Meta: I Am Aggressively Buying The Drop (Rating Upgrade)

Summary:

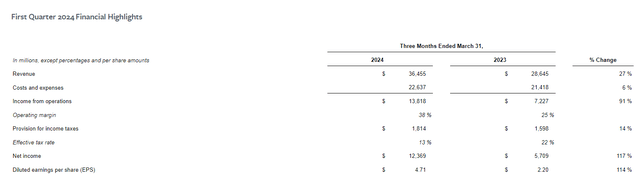

- Meta Platforms exceeded revenue and earnings estimates for Q1’24, with a strong digital advertising performance supporting results.

- The company’s spending/CapEx guidance disappointed investors, leading to a sell-off, but I believe investors may be overreacting.

- META shares dropped significantly in extended trading, pushing the P/E ratio to ~18X.

- Meta’s strong EPS growth prospects, high FCF, and margins make shares an attractive deal for investors on the drop.

peshkov

Meta Platforms’ (NASDAQ:META) shares crashed 16% after the social media company reported earnings for its first fiscal quarter. The reason for this sell-off relates to Meta’s higher CapEx guidance, which is set to lower the company’s free cash flow margins, but only temporarily. While the market seems to be excessively focused on Meta Platforms’ costs/CapEx, the social media company delivered very strong free cash flow and margins (again), which could support incremental capital returns going forward. Shares are more attractively valued on the drop, and Meta continues to see strength in platform advertising.

Previous rating

I rated shares of Meta a hold — Now A Dividend Growth Play — due to my concerns over valuation at the time. However, the social media company’s shares suffered a 16% after-hour price decline on Wednesday, which suggests that investors are overreacting to Meta’s AI spending guidance. I believe the drop is a golden buying opportunity for investors given that the company’s growth and free cash flows are still very strong.

Meta disappoints on guidance

Meta’s strong digital advertising performance allowed the social media company to easily exceed consensus estimates in terms of both revenues and earnings. Meta had GAAP earnings of $4.71 per-share which beat the consensus prediction by $0.39 per-share. The company’s revenues of $36.5B also came in $240M ahead of the consensus.

Meta’s first-quarter revenues soared 27% year over year to $28.6B due to continual strength in platform advertising… which is still responsible for 98% of the company’s total revenues. Meta also saw a 2 PP revenue acceleration in Q1’24 which is one of the reasons why the company has been able to grow its free cash flow and margins Q/Q. Costs came in 6% higher year over year and reached $22.6B as the company spends more money on new products, including in artificial intelligence.

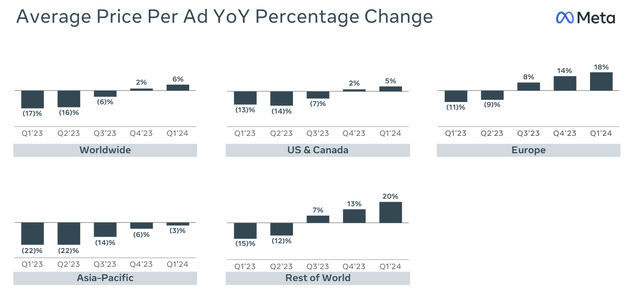

Meta’s core strength remained its ability to deliver effective ads for advertisers across its platforms and apps. This ad delivery effectiveness has been reflected in growing average ad prices across most geographies. Since the U.S. is a saturated market, average ad price growth was only 6% Y/Y in Q1’24, but the trend is clearly a positive for the U.S. as well as other markets.

Due to advertisers spending a ton of money on digital ads, Meta has been able to grow its free cash flow and margins quarter over quarter. In the first-quarter, Meta achieved a free cash flow margin of 34.4%, showing a Q/Q increase of 5.7 PP. Free cash flows totaled a massive $12.5B which means the social media company added $1.0B in free cash flow Q/Q. The strong free cash flow potential allows the company to return a lot of cash to shareholders or make investments… which brings us to the reasons for Wednesday’s sell-off.

|

in mil $ |

Q1’23 |

Q2’23 |

Q3’23 |

Q4’23 |

Q1’24 |

Y/Y Growth |

|

Revenues |

$28,645 |

$31,999 |

$34,146 |

$40,111 |

$36,455 |

27.3% |

|

Operating Cash Flow |

$13,998 |

$17,309 |

$20,402 |

$19,404 |

$19,246 |

37.5% |

|

Purchases of Property/Equipment |

($6,823) |

($6,134) |

($6,496) |

($7,592) |

($6,400) |

-6.2% |

|

Payments on Finance Leases |

($264) |

($220) |

($267) |

($307) |

($315) |

19.3% |

|

Free Cash Flow |

$6,911 |

$10,955 |

$13,639 |

$11,505 |

$12,531 |

81.3% |

|

Free Cash Flow Margin |

24.1% |

34.2% |

39.9% |

28.7% |

34.4% |

42.5% |

(Source: Author)

Meta’s free cash flows, in the short term, are set to fall as the company is guiding for aggressive capital spending, especially in the AI realm. Meta sees full-year expenses of $96-99B and CapEx of $35-40B which marked an increase of $5B at the lower end of guidance. With Meta set to invest more money into AI products, the company will also see lower free cash flow margins. I don’t believe investments into AI offerings should be a reason for the shares to sell off, especially since new AI products could open up new revenue streams for the company in the long term.

What also disappointed investors was Meta’s guidance for revenues which called for a top line of $36.5-39.0B. The guidance implies up to 22% Y/Y top line growth which I find is hardly a reason for the shares to drop 16%.

A unique opportunity to buy the drop

Meta is an enormously profitable social media company, and it rakes in billions of earnings and free cash flow each quarter from the monetization of user data in its core advertising business. Therefore, the best way to value Meta is by using earnings – or FCF-based valuation ratio.

The social media company is expected to generate earnings of $20.05 per-share in FY 2024, which implies a year-over-year earnings growth rate of 35%. In FY 2025, Meta is projected to generate 16% growth and $23.29 per-share in earnings, which makes sense to me given that the company is growing its revenues, free cash flows and EPS aggressively.

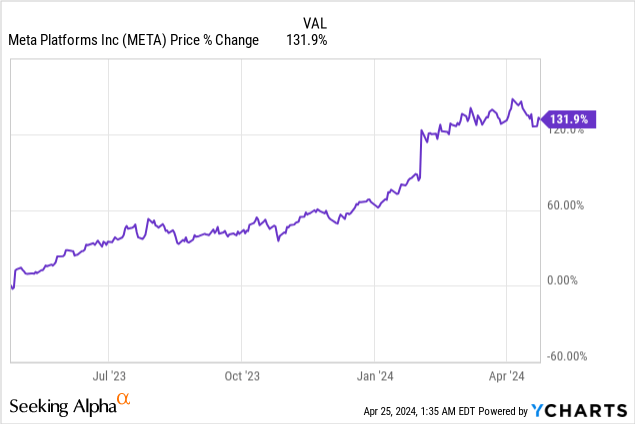

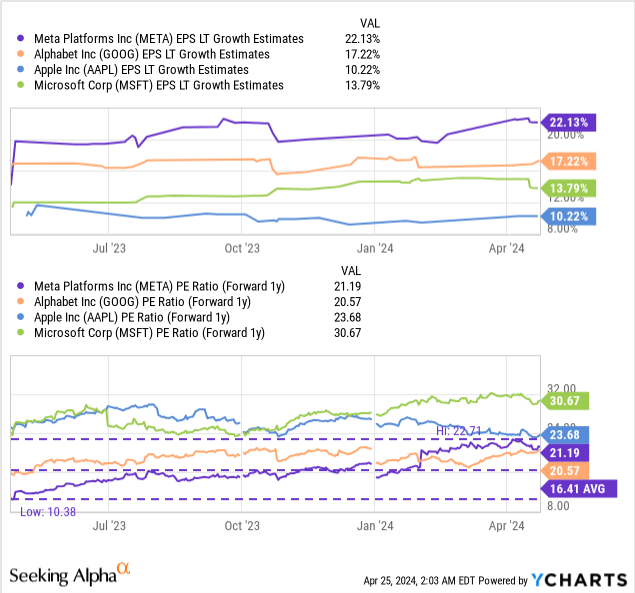

Meta has the most attractive long term EPS growth prospects in the group of large-cap technology companies and beats companies like Alphabet (GOOG), Apple (AAPL) and Microsoft (MSFT) easily. Currently, Meta’s shares are valued at a price-to-earnings ratio of 21.2X. However, the 16% sell-off pushes the P/E ratio down to 18X which is below the 20X price-to-earnings ratio that I previously cited as my fair value P/E for Meta. My fair value estimate has risen from $454 to $466, however, due to the increase in EPS estimates (20X fair value P/E x $23.29 FY 2025 EPS). With shares selling at $419 in extended trading, Meta is a bargain again, in my opinion.

Risks with Meta

The biggest risk for Meta, given its reliance on advertising, is a potential pullback in advertising spending. Meta remains overly dependent on digital advertising spending, a shortcoming that I believe management realizes and which likely explains the company’s push into artificial intelligence. What would change my mind about Meta is if the company were to see weaker capital returns and a slowdown in spending on stock buybacks and dividend growth.

Final thoughts

Meta delivered a reasonably strong earnings sheet for the first fiscal quarter that suggests that the digital advertising rebound that started in 2023 has staying power. Meta still has significant advertising relevance for marketers, and the company managed to accelerate its top-line growth as well. From a free cash flow point of view, Q1’24 was a very good quarter for Meta as the platform was able to grow its free cash flow margins in excess of 34%. I also believe the market overreacts to Meta’s push into AI, which is not something the company should be punished for. With a P/E ratio of less than 20X Meta is not entirely cheap, but with revenues, earnings and free cash flow growing, it is an entirely reasonable earnings multiplier to pay for the largest U.S.-based social media company!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.