Summary:

- Thermo Fisher is expected to have near zero revenue and earnings growth in 2024 despite the decline in COVID-19 testing revenue being now immaterial.

- Renewed funding of biotech startups and stimulus in China should help revive growth in the short term.

- In the long term, the growth thesis for TMO’s business is still intact, with growing demand from healthcare as well as semiconductor and battery manufacturing.

- Thermo Fisher stock price is near my fair value estimate. While Thermo is a great company, I downgraded the stock to Hold.

Monty Rakusen/DigitalVision via Getty Images

On Track For A Flat Year

When I last covered Thermo Fisher Scientific (NYSE:TMO) in October 2023, the company had just announced its planned acquisition of Swedish proteomics company Olink (OLK). As I discussed in that article, this deal is typical of Thermo’s successful M&A-focused growth strategy, but nothing particularly transformative. Nevertheless, I maintained a Buy rating on Thermo stock, as it was trading at $467.26, below the $500-$600 range in which it has spent most of the time since mid-2021.

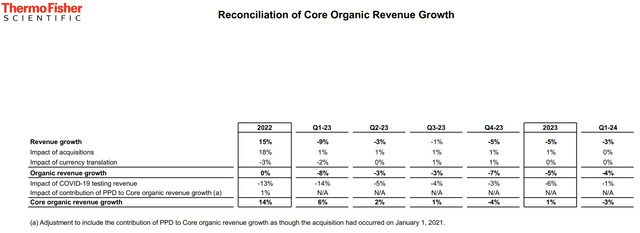

Since then, the share price is up nearly 23%. The main theme for Thermo Fisher this decade has been the supercharged growth spurt from 2020 to 2022 fueled by COVID-19 diagnostic and testing products, followed by the inevitable headwinds from this demand falling off. The good news from Q1 2024 results is that the negative impact of this COVID-19 testing revenue decline is down to 1% of total sales. Going forward, this should be a negligible factor for the company and there will be no need to break it out in the results. The bad news is that even outside of the COVID-19 testing decline headwind, Thermo is greatly lagging its long-term growth targets. Core organic revenue growth has been negative for the last couple of quarters.

With the Olink deal not set to close until midyear, there has not been much inorganic growth either. Thermo updated their sales guidance for 2024 to $42.3 to $43.3 billion, zero growth from the 2023 actual of $42.9 billion. The company also updated its EPS guidance to a range of $21.14 to $22.02, also flat compared to the 2023 actual of $21.55 (non-GAAP).

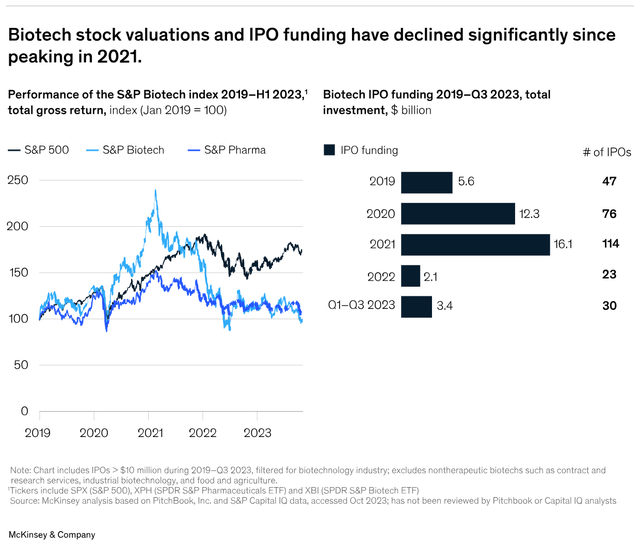

Longer-term, Thermo is targeting 7% to 9% organic growth. EPS growth should be higher than this due to margin improvement and share buybacks. Unfortunately, Thermo has not been hitting these targets due to economic constraints affecting some of their customers particularly hard. First off, funding for biotech startups dropped considerably since 2021. In that year, there were 114 biotech IPOs raising $16.1 billion. This dropped over 80% in 2022 and did not recover much in 2023. Earlier stage venture capital funding has also been in decline, although it remained above pre-2020 levels.

Also, China has been a key growth market for Thermo Fisher; however, demand has fallen off due to a slowing economy and an anti-corruption campaign.

The good news is that on the Q1 earnings call, Thermo expressed optimism that these factors were improving. Beyond this, underlying demand for analytical instruments, diagnostics, and lab products and services continues to exhibit secular growth, and Thermo should continue to capture an outsize share of this growth due to their scale and proven ability to integrate acquisitions.

As we see from the share price performance over the past 6 months, investors seem to be buying into the long-term thesis despite the lack of growth this year. While I don’t see anything to disprove the long-term growth case, the share price of $573.60 appears to price in the planned long-term growth. While Thermo remains a great company, the price is fair, and the stock is now a Hold.

Growth Drivers

Funding for biotech startups has turned up in Q1 2024. This is mentioned several times on the earnings call. This is corroborated by other reports showing that biotech startups drew $2.9 billion of funding in Q1, up 161% from Q1 2023. China may also be turning around due to the latest fiscal stimulus plan. This is bigger than previous programs, more focused on key industries, and spread out over a longer time. As Thermo Fisher CEO Marc Casper mentioned on the call,

It’s a multiyear program as opposed to the last one, which was shorter term. So, basically, the government is signaling at least to the economy that they’re looking for investments in instrumentation equipment, technological advances, advanced research. So, that’s very encouraging in terms of that it’s not a short-term program, but rather longer term.

One risk to the China recovery that analysts asked about on the call was the Biosecure Act. This proposed legislation would prohibit US government agencies from buying products or service from specific Chinese biotech companies, or from making loans or grants to other entities to do so. Therefore, I do not see much direct impact on Thermo Fisher, who is a seller of products into China. Indirectly, if China were to retaliate by blocking imports of US products, it could be an issue, assuming China has the capability of making these products internally.

Longer-term, the growth thesis appears to be intact. Thermo sees a total addressable market of $240 billion, of which they currently have about 18% share. The company sees this market growing by 4-6% per year, however Thermo plans to capture share and grow sales 7-9%.

Thermo Fisher listed 3 trends driving this growth in their latest investor presentation.

The first trend is reducing the time and cost of commercializing therapeutics. The typical time required to develop a drug from the discovery and development stage to government approval is around 9 years. Thermo’s oldest business, the Analytical Instruments segment, is essential in the early stages, particularly mass spectrometry and chromatography. These technologies have been around for over a century, but are still useful today for characterizing and quantifying specific molecules. Thermo’s more recent acquisitions in the Lab Products and Services segment are more geared toward later phases of research and development. These include PPD, a contract research organization (CRO), and Patheon, a contract development and manufacturing organization. CROs manage all or parts of clinical trials, while CDMOs also support manufacturing, packaging, supply chain management, and quality control.

The second trend of “precision medicine” refers to Thermo Fisher’s Specialty Diagnostics segment. This segment is used in allergy and autoimmune disease detection, transplant patient and donor matching, food safety testing, and other applications. The most recent acquisition of The Binding Site in 2023 help with early diagnosis and management of multiple myeloma, a form of blood cancer.

The third trend of “advanced materials” highlights that Thermo Fisher is not exclusively a healthcare company. The Analytical Instruments segment also includes electron microscopy, used in semiconductor manufacturing inspection, where distances are measured in nanometers. Electron microscopes also have applications in lithium-ion battery research.

All these secular trends should be long-term drivers of growth for Thermo Fisher, despite the current slowdown. Thermo also expects to take share and grow faster than the market because of its size and scale. The company’s involvement with all stages of the R&D process makes it a “one-stop-shop” for all its customers’ needs.

Financial Model Update

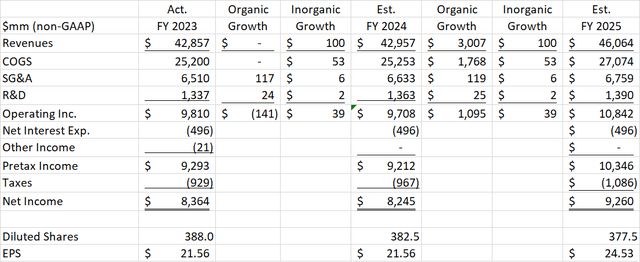

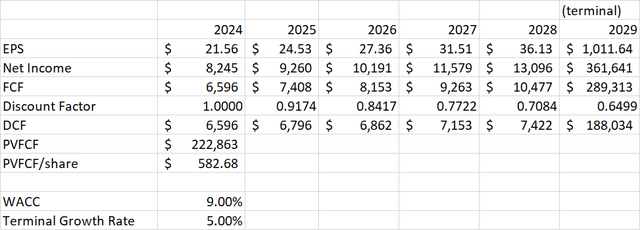

I updated my model from the October 2023 article with 2023 actuals and the latest guidance for 2024. Olink is expected to add $200 million per year of sales. With the deal closing at midyear, I am showing half the benefit in 2024 and the rest in 2025. Organic sales growth is zero in 2024 and 7% in 2025, the low end of Thermo’s long-term growth plan. I am using a non-GAAP effective tax rate of 10.5% based on company guidance for this 2024. The company already bought back 5 million shares this year, and I am assuming the same rate going forward.

The resulting EPS estimate for 2024 comes out exactly unchanged at $21.56. For 2025, I estimate EPS of $24.53, growth of 13.8% and about 0.5% above analyst consensus.

Valuation

I updated last year’s DCF analysis with the latest weighted average cost of capital from Finbox.com, which uses a WACC of 9%. This is higher than the WACC used in the last article, as risk-free rate and beta have increased since then. I am now using analyst consensus EPS values through 2028. I have increased the terminal growth rate assumption to 5%. Recent history on free cash flow conversion still shows the company averaging FCF around 80% non-GAAP income. I use this to translate EPS projections into future free cash flows.

The resulting valuation is $582.68 per share. This up from last year’s value, largely because of the higher terminal growth rate assumption. Terminal Growth Rate remains a major driver of the DCF result. If I lower it to 4%, the value drops to $484.35.

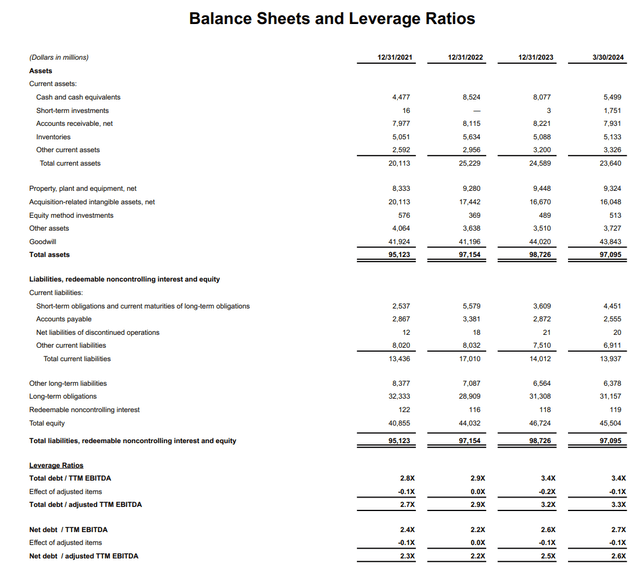

Capital Management

Thermo Fisher has grown debt over the years, but has maintained a reasonable net debt/EBITDA leverage, using some of its free cash flow to pay down debt after big acquisitions, as EBITDA increases. Since the last article, net debt/EBITDA has declined to 2.6 times from 2.9 as the company generated free cash flow but has not yet paid for the Olink acquisition. This will consume about $3.1 billion of cash and will take net debt/EBITDA back to 2.9.

Thermo has an attractive average interest rate on its debt, around 4.1.%. The company continues to issue debt in various foreign currencies, including yen, euros, and Swiss francs. These notes have lower interest rates than dollar denominated issues of similar maturity but do carry the risk of costing more to pay off at maturity if the dollar weakens. Thermo now has $4.5 billion of debt due in the next 4 quarters. The company currently expects free cash flow of $6.75 billion this year. I expect the cash needed for the Olink deal to come out of cash and investments already on the balance sheet. The tiny $0.39 quarterly dividend will consume just $0.6 billion of cash, so the company can pay off its debt with free cash flow and have some left over for 2025 buybacks or additional M&A.

Conclusion

Thermo Fisher is experiencing a slow year in 2024 with no earnings growth. The good news is that headwinds from declining COVID-19 sales are now gone, as these are now a negligible percentage of total sales. Also, the good news is that funding of new biotech companies has picked up and China has introduced a stimulus program targeted toward spending in areas Thermo serves. The long-term growth drivers are intact, and Thermo can capture an outsize portion of this growth due to its size and scale. The company has done well with its M&A focused growth strategy over time, consistently able to integrate new deals and keep leverage at a manageable level.

The only problem with the stock is that this growth appears to be priced in. My DCF analysis, which assumes earnings growing at 13% per year through 2029 and 5% thereafter, values the company at $582.68. This is less than 2% above the share price. Thermo Fisher is a great company, but with this reduced margin of safety, I have to downgrade the stock to a Hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TMO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.