Summary:

- Teladoc continues to report declining memberships and worsening profitability metrics, with it remaining to be seen if the downtrend may persist as market competition intensifies.

- Part of the headwinds may also be attributed to slowing demand for telehealth services as more patients return to in-person care, as reported by UNH.

- Combined with the cash drag reported by multiple telehealth providers, we can understand why UNH has opted to wind down its telehealth business.

- While TDOC continues to guide for growing FCF generation, its long-term prospects remain uncertain with the stock’s valuations similarly discounted compared to its newly profitable peer, HIMS.

- With no bullish support, the stock increasingly shorted, and insider selling intensifying, TDOC’s reversal remains speculative.

tap10/E+ via Getty Images

We previously covered Teladoc (NYSE:TDOC) in February 2024, discussing the troubling signs of declining memberships and worsening profitability in FQ4’23, with it remaining to be seen if the downtrend might persist as market competition intensified.

Combined with the accelerating operating expenses growth worsening the decelerating top-line expansion, we believed that the telehealth company might remain unprofitable on a GAAP basis for the near to intermediate term, resulting in our Hold rating.

In this article, we shall discuss why we are maintaining our Hold rating for the TDOC stock, since bullish support has yet to materialize, with the management reporting underwhelming performance metrics in FQ1’24. The stock has also declined by -16.8% over the past two months, well underperforming the wider market at 2.3%.

As UnitedHealth Group (UNH) throws in the towel on its telehealth segment, the insider selling intensifies, and with the stock increasingly shorted, TDOC’s reversal remains highly speculative indeed.

The TDOC Investment Thesis Remains Speculative

For now, TDOC has reported a bottom line miss in the FQ1’24 earnings call, with underwhelming gross profit margins of 65.8% (-3 points QoQ/ -2 YoY) and adj EBITDA margins of 9.8% (-7.5 points QoQ/ +1.4 YoY).

Its lack of profitability is further exemplified by the worsening adj EPS of -$0.43 (-207.1% QoQ/ -26.4% YoY) and Free Cash Flow generation of -$27M, compared to $94M in FQ4’23 and -$33M in FQ1’23.

These numbers imply TDOC’s inability to scale its operations, especially worsened by the minimal growth observed in the overall revenues at $646M (-2.2% QoQ/ +2.7% YoY), as both of its Integrated Care Segment Revenues decline to $377M (-1.8% QoQ/ +7.7% YoY) and BetterHelp Segment Revenues decline to $269M (-2.5% QoQ/ -3.5% YoY).

Readers must also note that much of the bottom-line headwinds are attributed to the still elevated total operating expenses of $593.05M (+7.5% QoQ/ inline YoY), after discounting for the non-cash stock-based-compensation and Depreciation/ Amortization.

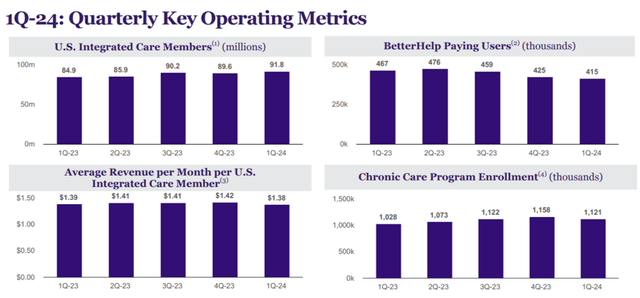

TDOC’s Performance Metrics

As more competitors launch telehealth services, we can also understand why TDOC reports decelerating user base growth in the US Integrated Care Members to 91.8M (+2.2M QoQ/ +6.9M YoY) and declining BetterHelp Paying Users to 415K (-10K QoQ/ -52K YoY) in the latest quarter.

This further underscores its lack of moat in an increasingly competitive market, as the use of telehealth services also moderate as more patients return to in-person care.

The shift in patient behavior has been highlighted by UNH, with a higher adj FQ1’24 Medical Care Ratio of 83.9% (-1.1 points QoQ/ +1.7 YoY), after excluding for the impact of the cyberattack and compared to FY2019 levels of 82.5% (+0.9 points YoY), with the increase mostly attributed to the higher outpatient care activities and physician office visits.

At the same time, it is interesting that UNH has opted to shut down its virtual care business, Optum Virtual Care, despite it being a “major part of Optum’s push into telehealth services in 2021, as Covid-19 accelerated the industry’s adoption of virtual services.”

While the UNH management has yet to offer any commentary on this particular exit, we posit that part of the reason may be attributed to the telehealth’s drag on profitability, with Optum Health reporting FQ1’24 operating margins of 7.1% (-0.6 points QoQ/ -0.6 YoY) and FY2023 at 7% (-0.7 points YoY), compared to FY2019 levels of 8.3% (+0.2 points YoY).

The same lack of telehealth profitability has been observed with American Well Corporation (AMWL) in FY2023 and the management’s guidance for FY2024, naturally triggering further pessimism in the industry, with the only exception being Hims & Hers Health (HIMS). The latter has been able to report narrowing losses and first quarter of GAAP profitability in FQ4’23, partly aided by rising net interest income.

For now, TDOC continues to report a generally decent cash on balance sheet at $1.1B (-1.7% QoQ/ +25% YoY) in FQ1’24, along with somewhat reasonable FY2024 revenue guidance of $2.68B (+3% YoY), adj EBITDA margins of 13.8% (+1.2 points YoY), and Free Cash Flow generation of $225M (+15.9% YoY) at the midpoint.

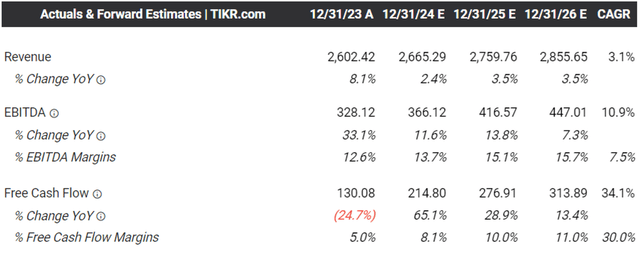

The Consensus Forward Estimates

For now, the same has been estimated by the consensus, with TDOC expected to remain profitable on an adj EBITDA and Free Cash Flow basis, allowing the telehealth company to maintain through the next few years of uncertainty.

Then again, readers must also note that TDOC faces $519.8M of debts maturing in June 2025 and another $843M due in June 2027, with a refinancing during an elevated interest rate environment likely to be very expensive.

As a result, we can understand why the market remains pessimistic about TDOC’s intermediate term prospects.

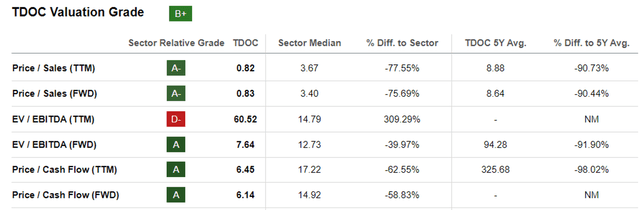

TDOC Valuations

The lack of profitable growth is also why the TDOC stock continues to be discounted at FWD Price/ Sales of 0.83x and FWD EV/ EBITDA valuations of 7.64x, compared to its 5Y mean of 8.64x/ 94.28x and the sector median of 3.40x/ 12.73x.

Even when compared to its direct competitors, the recently profitable HIMS at 2.25x/ 21.77x and the unprofitable AMWL at 0.6x/ NA, it is apparent that the market continues to be pessimistic about unprofitable telehealth providers.

So, Is TDOC Stock A Buy, Sell, or Hold?

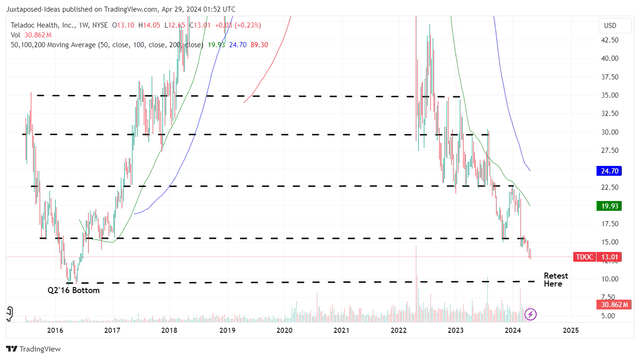

TDOC 8Y Stock Price

For now, TDOC has already dramatically lost -95.5% of its value since the February 2021 top, with it consistently trading below its 50/ 100/ 200 day moving averages.

Based on the LTM adj EBITDA of $338.5M (+38.2% YoY) and the last share count of 167.73M (+2.9% YoY), the telehealth company generates adj EBITDA per share of $2.01 (+34% YoY). Combined with the FWD EV/ EBITDA of 7.64x, it is apparent that the stock is trading below our estimated fair value of $15.30.

Based on a similar calculation method with the consensus FY2026 adj EBITDA estimates of $447.01M, there seems to be an excellent upside potential of +56% to our long-term price target of $20.30 as well.

Even so, we do not recommend anyone to add TDOC here, with it continually charting lower highs and lower highs over the past three years.

With no bullish support observed yet, we believe that the stock’s downward trend may continue for a little longer to retest its next support at $10s level, worsened by the potential volatility from the elevated short interest of 15.8% at the time of writing.

Combined with consistent insider selling thus far, TDOC stock may remain a battleground stock until a clear reversal in its profitability and market sentiments occur.

We reiterate our Hold (Neutral) rating here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.