Summary:

- 3M Company surpassed Wall Street estimates in its Q1 earnings release, underscoring the resilience of its turnaround.

- 3M buyers are likely looking past its legal challenges as new CEO Bill Brown takes charge.

- Despite massive legal liabilities, 3M’s fundamentally strong business model and undervaluation position it for continued recovery.

- I explain why MMM is poised for a potential breakout, as it is no longer stuck in a downtrend bias.

josefkubes

3M Continues Its Organic Growth Recovery

As ex-CEO Mike Roman turned over the reins to Bill Brown this week, 3M Company (NYSE:MMM) investors got the respite they needed. 3M reported its first-quarter earnings results, which surpassed Wall Street estimates. 3M reset its dividend policy after completing the divestiture of its healthcare business (spun off as Solventum (SOLV)) in early April. However, notwithstanding 3M’s anticipated dividend cut, that didn’t surprise the market. 3M’s healthcare business accounted for 30% of its overall adjusted free cash flow. Coupled with the need to remain cautious over its potentially massive legal liabilities, I assessed it as prudent for 3M management to reduce its dividend payout to 40% of its adjusted free cash flow (down from 60% previously).

In my previous 3M article in February 2024, I maintained my bullish thesis in MMM stock. I highlighted that MMM’s January 2024 selloff should find support above its 2023 lows. That thesis panned out, as MMM bottomed out soon after in February.

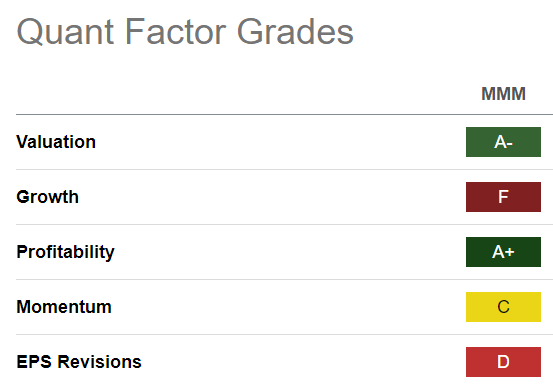

MMM Quant Grades (Seeking Alpha)

MMM stock’s post-earnings surge demonstrated my conviction that the market had already reflected the change in 3M’s dividend realignment in its valuation. As seen above, MMM is still assigned an “A-” valuation grade, underscoring the market’s pessimism in its execution relative to 3M’s industrials sector peers. Moreover, the market could have overstated 3M’s ability to improve its risk profile and balance sheet, bolstered by 3M’s best-in-class “A+” profitability grade. In other words, MMM remains a fundamentally solid company hampered by its litigation challenges, which lowered investor confidence significantly.

Notwithstanding my caution, the company has made substantial progress in Q1, providing new CEO Bill Brown with a more robust slate to lead the company forward. Accordingly, 3M reported a “return to organic growth and achieving double-digit adjusted earnings growth as key milestones.” The company posted an adjusted revenue of $7.7B and delivered an adjusted EPS of $2.39, outperforming analysts’ estimates. 3M’s resilience in the Transportation and Electronics segment was instrumental in driving growth in Q1, posting a 6.7% uptick in segment organic growth. Robust growth momentum in automotive electrification and normalizing inventory digestion in the electronics channel were pivotal to the segment’s performance.

Despite that, 3M’s Safety & Industrial and Consumer segments didn’t fare as well. Both segments delivered negative organic growth, suggesting that 3M investors will likely await a more robust organic growth recovery before re-rating MMM further.

3M Is Moving Past Its Legal Challenges

3M bears could indicate that 3M’s immense liabilities would likely derail any sustained recovery momentum. However, it’s crucial to consider that 3M has reached critical settlement stages in its PFAS and combat arms litigation challenges. Accordingly, 3M’s PFAS settlement agreement “entails a pre-tax present value commitment of up to $10.3 billion payable (pre-tax present value) over 13 years, for which 3M has already recorded reserves.” In addition, 3M has also obtained an agreement from more than 99% of claimants to participate in its combat arms settlement. 3M has reportedly set aside a pre-tax present value of $5.3B to resolve these legal liabilities.

Given the progress in 3M’s most pressing legal challenges, I believe the market has likely looked beyond these issues as Brown takes charge. The reset of 3M’s dividend policy has allowed the company to remove the veil of uncertainty over possible dividend cuts. As a result, it has allowed the potential turnover of income investors toward value investors who appreciate the fundamentally strong and significantly undervalued (though battered) business model of 3M.

Is MMM Stock A Buy, Sell, Or Hold?

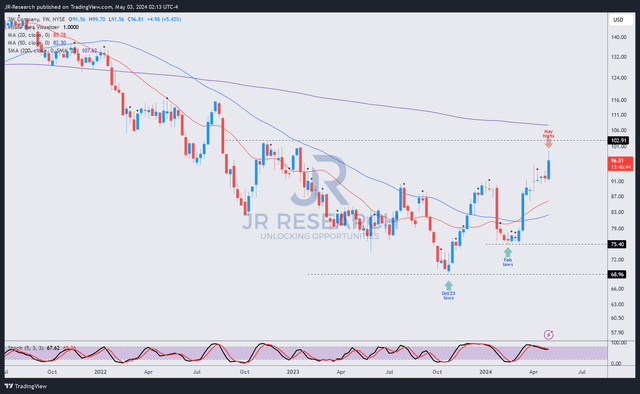

MMM price chart (weekly, medium-term, adjusted for dividends) (TradingView)

MMM’s price action suggests it has already formed its long-term lows in October 2023. MMM buyers also returned in February to underpin its steep pullback, improving MMM’s buying momentum.

With MMM’s post-earnings surge this week breaking well above the $90 consolidation level, it’s increasingly clear that MMM is no longer in a medium-term downtrend.

The trend bias has shifted in favor of MMM Bulls, corroborated by the 20-week (red line) and 50-week (blue line) moving averages. Bolstered by 3M’s fundamentally strong business model and MMM’s relative undervaluation, I believe 3M looks well-positioned to continue its recovery trajectory as investors look past its legal and execution challenges under ex-CEO Mike Roman.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!