Summary:

- Amazon has heavily invested in its infrastructure during recent years and has reached economies of scale. It led to a reduction in its cost to serve.

- The firm is now diversified, with all segments contributing positively to earnings in recent quarters.

- Operating leverage is elevated, fueling Free Cash flow growth.

- My DCF indicates further upside: I rate the stock as a BUY.

Umnat Seebuaphan

My thesis

Amazon (NASDAQ:AMZN) has become a well-diversified business and built a robust infrastructure allowing for economies of scale. Margin expansion started to kick in the last fiscal year and seems to continue its upward trajectory. All segments should now contribute to the group’s profitability, leading to a growing Free Cash generation. My DCF model indicates further upside: I rate the stock as a BUY.

Investment overview

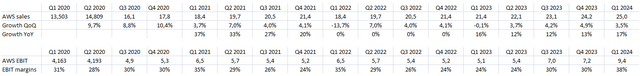

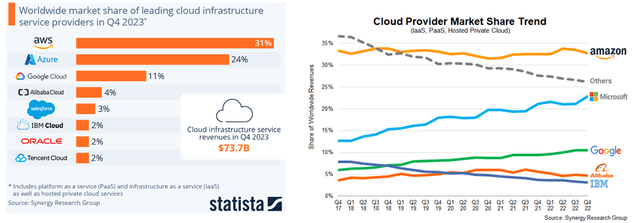

Amazon disposes of a dominant position within all its business lines. However, AWS has been the earning driver over the past decade, helping to fund its loss-making branches. Jeff Bezos decided strategically to enter the Cloud infrastructure business back in 2006. The firm built more than 30 data centers, mainly in the US, Europe, the Middle East, and Asia. The segment generated in FY2023 $91bn of revenues for an EBIT of $25bn. Thanks to its first mover advantage and heavy investments, AWS Infrastructure as a Service market share stayed above 30% from 2017 to 2022, despite growing competition coming from Microsoft Azure and Google Cloud. Amazon proposes storage, computing, database, and analytic services. It can serve small and medium businesses and also bigger and notable customers such as Netflix (NFLX), Sony (SONY), Unilever (UL), Pfizer (PFE), and Adobe (ADBE).

source: Statista / Synergy Research

After a period of stagnation, in 2022, AWS revenues are growing again. But, as its growth rate is below its competitors: it has been losing a bit of market share since last year. However, the good news comes from the profitability side, with the EBIT margin kicking in above the 30% level.

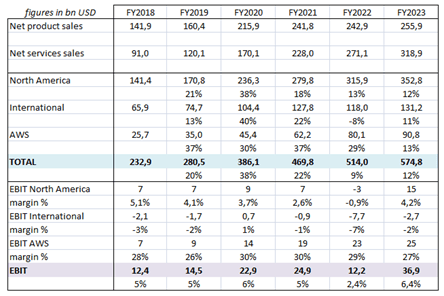

This segment was so important for the firm that its top executive Andy Jassy was named CEO of Amazon in 2021. While AWS is the core of Amazon’s profitability, other segments are gaining traction and gradually contributing to the company’s EBIT as can be seen here below.

source: company data

Improving logistics and economies of scale lowered the cost to serve, helping Amazon’s e-commerce operations significantly improve their margins. The weak point remains International operations, still in loss-making territory in FY2023.

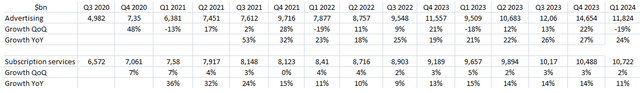

Amazon breaks its revenues through different verticals, including Advertising and Subscription revenues. The company doesn’t disclose their respective level of profitability which should most probably be high. On advertising: we can look at Google and Meta’s margins to have an idea of how profitable it could be. Subscription revenues are mainly associated with recurring revenues coming from Amazon Prime memberships which improve customer retention.

These two segments accounted for 24% of FY2023 revenues, progressing from 13% back in 2021. Amazon’s advertising revenues nearly reached $50bn last year, which is impressive compared to Google’s (GOOG) $237bn and Meta’s (META) $130bn.

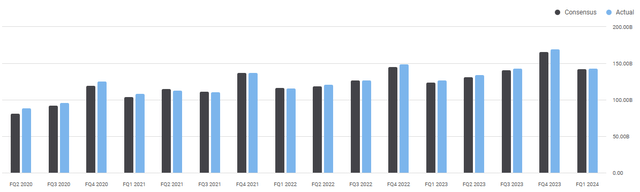

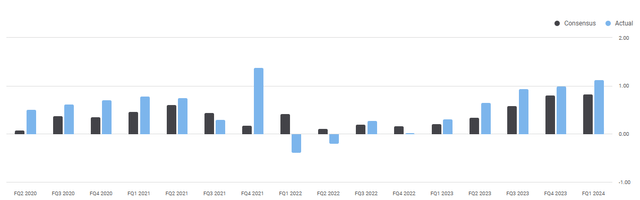

Recent quarterly trends

The revenue trajectory has generally met analyst expectations, whereas noticeable beats came from earnings thanks to a margin expansion. Amazon’s financials have tilted toward a profitability story rather than a top-line growth story.

source: Seeking Alpha source: Seeking Alpha

Key takeaways from Q1 FY2024 results were the following. Revenues grew by +13% YoY to $143bn driven by solid results all across the board. Execution was once again at the core of Amazon’s focus. On Prime services, the management said: “We delivered to Prime members at our fastest speeds ever. In March, across our top 60 largest U.S. metro areas, nearly 60% of Prime members’ orders arrived the same or the next day”,“Globally, in cities like Toronto, London, and Tokyo, about three out of four items were delivered the same or next day.”.

AWS grew by 17% YoY as the company saw activity pick up from smaller businesses, while segment margins expanded significantly. “We expect the combination of AWS’ reaccelerating growth and high demand for gen AI to meaningfully increase year-over-year capital expenditures in 2024”. Amazon recalls that while its Cloud business reached an annualized $100bn revenue stream, more than 85% of the world IT spent is still on-premise: there is still room to grow. AWS AI solutions are driving traction, customers are increasingly using SageMaker as a building tool and other Large Language Models available. SageMaker is a platform on Cloud (PaaS) helping to build, train, and deploy machine learning (ML) models. Advertising growth was still healthy, at 24% YoY.

Concerning the margin trajectory of its international operations, the management said: “I would say the established countries of Europe, Japan, as well as the UK, are following a lot of the same trajectory as in the United States. They are profitable in their own right.” Most emerging markets remain in loss-making territory but enjoy gradual improvements.

Quarterly group GAAP EBIT reached a record high, at $15.3bn, leading to a 10.6% operating margin: the best recorded. The solid operating leverage came from a stabilization of R&D expenses and a decrease in SG&A spending. Amazon anticipates next quarterly revenues to grow sequentially between 7% and 11%, above $144bn, while EBIT is seen in a range of $10bn to $14bn, below what it just delivered in Q1. Yearly CAPEX is seen above FY2023 levels, pushed by elevated AWS investments as GenAI applications are expected to generate new revenue streams.

Peer group analysis

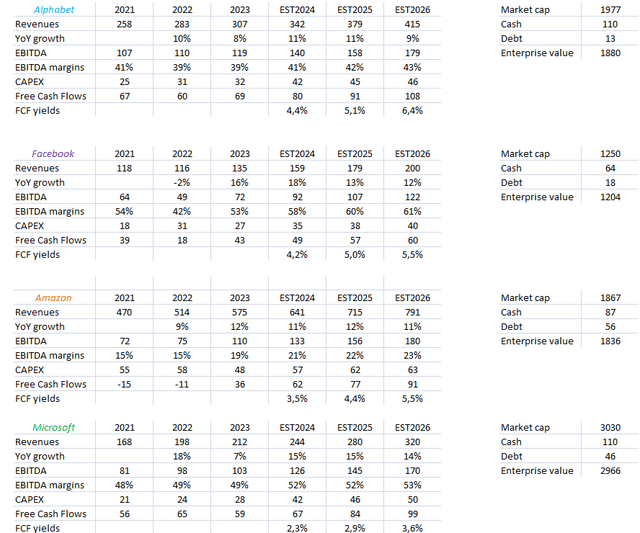

Let’s compare Amazon’s recent financial results to other US big tech companies. These figures are sourced from S&P Global Market Intelligence and are compiling the consensus from major brokerage firms. While not perfect, it should give a reasonable picture of what could be financial projections of these tech companies.

In the following tables, using consensus figures, we see that big techs are expected to see their revenue growth converging, between 10% and 15% per year in the coming three years.

Also, we see that the firm’s cash flow generation is gradually catching up with its peers, thanks to a strong operating leverage and CAPEX control.

source: https://www.marketscreener.com/

What valuation can we expect?

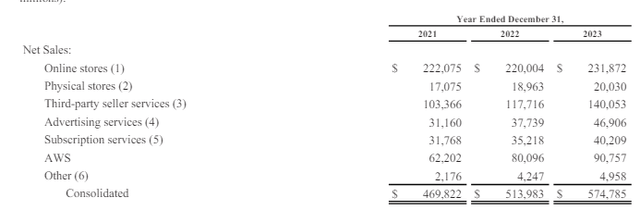

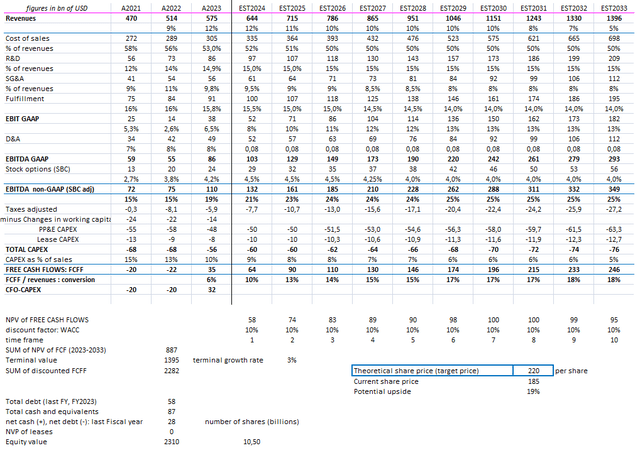

I modeled a revenue stream growing at a CAGR of 11% in the next three years, in line with recent trends. In granularity: I do expect AWS to grow close to 20% per year, as recent trends are indicating a business reacceleration thanks to GenAI usage. Advertising could sustain a 20% CAGR. These two segments represented 25% of total revenues in FY2023. Then, I modeled subscription fees to grow 10% per year, in line with the 3-year average. Other business lines should grow at a slower rate, especially online stores, at a trend close to 3%/year (GDP-related plus increasing penetration of e-commerce in retail sales).

Margin expansion should be driven by two factors: first, continuing logistic improvement in the e-commerce logistics, especially in International operations (currently close to breakeven). Second, I expect AWS and the advertising segment to outgrow other business lines and should be accretive for the margin mix.

CAPEX is expected to remain elevated in coming years driven by AWS AI developments. I see annual Free Cash Flow outpacing $100bn shortly, yielding more than 5% on the market cap (P/E of 20X). I find that attractive.

To discount Cash Flows, I use a WACC of 10% based on: a risk free rate of 4.5% (10 year US Treasury), a beta of 1 (Indexed stock) and market risk premium of 5.5%. My terminal growth rate is set at 3%, assuming a world with above 2% inflation and higher than average financial performance from the company.

Using these inputs, I get a price target of $220/share indicating 20% upside potential.

source: company data, own estimates

Technical analysis

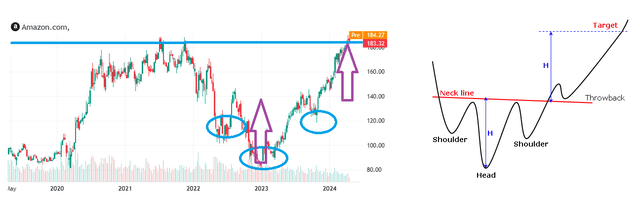

Amazon’s share price has rebounded sharply from 2023 lows, forming a powerful reverse head and shoulder pattern. The positive momentum halted by reaching 2021’s resistance level concomitant with recent spikes in the 10-year US Treasury yield. As the $185 resistance level doesn’t look solid, there could soon be a breakthrough.

Risks

Amazon’s main risk relates to the intense competition it faces. Within infrastructure and platform cloud computing: it is facing Microsoft (MSFT), Google, IBM (IBM), and Oracle (ORCL). While the firm held a large market share, this could change and materially affect its profitability.

The second important risk comes from the regulatory side, with ongoing antitrust inquiries in the US and Europe. Lastly, any supply chain disruption or inflationary pressures would once again damper Amazon’s profitability.

Conclusion

Amazon’s stock is still reasonably valued based on forward multiples, especially if we compare it with its tech peers. I see no reason margin expansion should stop here, which should fuel a strong cash-flow stream in the coming years. We saw that recent earning results have surprised on the upside, with noticeable beats. I do believe more are coming: operating leverage could be understated by analysts.

I think it is not too late to enter the stock or add up to the position: I rate the case as a BUY.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.