Summary:

- Snap reports strong all-round growth from direct response, brand advertising and subscriptions, with further tailwinds ahead.

- Snap still trades at a massive discount in price to sales multiple to Pinterest, Reddit and Meta Platforms, and its app appeal to younger audiences is often not understood.

- Snap is demonstrating accelerated AI monetization in Snapchat+ and has one of the largest used chatbots in MyAI.

- Further strategic partnerships with tech peers expected in the nearer term.

- 50% upside price target to fair value.

Tero Vesalainen

Summary

This is a follow-on to my Strong Buy rating article on Snap (NYSE:SNAP) on 1 March 2024 at its price of $10.73.

Whilst Snap’s stock price at $15.05 on Tuesday’s close is up 40% from my Strong Buy call, there is still major upside ahead both in the near term and over a 12-month horizon, in my view. Snap’s strong Q1 result and guidance for Q2 represents an important inflection point in both Snap’s growth and the stock price momentum for the stock’s bulls. In the nearer term, I expect Snap to rise and potentially break above its 52-week high of $17.9 reached in January, following a similar price trajectory of its stock price run from November to January. The difference being that November’s previous price surge from $11 levels to the $17.90 high was based on sentiment (not actual reported results) of a rebounding advertising environment and new partnership announcements. Whereas, the difference now is that Snap has demonstrated Q1 strong results, after its Q4 2023 disappointment. Within a 12-month horizon, I see Snap stock reaching at least $22, and potentially within this year.

Snap reported 1st quarter results of $1,195 million revenue (+21% YoY revenue growth) that resoundingly beat expectations for $1,120 million, with an all-rounded contribution from direct response advertising (+17% revenue growth) and brand advertising (+12%), plus its Snapchat+ subscription reaching over 9 million subscribers. Snap reported an adjusted EPS of $0.03, above the expectation for a loss per share of $0.05. Net loss was $305 million compared to $329 million in the prior year’s quarter. Q2 guidance is for midpoint revenue growth of 16.5% based on its guidance range of $1,225 million to $1,255 million, which surpasses consensus expectations for $1,210 million. Daily Active Users grew 10% YoY to 422million, driven by strong rest of world growth (+17%), Europe (+4+) whilst North America was virtually unchanged (-1% on rounding).

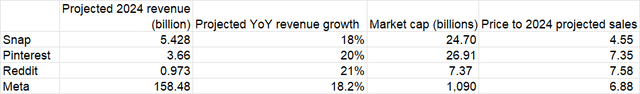

At a price to sales of 4.55x 2024 projected revenue (assuming 18% projected 2024 revenue growth), Snap still trades at a massive price to sales discount to social media comparables Pinterest (PINS) (7.35x price to sales), Reddit (RDDT) (7.37x) and Meta Platforms (META) (6.88x). In the communications social media oligopoly of leading players (Meta’s platforms, TikTok and Snapchat), Snap presents itself as the enticing social media play hereon given its vast stock price underperformance vs Meta in the last two years despite the rebounding advertising market and positive stock sentiment following Snap’s results.

2 years ago (25 April 2022 and well into 2022’s bear market), Snap’s stock price was double ($28.48) what it was on Monday, as Snap posted a strong Q1 2022 result back then with its first profit. Now Snap trades at around half of those levels. Meta’s stock price on 25 April 2022 was $200.47, and it is up 121% since then versus Snap’s stock price being down by half!

Whilst Meta had another strong Q1 2024 result recently (and its price has risen spectacularly since October 2022), the company’s increased AI capex plans and the anticipated years ahead before meaningful payback has spooked market sentiment on its stock, at least for the nearer term. Meanwhile, Snap is seeing immediate accelerated monetization from new generative AI features released in its Snapchat+ subscription such as Dreams. Snapchat’s chatbot MyAI (based on ChatGPT) is also one of the largest used chatbots (being over a year now since its launch). Whilst the tech giants battle it out in the AI clash of the tech titans, Snap can piggyback to an extent on the latest AI developments from the tech giants’ capex (e.g. ChatGPT). Snap’s own AI development is focused on fun and quirky generative AI enhancements to add-on into Snapchat app’s existing features such as its Augmented Reality lenses and messaging. The point is, Snap isn’t attempting to revolutionalise AI by developing entirely new use cases for it where the payback is many years away. Instead, given its much smaller size as a company, Snap is demonstrating immediate accelerated AI monetization and AI-related ad partnerships (sponsored ad partnership with Microsoft for MyAI) whilst providing full year guidance on its cost structure to demonstrate its progress in cost optimization, which is what the market wants to hear from it. There is a lot to like about Snap’s result and outlook going forward.

Average Per Revenue User Growth

Snap recorded average revenue per user (ARPU) growth in Q1 of 17% YoY in North America from $6.37 to $7.44, 20% YoY growth in Europe from $1.70 to $2.04 and 13% revenue growth in rest of world from $1.00 to $1.13.

We can contrast Snap’s low ARPU to Meta’s Facebook North America’s ARPU of $53.53 in Q2 2023 (when Facebook ARPU breakdown was last provided). The low ARPU for Snap represents a significant monetisation opportunity for growth ahead. At the same time, per my previous article, some of Snap’s core popular features (messaging, filters, AR and Maps) represent relatively lower ads or no ad (in messaging) type features (whilst its Stories feature is a higher ad product). This is not unique to Snap as WhatsApp messaging app similarly has low ad monetization, which brings down Meta’s family of apps ARPU as a whole.

Snap’s TikTok equivalent Spotlight, represents a major ad monetization opportunity ahead for Snap. Spotlight recorded an over 125% increase in time spent watching on a year-on-year basis. Ads were only introduced to Spotlight less than a year ago so it is still early days in its ad monetisation. With the uncertainty that TikTok is facing amidst the passing of the bill requiring its divestment, there may be more content which goes additionally on to Spotlight, with increased user time spent to follow. TikTok recorded $20 billion in revenue in 2023. Even a mere couple of percentage points ($400 million) of TikTok’s revenue going to Snap in the future would move the needle significantly for Snap’s revenue, not to mention the incremental new ad dollars in a strong, growing advertising market.

Snap’s AI monetisation

The rapid growth of paying subscribers for Snapchat’s subscription tier Snapchat+ to reach over 9 million subscribers illustrates Snap’s accelerated monetization of generative AI and the popularity of Snapchat amongst its core Gen Y/Z/Alpha user base. Snapchat+ subscriptions growth saw a very large acceleration in Q4 last year (from 5 million+ subscribers announced on 21 Sept 2023 to 7million+ subscribers announced on 12 December 2023), which I see as being driven by the release of Snapchat’s generative AI feature Dreams in September, which is a fantastic function for Snapchat’s core messaging use.

Based on Snap’s announcement dates of its Snapchat+ user numbers reaching various million user thresholds, this is an illustrative rate of growth in Snapchat+ users calculated and shows the acceleration that took place following the release of generative AI Dreams in September last year:

29 June 2022: Snapchat+ launched

August 15, 2022: 1 million+ subscribers reached, 47 days to add 1 million, average new subscribers per day: 20,408

31 Jan 2023: 2million+ subscribers reached, 169 days to add 1 million average new subscribers per day: 5,917

29 Jun 2023: 4 million+ subscribers reached, 149 days to add 2million, average new subscribers per day: 13,422

21 Sept 2023: 5million +subscribers reached, 84 days to add 1milllion, average new subscribers per day: 11,904

12 Dec 2023: 7 million+ subscribers reached, 82 days to add 2 million, average new subscribers per day: 24,390 – a major acceleration in subscribers.

In its quarterly results on 25 April, Snap announced that Snapchat+ subscribers had reached over 9 million in the first quarter. Since there is not the exact date provided for this in Q1, we could assume that the growth of 2 million additional subscribers took the 135 days between the 12 December 2023 announcement of 7 million subscribers and the 25 April earnings date. This translates to an average daily rate of over 14,814 new subscribers (since the actual date when 9 million subscribers was reached was sometime before the actual earnings date).

Although this estimated subscriber growth rate appears lower than the 24,390 average new subscribers between the September and December dates, it is significantly higher than the growth rate that Snapchat+ achieved throughout 2023 prior to September. Based on this current subscriber growth rate, we can assume that Snap’s 10 million subscriber milestone will be reached within 68 days from 25 April, before the Q2 quarterly results date. This would be a further near-term catalyst to add to the strong quarterly results.

Snapchat+’s generative AI features are the type of cool features for its user base that has an accelerating effect on subscriptions – a user receives the generative AI Dream pic from their friends, and then they too want to use the function – hence why there was the surge in Q4 in already strong Snapchat+ subscriptions and a continued elevated rate in Q1. Snap also released additional generative AI features for Snapchat+ in December last year.

In January, Snap released its generative AI pet Bitmoji, which allows Snapchat+ subscribers to snap a photo of their pet to create an avatar to accompany their Bitmoji in the Snap Maps. This has proven to be another highly popular generative AI function for Snap+ subscribers, illustrating the core appeal of Snapchat of innovative, fun and quirky product features for its younger Gen Y, Z and Alpha user base. At the same time, it also shows how the appeal of Snapchat continues to not be understood by many non-users and tech commentators alike.

For instance, a ZDNet editor’s remarks on Snapchat’s AI pet Bitmoji and Snapchat’s generative AI features generally:

“If you are wonder what the point is, so are we. Since its initial implementation of generative AI last February, Snapchat has been guilty of implementing generative AI for the sake of it, and not solving a real problem.”

Yet, we can see that Snap’s generative AI features are highly popular amongst its user base and translating into accelerated AI monetization.

Snapchat’s MyAI chatbot (based on ChatGPT) has been rolled out for over a year and is one of the largest used chatbots today. Designed to be like chatting to a human, MyAI has become a very well-suited chatbot tailored to its core audience. Last September, Snap and Microsoft announced an ads partnership for sponsored links ads to be inserted in MyAI based on Microsoft’s Ads for Chat API. This is a good supplementary offering to Snap’s existing suite of app ad offerings for direct response and brand advertisers alike.

I view that Snap is in an ideal position in its generative AI development and roll-out, with a suite of useful (MyAI) and fun (Dreams, generative AI in filters and AR, pet Bitmoji) features which are ideal for its user base and simple to use. For many of Snapchat’s core user base, their first use of generative AI is via Snapchat’s AI features. There is a lot to like about Snap’s AI offerings and monetization and at Snap’s current massive price to sales valuation discount to peers, it has yet to be recognized in my view.

The valuation of Snap and its position in the social media oligopoly

Previously, there were numerous bearish comments in response to my February article on Snap. Being bearish on Snap stock might have worked well in the past up until February after its Q4 2023 report, but at its current $15.05 stock price after strong results, it remains significantly undervalued, as it was at February’s $11 levels. Many of the bearish current arguments against Snap stock are based on i) using a classic value style analysis and mindset wrongly for a forward-looking growth stock and ii) looking backward to its financial and stock price performance versus the more qualitative forward-looking approach required for forward-looking growth stocks.

Snap competes in a communications social media oligopoly with two much larger rivals, Meta’s platforms and TikTok. There are major barriers to achieving scale to any potential new social media entrants in terms of both the massive financial resources and product innovation required to achieve the user numbers of the top three players Meta, TikTok and Snapchat (each of whom have achieved varying degrees of business moats, with Meta having the widest moat). TikTok itself was able to be a major success within the short span of a few years from both its product innovation and AI and the billions in financial resources from its parent company ByteDance (owner of the Chinese version of TikTok Douyin). Outside of the long-standing incumbent behemoth Meta, for the other players in the social media oligopoly, net profitability must be put on hold for continued user and revenue growth. TikTok itself is reported to have lost several billion dollars in 2023 on revenue of roughly $20 billion. Therefore, the ideal metric to value Snap on is based on price to sales, especially as other social media comparables Reddit and Pinterest also both do not yet have net profitability and full year net profitability respectively.

Based on various estimates of 2024 revenue*, the price to projected 2024 sales multiple of Snap vs its other social media peers are as follows below. These revenue estimates reflect higher than consensus average revenue estimates across each of the companies (not solely Snap) based on their above expectation latest results, and consensus estimates may have yet to reflect the stronger ad market. Snap’s stock price would have to trade 62% higher than the current $15.05 level to be at a similar price to sales multiple to Pinterest and 67% higher to be at a similar price to sales multiple to Reddit.

Company’s websites and author estimates

*Snap 2024 revenue growth estimate of 18% is based on company’s Q1 21% revenue growth result, midpoint guidance for 16.5% revenue growth in Q2, and a high teens rate growth in 2H for FY2024 revenue of $5.428 billion. Average analyst consensus estimates are for $4.98 billion in FY2024 revenue.

Pinterest 2024 revenue growth estimate 0f 20% is based on company’s Q1 23% revenue growth result and guidance for midpoint 19% growth in Q2, and assuming a minor slowdown in 2H to the above expectations 1H growth rate, for FY 2024 revenue of $3.66 billion. This is higher than average analysts’ consensus estimates for $3.58billion.

Reddit 2024 revenue growth estimate of 21% is based on company’s guidance during its IPO roadshow.

Meta 2024 revenue growth estimate of 18.2% revenue growth is based on Q1’s 27% revenue growth and guidance for 18% revenue growth in Q2, with a continued minor deceleration in 2H (for FY2024 $158.48 billion). Average consensus estimates are for $148.09 billion in 2024.

Note that the leading social media companies above have a much higher price to sales ratio than the broader communications services sector price to sales ratio of 1.22 on Seeking Alpha. Each major social media stock should be compared to its social media peers and not to the broader communications services sector, which includes tech and non-tech companies. Compared to both communications (tech and non-tech) and other tech companies, the higher price to sales multiple for social media stocks is reflective generally of the social media players’ higher gross margins, scarcity value of the major social media companies (small number of players that have significant scale), potential private market value and the resources required to potentially replicate a platform to achieve similar user scale. Other tech giants (e.g. Alphabet) have attempted to develop their own social media platforms without success and potential acquisitions are likely the only way forward for the non-social media tech giants to have a sizeable social media business (e.g. Microsoft’s acquisition of LinkedIn).

As described, Snap operates in a communications social media oligopoly of a trio of leading players of scale (Meta’s platforms, TikTok and Snap). I distinguish this communications social media oligopoly trio from indirectly comparable social media companies Pinterest and Reddit, primarily as these two platforms have a more specific core niche and their core users are comprised of monthly active users, not daily active users of the same scale as the communications social media oligopoly trio. In the sense, Snap represents the only other public market traded communications social media company apart from Meta, and deserving of a price to sales valuation premium but trades at a major discount to Pinterest and Reddit.

As I described in my previous article, in spite of the high-rate environment, tech companies do not need to achieve net profitability for their stock prices to be well-rewarded, but they do need to achieve revenue growth (of the kind that Snap has now demonstrated) when they forego profitability:

“That is not to say that tech companies need to deliver net income profit and growth in this environment for their stock prices to be rewarded, but they do need to deliver growth. For instance, Spotify which remains unprofitable but has demonstrated significant growth in both latest quarter revenue (+16%) and users (+23% MAUs) in its results, is up 115% in its past 1-year stock price. Snap’s market cap of $17.7billion is dwarfed by Spotify which has a market cap of $50billion and 602million MAUs (vs Snap’s over 800million MAUs). Audio streaming is arguably a more competitive environment than communications social media’s oligopoly, with tech behemoths Apple, Alphabet, Amazon each competing against Spotify. Tech stocks that are growing revenue and users above expectations even as they forego net income profitability can continue to do well in stock price performance. I do view it is possible for Snap to achieve similar revenue growth (in the mid-teens) to Spotify this year.

From Snap’s latest quarterly result, I view it is well on-track for high teens (about 18% revenue growth) this financial year.

Fair value is far above Street analysts’ average price targets

Street analysts’ price targets on Snap have been almost as volatile as its stock price. There were a host of price upgrades at the beginning of the year only after its stock price had surged but prior to its 2023 Q4 results. This was followed by large price revisions downward after its Q4 disappointment and in the weeks prior to its latest Q1 result. Now there are price revision upgrades again across the board after the strong Q1, with the average price target being $14.82. I view that most Street analysts in their latest upward adjusted price targets are still generally far below where Snap’s price will be within the next 12 months.

Snap’s previous history of results disappointments since 2022 and its price volatility has made many analysts and investors alike generally highly cautious and scarred in their Snap price calls. Given Snap stock’s past history of false dawn disappointments, it is understandable that many analysts and investors are overly cautious on Snap now and advocating a wait and see approach for Snap’s results next quarter and beyond.

One could wait for Snap’s demonstration of continued strong growth in next quarter’s result, but then the price will have already reflected this. The fundamentals, sentiment and stock tape now reflect a continuing price move higher for Snap stock from the current $15 level. In my view, there is an all-clear signal for long investors to be in Snap stock, without the previous concern of its earnings reporting.

Further strategic partnerships likely in the near-term

In my previous article, I described the attractiveness of Snap with its 422 million DAUs and overly 800 million monthly active users to the tech giants and other larger tech companies for strategic partnerships. This is especially as there is an arms race amongst the tech giants in AI and an ongoing battle amongst tech giants and larger tech and non-tech peers across multiple areas (video and audio streaming, e-commerce, payments, cloud). Snap did announce numerous advertising partnerships in Q1 (albeit with smaller companies compared to the blockbuster type partnerships announced last year with Amazon and Microsoft) and I expect more in Q2. Per the response to an analyst’s question in the conference call on further partnerships:

Dan. Yes, as we look at Amazon partnership and what they’re doing with Handshake, I do think that’s a great learning opportunity for us. It’s still very early, but I think what’s exciting is being able to bring relevant products to Amazon shoppers inside the Snapchat experience. We know that people now shop where they consume content and so to be able to offer a relevant product selection in line and allow people to check out with one tap is certainly an exciting product development.

So we’ll obviously continue to learn there and evolve that product. I do think just separately that some of these ad partnerships we’ve done and work we’ve done with other demand partners have been important elements of our growth, and we do see continued opportunity there.

Risk factors

Major risk factors to an investment in Snap stock hereon can be described as follows:

History of lack of net profitability

As a company operating in an oligopoly with two much larger rivals, Snap has not achieved net profitability (it had one quarter of bottom-line net profit in Q1 2022) and will likely continue to forego any potential full-year net profitability to prioritise product innovation and user growth. We should also note that even the second-largest player of significantly larger size ($20 billion in revenue), TikTok, had an estimated loss of several billion dollars last year. In view, we should be aware that full-year net profits for Snap may be several years away.

In a scenario of an elevated rate environment persisting for longer with no rate cuts this year and inflation remaining elevated, one can expect that loss-making growth stocks including Snap will be significantly impacted.

Risk of downturn in advertising market

Q1 results of social media companies have shown a strong, rebounding ad market. Whilst I view that there are highly positive company-specific factors driving Snap’s latest results and outlook, there is a risk that broad-based advertising industry strength has been a rising tide for Snap’s results. Therefore, any slowdown or slower growth in the broad ad market would negatively impact both Snap’s financials and its stock sentiment.

Stock-based compensation

Snap recorded over $1.3 billion in stock-based compensation in 2023. Stock-based compensation is necessary to attract and incentivize top talent when competing against its two much larger peers with their greater financial resources and scale. This has a dilutive impact on shares. In the event of Snap shares underperforming, the impact of significant stock-based compensation and a lower share price can have an accelerated negative impact to Snap stock and its business performance (ability to attract and retain talent).

Conclusion

In my previous February article, I had a 12-month price target for Snap in a base case scenario of $17 and a blue-sky scenario of $22. My base case then of $17 was based on Snap registering 2024 revenue growth of 11% in 2024 to record $5.1billion in revenue and would trade at 5.5x revenue. My blue-sky scenario was based on Snap registering 2024 revenue growth of 16% or more in 2024 to record $5.33billion in revenue and would trade at 6.81x revenue.

With Snap having registered 21% revenue growth in Q1 and a mid-point guide of 16.5% for Q2, I view that Snap will meet/exceed my blue-sky scenario target of 16% or more revenue growth in 2024 (my current forecast is for 18% 2024 revenue growth). Therefore, my price target for Snap now is $22, representing 46% upside from current $15.05.

Whilst this is a 12-month price target, I view that it can be achieved within this year with another quarter or two of above expectations/guidance results. At $22, Snap would only trade at 6.6x projected 2024 price to sales, still a significant discount to both Pinterest and Reddit’s price to sales ratio.

If Snap continues to execute, there is also a clear 2025 path to Snap almost doubling in price from its current levels to $28 (where it traded two years ago), which I view can be attainable within 2025. If we assume 18% revenue growth in both 2024 and 2025, $28 would represent 7.16x Price/2025 projected sales, so still a lower multiple than Reddit and Pinterest.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNAP, PINS, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.