Summary:

- Tesla has seen an accelerating decline in December with the stock losing 42%.

- Other controversies surrounding Elon Musk have created negative sentiment overhang, resulting in a soaring short interest for Tesla.

- However, Tesla has a very attractive valuation and risk profile right now.

jetcityimage

A unique buying opportunity has revealed itself for shares of electric vehicle company Tesla (NASDAQ:TSLA) which experienced an intensifying sell-off in December that is putting Tesla on track to its worst month ever. After Tesla lost more than $800B in market cap this year and controversy mounted over Elon Musk’s time-consuming involvement with Twitter/stock sales, I believe the risk profile and the valuation are at their most attractive points in years. Considering that China’s economy is reopening and that Tesla has the most mature footprint in the EV industry, I believe the valuation drop and negative sentiment overhang make Tesla very compelling as a long-term EV investment.

Tesla is ending a terrible year with its worst monthly performance ever

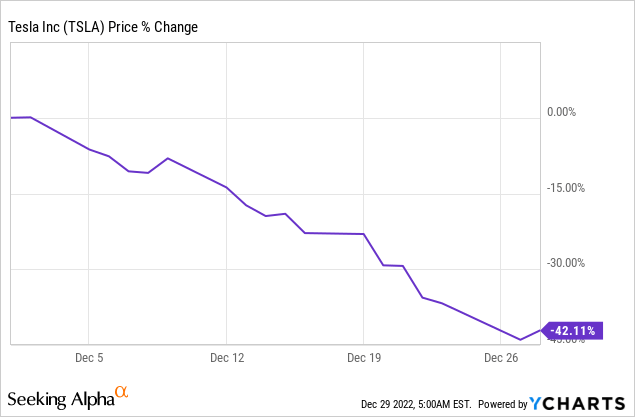

Tesla is ending FY 2022 with massive valuation losses that have yielded enormous windfall profits for short sellers that bet against the electric vehicle company at the beginning of the year. Tesla’s shares have experienced a bloodbath this year, losing 68% YTD and 42% so far this month, making December 2022 potentially the worst month for the electric vehicle company ever.

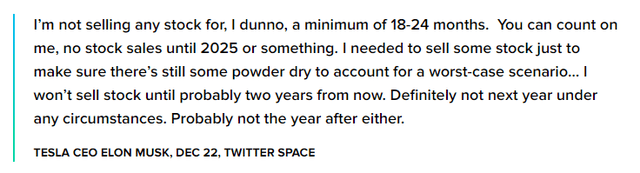

Controversies are weighing on Tesla’s valuation, soaring short interest

There are multiple controversies that played a role in Tesla’s stock plunge, including the extraordinary amount of time Elon Musk spends on Twitter, COVID-19 lockdowns in China that interrupted the ramp of Tesla’s Model 3 and Model Y as well as his unprecedented sales of Tesla stock in order to finance the acquisition of Twitter. According to a disclosure made on December 14, 2022, Elon Musk recently sold 22M shares of Tesla between December 12 and December 14, resulting in transaction proceeds of $3.6B. Although Elon Musk later said on Twitter Spaces that he won’t sell any more shares over the next 18-24 months, investors don’t seem to believe it, at least for now.

Additionally, a big problem for Tesla has been that short sellers took advantage of Tesla’s downfall in December which resulted in a soaring short interest ratio for shares of Tesla. Soaring short interest, in my opinion, could also be seen as a contrarian indicator.

But putting all this noise aside, I believe investors that focus on Tesla’s achievements in the EV industry and potential for long-term growth actually get really good value now.

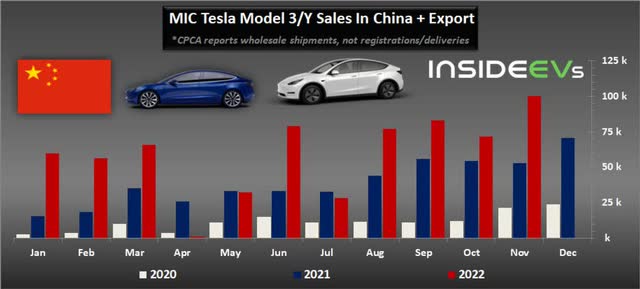

Tesla’s factory output in China recovered and reached a fresh high

After multiple production setbacks in FY 2022 due to factory lockdowns in China, production and deliveries at Tesla’s Shanghai Gigafactory are ramping up rapidly. Tesla delivered 100,291 electric vehicles in November, showing 90% year-over-year growth. It was also a new 4-month reopening high for Tesla and it is an achievement the electric vehicle company can build on in the coming months. With about 100,000 electric vehicles produced in November, Tesla could achieve a 1.2M production volume in FY 2023, but potentially much more as I expect a ramp in production after the Gigafactory in Shanghai reopens after the Chinese New Year. The new delivery record is good news for investors, chiefly because the market ignored it and seems overly obsessed with other non-production related factors surrounding Tesla. A contrarian indicator, perhaps? I think so!

The broad reopening of the Chinese economy and the easing of COVID-19 restrictions could be a catalyst for Tesla’s growth in deliveries, but the real reason to buy Tesla, I believe, is the valuation: after a near-70% drawdown in the firm’s valuation this year, Tesla is actually compellingly cheap, at least based off of its historical standard.

Is Tesla’s unprecedented price drop alone a reason to buy the shares?

The 42% decline in Tesla’s valuation in December and 68% decline in 2022 has reduced a lot of the premium that was built into the EV firm’s valuation in the past. Since Tesla was punished for a variety of factors that were totally unrelated to Tesla’s execution (Twitter distraction, stock sales) or of only temporary nature, such as China’s factory lockdowns, I believe Tesla is currently extremely attractively valued based on a variety of metrics.

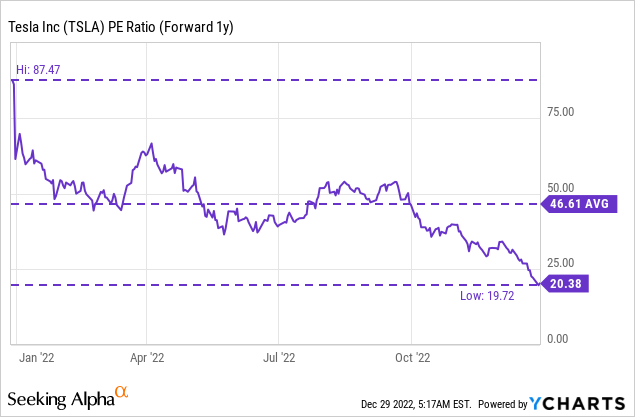

Tesla is the leading EV company in the world (based on output and revenues) and is currently trading at a forward P/E ratio of 20.4x and that’s despite Tesla being projected to generate 34% year-over-year EPS growth in FY 2023. Compared against its historical valuation, Tesla is a bargain with its P/E ratio trading more than 50% below its 1-year average P/E ratio of 46.6x.

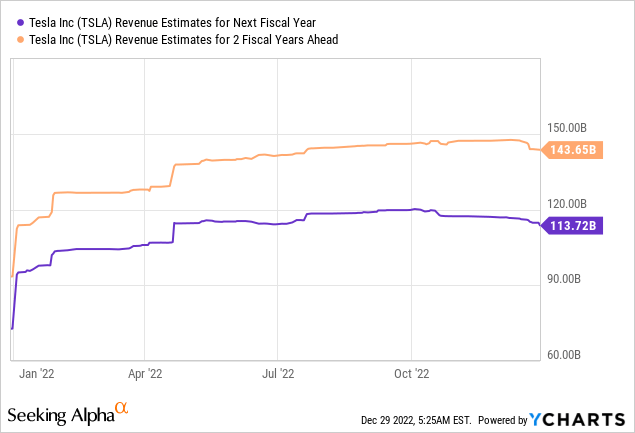

Given the expected launch of the Cybertruck next year and a continual recovery in China-based production volumes, I believe a change in investor sentiment could also drive an upwards revaluation of Tesla’s revenue estimates. The trend for Tesla’s revenue estimates was generally a positive one in FY 2022, despite production limitations and other distractions. According to Seeking Alpha-provided estimates, Tesla is expected to grow its revenues 37% in FY 2023 and 26% in FY 2024, with the Cybertruck expected to make its first revenue contributions in the second half of next year. I believe that Tesla could deliver 80-90 thousand Cybertrucks in FY 2023 before ramping deliveries up to 200 thousand by FY 2024.

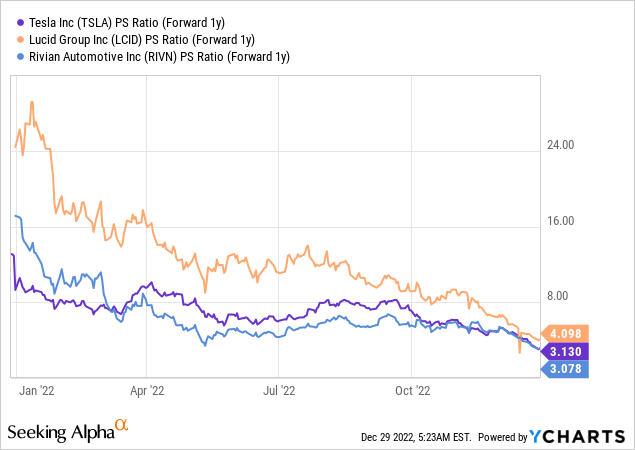

Based off of revenues, Tesla is also looking increasingly attractive with the firm’s revenue potential now being cheaper than that of Lucid Group (LCID), despite Tesla already delivering millions of cars to customers.

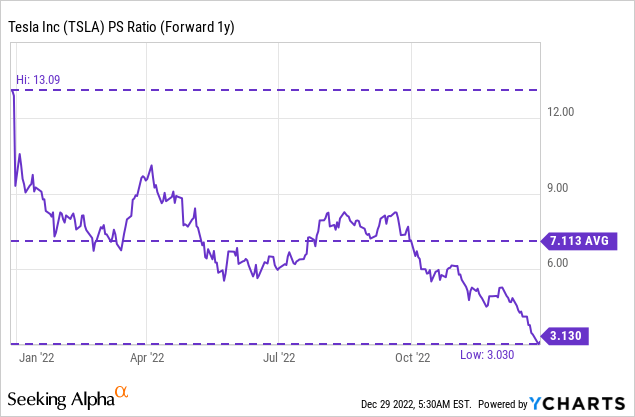

Right now, Tesla’s forward P/S ratio is 56% below its 1-year average P/S ratio. Almost all of the under-performance relative to the 1-year P/S average has occurred since the end of October.

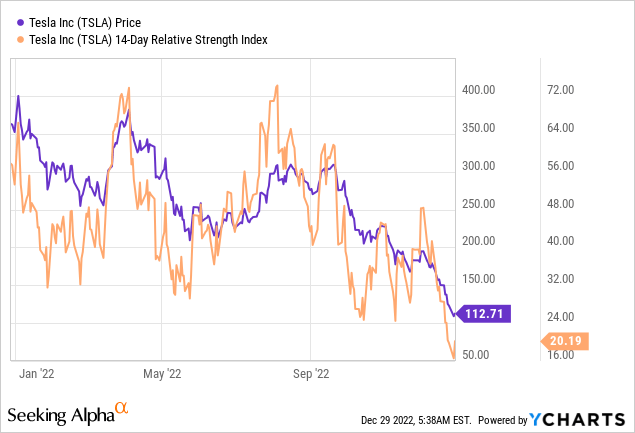

Tesla is oversold

What makes Tesla especially attractive, I believe, is the technical sentiment reflected in the Relative Strength Index. Tesla has become widely oversold based on this index lately and shows a value of 20.2. Tesla hasn’t been this technically oversold in at least a year. While I don’t decide how and where to invest based on RSI, it can be seen as a contrarian indicator (in connection with Tesla’s soaring short interest).

Risks with Tesla

There are many risks with Tesla including the possibility of further stock sales on the part of Elon Musk which could further depress Tesla’s share price, but likely only in the near term as the recovery in Tesla’s China production is a strong catalyst for delivery growth in FY 2023. Additionally, Tesla’s short interest may remain high in the short term as bears seek to exploit Tesla’s draw-down to the fullest. In the longer term, however, real economic concerns should take precedence for Tesla investors and I definitely see pricing and demand risks here for the electric vehicle sector. EV companies may see compressing vehicle margins as inflation continues to pressure consumers and higher raw material/battery costs represent a challenge as well. Since Tesla has the most mature production footprint in the sector, I believe Tesla is in the best position to deal with such risks.

Final thoughts

Tesla had a terrible December with the price of the EV firm’s shares dropping 42% so far this month and December 2022 will likely end as the worst month for Tesla’s shares ever. There are reasons for the decline in Tesla’s market cap, but none, I believe, are related to either Tesla’s execution or Tesla’s growth prospects. The fact that Tesla’s short interest has soared in December and short sellers piled on the EV company, resulting in oversold technical sentiment, is actually the precise reason why I like Tesla more than ever.

The market has become too fearful of Tesla due to a series of unfavorable news, but I believe all of the factors discussed here (Twitter, stock sales, production setbacks) are transitory and Tesla could soon be able to recover from this unprecedented sell-off, especially if the market’s focus returns to Tesla’s improving delivery growth and a reopening Chinese economy. Since the shares have a very attractive valuation and the best risk profile in years, I believe investors should lean into the fear and buy the bloodbath!

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.