Summary:

- Very strong US consumer spending in March helped domestic retailers, but we’ll know more in a few weeks when major consumer companies report Q1 numbers.

- I am downgrading shares of Target from a buy to a hold based on valuation trends.

- Heading into earnings, comp-store sales growth will be in focus along with the margins story.

- I highlight key price levels to watch over the coming months.

JHVEPhoto/iStock Editorial via Getty Images

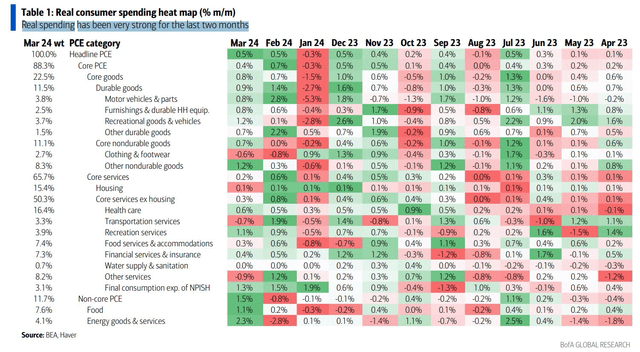

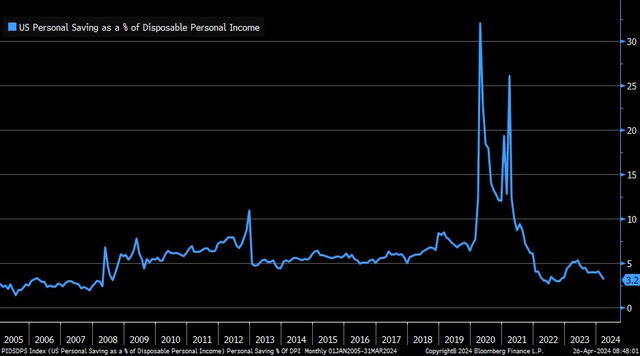

There seems to be no quit in the consumer. According to data from the US Bureau of Economic Analysis, retail spending was very strong in March. It was a gangbuster Retail Sales report, and last week’s PCE data revealed that the aggregate US Personal Saving Rate has dipped to just 3.2%, the lowest since October 2022.

It’s apparent that while inflation is still a concern, workers remain confident in their ability to hold a job or seek new employment with a higher income. We’ll find out more in a few weeks when major retailers report Q1 results.

I am downgrading shares of Target (NYSE:TGT) from a buy to a hold. After a stellar recovery from Q4 last year, I see the stock now close to fair value, and the uptrend has paused at a key level on the chart.

Very Strong US Consumer Spending in March

BofA Global Research

US Personal Saving Rate Drops to 3.2% as Spending Jumps

Liz Ann Sonders

According to Bank of America Global Research, Target Corporation is one of the largest discount retailers in the US, operating roughly 1,900 Target stores across the US. The company sells merchandise in its Signature Categories Style, Baby, Kids, and Wellness as well as other products in both physical Target stores and online at Target.com.

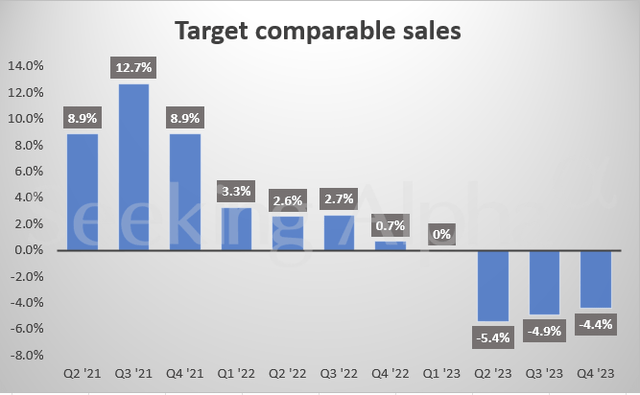

Back in March, Target issued a very strong earnings report. Q4 non-GAAP EPS verified at $2.98, beating the Wall Street consensus forecast by $0.56. Revenue of $31.9 billion was up just 2% from the same period a year earlier and fell shy of estimates. But the broader story of the Minneapolis-based retailer returning to glory appeared on track as it seeks to drive improved sales, traffic, and market share. Comp-store sales growth was negative from Q2 through Q4 last year, but the declines were better sequentially as the year progressed.

Management Hopes to Improve Comp-Store Sales Growth This Year

Seeking Alpha

Gross margin improvement is the focus amid efficiency efforts, including cost-cutting. The management team hopes to hit an EPS target range of $8.60 to $9.60 this year with better operating margins, perhaps in the mid-single digits. Its new subscription-based membership program could help deliver that, and all eyes and ears will be on the upcoming quarterly report and conference call regarding plans for the service that aims at retail rivals Amazon (AMZN) and Walmart (WMT).

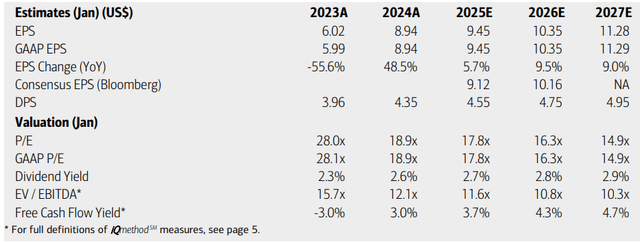

On valuation, analysts at BofA see earnings rising by just 6% this year after a strong EPS recovery last year. Per-share profits are expected to accelerate to a 10% clip in the out year, with continued healthy gains by FY 2027. The current consensus estimates via Seeking Alpha reveal a similar EPS trajectory, with per-share operating earnings climbing toward $11.50 by ‘27. Top-line trends are less sanguine, however, ranging from 0 to 4%.

Dividends, meanwhile, are set to rise at a pace of $0.20 annually, making for a yield that is still significantly above that of the S&P 500. With a modest EV/EBITDA multiple and solid free cash flow, the fundamentals still appear sound with Target.

Target: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

BofA Global Research

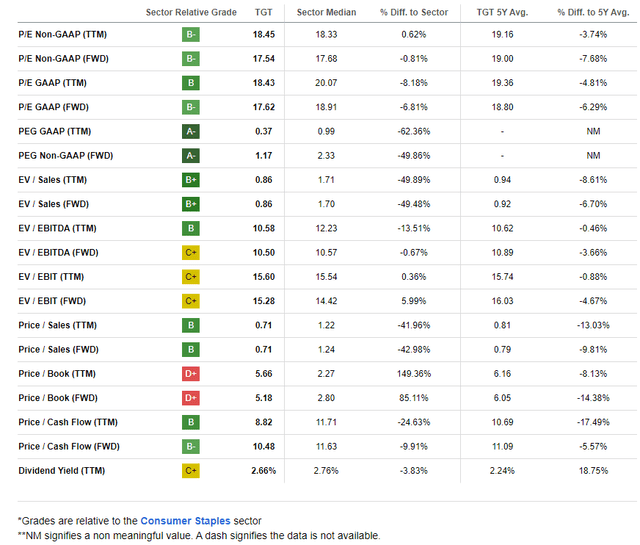

TGT has returned closer to its 5-year average price-to-earnings ratio. If we assume $9.80 in operating EPS over the coming 12 months and apply a 17 multiple, then shares should be near $167. While that is a significant increase from my fair value estimate back in October last year, it puts TGT about properly priced. The firm’s forward non-GAAP PEG ratio remains attractive, though.

Target: Shares Closer to the Long-Term P/E

Seeking Alpha

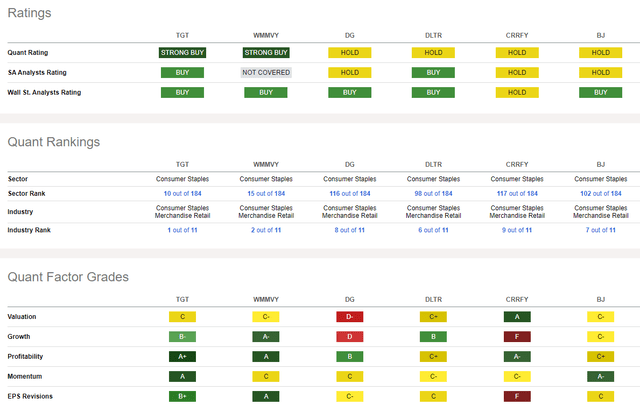

Compared to its peers, TGT features a mixed valuation grade – weaker than six months ago. But its growth profile is a notch better, given a pair of strong earnings beats most recently.

With robust profitability trends and solid share-price momentum, it’s not surprising to see many more sellside EPS upgrades in the last three months compared to downgrades. Target is now ranked no. 1 in its industry, per Seeking Alpha’s Quant Ranking.

Competitor Analysis

Seeking Alpha

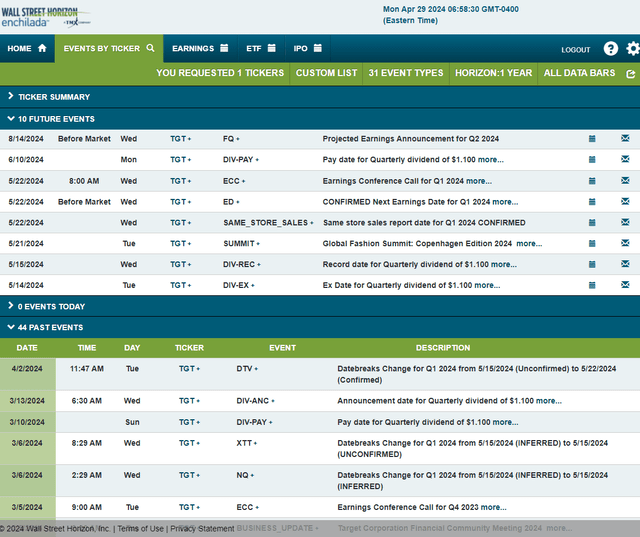

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q1 earnings date of Wednesday, May 22 BMO with a conference call immediately after the numbers are released. You can listen live here.

Before that, shares trade ex a $1.10 dividend on May 14 and Target’s management team is slated to present at the Global Fashion Summit: Copenhagen Edition 2024 in Denmark from May 21 to 23.

Corporate Event Risk Calendar

Wall Street Horizon

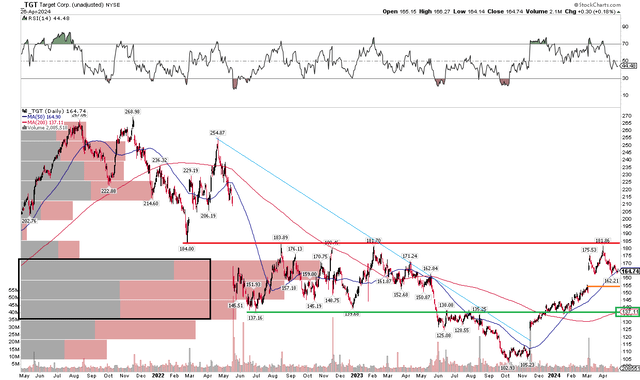

The Technical Take

With this big winner having achieved fair value and with quarterly earnings on the horizon, the technical situation has turned less conducive to the upside. Notice in the chart below that shares tagged key resistance that I pointed out last October. TGT touched $180 and then fell back toward a major gap from early March. What is impressive, though, is that the bulls managed to defend the stock, not allowing the bears to take shares into the gap very much. Still, I would not be surprised to see TGT fill the gap down to about the $155 level.

But also take a look at the rising long-term 200-day moving average. It’s way down at $137, so TGT got extended a bit from the broader trend. As it stands, TGT’s RSI momentum oscillator at the top of the graph dipped to about the weakest mark since last November, further indicating that a pause may persist as we head into the earnings date. I see solid long-term support in the $137 to $140 zone, but I would be surprised to see the stock fall that much.

Overall, TGT confirmed the breakout from a downtrend, and while a consolidation appears likely in my view, the next move is probably higher should the stock can climb above the low $180s.

Target: Shares Pause At Key Resistance, $140 Support

Stockcharts.com

The Bottom Line

I am downgrading TGT based on valuation. The EPS recovery story remains intact, while the technicals auger for a consolidation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.