Summary:

- Tesla has been down for 7 consecutive trading sessions. Reuters reported that Elon Musk said he will not sell Tesla stock for the next 2 years.

- I provide 4 reasons why this is a game changer for the current sell-off in the short term.

- Also, I’m reviewing a recent report from Morgan Stanley that gives me darker thoughts in the medium term.

- I would recommend fishing the entry point if you are interested in swing trading, but staying away until the U.S. recession actually starts to assess the impact on Tesla if you are a longer-term investor.

Dimitrios Kambouris

Introduction

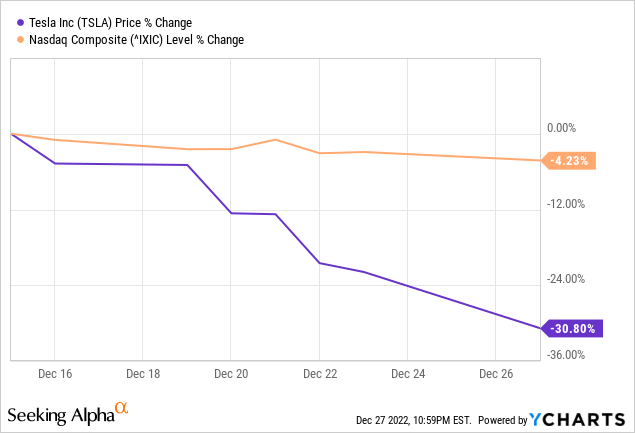

It has been quite interesting to watch Tesla Inc. (NASDAQ:TSLA) fall for 7 consecutive trading sessions against the backdrop of the falling but relatively stable NASDAQ 100 Index (COMP.IND):

It was especially interesting considering that trading volumes were well above average on those sell-off days. On December 22, for example, when TSLA fell a miraculous 8.88%, trading volume was over 205 million shares – nearly 2.5 times the 200-day average, according to Investing.com. On December 27, we saw a similar picture (~203 million shares traded).

Amid the dramatic drop in TSLA on high trading volumes, a significant piece of news was overlooked by the market – it has the potential to significantly impact short-term market trends for the stock, in my view.

In this article, I will examine the potential implications of this overlooked news, as well as a note from Morgan Stanley analysts questioning the future of the entire industry and Tesla in particular. Let’s delve deeper.

Elon Musk says he won’t sell any more Tesla stock in the next 2 years

This news was published by Reuters a few days ago and Seeking Alpha mentions it in its News section so that you can read it yourself if you can’t access that Reuters’ post:

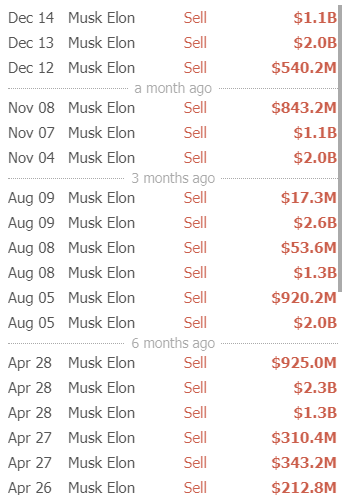

In my opinion, in addition to retail investors (~15% of the whole float, according to CNN Business) who massively exited their positions in anticipation of a recession in 2023 (which Elon Musk himself warned about back in June), the insider selling was the main factor influencing the negative momentum. Musk – the most active insider – sold more than $3.64 billion worth of shares in December alone, based on TrendSpider’s data:

TrendSpider.com, TSLA, author’s notes

Therefore, I believe that this news is a very important catalyst that can set off several chain reactions at once. Here are my 4 reasons for that.

First, the decrease in stock supply by Musk himself is a very important turning point, in my view.

A reduction in the supply of stock can lead to an imbalance in the whole supply-demand story for TSLA, which can drive up the price of the stock in the short term. Let’s just try to understand how much Musk’s sales have affected the supply side. In fact, Musk sold at prices in the $156-176 per share range recently, selling more than 20 million shares in total. That represents about 23-25% of average trading volume – that’s a very large addition to the “ask” side that was on the market even without Musk. Now imagine that such volumes are regular – every month.

By stopping to sell, Musk is definitely taking a lot of selling pressure off the market – if we multiply the average trading volume by 22 trading days and divide the approximate average monthly volume of Musk’s sales in recent months by the resulting figure, we get more than 1% of the total monthly supply – that seems like a small number, but it’s actually a lot.

TrendSpider data

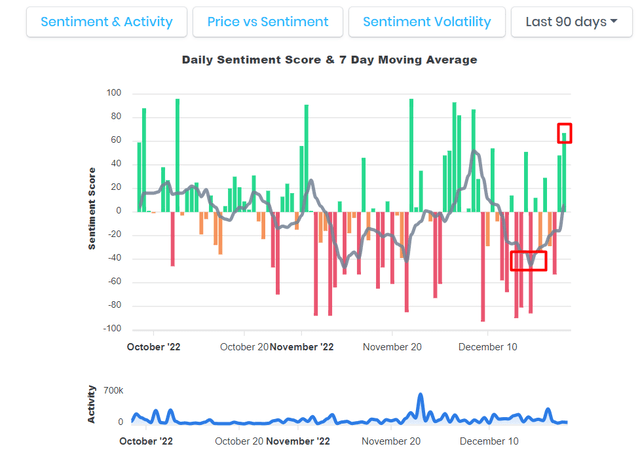

Second, this decision will spur retail investors who have lost >30% of their position values in just 7 days (if not taken out by stop loss). It’s worth noting that retail investors, who have traditionally been bullish on Tesla, often pay close attention to Musk’s statements when making trading decisions. His recent message was clear and, although it is difficult to quantify the impact of retail investors’ sentiment, socialsentiment.io data suggests that the general sentiment of retail investors (as measured by Twitter posts) reached a low point a few days ago and is now showing signs of improvement:

SocialSentiment.io, author’s notes

Third, the current depressed momentum may trigger some algo-driven hedge fund strategies to step in once there’s a confirmation of a short-term rebound.

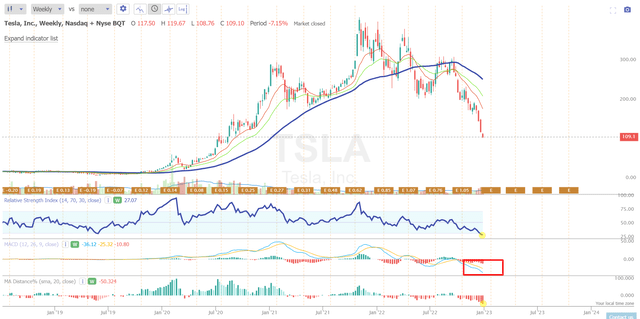

Again, this point cannot be overstated because as we know, many algorithms in quantitative funds are based on looking for oversold/overbought levels, and right now, TSLA stock is at one of the “deepest” oversold levels if you focus on RSI, MA Distance, or MACD:

TrendSpider, TSLA, author’s notes

The last time weekly RSI was this oversold, we saw some pretty vicious snap-back rallies off the lows, according to TrendSpider’s observations. So, I think the algorithms will most likely be looking for signs of a reversal of the current price drop – perhaps the first two points I described above will help them. That’s how the chain reaction may continue.

Fourth, the buy side – those who believe in Tesla’s long-term future – may start accumulating shares after the bad news about reduced production in Shanghai settles. Despite all the negativity surrounding the company in the professional investment management community (think of Michael Burry and others), institutional investors [the buy side] account for 44.20% according to Seeking Alpha – about the same as Toyota Motor (TM) or a bit lower than Ford (F). So despite the poor technical picture of the stock, its current price levels may still encourage some big-money investors to gradually average down their positions.

The sell-side – investment banks and their equity research teams – have already woken up: on December 21, Morgan Stanley published a 9-page report assessing the TSLA stock situation. I propose to dissect the main points from it to better understand the whole bullish reasoning.

Morgan Stanley’s report explains why I’m still not bullish in the medium-term

Adam Jonas, CFA, Evan Silverberg, CFA, CPA, et al. wrote that the erosion of Tesla’s market capitalization by $600 billion in such a short period represents a solid buying opportunity. Here are the key arguments in favor of this thesis straight from the report [paraphrased and enumerated by the author]:

-

With a 0% funding rate, the future seemed much brighter for the EV industry, but now investors are asking uncomfortable questions that few have answers to. Perhaps a better approach would be to look at “dual-path” stories like the one Porsche is trying to achieve with its investment in eFuels

-

Deflationary processes – TSLA’s lowered car prices in China, which are likely to spread to Europe and the United States – are expected to contribute to a new leg of mass adoption of electric cars there, which will help Tesla displace other EV car manufacturers

-

Ford’s “Model E” unit (to be disclosed 1Q 23) will display that legacy EVs are not profitable today

-

Imagine the narrative of tens of billions of dollars of taxpayer funds to help give vertically integrated and high-scale players like Tesla an even greater advantage over high-employing traditional OEMs

-

The most successful strategy in the current macro situation for less capitalized players in the EV sector [i.e. ex-Tesla] would be “hunkering down” [as a way to manage the pace of cash burn]

-

Most likely, General Motors (GM) and Ford will be forced to cut their R&D spending, which now goes mainly to EV development. This will play into Tesla’s hands, as competition in the market will be weaker for longer than currently expected.

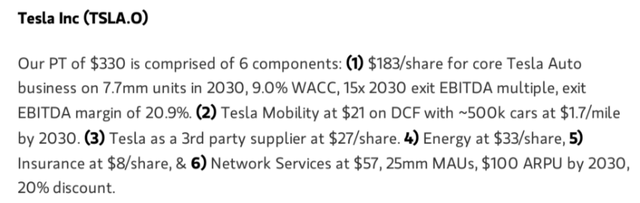

In addition, analysts lowered their previous price target of $350 per share to just $330/share [-5.7%] based on the following assumptions:

In my previous article – “Tesla: Accounting And Valuation Concerns” – I have already presented my reasoned opinion on why MS’s forecasts do not correspond to reality.

While I understand that financial modeling (especially DCF modeling) involves some level of subjectivity, I have concerns about the way Morgan Stanley analysts have calculated the output targets for Tesla.

First off, it seems that the analysts may not have taken into account the fact that the betas of many companies have increased since their previous calls. This is an important factor to consider, as a higher beta generally leads to a higher weighted average cost of capital (WACC). It is possible that they used a three-year coefficient, but this would be selective and may not accurately reflect the current market conditions.

The second factor that seems to be overlooked is the increase in the risk-free rate, which is typically reflected in the yield of 10-year Treasury bonds. This rate has risen from 3.292% on June 15, 2022, to 3.851% at present. The yields on corporate bonds with maturities of 7-10 years have also experienced a significant increase during this time.

The third factor that may not have been taken into account in the WACC calculation is the slowdown in global economic growth, particularly in China, which should have been reflected in the discount rate as an added premium. Since mid-June 2022, the geopolitical situation has worsened, and the International Monetary Fund has revised its forecast for global economic growth downward. This suggests that the premium should have been larger [if it was included in the analysis at all].

Since the end of October, MS analysts have increased the WACC in their assumptions by only 0.3% and decreased the exit EBITDA margin by 0.1% – this has led to a decrease in the resulting “intrinsic” value of Tesla’s Auto Business from $287/share to $183/share [-36.23%]. We also see that the company’s Networks Services business is now worth $57 based on estimates from MS – a drop from $75 when I last evaluated their outputs in early October. And as far as I can see, that’s without changing any of the key assumptions (WACC is probably the only criterion that’s changed).

If such a small increase in WACC leads to such drastic reductions in price targets for the company’s various businesses, it is worth considering the risks of relying on the long-term projections of Morgan Stanley’s analysts, which extend to 2030 and include high growth rates. Any deviation from these rates could potentially cause the model to break down.

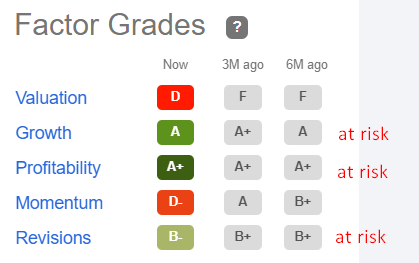

Given all this, I assume that Tesla’s current valuation, even if it has improved a bit, is still too high to explain the risks that have settled over the company like a thundercloud. If profitability is at risk, a 0.1% decline in EBITDA margin projections alone is not enough – that’s why I foresee a deterioration in the company’s profile in FY2023.

Tesla’s SA grades, author’s notes

In the short term, I expect a bounce due to the 4 reasons [above] following Elon Musk’s decision to freeze stock selling for 2 years. This is a strong catalyst, but it cannot save the company from further multiple contractions.

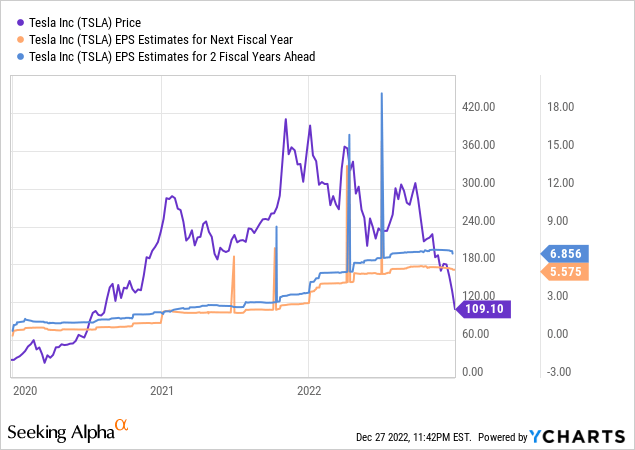

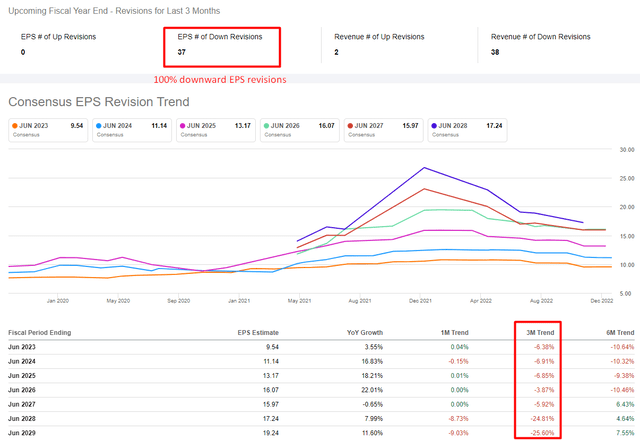

The stock began pricing in another round of EPS downward revisions, which accounted for only 62% of all revisions in the last 90 days, according to Seeking Alpha. Based on the dynamics of the consensus EPS forecasts [next year and 2 years ahead], we see that the current price trend is leading the revisions in a certain way:

Over the last 3 months, consensus EPS estimates for FY2023 and FY2024 are down only 4.45% and 1.9%, respectively. Tesla’s problem, in my opinion, is that the company has become hostage to its “great past,” when Wall Street analysts could simply assign another “buy” rating and sleep soundly knowing that cheap funding, increasing electric vehicle penetration, and Elon’s ingenuity will boost the overall win rate of their recommendations. Maybe I am wrong in this assumption, but I think that’s why Tesla’s downward revisions are so hesitant. Just look at what is happening with Microsoft’s (MSFT) revisions to feel the difference:

Seeking Alpha data, MSFT, author’s notes

Currently, the market is skeptical of Tesla’s bright future and the projections of sell-side analysts, whose models could break down if the implied WACC were to increase by a conditional 100-200 basis points.

So yes, Tesla stock should eventually respond to what Musk said in the short term, but the stock is unlikely to continue that growth in the medium term because the sell-side will look at its chart anyway, no matter how they try to describe everything just from a fundamental analysis perspective. So I expect a drastic deterioration of the revisions and a new part of a gloomy description of the future that will eventually lead to even deeper lows. At that point, we will have to deal with the facts and how the company will achieve its long-term goals of operating growth.

Takeaway

My article moves from positivism to negativism – so I choose to be Neutral on Tesla in the medium term and bullish in the short term. The news that Musk will freeze his stock sales for 1-2 years is a strong catalyst for the market – if this turns true, then TSLA stock could start its next upswing from the current oversold levels (based on RSI and other technical indicators).

Therefore, I would recommend fishing the entry point if you are interested in swing trading, but staying away until the U.S. recession actually starts to assess the impact on Tesla, Inc. if you are a longer-term investor.

Thanks for reading!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSLA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Struggle to navigate the stock market environment?

Beyond the Wall Investing is about active portfolio positioning and finding investment ideas that are hidden from a broad market of investors. We don’t bury our heads in the sand when the market is down – we try to anticipate this in advance and protect ourselves from unnecessary risks accordingly.

Keep your finger on the pulse and have access to the latest and highest-quality analysis of what Wall Street is buying/selling with just one subscription to Beyond the Wall Investing! Now there is a free trial and a special discount of 10% – hurry up!