Summary:

- Danaher Corporation, a healthcare/biotech/life sciences supplier, has shown resilience and strength in its core businesses despite post-pandemic growth challenges.

- The company maintains strong margins, consistently generates elevated free cash flow, and focuses on innovation for deeper market penetration and share gains.

- While its current valuation may be high, Danaher benefits from secular growth trends and has the potential for sustained long-term growth. However, post-pandemic challenges and market volatility could impact short-term performance.

ADragan

Introduction

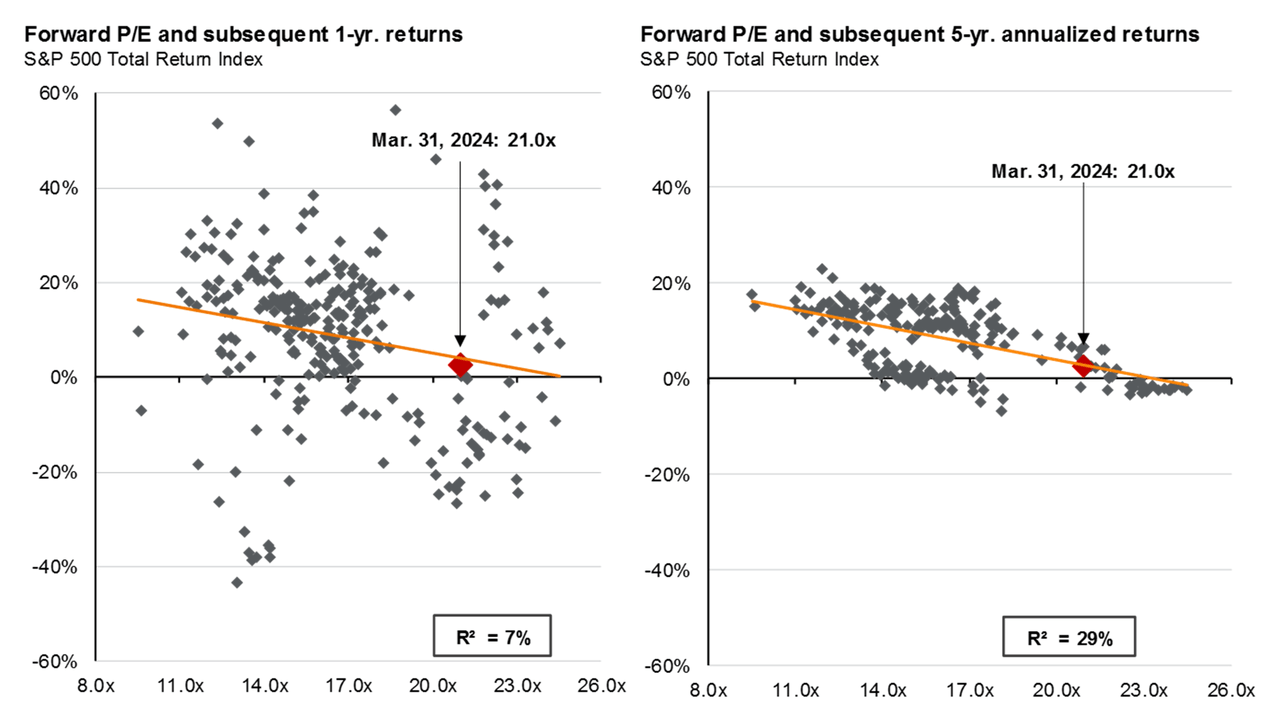

If there’s one thing we have discussed a lot over the past few months, it’s my increasing focus on “value” stocks, as I believe the market’s overall lofty valuation poses a risk for long-term returns.

JPMorgan

For example, in a recent article, I wrote the following:

Stocks are lofty valued, which increases the odds of subdued long-term returns.

Elevated earnings growth may be a solution. However, can earnings grow at above-average rates when inflation is slowly but steadily pressuring the economy? Personally, I doubt it.

How sustainable is the AI trend? While I have zero doubt that AI is here to stay and a major disruption force for many years to come, I believe a lot of tech stocks have gotten ahead of themselves.

With that in mind, in this article, we’ll discuss one of the few “growth” stocks that I have been buying in recent years. In fact, it’s the only growth-focused stock I have bought in the first months of this year.

That company is the Danaher Corporation (NYSE:DHR), one of the world’s biggest healthcare/biotech/life sciences suppliers, which comes with a terrific track record of M&A-focused shareholder value creation.

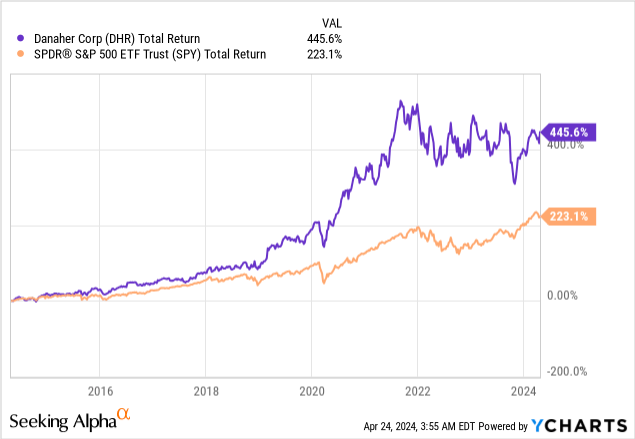

Over the past ten years, shareholders have seen a total return of more than 440%, which beats the already impressive 223% return of the S&P 500 by a huge margin.

Having said all of this, my most recent article on the stock was written on January 30. Back then, I went with the title “Bull Case Confirmed: Danaher Is Still One Of The Best Stocks To Buy Long-Term.”

Since then, shares are up 3.4%, beating the S&P 500 by roughly 40 basis points.

In this article, I’ll update my bull case using the company’s just-released quarterly earnings.

While Danaher’s valuation is still tricky due to the mix of poor post-pandemic growth and a lofty valuation, the company continues to fire on all cylinders, as it keeps proving to be in a perfect spot to not only grow on a long-term basis, fueled by secular growth, but also its ability to grow margins and market share.

As a result, after its earnings call, shares rose by more than 7%.

This rise happened without the company raising its guidance!

So, let’s dive into the details!

Post-Pandemic “Struggles”

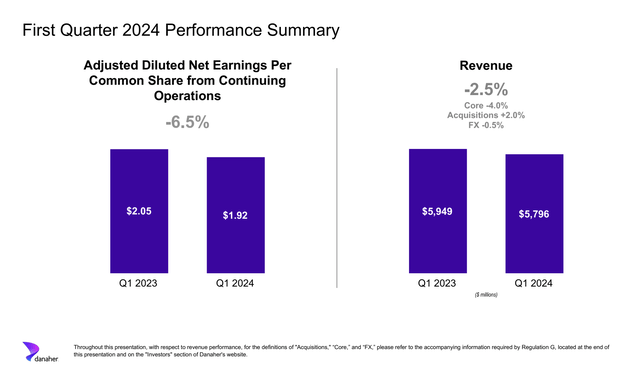

-2.5%.

That’s the company’s 1Q24 revenue growth.

Not that special, is it?

Especially as we’re dealing with a supposed “growth” stock, it’s hard to get excited when revenue growth is negative.

However, this is still a post-pandemic effect.

After all, Danaher was one of the biggest beneficiaries of the pandemic.

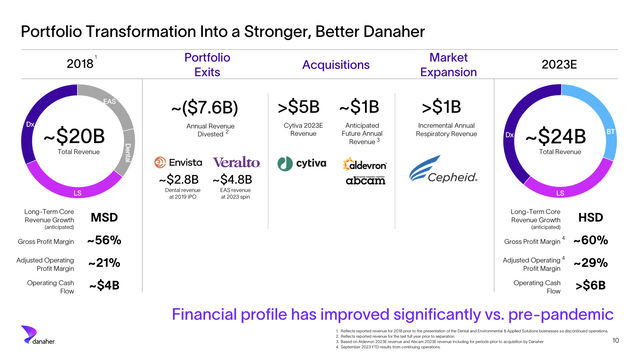

As we can see below, after spinning off Veralto (VLTO) last year, the company has a 100% healthcare-focused portfolio consisting of pharma, molecular, research, and clinical products. On a side note, 80% of the company’s revenue is recurring, which tremendously improves earnings visibility.

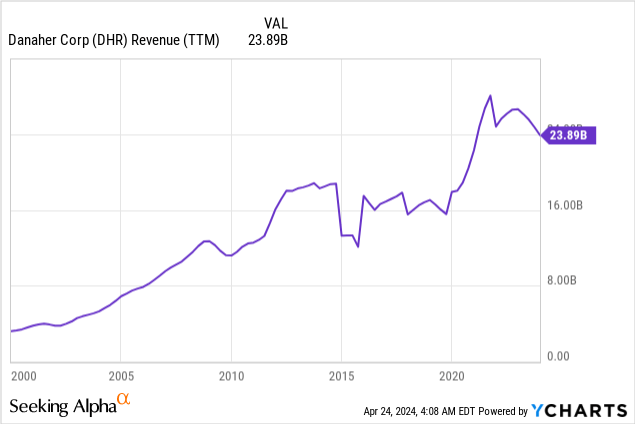

Based on that context, before the pandemic hit, the company generated roughly $16 billion in annualized revenue. Now, it’s north of $20 billion.

Due to rapidly fading pandemic-related demand, the focus shifts back to the company’s core business, which means despite Danaher being a long-term grower, it is currently showing poor growth rates.

On top of 2.5% lower revenues, the company saw 4% lower core revenues, as the 2.5% revenue decline benefited from 2.0% growth related to acquired growth.

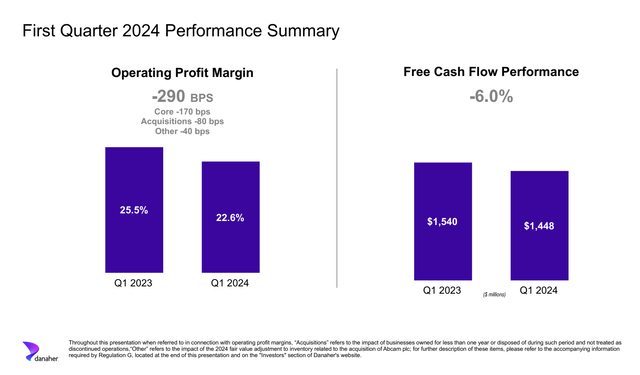

The good news is that margins remained strong, as the company maintained a gross profit margin of 60%. Moreover, the adjusted operating profit margin, although slightly lower than the previous period, remained strong at 30.1%.

Bear in mind that in 2018, the company had an operating margin in the low 20% range, which is visible in the “portfolio transformation” slide above.

On top of that, the company generated $1.4 billion of free cash flow. While this is down on a year-over-year level, it translates to a net income conversion ratio of more than 130%, which is extremely healthy.

After all, the conversion rate indicates the “quality” of earnings. If a company generates a lot of earnings but ends up with low free cash flow, it could be a sign of inefficiencies. Please note that exceptions are common, as some companies are aggressively investing in capital expenditures to boost future growth.

Generally speaking, a free cash flow conversion close to 100% is excellent.

With that said, let’s take a closer look at its segments, which reveal a lot about the underlying strength of the Danaher business model.

Danaher’s Business Is Simply Impressive

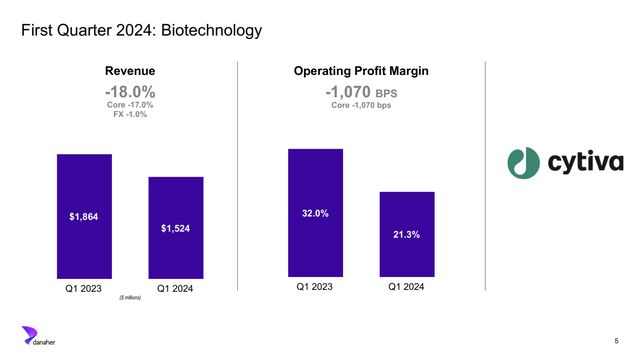

Starting with Biotechnology, we see a pretty significant core revenue decline of 17%, resulting in a 1,070 basis points decline in the core profit margin to 21.3%. This deterioration came with weakness in Bioprocessing and a decline of roughly 20% in Discovery and Medical.

However, despite this overall decline, there was a slightly more positive start to the year in Bioprocessing than the company initially expected, with orders increasing by mid-single digits compared to 4Q23.

Moreover, this segment’s book-to-bill ratio also rose to roughly 0.95x, which signals encouragement in light of typical season weakness between 4Q and 1Q.

While the book-to-bill ratio is still below 1.00 (meaning it gets $0.95 in new orders for every $1.00 in finished work), the company saw that large customers in North America and Europe are addressing excess inventory levels.

These inventories are expected to normalize by the end of the second quarter. While China is expected to see weaker demand on a longer-term basis, these developments are highly encouraging for the book-to-bill ratio.

On top of that, the company sees strong underlying market trends, including projected high-single-digit growth in demand for biologic medicines and a significant increase in FDA approvals for biologic and genomic medicines.

In general, these comments/developments are bullish for Danaher’s entire industry, as excess inventory has been a huge drag on demand since the pandemic.

To better address and exploit these improving tailwinds, the company is doing what it does best: innovating.

This includes the recent release of Cytiva’s Xcellerex magnetic mixing system, which could save customers potentially hundreds of thousands of costs due to leak prevention and more efficient operations.

To help prevent leaks, the system includes a novel mixer biocontainer incorporating user-centered design elements aimed to bolster durability and improve ease of use. This evolution in design results in enhanced safeguards, providing added protection against leaks throughout shipping, storage, and operation. – Lab Manager

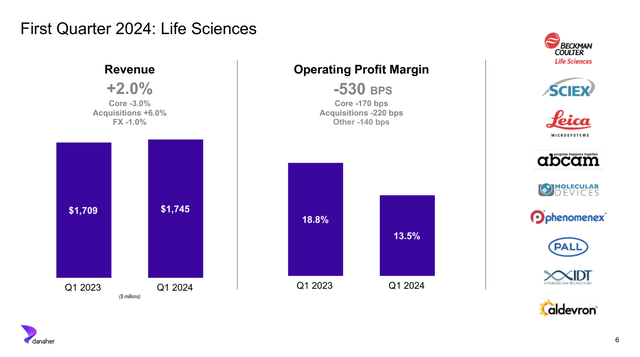

Moving to Life Sciences, this segment saw a 3% decline in core revenue, mainly driven by lower Life Sciences instrument sales.

Although the company saw stable demand in developed nations, mainly in the pharma and biotech sectors, it saw overall subdued demand.

The good news is that there were comparatively better developments in academic and applied markets, especially for more advanced instrumentation.

Furthermore, this segment has become a star with more than 60% recurring (high-margin) revenues and opportunities for long-term margin improvements.

While current end market conditions remain challenging, our Life Sciences businesses are well positioned for the long term. A combination of investments in innovation and strategic acquisitions over the last several years has increased our exposure to attractive end markets in Life Sciences and accelerated our growth trajectory. – DHR 1Q24 Earnings Call

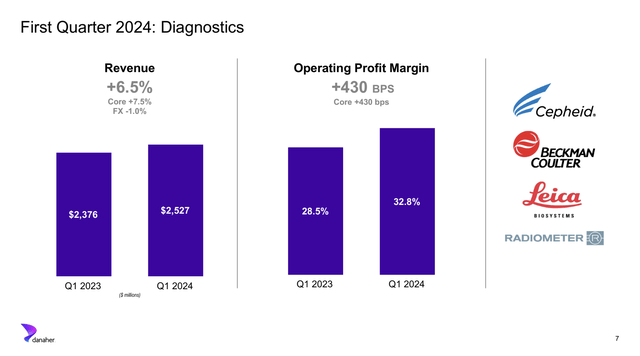

Moving over to the Diagnostics segment, I get to discuss a year-over-year improvement in core revenues. In this case, the Diagnostics segment reported 7.5% higher core revenues, driven by mid-single-digit growth in clinical diagnostics businesses – supported by a 430 basis points increase in the operating segment margin to 32.8%(!).

To add some color here, the company saw significant growth in its Beckman Coulter business, supported by new product introductions such as immunoassay and chemistry analyzers.

Furthermore, Leica Biosystems received FDA clearance for its digital pathology slide scanner, which is a major milestone in advancing digital pathology, according to the company.

On top of that, Cepheid achieved double-digit core revenue growth in Molecular Diagnostics, driven by respiratory revenue exceeding expectations.

These developments have allowed the company’s installed base to expand consistently on a global space, supporting increased menu options and utilization.

To give you some numbers, Cepheid has an installed base of 55,000 respiratory products. That number is up more than 3x since 2019.

Cepheid also got good FDA news, as it received clearance for its women’s health portfolio, which will enable critical testing in more accessible care settings and improve treatment outcomes.

Outlook & Valuation

The good developments at Cepheid were also reflected in the company’s comments in the 1Q24 Earnings Release (emphasis added).

We had a good start to 2024, with our team delivering better-than-expected revenue, earnings and cash flow. We were especially pleased to see improving order trends in our bioprocessing business and believe we continued to gain market share in our molecular diagnostics business at Cepheid. – DHR 1Q24 Earnings Release

Nonetheless, the company’s full-year guidance remains unchanged, with expectations of a low-single-digit core revenue decline and an adjusted operating profit margin of around 29%.

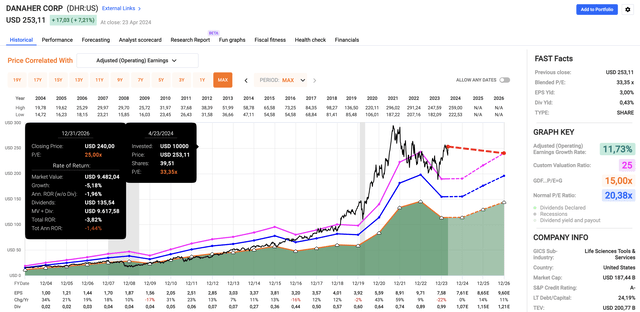

Using the FactSet data below, analysts believe this will result in flat EPS after a 22% EPS contraction last year.

Next year, EPS is expected to grow by 14%, potentially followed by 11% in 2025.

The problem is that DHR is not cheap.

Currently trading at a blended P/E ratio of 33.4x, it trades at its fair price when using a “fair” multiple of 25x earnings (its 10-year normalized average). That’s the pink line in the chart above.

After all, 25x$9.60 in expected 2026 EPS is $240.

The current consensus price target is $273, 8% above its current price.

I agree with that target.

However, I’m consistently buying DHR as the “growth” component of my portfolio, as I believe DHR remains in a fantastic spot to beat the market on a long-term basis.

It is also not overhyped, like AI-focused growth stocks, but increasingly benefitting from secular growth in healthcare.

Essentially, to me, the company offers both value and growth characteristics, supported by an anti-cyclical business model with strong secular growth and an elevated recurring revenue share.

Hence, as I said in my prior article, I continue to buy DHR on most 8-10% corrections, which is what I have been doing since I started buying this company a few years ago.

Takeaway

Despite facing post-pandemic growth challenges, Danaher shows resilience and strength in its core businesses.

While revenue growth may be subdued, the company maintains strong margins and continues to innovate, positioning itself for long-term success in healthcare and life sciences.

Although its current valuation may seem high, I see DHR as a solid investment due to its consistent performance and potential for market outperformance.

As I continue to buy on dips, I remain confident in DHR’s ability to deliver sustainable returns in the ever-evolving healthcare landscape.

Pros & Cons

Pros:

- Resilient Performance: Despite post-pandemic challenges, DHR maintains strong margins and demonstrates resilience in its core businesses.

- Innovation: The company’s focus on innovation results in major FDA approvals and products capable of deeper market penetration and market share gains.

- Long-term Growth: DHR benefits from secular growth trends, providing opportunities for sustained long-term growth.

- Steady Cash Flow: Despite temporary fluctuations, DHR consistently generates elevated free cash flow, indicating the quality of its earnings and financial stability.

Cons:

- Valuation Concerns: DHR’s current valuation, trading at a relatively high P/E ratio, may keep the stock price performance subdued in the short term.

- Post-Pandemic Challenges: While the company remains strong, post-pandemic growth challenges, such as subdued revenue growth, could impact short-term performance.

- Market Volatility: Like any stock, DHR is subject to market fluctuations.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.