Summary:

- AbbVie Inc.’s shares dropped last week due to concerns about the erosion of Humira and despite the company beating revenue and EPS expectations.

- Humira’s global sales fell 36% YoY, but AbbVie’s other growth products performed well, leading to overall revenue growth after four consecutive down quarters.

- AbbVie’s long-term growth prospects have improved due to the better-than-expected performance of several key products, the recent acquisition of ImmunoGen and the expected acquisition of Cerevel Therapeutics.

- In today’s article, I analyze the recent developments and AbbVie’s growth prospects and upside potential in the following years.

vzphotos

Shares of AbbVie Inc. (NYSE:ABBV) closed nearly 5% lower after the first quarter earnings announcement last week, despite the company beating revenue and EPS expectations. Apparently, investors are worried about the erosion of Humira and the most recent move by Cigna which will offer a biosimilar version of Humira with no out-of-pocket cost to patients and a deep 85% discount to the branded version AbbVie is still selling. AbbVie has done a great job managing Humira’s loss of exclusivity, but in reality, the company was just delaying the inevitable and I would not be worried about Humira going forward given its ever-declining relevance, the strong performance of growth products, the recent acquisitions, the expected pipeline progress, and the company returning to top-line growth this year.

AbbVie is another in a series of big biopharma initiations for the Growth Stock Forum, with a Buy rating based on an expected return to stronger top and bottom-line growth next year and an improving medium to long-term outlook, driven by Rinvoq, Skyrizi, other growth products in the earlier launch stages such as Epkinly and Elahere, and the Cerevel acquisition which I expect to be one of the more important medium and long-term growth drivers for AbbVie.

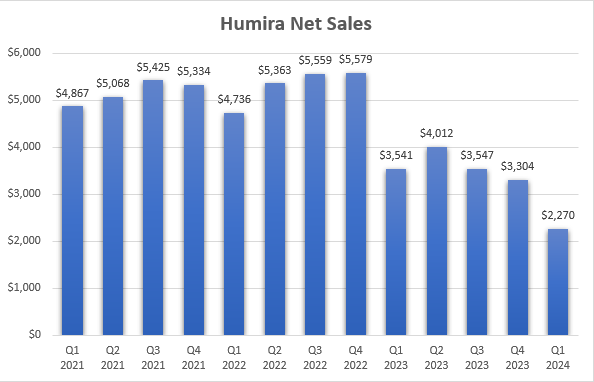

Humira’s performance

I have been watching Humira’s performance since the launch of biosimilars with great interest, and I was very surprised by how well it has been holding up.

Global sales of Humira fell 36% YoY to $2.27 billion, with international sales declining 16% YoY to $499 million and U.S. sales falling 40% to $1.77 billion.

AbbVie earnings reports

Management said on the first quarter earnings call that U.S. erosion in the quarter:

“played out slightly better than our expectations with the vast majority of the impact this quarter driven by price.” They further stated that the recent formulary changes were anticipated in the full year outlook, that prescription volume is tracking in line with their expectations, and that they “anticipate parity access to biosimilars for a significant majority of patient lives this year.”

For the second quarter, the company expects erosion in the U.S. of approximately 32%, reflecting a step-up in volume erosion which will be partially offset by a one-time price benefit associated with the CVS formulary change.

The Cigna biosimilar move I mentioned in the introduction seems to be falling within management expectations for the year, but even if it is not, the rest of the product portfolio is outperforming, and I am not worried about Humira’s performance as its relevance is decreasing rapidly, and the company is doing a good job managing the transition to a post-Humira AbbVie.

Full-year outlook improves, driven by the strong performance of key growth products in the first quarter

You would not know from the share price reaction that AbbVie outperformed expectations in the first quarter and that the full-year outlook has improved.

The $380 million revenue beat brought AbbVie back to YoY growth in the first quarter. Total revenues grew modestly from $12.225 billion in Q1 2023 to $12.31 billion. Looking back, it is quite an accomplishment for the company to go through the erosion of its largest product by experiencing mid- to high-single digit Y/Y declines in revenue growth for four quarters and to return to Y/Y growth despite the continued significant erosion of Humira.

The ex-Humira product portfolio delivered 7%, 12%, 15%, and almost 16% Y/Y growth in the last four quarters. The outperformance was driven by the strong growth of several key products:

- Global net sales of Rinvoq and Skyrizi grew 59% and 48% compared to the same quarter last year, respectively, and nearly made up for Humira’s erosion – the immunology segment’s net sales declined only 4% YoY.

- The oncology segment grew 9% YoY, driven largely by the addition of Elahere and its $64 million contribution following the closing of the Immunogen acquisition, and the recent launch of Epkinly which contributed $27 million in global sales. I should note that this was a partial quarter for Elahere since the acquisition closed in February, and management said on the earnings call that full quarter net sales were $113 million. Venclexta performed well and the erosion of Imbruvica driven by the increased competition in the chronic lymphocytic leukemia market was less than feared, with management expecting further stabilization throughout the rest of 2024.

- The neuroscience segment was the best performer in the first quarter with 15% YoY growth, driven by the strong performance of Vraylar, Ubrelvy and Qulipta.

- The other three segments, aesthetics, eye care, and other products experienced modest YoY declines in net sales.

On the earnings call, management said it expects full-year revenue of approximately $55 billion, an increase of $800 million compared to the guidance provided on the Q4 2023 earnings call. A negative foreign exchange impact of 0.9% is built into the guidance.

The improved outlook is the result of a $200 million increase in the net sales guidance of Skyrizi to $10.7 billion, a $100 million increase for Rinvoq to $5.6 billion, a $200 million increase for Imbruvica to $3.1 billion and Elahere contributing $450 million for the full-year, an increase of roughly $200 million, and it reflects the early closing of the ImmunoGen acquisition in February.

The non-GAAP EPS guidance range was increased from $10.97-$11.17 to $11.13-11.33 and was above the $11.12 consensus at the time of the earnings report.

Overall, the ex-Humira business is performing well, the company will return to topline growth for the full-year after only one down year.

Long-term growth expectations should continue to increase with several upside drivers

Back in February, AbbVie provided an updated long-term guidance for several products and categories. Most of the segments are on track to meet the long-term guidance and the company raised the guidance for Rinvoq, Skyrizi and the oral CGRP franchise (Qulipta and Ubrelvy).

There are several growth products that, I believe, are still underrepresented or not included in the long-term guidance.

In my previous coverage on Genmab, I noted the potential for Epkinly (epcoritamab) and that the currently approved indication in late-line diffuse large B cell lymphoma (“DLBCL”) is just the start, with the two companies running label expansion trials in several hematological malignancies. I expect Epkinly to generate several billion in global peak sales and while the profit split in the U.S. is 50:50, AbbVie gets a much higher share outside the U.S. and will owe Genmab royalties on net sales.

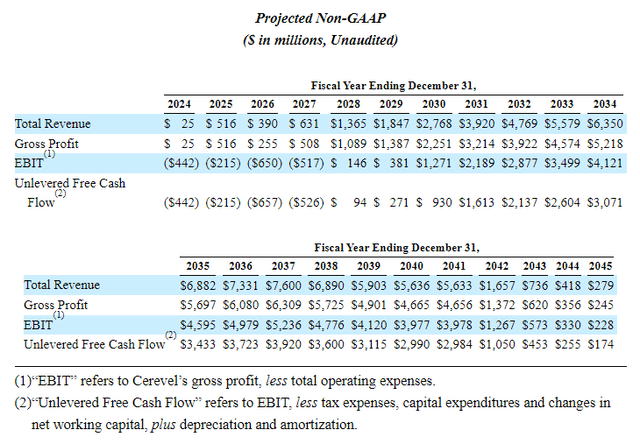

The acquisition of Cerevel is expected to close in mid-2024, and I see Cerevel as one of the most significant contributors to top and bottom-line growth toward the end of the decade and into the 2030s. Emraclidine is by far the most important asset this acquisition brings, and it is a fast follower to Bristol-Myers Squibb’s (BMY) KarXT which it gained through the $14 billion acquisition of Karuna Therapeutics.

KarXT and emraclidine are muscarinic agonists and have demonstrated robust efficacy in clinical trials in schizophrenia patients, and they are considered the next-generation therapies for this sizable population. And the muscarinic class has potential beyond schizophrenia. Both candidates are being evaluated in Alzheimer’s disease psychosis, another large addressable market, and may have potential in other mood disorders. Revenue projections of Cerevel’s management team in the SEC filings following the acquisition announcement go up to $3.9 billion in 2031 and to a peak of $7.6 billion in 2037. These projections include the potential contribution of Cerevel’s other clinical assets, but emraclidine’s contribution is likely the largest.

Cerevel Therapeutics SEC filings

The other assets that Cerevel brings are tavapadon for Parkinson’s disease which recently generated positive phase 3 results, darigabat which is in phase 2 trials for the treatment of epilepsy and panic disorder, and CVL-871 is another phase 2 asset for the treatment of dementia-related apathy. There are also three other earlier stage and preclinical assets in Cerevel’s pipeline.

I am not yet sold on the acquisition of ImmunoGen. Elahere is off to a strong start and it has potential beyond the currently approved indication, but the antibody drug conjugate (‘ADC’) market is evolving rapidly and Elahere could be disrupted sooner rather than later, among others, by Epkinly partner Genmab (GMAB) which has recently acquired a next-generation ADC candidate with the same target as Elahere (see my recent article on Genmab covering the acquisition of Profound Bio).

The upside potential on AbbVie shares is certainly not exceptional, but based on the current expectations, what I see is a relatively high likelihood of expectations trending higher in the medium- and long-term, and the current valuation, I can see AbbVie delivering above-market returns. Said differently, I expect a compounded annual growth rate (including dividends) in the 10-12% range through the rest of the decade.

To achieve this, AbbVie will need to achieve or slightly overachieve its long-term goal of high single-digit topline growth and slightly better bottom-line growth, or, alternatively, we will need to see some multiple expansion to make up for the growth shortfall. This may not be a tough ask because AbbVie investors and traders have spent the last several years, and probably much longer, contemplating the company’s post-Humira future, which is finally here, and I think it is looking better than one could have imagined.

Risks

Further erosion of Humira should be everyone’s base case scenario. But like we saw last week, AbbVie’s share price can still be negatively impacted by Humira news flow.

The company’s financial position is stable, but it had long-term debt of $59 billion at the end of 2023, and it will further increase by $18 billion after the recent closing of the ImmunoGen acquisition and with the upcoming closing of the Cerevel acquisition. However, the debt structure is well-balanced, with more than $33 billion of debt maturing after 2028.

Although it does not look likely, if revenues and cash flows fall short of expectations, the dividend payments and share repurchases may be reduced or suspended. To put this into perspective, the company generated $22 billion in operating cash flow in 2023 and returned nearly $12 billion in cash to shareholders through dividends and share repurchases.

Achieving the long-term revenue and profit growth is the key objective, and the road to get there will not be easy. Most of the markets AbbVie depends on for growth are highly competitive, and the situation will not get better in the future. For example, the irritable bowel disease and dermatology indications that are important for Rinvoq and Skyrizi will only see more competition from new classes of drugs toward the end of the decade, and while the Cerevel acquisition does bring emraclidine as an attractive asset in the muscarinic class, KarXT has the head start and there are also fast followers such as Neurocrine Biosciences (NBIX) with a whole portfolio of muscarinic candidates.

Conclusion

AbbVie Inc.’s post-Humira transition is going better than expected, driven by the strong growth of key products such as Rinvoq and Skyrizi, but also by Humira itself eroding slower than Street expectations. The news flow related to Humira, good or bad, should not lead to significant changes to AbbVie’s long-term outlook and the more important things to focus on are the key marketed growth assets, the closing of the Cerevel acquisition, pipeline progress, and eventually, M&A. And I say eventually because the debt position has increased after the recent acquisitions, and it will take some time for the net debt position to go down.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NBIX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I publish my best ideas and top coverage on the Growth Stock Forum. If you’re interested in finding great growth stocks, with a focus on biotech, consider signing up. We focus on attractive risk/reward situations and track each of our portfolio and watchlist stocks closely. To receive e-mail notifications for my public articles and blogs, please click the follow button. And to go deeper, sign up for a free trial to Growth Stock Forum.