Summary:

- Harley-Davidson is a legendary motorcycle brand with a controlling interest in LiveWire, an all-electric motorcycle company.

- The stock has experienced a pullback, presenting a potential buying opportunity.

- The CEO, Jochen Zeitz, has a reputation for turnaround situations and is expected to continue making progress for the company.

Shofi –

Harley-Davidson, Inc. (NYSE:HOG) is a legendary motorcycle brand and, for many people, and an icon that represents America. This company has been in business since 1903. In addition to the Harley-Davidson brand, which is known for having a very memorable exhaust note, this company owns a controlling interest in LiveWire Motorcycles (LVWR), which are all-electric. LiveWire has been producing losses, but it is growing rapidly. Harley-Davidson shares have experienced a pullback from recent highs, so this could be an ideal buy the dip opportunity (as long as we avoid a recession).

One factor to keep in mind is that Harley-Davidson hired Jochen Zeitz for the CEO position in 2020. Mr. Zeitz has a reputation for turnaround situations because in the past, he was brought in to turnaround Puma (an athletic apparel company) and he succeeded. So far, his tenure at Harley-Davidson seems to be going well, and hopefully, he can build on the progress in the coming years.

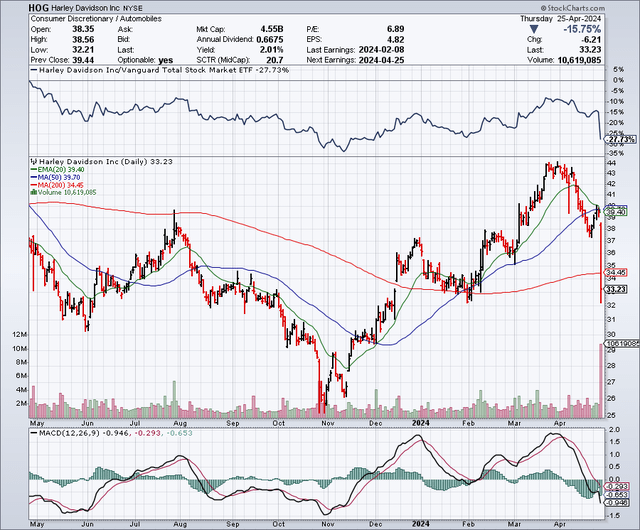

The Chart

As the chart below shows, this stock bottomed out at around $25 per share late in 2023. It then surged up to about $44 per share in March. More recently, it has had a pullback, and then the plunged after Q1 earnings were released. This gives investors a better buying opportunity, well off the highs. The 50-day moving average is $39.74 and the 200-day moving average is $34.44. The stock is now trading at just around $33.00 per share.

Q1 2024 Earnings

For Q1 2024, Harley-Davidson reported earnings of $1.72 per share, with revenues coming in at $1.73 billion. The revenues were impacted by a 7% decline in global motorcycle shipments, which was partially offset by a 6% increase in the North American market. These numbers were in line with expectations, so the drop in the share price seems very overdone. The selling pressure was probably exacerbated by the market plunge on Thursday, April 25th, which was the same day this company reported Q1. Riding season is just getting started, so I think quarterly results will improve going forward, and so could a relatively new line of touring motorcycles such as the “Street Glide” and “Road Glide”. There may have been some concern that these new models are not selling as quickly as hoped, but again, it is still early in the riding season, so I think there is plenty of time for sales to kick in this year.

Recent Developments With Harley-Davidson

On April 23, 2024, an analyst at Morgan Stanley (MS) gave this stock an overweight rating and set a $50 price target. The analyst seems to think this company is putting in the right strategies and believes the stock is undervalued.

On April 8, 2024, Harley-Davidson announced it ratified contracts with all unions at its Wisconsin facilities.

Earlier this year, Harley-Davidson announced a new financing option for customers which gives them an option to lease a new motorcycle. This could help spur more transactions and keep the competition at bay.

Earnings Estimates And The Balance Sheet

Analysts expect Harley-Davidson to earn $4.21 per share in 2024, with revenues coming in at $4.69 billion. For 2025, earnings estimates are at $4.70 per share on revenues of $4.89 billion. For 2026, estimates are expected to rise again to $4.98 per share on revenues of $4.85 billion. These estimates suggest a price to earnings ratio of around 8 times earnings for 2024, and less than 7 times the estimates for 2026. That is very undervalued when considering that the S&P 500 Index (SPY) trades for about 21 times earnings.

On the balance sheet, Harley-Davidson has $7.2 billion in debt and $1.5 billion in cash.

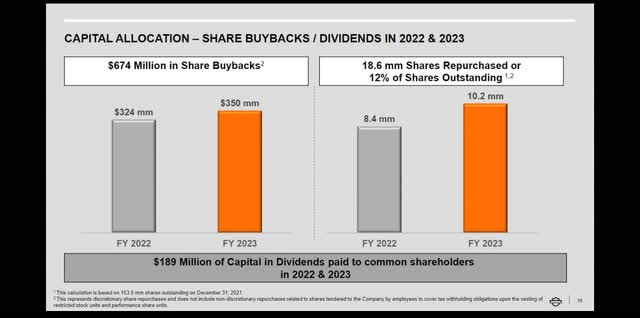

The Dividend And Share Buybacks

In February 2024, Harley-Davidson raised the quarterly dividend from $0.1650 per share to $0.1725 per share. This dividend payout totals $0.69 per share on an annual basis, and it provides a yield of about 1.8%.

As shown below, this company has a shareholder friendly capital allocation plan that includes share buybacks and dividends. It paid $189 million in dividends to shareholders in 2022 and 2023. It also completed $674 million in share buybacks in those two years, which represents about 12% of the outstanding shares.

Potential Downside Risks

There are some signs that the economy is slowing down under the weight of high interest rates. There are also signs that consumers are starting to feel some pressure that comes from higher interest rates and consumer debt like credit cards, which are at very high levels. Credit card and auto loans have been seeing increased delinquencies. The Federal Reserve is trying to create a soft landing and avoid a recession, but historically this has not often been successful.

In the event of a recession, unemployment will grow and consumers will curtail spending on big ticket items like motorcycles. I would say a recession is the biggest potential downside risk, and if that occurs, I would be more concerned with the debt on the balance sheet becoming a potential downside risk. The balance sheet seems manageable now, but if sales and earnings decline significantly in a recession, it could impact credit ratings as well as what investors are willing to pay for this stock.

In Summary

I am buying the pullback on this stock because it appears undervalued, and it is a legendary brand name. However, I won’t buy a full position in this stock because I feel the U.S. economy could go into recession, in which case Harley-Davidson shares will likely drop and allow me to dollar-cost average to a lower level. The CEO looks like the right person to bet on, and the company has a shareholder-friendly capital allocation program that seems likely to continue.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.