Verizon: Not A Good Fit For Dividend Growth Investors (Rating Downgrade)

Summary:

- VZ stock has provided a total return of over 10% since December 2023, but there are better investment opportunities in sectors like REITs and Business Development Companies for income.

- Wall Street has an average price target of $45.44 per share for Verizon, representing a potential upside of over 14%. However, my dividend discount model estimates fair value at $31.65.

- While the dividend yield over 7% is enticing, the lack of dividend growth makes this less attractive.

jetcityimage

Overview

I previously covered Verizon (NYSE:VZ) at the tail end of December in 2023. Since then, we’ve experienced a total return of over 10%. My thesis at the time was focused around the idea that VZ has just made the 2024 Dogs Of The Dow list and I expected a recovery movement in price as additional capital came rolling in. Now, I want to take a look at what the actual valuation would be in terms of price targets and other calculated metrics. While there was some upside since my initial coverage, there are undeniably some better deals in the market right now across sectors like REITs, Business Development Companies, or Closed End Funds that can provide an equally as high yield and a better total return.

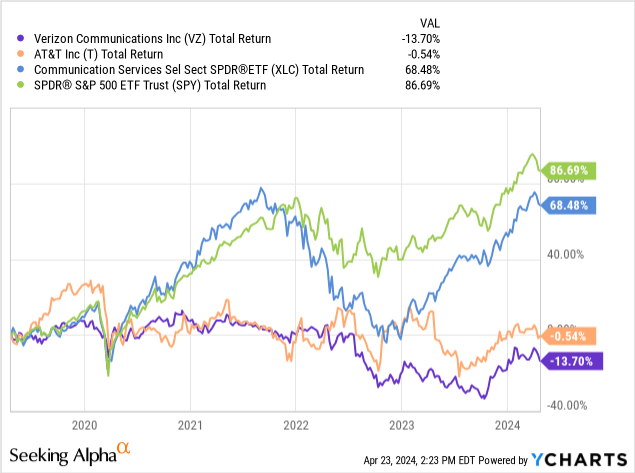

Telecom companies like VZ and AT&T (T) have always underperformed the S&P 500 (SPY) and the Comm services index (XLC). However, their high distributions have always kept investors anchored in despite the headwinds they may face. Verizon’s dividend is nearing 7% and offers the opportunity to add additional high-yielding income to your portfolio. However, as dividend investors we have the responsibility to avoid value traps and not to yield chase. We should not ignore a company’s core fundamentals and earnings growth in order to chase a high yield.

As a result, I wanted to reassess VZ’s financials and come to a better understanding of where the fair value may actually lie. While the price remains flat or negative over the last decade, is there actually still value in holding Verizon’s stock? Let’s find out!

Valuation

In terms of valuation, Wall St. has an average price target of $45.44 per share, which represents a potential upside of over 14%. The highest price target sits at $54 per share and the lowest is at $38.86 per share. From this logic, the price sitting near the lowest range of the price target makes VZ a buy, right? In order to answer this question, I think it would be a good idea to implement my own dividend discount model here. This will give us another perspective around what VZ’s fair price value is.

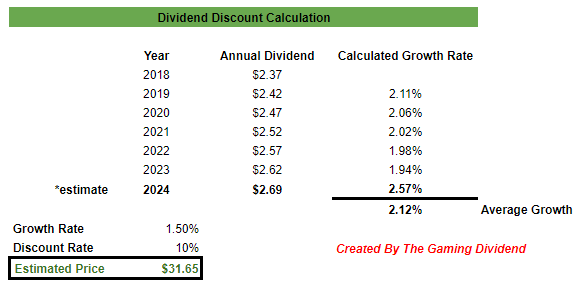

First, I compiled all the annual dividend payouts for VZ dating back to 2018. We can see that the dividend has grown at an average CAGR (compound annual growth rate) of 2.12% since then. Next, I input the estimated dividend amount for the full year of 2024. The dividend is expected to be raised for a higher Q4 payout within the next few months. So an estimated 2024 payout of $2.69 per share will do for now.

In order to get an estimated growth rate, I took a look at the historical EPS and revenue growth. Revenue growth YoY has only averaged 0.74% over the last 5-year period, while forward EPS growth has only averaged 1.8% over the same time frame. Management estimates EBITDA growth to land between 1% and 3%, however over the last 5 years the actual EBITDA growth has averaged 1.4%. Therefore, I thought an estimated growth rate of 1.5% was more fitting here, as it’s still within management’s projected range but also closely aligns with what their actual growth rate was over a 5-year period.

Author Created

Using these inputs nets us an estimated fair value of $31.65 per share. This represents a potentially over-valuation of about 25% at the current price level. Profitability and future outlook just doesn’t support that there is additional upside when looking at the performance as of recently. For example, their latest Q1 earnings showed up a weak revenue growth of only 0.3% YoY. While there may be periods of strong performance within a specific segment of their business, the lack of growth aligns with the lack of financial performance.

If a high dividend yield is what you are after, there are plenty of other options out there. While they may not be in the same industry or the most tax efficient methods, there are plenty of ways to generate a 7% yield. For example, Altria (MO) has a dividend yield of 9.2% and the income from MO would be counted as qualified dividend income. In addition, you can obtain over a 10% yield with business development companies. An example of this would be VanEck’s BDC ETF (BIZD) that has a 10.7% yield with a very little risk profile. I am not saying these are the best alternatives for you, but I just want to point out there are a ton of high-yielding options out there with better valuation metrics.

Updated Financials

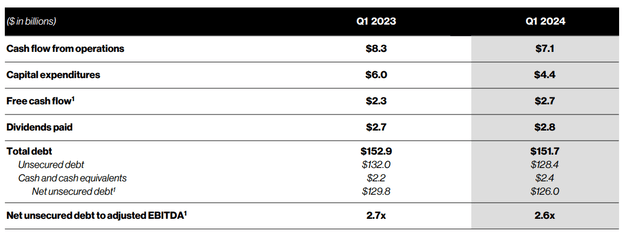

Verizon reported their Q1 earnings on April 22nd and the results were pretty lackluster. Earnings per share was reported at $1.15 while revenue only slightly increased by 0.3% year over year. Adjusted EBITDA grew by 1.4% YoY and totaled $12.1B for Q1. Something that stood out from this report was that cash from operations decreased from $8.3B down to $7.1B while free cash flow rose from $2.3B to $2.7B.

The free cash flow increase likely has something to do with the reduced debt load. Debt in Q1 of 2023 totaled nearly $153B while the debt total form this most recent Q1 report decreased down to $151.7B. As a result, the net unsecured debt to adjusted EBITDA ratio decreased slightly to 2.6x.

Their broadband segment saw 389k of net additions, including 53k of new Fios internet subscribers. They also reported 151k fixed wireless additions for Q1 and fixed wireless revenue totaled $452M for the quarter. This was an increase of $197M compared to Q1 of the prior year. VZ saw a growth in revenue in their wireless service segment of 3.3%, totaling $19.5B for the quarter, which was a slight increase over the last quarter’s revenue of $19.4B. This increase was attributed to pricing increases, a higher premium price plan, and growth in the fixed wireless subscriber amount.

Lastly, management’s outlook for next year includes wireless service revenue growing by 2-3.5% while EBITDA grows anywhere between 1% and 3%. They are also aiming to allocation between $17B and $17.5B in capital expenditures the fuel growth initiatives that can drive additional customer revenues. Moving forward, I noticed that there was some focus on the use of AI to assist with scaling growth from here. The plan seems to be using it to increase cost efficiencies and enhance personalization around plan customization. While there are not any clear paths on how this will turn out yet, I think it’s a great thing that management is open to using all tools at their disposal to drive growth.

During the most recent earnings call, we received the following outline and confirmation:

Our AI strategy focuses on three priorities. First, optimizing internal processes and operations through machine learning, such as creating efficiencies in fuel consumption. AI is already centered to our cost transformation program and will become even more important over time. Secondly, enhancing product experiences with AI capabilities like the personalized plan recommendation on myPlan, which is producing good early results. And thirdly, establishing an AI-based revenue stream by commercializing our network’s unique low latency, high bandwidth, and robust mobile edge compute capabilities. Generative AI workloads represent a great long-term opportunity for us. As we expand our network and increase our performance advantage, we’re also making Verizon a more efficient organization. – Hans Vestberg, CEO

While there are certainly improvements here, I still feel that the growth potential is nothing to get excited about. An estimated growth of about 2% and a flat price doesn’t fit my current needs. In addition, the dividend growth rate isn’t appetizing enough here. I have time on my side and would like to see the benefits of compounding over time in combination of dividend growth and price growth.

Dividend

As of the latest declared quarterly dividend of $0.665 per share, the current dividend yield sits at 6.8%. While Verizon has a solid dividend growth streak of 19 years of consecutive raises, the growth rate has been pretty lackluster. However, this may be acceptable for a stock yielding in the high single digit range already. We’ve already established that the dividend grew at a CAGR of 2.12% since 2018. On a smaller time frame of 3 years the growth is even lower at a CAGR of 1.96%. Similarly, zooming out to a longer time horizon of ten years, the dividend increased at a CAGR of 2.3%.

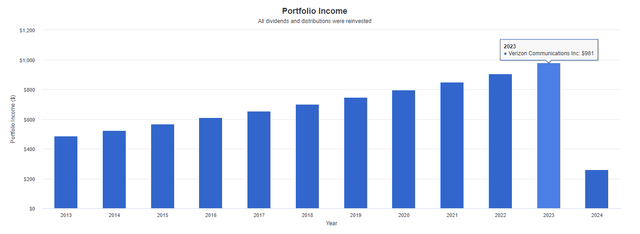

Using Portfolio Visualizer, we can see how the dividend income of VZ would have grown over time. This graph assumes an original $10,000 investment in 2013 with no additional capital ever being added. However, this does assume that dividends were reinvested every quarter. In 2013, your original $10k would have earned you $488 in dividend income. Fast-forward to 2023, and you would now be receiving nearly $1,000 annually in dividend income.

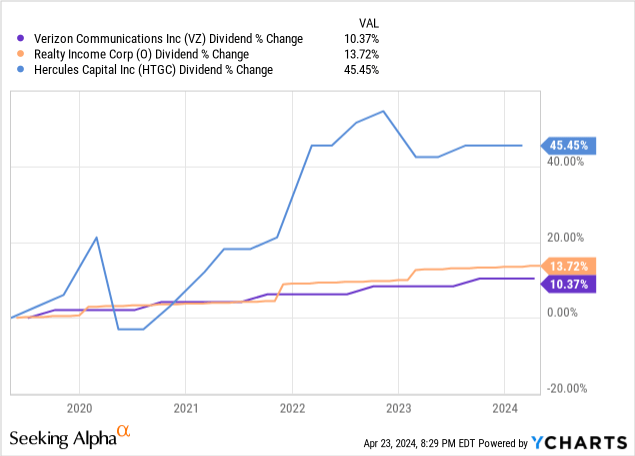

Like I briefly mentioned before, if you are sticking with VZ for some high-yielding income, I understand, but there are alternatives out there with better valuation metrics. I can understand holding on to VZ if you’ve had a position for the last couple of decades, or if you are holding it for tax reasons. However, if you are an investor who values a growing income, you would be able to achieve better results in some BDCs or REITs. For example, look at the dividend growth of Hercules Capital (HTGC) which already has a high dividend yield of 8.5%. Within the REIT space, you have Realty Income (O) with a dividend yield of 5.8% and a higher growth rate.

While I understand these may not be the right fit for you, the purpose was to demonstrate that there are alternatives for those who want to focus exclusively on the income aspect.

Risk

Verizon’s debt load is pretty large, current sitting at over $150B. While this always been the case, recent lawsuits could create an additional burden on their finances. Verizon will likely have to pay out $100M towards this sit regarding administrative charges that were misleading. While this may be a drop in the bucket for their current cash from operations totaling $36B, it could spiral into more costs with additional lawsuits.

In addition, Verizon’s market dominance remains threatened by the growth of T-Mobile (TMUS). This adds another challenge for VZ’s future growth prospects if customers continue to flock over to competitors. So far VZ has been able to maintain margins and throw some cash towards debt, but if the base customer amount decreases, we may see profitability margins decrease as well.

Takeaway

Verizon still has value as a source of dividend income, but the growth prospects are lacking. Although debt is decreasing and the dividend remains covered, the growth rate of the dividend has been disappointing over the last decade. As a result, I think there are better places for your money at this moment. Lowered cash flow from operations and capital expenditures make this less attractive than it once was. From a valuation perspective, fair value is estimated at $31.65 per share based on my dividend discount model. As a result, I am downgrading my rating to a Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.