Summary:

- Palantir presents an asymmetric investment opportunity. I see its Artificial Intelligence Platform as a scalable Software-as-a-Service that could significantly expand the company’s business.

- If Palantir’s AIP platform succeeds, my target for the company is a fivefold increase from current levels, matching Salesforce’s market cap.

- I see Q1 results as an inflection point. Palantir needs to demonstrate that AIP can scale. If they succeed, the market will likely begin valuing Palantir as a SaaS company.

- Risks include a hefty valuation that could falter if AIP doesn’t scale as expected, and the possibility of stock dilution.

Michael Vi

Thesis: Palantir’s valuation depends entirely on its Artificial Intelligence Platform

Palantir Technologies Inc. (NYSE:PLTR) is currently valued at a 68 P/E, with a forward EPS of $0.33. The company pays no dividends and with a $50 Billion market cap, its valuation is not too far from PayPal Holdings, Inc. (PYPL), a significantly more established tech business. The latter stock has a P/E of just above 14 at the time of writing.

In my view, Palantir’s valuation and the future of its stock depends entirely on Palantir’s Artificial Intelligence Platform (AIP). AIP is a proprietary software that is supposed to help businesses make better decisions by analyzing large amounts of data and providing actionable insights. AIP is sold to customers through “AIP Bootcamps”, workshops where Palantir works with prospects to design solutions for their needs.

I believe that Palantir at the current valuation represents an asymmetric bet. AIP could prove to be a hyper-scalable, high margin software business, and in that case, the stock can do a 5X or 10X from these levels. On the other hand, if AIP fails to deliver and proves to be a glorified version of a PowerPoint deck, the stock will inevitably correct its current tech-like valuation.

I personally like this bet, and Palantir currently represents the third largest single holding in my portfolio.

Simplifying Palantir’s business

One of the issues with Palantir is the apparent complexity of its business. Palantir’s website uses many buzzwords and puffery claims such as “Foundational Software of Tomorrow. Delivered Today.™”, “Get AI Into Operations” and “Category-Defining Technology”. At a first glance, it can be difficult to wrap your head around what exactly Palantir does.

I will try to simplify Palantir’s business. At its core, Palantir provides advanced software that analyzes large amounts of data and turns them into actionable insights. Applications for its solutions are many, and go from military operations to battery production and football.

Another, more simplified, way to think about Palantir business is as a highly customized ChatGPT for your business.

Crucially, Palantir offers solutions that are highly tailored to its customers. The company prides itself for having a no-nonsense approach and working almost exclusively to build real use cases to show how its products can deliver value to customers. I see this high product customization both as the fundamental strength and weakness of Palantir.

On the one hand, Palantir’s customization is a strength because its solutions can solve specific business needs that are not tackable with simple software. Simple problems such as storing customer data can be solved with standard software. Complex problems, such as predicting the location of land mines or predicting the variables needed to win a football game, need tailored software. Few companies in the world have the technology to tackle these issues. However, this is also Palantir’s weakness, in that creating these custom solutions is time consuming and represents a limit to the scalability of a business model.

From a consultancy business to a SaaS-like enterprise

Palantir was founded in 2003 and, up until relatively recently, was fundamentally a consulting business in the fields of data mining, data analysis and AI. The company’s history is a valuable asset in my opinion. Backed by Peter Thiel, a known FBI informer and legendary venture capitalist, Palantir has established strong connections with military and paramilitary agencies globally. Partially funded by the CIA, Palantir is significantly involved in the conflicts in Israel and Ukraine. These relationships are likely to secure a steady revenue stream from these agencies for the foreseeable future and provide access to many leading organizations worldwide.

Palantir’s historical business model has a scalability issue because it relies heavily on hiring more developers as operations grow in order to deliver customized solutions to customers.

Everything changed when the company launched AIP in mid-2023. AIP is Palantir’s first product aimed specifically at commercial customers. It’s a more standardized and scalable version of its existing products like Foundry, Gotham, and Apollo. Palantir markets AIP by holding workshops known as “AIP Bootcamps” with potential and existing customers. This approach has proven to be the most effective way for the company to close deals.

I personally like this approach because the company is focusing its efforts on delivering value to customers rather than building PowerPoints.

As of Q4, 2024, a significant portion of Palantir’s revenue still comes from its historical business. Commercial revenues are at $284 million, which is significantly less than the $324 million generated from government contracts.

Palantir now has a product that, in my opinion, is very similar to a Software-as-a-Service (SaaS) solution like the CRM ecosystem of Salesforce, Inc. (CRM). Salesforce’s CRM is a software that has standardized code behind but can be sold and scaled in a highly customized manner to customers.

Salesforce offers customers a tailored base product and sets prices based on the number of users and features. Initially, a customer might buy a basic CRM software for sales, including licenses for 10,000 contacts and five users. Over time, Salesforce could offer upgrades like a marketing automation platform, additional user licenses, and more contact capacity.

Since the code behind Salesforce’s CRM is fundamentally the same across customers, the work required to customize its solutions is limited. On top, Salesforce has massive pricing power because once customers are locked in their ecosystem, switching costs are significant.

SaaS businesses have dominated the tech and venture capital scene in recent years. And this is because SaaS represents a highly scalable, high margin business model with high barriers to entry. I believe Palantir is the first major AI-focused company that is entering the SaaS space.

Understanding Palantir’s growth and financials: eyes on Q1

To evaluate Palantir’s valuation, it’s important to concentrate on the growth of AIP. Although its government business has been successful and profitable as of late 2022, the real growth opportunity lies in its US commercial business. This area is currently Palantir’s main focus. Success here can be quickly expanded and then replicated internationally using a similar business model.

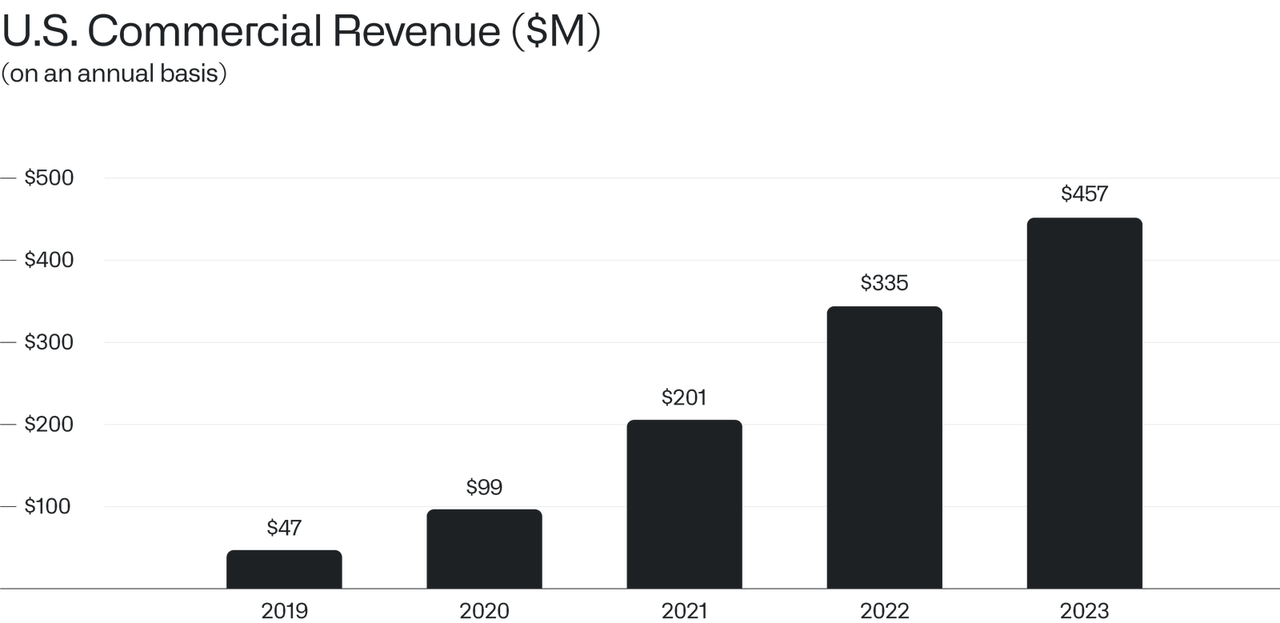

According to Palantir’s Q4 2023 report, US commercial revenue grew 70% year-over-year and the total contract value (TCV) grew 107% year-over-year on a dollar-weighted duration basis. I specifically like this latter figure, as it indicates the actual growth of the commercial segment – since contract value is usually not registered until invoices are being paid.

In other terms, Palantir has more than doubled the size of its US commercial business since the introduction of AIP. What’s impressive is that this growth has been experienced with a product that only launched in mid-2023.

On top of revenue growth, it is important to note how Palantir is currently reporting a 50% margin across its operations. This is impressive for a company that is still very much in its growth phase and not necessarily caring about margins. For reference, Salesforce’s average margins are at just above 70% at the time of writing.

US Commercial Revenue, PLTR (Palantir Q4 2024 Presentation)

In its 2024 Annual Letter, CEO Alex Karp reports expected overall revenue growth to be at around 40% in 2024. I believe we are now at a point of inflection. Q1 results will show whether AIP success is continued or not, and whether that target can be sustained.

If successful, I expect Palantir to report a significant acceleration in its US commercial business, given AIP is maturing and a significant customer base for up-selling has also been established.

My target: Palantir could be the Salesforce of AI

My bullish case for Palantir depends on AIP working as expected. If this happens, I see a strong similarity in Palantir’s AIP product with Salesforce’s SaaS suite of products. That’s why I expect Palantir to eventually match Salesforce’s in valuation. If Palantir was to match Salesforce’s current market cap of approximately $260 Billion, this would represent a 5x return for shareholders.

This bullish thesis relies on Palantir’s commercial business to quickly become the most significant revenue and profit generator for the company. Assuming a valuation of Palantir in line with that of Salesforce, currently trading at 28 P/E, Palantir’s business would need to reach the following key financial metrics:

-

Revenue to grow 15x from 2023 levels

-

Profitability to grow 48% from 2023 levels

I do not expect Palantir to start paying a dividend, nor to initiate a stock buyback program anytime soon, as they are solely focused on growing their business for the foreseeable future. Historically, Palantir has actually diluted existing shareholders, a point that I will cover in the risk section of this article.

I don’t have a specific timeline for when I expect this investment to potentially pay off. I usually avoid market predictions and focus on product and macroeconomic factors instead. However, I do believe that the first quarter results will be crucial for Palantir. Since markets are forward-looking, if Q1 demonstrates that Palantir’s AIP is scalable, I expect the company will begin to be valued as the next major SaaS business.

Risks to my thesis – valuation and stock dilution

The main risk to my thesis is that AIP could not prove to be as scalable as I assumed.

As a result, Palantir might never reach levels of growth and profitability allowing the company to sustain its current, hefty market valuation. If commercial revenue does not materialize at or above management’s forecast, the stock will correct significantly in the short and medium term. The market is already discounting Palantir as a scalable business with significant prospects for future profits. If this expectation fails to materialize, the stock might correct by a factor of 50% or more from current levels.

Stock dilution is another risk worth mentioning. Palantir has historically issued a significant amount of new shares to reward its management. This has resulted in an increase in stock count and dilution for existing shareholders. Even if Palantir’s stock count has decreased in Q4 2023, the company might revert to issuing stock as a way to attract and retain the top performer it needs to deliver superior software. While I do not think this is a significant risk, as long as Palantir continues to grow its commercial business, it is something investors should consider if they are thinking about opening a position in this company.

Conclusion

Asymmetric bets are hard to come by in the investing world. Asymmetric bets are one of the few opportunities where a position can grow by a factor of 5X or more in a relatively short period of time.

I believe Palantir today represents an asymmetric bet. The market is not yet fully discounting the company’s success in the B2B commercial business. If that happens, the company is bound to at least match Salesforce’s valuation, a company that I see as a benchmark for Palantir because of its SaaS business.

Q1 will be crucial to see whether AIP is continuing to deliver on its promise – the AI platform needs to prove that it can scale Palantir’s business.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.