Summary:

- Textron’s Q1 earnings report showed a miss on earnings estimates.

- Revenues for Textron’s aviation and Bell segments increased, while the industrial segment saw a decline.

- Despite the stock price drop, there’s potential for upside and opportunities for investors in Textron stock.

sierrarat/iStock Unreleased via Getty Images

Textron (NYSE:TXT) recently provided its first quarter earnings, and TXT stock dropped to a three-month low in response. In this report, I will analyze the results to detect whether the stock price drop was warranted and determine whether I need to revise my buy rating.

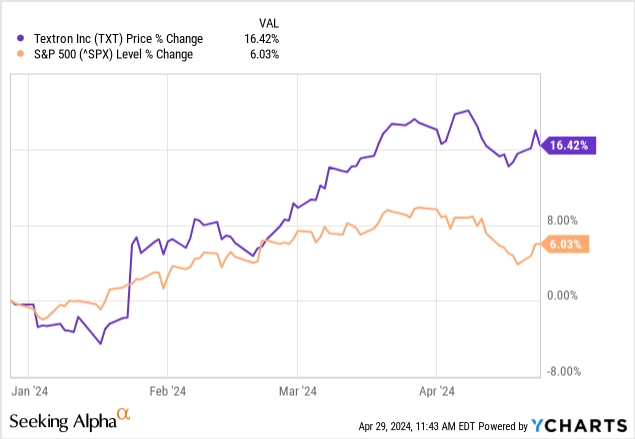

Textron Outperformed Until Its Q1 Earnings Report

In December 2023, I covered Textron posing the question whether Textron stock would go from an underperformer to an outperformer. After the most recent drop in share prices, the answer to that question is “No.” The stock has shown returns in line with market performance, which is 6%-7%. However, before earnings the stock had returned 16.4% while the S&P 500 returned only 6%. One could, however, argue that the stock price had climbed too rapidly as it hit a 52-week high of $97.34 while my price target for 2024 was $92.90.

Textron Misses Q1 2023 Earnings Estimates

Textron reported revenues of $3.13 billion, missing the consensus by $130 million while its core earnings per share of $1.20 missed estimates by $0.03. I would say that the miss was not huge but combined with the stock prices that had run a bit ahead of its valuation and prospects for 2024 a recalibration of the stock price had to happen.

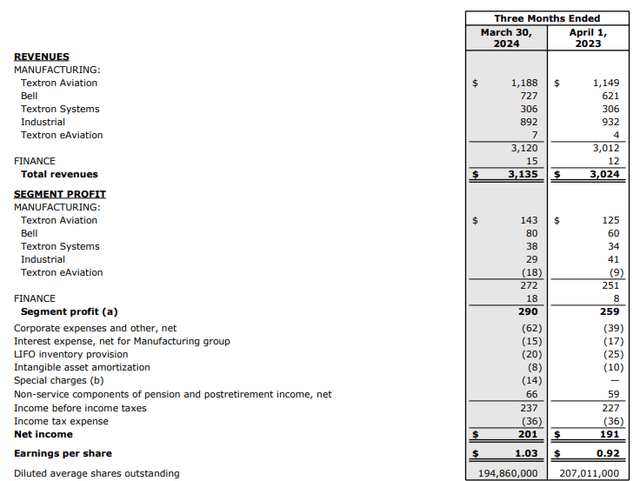

Textron

Textron saw its revenues increase from $3 billion to $3.1 billion, or 3.6% growth. Those are not bad numbers by any stretch, especially for the first quarter which tends to be a bit on the slow side while the aerospace industry is also coping with supply chain challenges. Textron Aviation reported revenues of $1.2 billion, which was up 3.3%. The revenue increase was driven by higher pricing driving revenues higher by $48 million, but partially offset by lower volumes and mix, which would have otherwise generated $9 million in additional revenues. Profits for the segment increased 14%, indicating a margin expansion from 10.9% to 12%.

Bell revenues increased 17.1% to $727 million, reflecting the ramp up of the FLRAA program, while profits jumped by $20 million 33.3% to $80 million, indicating margins of 11% compared to 9.7% in the same period last year, driven by lower research and development costs as well as higher productivity.

Textron Systems revenues were flat year-over-year, but profits expanded from $34 million to $38 million. The only segment of Textron that saw revenues decline was the Industrial segment which saw revenues decline by 4.3% to $892 million, driven by lower volume and mix of $51 million offset by $16 million revenue growth driven by pricing. Segment profit decreased from $41 million to $29 million.

Textron eAviation saw its revenues improve from $4 million to $7 million, but its loss widened from $9 million to $18 million while finance revenues were $7 million up $3 million and profits expanded $10 million to $18 million.

Overall, Textron profit jumped 12% on 3.6% revenue growth. Even an earnings miss of $0.03 per share is not huge as it’s just $5.8 million on the income line and can quite easily be explained by widening losses as Textron eAviation, which is Textron’s smallest segment, or in other words, it should barely move the needle.

The operating earnings are strong and to me don’t provide a strong reason for the sell-off other than Textron stock having run up quite significantly. When a stock price goes up quite a bit, even the smallest miss on earnings becomes a pain point.

Textron Sees Industrial Softness, Expands Restructuring Plan

I believe that the reason for Textron stock to have tumbled is the softness in the Industrial segment. The automotive part of the segment is pretty stable, but personal transportation vehicles sales were softer than expected. As a result, the company is expanding its previously announced restructuring of $115 million to $135 million to $165 million to $170 million.

So, that points at some continued softness and softening expected ahead and we already saw the results at the Industrial segment slide, so there likely is the fear that the margins are a bit under pressure dragged down by the Industrial segment. Furthermore, the margins at Bell might not be recurring as the results in Q1 were boosted by a settlement of a lawsuit. Margins expanded the ramp up on the FLRAA program, which is in the low margin EMD phase and will provide a margin pressure despite the strong margin expansion during the quarter. So, at Bell, Textron is balancing strong performance with the dilutive impact that the FLRAA program ramp up will have in the years to come and that obviously does pose some questions on where the margins will stabilize.

The good news is that the company now sees $185 million in restructuring savings. Previously, this amount was $75 million, mostly related to asset impairment, but the savings have now gone up as there’s more headcount reductions to right size the company for the soft Industrial demand and the shutdown of the Shadow and FARA programs.

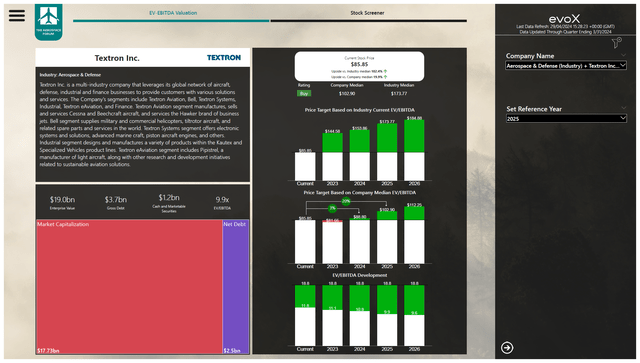

Textron Stock Has Upside

The Aerospace Forum

I processed the Textron balance sheet and forward projections into my stock screener to parse a price target. My price target for 2024 has dropped from $92.90 to $88.80. So, perhaps it’s not that odd that we saw the significant sell off in Textron stock. However, when allowing the stock to trade with earnings one year ahead priced in, we get roughly 20% upside with a $103 price target. As a result, I’m maintaining my buy rating for Textron stock.

Conclusion: Textron Stock Price Crash Provides Opportunities

I believe that the Q1 2023 earnings were not bad. They actually came in quite strong in many segments. But the realities of the Industrial segment radiated and gave investors an exit point as share prices had increased quite significantly beyond the 2024 valuation. However, as we price in 2025 earnings, I believe that the current price levels provide a compelling entry point as the stock price is discounted compared to 2024 price targets and significant upside exists compared to the 2025 projections. Furthermore, the company is significantly undervalued compared to its peer group, leading me to believe that my projected price targets are somewhat conservative.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.