2026. Aside from the company’s anticipated adjusted diluted EPS growth, this growth is underpinned by a sustainable dividend.

Dividend Kings Zen Research Terminal

Relative to the 75% EPS payout ratio that rating agencies prefer from utilities, NEE’s 61% EPS payout ratio is quite low. The company’s 49% debt-to-capital ratio is also below the 60% that rating agencies desire. This further suggests NEE’s balance sheet is well-capitalized.

Based on NEE’s $3.33 adjusted diluted EPS guidance midpoint for 2024, the company’s dividend payout ratio would be 61.9% for the year. That is assuming $2.06 in dividends per share will be paid during 2024. This is why I’m confident that NEE can extend its streak as a Dividend Aristocrat in the years ahead.

Risks To Consider

NEE is a quality business, but there are risks to an investment.

The company’s geographic concentration is one factor to contemplate. NEE’s Florida-based FPL segment was roughly two-thirds of its operating revenue in the first quarter. This exposes the company to a couple of risks.

The average bill for NEE’s electric customers stacks up favorably to the national average. However, that doesn’t guarantee that the company won’t experience unfavorable outcomes with regulators. If this did happen, NEE’s growth prospects could be somewhat reduced.

Natural disasters such as hurricanes could also cause disruptions to service. This could impact the company’s operating results. If damage to NEE’s infrastructure was beyond the scope of commercial coverage, that could also impair the company’s earnings power.

Summary: A World-Class Utility Is (Still) On Sale

NEE is a reliably growing business with a tremendous balance sheet. The company’s status as a Dividend Aristocrat is another factor that I like about it. Topping it off, shares could be priced 15% below fair value. Putting all these traits together, I believe NEE is highly likely to deliver double-digit annual total returns over at least the next few years (3.2% yield plus 7% to 8% annual earnings growth). This isn’t even counting modest annual valuation multiple expansion, either.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NEE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.