Summary:

- I think the recent financial performance has been quite good, in spite of the slight deterioration of the balance sheet. The dividend remains very well covered in my view.

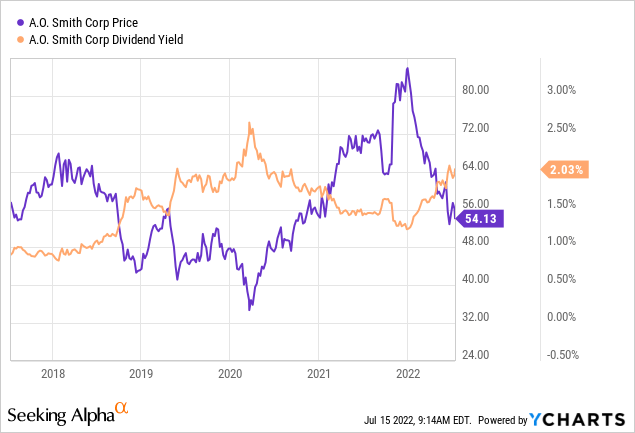

- In spite of this, the shares are trading near the bottom end of their range, which puts the yield near the top of its historical range.

- The puts I wrote earlier did better (less badly) than the stock, highlighting yet again the risk-reducing, yield-enhancing potential of short puts.

Jonathan Kitchen

I last looked at the shares of A. O. Smith Corporation (NYSE:AOS) in mid-February of this year, and since then the stock has dropped about 24% against a loss of about 12.75% for the S&P 500. Although I bought a few shares around $70, most of my bullishness was manifested in short put options. I want to write about the relative performance of these two investments, as I think there are lessons to be learned from my experience. Additionally, in this piece I want to work out whether or not it makes sense to add to this position aggressively at current prices. After all, the shares recently received a downgrade, and that’s frequently a positive in my view. I’ll make that determination by looking at the latest financial results, as well as by looking at the stock as a thing distinct from the underlying business. As stated above, I’m also really looking forward to writing about put options.

Welcome to the “thesis statement” portion of the article. It’s here where I present you with the high points of my thinking about a given name so you won’t have to wade through the tedium of my cumbersome prose. This is one of the many “value adds” that I offer my readers, and it’s further proof that I’m absolutely obsessed with making your lives more pleasant. I think the latest financial performance has been quite good, and nothing here suggests that the dividend is at risk. Further, thanks to the near record low valuations, the dividend yield is near a multi year high. Given the above, I think it now makes sense to aggressively buy this dividend aristocrat on sale. I know that it may be emotionally challenging to do so, but if we want to “buy low”, the only way we can do so is when times are a bit scary. Finally, the short puts I wrote earlier did much better (or, more precisely, “less badly”) than the stocks I bought. The period February to now is yet another example of the risk reducing, yield enhancing potential of short put options. Although I normally like selling puts, I think the stock currently represents greater value.

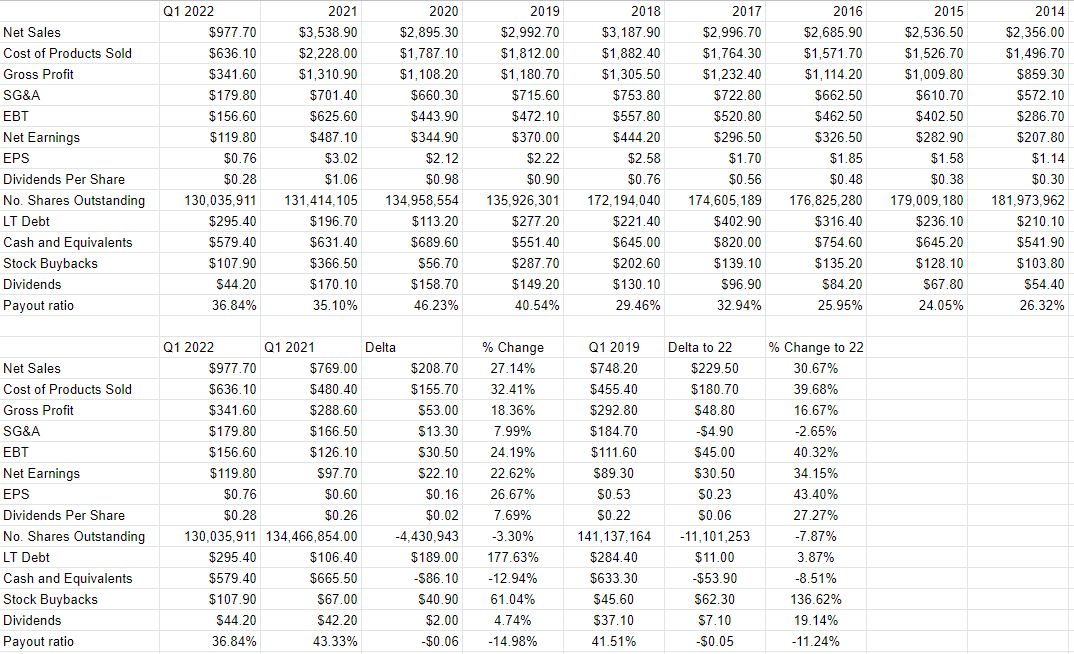

Financial Snapshot

I think the latest financial results have been generally good at A. O. Smith in a number of ways. First, revenue for the first quarter of 2022 was about 27% higher than it was the same period a year ago, and net income was up a very respectable 22.6%. The company managed to grow profits very nicely in spite of a 32.5% uptick in cost of goods sold. In case you’re worried that the recent performance only looks good because 2021 was a particularly soft period for the company, fret no longer. I’ve taken the liberty of comparing the most recent period to the same span of time in 2019, and recent results are similarly good. Specifically, revenue and net income are higher by 30.7%, and 35% respectively. In sum, 2021 was the strongest year for the company since at least 2014, and if things continue apace, 2022 looks to outdo 2021.

Above, I wrote “generally good” because it’s not all animated bluebirds and flowing streams of Powers Whiskey at A. O. Smith. The capital structure has picked up relative to the same period in 2021. Long term debt is up by about $189 million, or 177% relative to 2021, and cash and equivalents are down by about $86 million or 13%. In fairness to the company, though, I should point out that 2021 was more of an aberration than is the current time. For instance, debt today is only about 4% greater than it was in 2019, and cash is only about 8.5% lower. Finally, the $579.4 million in cash on hand is far greater than the $170 million the company spent on dividends in 2021, so my fretting about the capital structure is a bit overdone. One of my many charming character traits is the fact that I can get worked up over relatively small things. In my previous article on this name, I concluded that the dividend was very well covered and, with a payout ratio of only 36%, nothing’s happened in the meantime to convince me otherwise.

I’d be very happy to buy this stock at the right price.

A. O. Smith Financials (A. O. Smith investor relations)

The Stock

As my regulars know, I consider the “business” and the “stock” to be quite different things. In case you’re new here, I’ll tell you also. I consider the “business” and the “stock” to be quite different things. Every business buys a number of inputs, performs value-adding activities on them and sells the results at a profit. In the final analysis, that’s what every business is. The stock, on the other hand, is an ownership stake in the business that gets traded around in a market that aggregates the crowd’s rapidly changing views about the future health of the business. Some analyst decides that “future growth catalysts” are weaker than once thought, and the stock falls in price in sympathy, in spite of absolutely no change at the company. The stock also moves around because it gets taken along for the ride when the crowd changes its views about “the market” in general. So, in some sense, the stock is “doubly buffeted” by the crowds’ rapidly changing views about a given company, and the crowd’s rapidly changing views about the overall stock market.

This is troublesome, but it’s a potential source of profit because these price movements have the potential to create a disconnect between market expectations and subsequent reality. In my experience, this is the only way to generate profits trading stocks: by determining the crowd’s expectations about a given company’s performance, spotting discrepancies between those assumptions and stock price, and placing a trade accordingly. I’ve also found it’s the case that investors do better/less badly when they buy shares that are relatively cheap, because cheap shares correlate with low expectations.

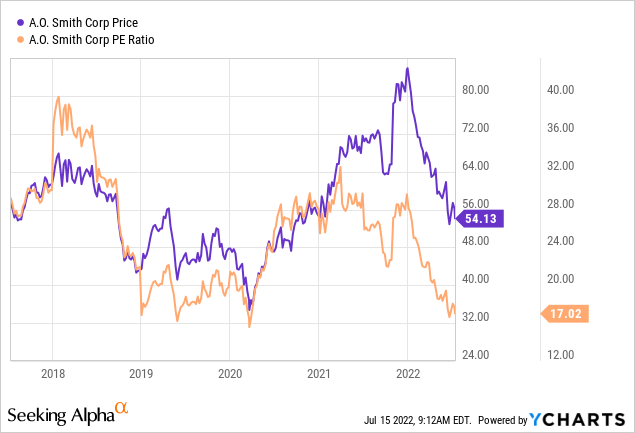

As my regulars know, I measure the relative cheapness of a stock in a few ways. For example, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. Previously, I liked the fact that shares were about 11% cheaper than when I last looked at the stock, but I was a bit bothered by the fact that, at a P/E of 23.5, the shares weren’t “unambiguously cheap.” This is why I took the middle path and only “nibbled” on this position while selling 10 deep out of the money puts.

Here we are five months later and the shares are about 26% cheaper, per the following:

While investors are buying the shares at a relative discount, they’re receiving a dividend yield that’s relatively high, per the following:

That’s enough for me. I think the dividend is very well covered here, and is on the high side. I also really like the fact that the shares are trading near the low end of the range. I’ll buy some more shares this morning.

A Tale of Two Investments: My Stock Investment Versus my Short Put Investment

As you may remember from earlier in this article, most of my prior bullishness on this name was expressed via short put options. I liked the stock, but I didn’t love it at the then price, so I took a small position. At the same time, I sold 10 November A. O. Smith puts with a strike of $50 for $1.20 each. I added this premia to the $7.35 I’d already earned on this name. Now that the stock is down dramatically, you might be forgiven for assuming that the puts have exploded higher in price, but you’d be wrong. Even though they’re no longer that far out of the money, they’re currently bid at $1.80, and last traded hands at $1.86. So, the puts have lost about $.60 while the shares have lost about $15. This highlights, once again, the power of selling deep out of the money put options.

While I normally like to sell puts, I haven’t found reasonable premia at the moment, so I would recommend simply buying the stock at this point. In my view, the longer term potential of buying a dividend aristocrat at current prices is far greater than the short term returns from put options. This is not like me, but I prefer straightforward stock ownership to short puts at the moment. You need to remain flexible in my view.

Conclusion

The shares of this dividend aristocrat are now trading near a multi-year low and, as a result, the dividend yield is very near a multi-year high. The recent financial performance has been quite strong in my estimation. In my opinion, this highlights the strangeness of the current valuation. I’m willing to take advantage of the discrepancy between expectations and what I consider to be the reality here. I think “price” and “value” can be quite distinct from each other, and I think investors would be wise to buy now before price rises to match value.

Disclosure: I/we have a beneficial long position in the shares of AOS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I’m still short the November puts as I’d be happy to buy at $50. I’ll be buying 500 more shares this morning.