Summary:

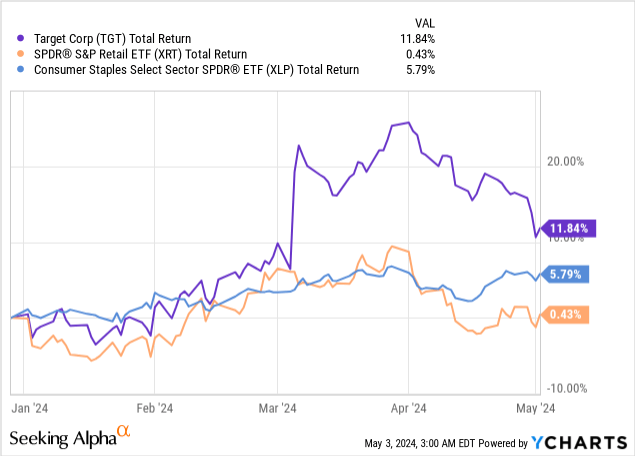

- Target has outperformed its peers and the consumer staples sector due to its strong recent earnings and guidance.

- The company is focusing on driving top-line growth through new private brands, store openings, and expanding its loyalty program.

- Target aims to grow its top-line at a rate of 4% annually for the next decade and expects to grow back into a 6%+ EBIT margin business.

- Recovery is promising, but not a done deal. The stock trades at its 5-year average valuation.

John M Lund Photography Inc/DigitalVision via Getty Images

Target Corporation (NYSE:TGT) has outperformed its retailer peers and the consumer staples sector this year by a significant margin. This was primarily due to its upbeat 4Q (year-end: January) earnings result and FY24E guidance. Both of which mark the bottoming of its business cycle, which has fallen prey to the reopening of the economy post-pandemic. When we last wrote about Target in 2019, the company was embarking on a supercycle of the burgeoning omni-channel distribution model, which brings synergy between its online and offline channels.

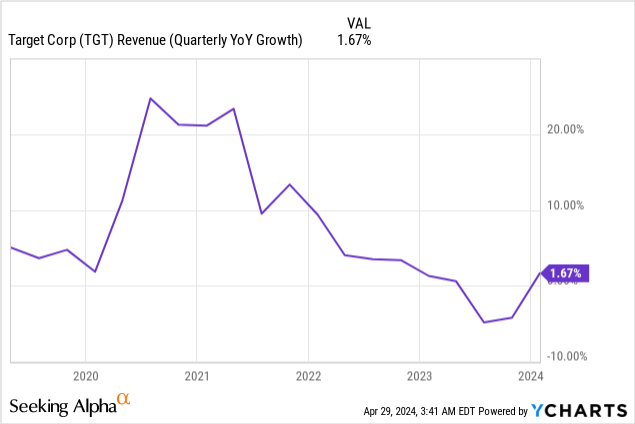

Quarterly revenue Y/Y growth finds a bottom

Target benefited immensely from the pandemic era when they were able to offer same-day pickup or delivery for groceries and electronics, while online competitors could not reach the equivalent level of fulfillment and offline-only stores lost traffic. However, as COVID-19 faded into distant memory, the reopening of the global economy has reignited inflation which was stubbornly low for the past decade and competition has grown fiercer.

The company lost its competitive edge as its peers began offering the same level of service and inflation ate into its margins.

Fortunately, things began to turn around as the management started to refocus on driving the top-line by introducing new private brands, opening new stores and expanding its loyalty program, Target Circle 360.

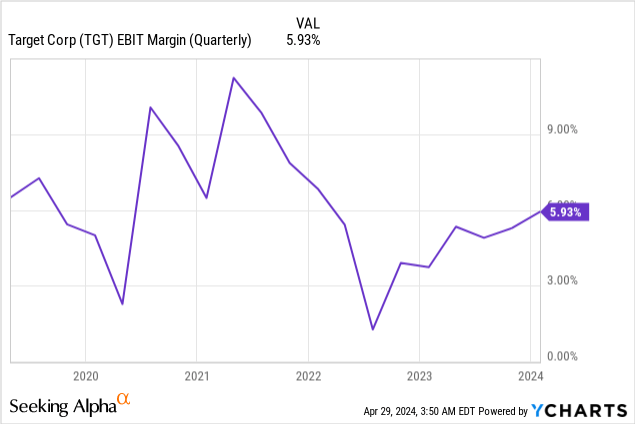

Looking at the quarterly revenue growth and EBIT margin charts below, we are seeing signs of stabilization and fundamentals reaching an inflection point. We believe the data points to the fact that the recovery is in process but has yet to reach its full potential, given its distance from the peak.

Modest operating margin improvement in 2024

The management has guided FY24E operating margin to reach 6.0% from 5.3% in FY2023, propelled by gross margin expansion and higher cost efficiency from lower SG&A expenses. Inventory shrink dragged down margin by more than 1.2% since 2019 and impacted FY23 margin by about 50bps. The company anticipates that with better theft control, shrink should be flat in FY24E. Markdown rates also appear to have largely stabilized post-COVID.

Traffic in 4Q also improved sequentially from 3Q (4Q: -1.7% Y/Y vs. 3Q: -4.1% Y/Y) which hints at an inflection point and nicely correlates with the rebounding revenue growth figures shown above.

Its ad platform, Roundel, recorded 25% Y/Y growth in CY23 and is expected to have momentum going forward in CY24E, which serves to diversify income from pure product sales.

In our view, we welcome the uptick in operating margins, which should, in theory, assuage investors that rising costs due to inflation have not been as bad as feared. The improving inventory shrink has been pertinent to driving higher margins and shows that the company has been managing well to keep inventory loss down.

Robust 10-year growth targets

Target believes it can grow its top-line at an average annual rate of 4% in the next decade and estimates that EBIT margin should be at least 6% or above, which was achieved in 2019.

They estimate in the next ten years, 300 more stores will be added and will contribute to $15B of sales annually.

New private brands, GiggleScape (toys) and Dealworthy (cheap items across categories) will likely help drive incremental sales and margin.

We opine that these are very realistic targets and the current market valuation for the stock reflects the base case for moderate recovery but not necessarily a blue-sky scenario which entails operating margins sustaining above 6% and revenue growth rates experienced during COVID-19. We believe that the private brands will help drive differentiation in a competitive industry.

Red Circle 360 to drive further brand loyalty

Targeting to customers without an existing Red Card membership, new joiners are able to purchase a $49 annual subscription to enjoy same-day delivery (sometimes within the hour) and other TGT Circle member benefits during the promotion. The management has noted that same-day delivery customers tend to spend 20%-30% more annually, so this promotion intends to drive incremental engagement from new joiners.

We believe that this could potentially lead to more revenue upside than what their conservative CY24E guidance would suggest, should loyalty benefits materialize.

Verdict

While Target’s turnaround is not a done deal, it has shown promising revitalizing trends in its revenue Y/Y growth, margin improvement and forward guidance. Its focus on driving the topline from opening new stores, expanding its loyalty program and introducing private labels have borne fruit. Better cost control has also led to its operating margin recovery.

Going forward, it would be important to see if the trends hold in the coming quarter and whether inflation, which has crept up in the recent months in the U.S. will impact its gross margin.

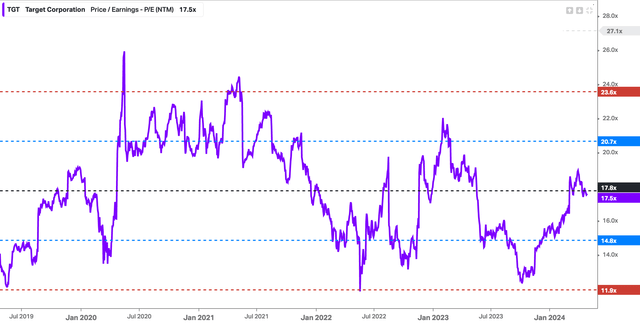

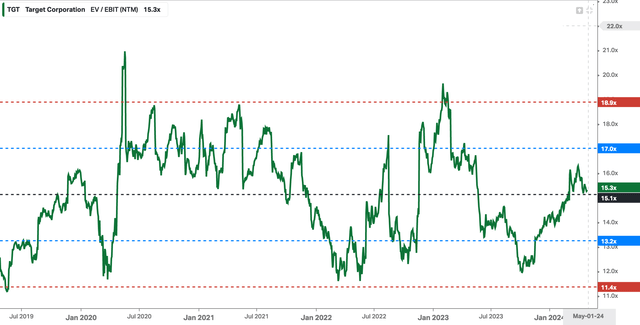

That said, the stock trades at 17.5 times forward earnings or 15.3 times forward EV/EBIT. Both metrics are at their respective 5-year averages. Its valuation is slightly cheaper than the broader SP500 index but its EPS growth will likely remain in the mid-single digits, which is considered a notch lower than the typical high single digit one would expect from the index.

We rate the stock as neutral, but with potential upside if the company’s new growth drivers pay off.

Risks

Target is competing in a more intense environment with peers also succeeding with their offline plus online model, and thus may lose market share.

Their revenue is dependent on how attractive and how competitively priced their products are. In addition, its new brands may not gain satisfactory traction and customer loyalty may wane, leading to deterioration of the top-line and margins.

The company can face supply chain issues and input costs may rise faster than their sales due to inflation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: All research, figures, and interpretation are provided on a best effort basis only and may be subject to error. Any view, opinion, or analysis does not constitute as investment or trading advice, please do your own due diligence.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.