Tesla: After Sitting On The Sidelines For Years, I’m Finally Diving In

Summary:

- Tesla has been a lightning rod for negative criticism this year, driven by Elon Musk’s purchase of Twitter as well as a dour outlook for car sales.

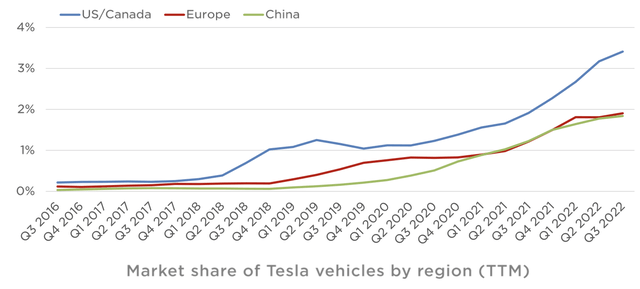

- The company has been boosting production, and its market share continues to be growing quickly with low overall penetration.

- Tesla is logging positive adjusted EBITDA and can be appropriately valued on forward earnings.

- Looking ahead long-term, Tesla will continue to gain market share in hardware while also expanding software and adjacent services.

Spencer Platt

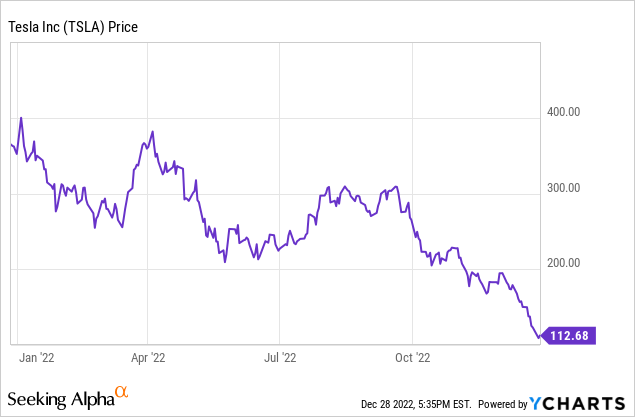

Perhaps one stock has made more headlines than any other over the past month: Tesla (NASDAQ:TSLA). The EV giant has been a true lightning rod for sharp criticism recently, owing to Elon Musk-related drama especially over his sale of Tesla shares and his purchase of Twitter.

Amid this backdrop, shares of Tesla are down more than 70% this year, wiping off hundreds of billions in market value. And while I don’t disagree that there was plenty of “fluff” and overhyped expectations for Tesla during its pandemic peaks, we have to ask ourselves the question: how far is too far?

I have long been wary of Tesla and stayed on the sidelines for this stock, preferring to invest my tech portfolio primarily in software and internet names. After observing the stock’s sharp drops in the last quarter of 2022, and catching up on the company’s actual fundamental performance – I’m finally willing to be bullish and buy into this name.

Here are the reasons why.

Tesla production is on the uptick, and finally getting closer to catching up with demand – right as federal incentives are about to get sweeter

If you tried to buy a Tesla earlier in the year, especially the popular lower-end Model 3 or Model Ys, your lead-time quote would extend out three or four months. Now, local inventory is available and some models are available for immediate delivery.

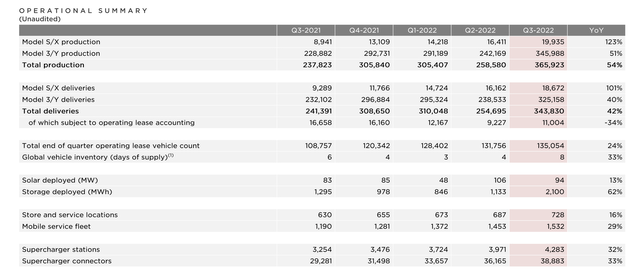

In Tesla’s most recent quarter, the company boosted vehicle production to 366K units – up 54% y/y.

Tesla quarterly production and deliveries (Tesla Q3 investor presentation)

Tesla is finally catching up to its backlog and increased production was the primary driver behind 56% y/y revenue growth to $21.5 billion in revenue for the third quarter.

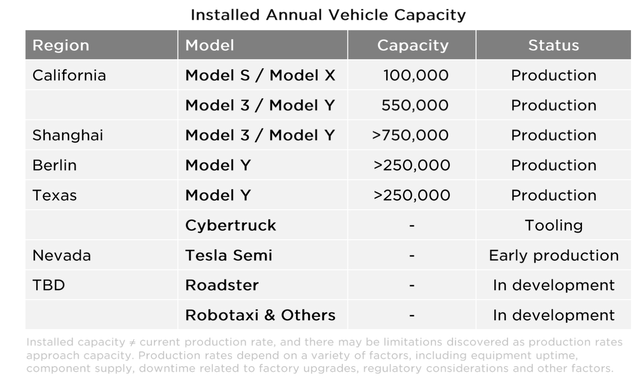

We note as well that Tesla’s current installed capacity is capable of supporting north of 1.9 million annual units (versus ~1.46 million clip rate using the 366K vehicles that Tesla produced in Q3). As global supply constraints soften and Tesla is able to bring actual production closer to installed capacity (not to mention other facilities in earlier stages of testing and tooling), the company still has more room to grow.

Tesla production capacity (Tesla Q3 investor presentation)

Tesla market share is still very low

The ex-skeptic in me would say this: okay, Tesla is finally catching up to demand, but isn’t that also due to the fact that demand is lower? There’s no doubt that current macro headwinds have many consumers delaying their car purchases, especially pricey purchases like Teslas.

However, we note one caveat here: The federal government is set to retire the 200k vehicle EV credit cap in 2023. Details on this program are still forthcoming early next year, but it’s highly likely that Tesla buyers will be able to secure the $7,500 tax break once again.

Right now, Tesla is offering a $7,500 discount on most models for buyers taking delivery of their vehicles before year-end. Most industry watchers have viewed this as a sign of demand softness for Tesla, but in my view, Tesla is just trying to front-run the coming tax break and encouraging buyers not to wait for the credit to come back in 2023. This, to me, is a temporary incentive to prevent Tesla from taking on too much unsold inventory by year-end.

Once the federal government offers more clarity around these credits, I believe there will be a lot of backlogged buyers who will start placing their Tesla orders.

When we look ahead to the long term, I see abundant opportunity for Tesla – especially as prominent national and local governments issue more EV-related edicts (California, for example, instituting a 100% EV sales goal by 2035 will pressure many other localities into enacting similar rules).

At present, Tesla’s market share has barely cracked 3% in the U.S. and Canada, and is below 2% in Europe and China (held back, in no small part, by the supply constraints and extremely extended lead times that dominated most of 2020-2022).

Tesla market share (Tesla Q3 investor presentation)

Annual vehicle sales total roughly ~66 million units worldwide. If we assume a round market share number like 10% and believe that Tesla can eventually sell a steady-state of 6.6 million units annually, assuming no growth on the company’s current quarter ASP of ~$54K ($18.7 billion in auto revenue in Q3, divided by 344K deliveries), Tesla would generate ~$356 billion of annual revenue – roughly 5x its current scale.

Tesla is both profitable and can be valued on its profits

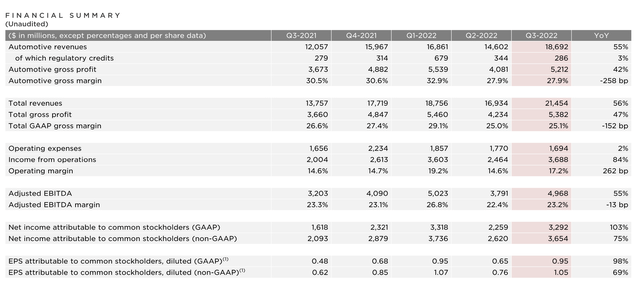

Here’s a surprising fact for those who haven’t dug into Tesla’s results in several years: the company is actually turning a profit. In Q3, the company delivered $5.0 billion of adjusted EBITDA (23% margin) and $3.3 billion of GAAP earnings. And note that is also weighed down by current gross margin headwinds due to constrained components in the supply chain and higher logistics costs. Elimination of these constraints in the long term as well as greater production scale should help Tesla nudge these margins upward.

Tesla fundamental trends (Tesla Q3 investor presentation)

Another healthy shocker: with the drop in Tesla’s share price, the company can actually be valued based on its bottom line.

For 2023, Wall Street analysts are projecting Tesla to generate $5.43 in pro forma EPS (+34% y/y) on $114.4 billion in revenue (+38% y/y; data from Yahoo Finance). Just for sizing purposes, that compares to consensus 2023 revenue of $152 billion for Ford (F) (+4% y/y) and $160 billion for General Motors (GM) (+4% y/y).

This puts Tesla’s forward P/E at 20.6x, barely a premium to the broader S&P 500 despite its superior revenue and earnings growth profile.

From an adjusted EBITDA standpoint: if we assume Tesla continues to generate a 23.8% adjusted EBITDA margin on next year’s revenue consensus (flat to TTM adjusted EBITDA margins), Tesla’s 2023 adjusted EBITDA would be ~$27.2 billion.

At current share prices near $113, Tesla trades at a market cap of $353.2 billion. After netting off the $21.1 billion of cash and $3.6 billion of debt on Tesla’s most recent Q3 balance sheet, the company’s resulting enterprise value is $335.7 billion. This puts its multiple at just 12.3x EV/FY23 expected adjusted EBITDA.

Services and adjacent revenue opportunity; key takeaways

Finally, we shouldn’t lose sight of the fact that Tesla doesn’t have designs solely on becoming a dominant auto manufacturer, but also an end-to-end energy company. Tesla also brings in growing revenue from its solar panels, supercharging (there are 4.28 million live supercharging stations as of the end of Q3, up 32% y/y), as well as software upgrades (Enhanced Autopilot runs as a $6K add-on, and Full Self-Driving costs $15K). These non-auto hardware revenue streams should help Tesla boost its gross and EBITDA margins over time.

The bottom line here: we’ve heard plenty of pessimism over Tesla’s risks, from management confusion/Musk’s distraction over Tesla, potential brand dilution from Musk’s unpredictable Tweets, demand slowdown and macro concerns. But with the stock down ~70% year to date, it’s prudent to also recognize the long-term bull case here.

I’ve plunked down a small position and believe Tesla is well on track for a 2023 rebound.

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.