Summary:

- This article is not a specific pre-/post-earnings discussion, but rather examines Disney from a strategic long-term perspective (based on information available prior to Q2/24 Earnings).

- I aim to do this by using the very current example of the Disney – Taylor Swift symbiosis.

- Disney’s 75 million USD expenditure for the Eras Tour streaming rights might have been a bargain considering its ripple effects.

- I argue that this deal represents a perfect match and will pay off for Disney.

- DIS is a significant anchor investment in my portfolio.

OGULCAN AKSOY/iStock Editorial via Getty Images

Thesis And Plea To The Readers

“They cry a lot, but we are so productive — it’s an art,” adapted from Taylor Swift. This provocative sentence could describe Disney’s (NYSE:DIS) and Swift’s successes, regardless of their public criticisms. At the same time, I sincerely ask each and every reader not to fall into a culture war or engage in mutual insults over taste and entertainment, which are always highly subjective. This is not a hymn of praise for Taylor Swift or Disney. It merely highlights their undeniable successes and potential synergies. I ask that you take this into account without judgment.

The foundational elements of my portfolio include Technology, Healthcare, Personal Care Consumer Goods, and “Panem et Circenses” — Latin for “bread and games”. This is a concept originating from the Roman Empire, suggesting that people are satisfied when they have access to affordable food and are well entertained. Entertainment persists even during politically challenging times and could almost be considered a basic human need, or, more cynically, a form of escapism. With Disney still one of the leading representatives in this field and Taylor Swift, who, despite being mainstream, seemingly unites diverse tastes, my stance is that Disney and Taylor Swift represent a logical symbiosis. In this article, I aim to dissect both the strategic, qualitative, and quantitative implications for Disney.

Disney Capitalizing On “Swiftonomics”

Netflix, Comcast’s Universal Pictures, and Disney+ were all interested in partaking in the so called Swift Effect, which has been further fueled in recent months by Swift’s iconic Eras Tour. Disney won the bidding, securing the streaming rights for the concert film at a cost of over 75 million USD. The Eras Tour is available in the Disney+ library from March 15. To be fair, Netflix already got some share with Swift’s “Miss Americana” documentary, and Universal led the digital distribution of the film as of December 13. The film premiered in theatres on October 13.

To put things in perspective, 75 million USD accounts for only 1 to 2% of Disney’s quarterly operating expenses in their Direct To Consumer business, which largely encompasses Disney+, based on Q1/24 numbers. So, this amount is almost negligible and is likely to yield returns many times over. Nevertheless, let me briefly and simply calculate conservatively with Disney+’s global ARPU of 5.42 USD. This equates to about 65 USD per year, after what the revenue contribution from 1.15 million yearly subscriptions would be equivalent to the 75 million USD Disney paid for the Eras Tour streaming rights. So, let’s assume that these 1.15 million additional subscribers would justify the extra cost after one year. Is this a realistic number? I argue that yes, it is, and beyond that, there are even more significant ripple effects for Disney. And again, we’re not even talking about the higher ARPU in Swift’s more relevant geographies, advertising revenue through Disney+, and the potential to penetrate a huge and youthful audience in the longer term.

Let’s dive deeper. Loads of numbers are being thrown around about Taylor Swift, which I want to summarize in the following section through five categories, while putting them into context with Disney and how they can potentially benefit them:

- Eras Tour Stats

- Eras Tour Concert Film in Theatres Stats

- Eras Tour Concert Film on Disney+ Stats

- Taylor Swift Stats

- Swiftonomics

Eras Tour Stats

Some might argue that people who have already attended the concerts live would not want to stream them again. However, I believe the opposite is true — the ability to relive this experience at home, over and over again, actually makes those who attended the concerts a highly relevant target audience for Disney+’s streaming of the concert film. With concert tickets costing between 200 and 800 USD, an extra 65 USD per year for Disney+ might not even register for Swift fans. This is especially true given the willingness of Swift fans to spend money beyond the ticket price, as we’ll impressively explore later. Here’s how successful the tour has been so far:

- 1 billion USD in gross ticket sales in 2023

- 2 billion USD expected to be exceeded through 2024

- 4.35 million tickets sold in the first 60 shows, averaging 72.5 thousand visitors per show and 239 USD per ticket.

- 11 million visitors extrapolated across all 152 shows.

- Far surpassing Elton John’s multi-year Farewell Yellow Brick Road Tour, which sold 6 million tickets over 328 shows, totaling 939 million USD in gross sales.

- Swifties are estimated to spend an additional 1,300 USD on top of ticket costs for travel, dining, merchandise, and other expenses surrounding their concert experience, while typically 300 additional Dollars are spent for every 100 USD spent on live performances.

- 91% of concertgoers said they would attend another Taylor Swift concert.

Now we have some numbers to work with. Among the 11 million concertgoers, most appear quite willing to spend, so paying for a streaming service subscription wouldn’t be an existential question — in fact, it’s likely a welcome opportunity to relive the concert experience. Let’s subtract the 9% who might not be interested in rewatching, plus those who might buy the film through other channels, and some who are already Disney+ subscribers. Even with these deductions, I estimate that this audience alone could generate a low single-digit million number of new Disney+ subscribers.

Eras Tour Concert Film in Theatres Stats

- All-time top-selling concert film grossing 260+ million USD in worldwide box office sales

- Nearly 100 million USD in ticket sales in the US and Canada during its opening weekend, surpassing Justin Bieber’s “Never Say Never” concert film debut in 2011 with 73 million USD.

- 100+ million USD in advanced ticket sales globally

- However, this did not positively impact AMC stock, which we need to consider when assessing potential ripple effects on Disney later on.

Eras Tour Concert Film on Disney+ Stats

- YouTube Trailer has garnered 4.2 million views to date.

- 16.2 million streamed hours within its first three days on Disney+. Divided by the film’s length, this equates to an estimated 4.6 million views.

Taylor Swift Stats

- 53% of Americans are self-reported Swift fans, equaling around 180 million followers in the US alone.

- Ranked the fifth most influential woman by Forbes, 2023 Time Magazine Person of the Year, with an estimated net worth exceeding 1 billion USD (irrelevant fun-fact).

- 284 million followers on Instagram. For comparison: Disney – 39 million followers, Disney Plus – 5.6 million followers.

With half of all Americans being fans of Taylor Swift, and given her large Instagram following, it’s plausible to estimate her global fan base at around half a billion. Admittedly, there’s quite a bit of guesswork involved here, so be aware that some of my claims are rough estimations. Let’s assume that about two-thirds of Swift and Disney fans already overlap — they would have subscribed to Disney+ if they wanted to, and thus would be part of Disney+’s roughly 150 million current subscribers — representing around 45% of all 335 million Disney-liking Taylor Swift fans (which is the two thirds overlap of 500 million). Now, let’s apply an even lower percentage range, just 1-5%, to the remaining third (165 million) of Taylor Swift fans who might be willing to subscribe to Disney+ for the Eras Tour, and once again, we end up with a potential single-digit million number of new Disney+ subscribers from the Swift effect.

Swiftonomics

- Taylor estimatedly increased the Kansas City Chiefs’ brand value by nearly 50% to 1 billion USD just by attending games of her boyfriend and tight end Travis Kelce. For context: the four-time Super Bowl-winning Chiefs were obviously already a top-tier NFL brand beforehand.

- Sales in Kelce merchandise increased by almost 400%

- Most-watched Sunday Night Football game since the Super Bowl, thanks to a 53%, 24%, and 34% increase in female viewers aged 12-17, 18-24, or 35+, respectively, compared to season-to-date averages. Potentially a 20% increase in NFL sponsorships.

- Bank of America suggests that the Eras Tour has economic impacts on cities comparable to the Super Bowl. Mastercard has observed a similar phenomenon, dubbing it “The Swift Lift”, while the Uber CEO notes a significant increase in volume extending to surrounding areas, though he claims it’s not substantial enough to affect overall company figures. While this might indicate a limiting factor for Disney as well, I will later explain why I believe the brand connections between Disney and Taylor Swift might be stronger and more advantageous than for other companies.

- Even the FED pointed out the concerts’ effects on Philadelphia hotel revenues.

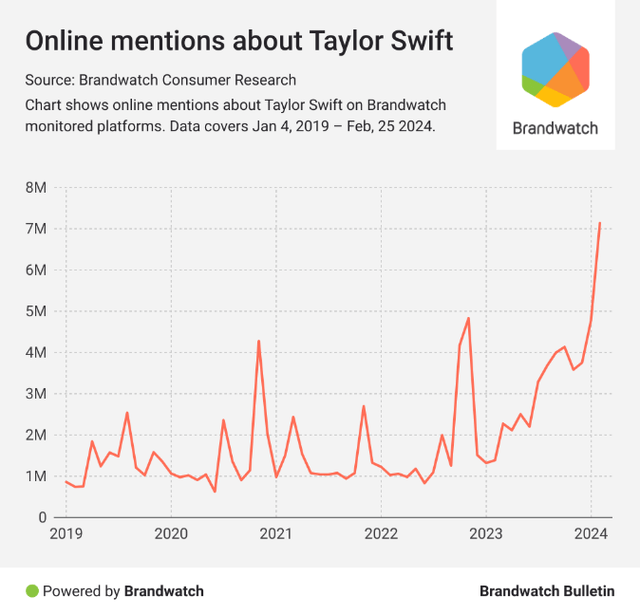

With some highlighting a cost-of-living crisis, all of this suggests that “Panem et Circenses” might be a good strategy in different economic and political environments. While some question whether the world has had enough of Taylor Swift by now, the following chart seems to suggest otherwise. Not to mention Swift’s recent 11th album release, “The Tortured Poets Department,” which shattered record after record in the shortest amount of time for a new album. I won’t go into detail, but with about 1 billion total streams within one week after release, it is already the most streamed album ever. And so, the end of the flagpole doesn’t necessarily seem to have been reached.

Brandwatch

A New Princess to The Disney Universe

If there’s a recurring key element besides the mouse that distinguishes Disney, it’s Disney’s princesses. And without intending to diminish Taylor Swift by labeling her a fairy tale princess, I have noticed that some people draw strong parallels, one of which is shown in a highly liked YouTube comment below. Having visited Disneyland and watched the cast perform live on several occasions, I can confirm that I’ve noticed those parallels myself in the facial expressions and gestures in Swift’s performance on her Eras Tour, again signaling she might be a perfect match with Disney. While Taylor Swift exhibits some Disney princess-like gestures, she represents female empowerment rather than the allegedly outdated princess connotations, along with left-leaning political views. This creates a symbiosis of two often seemingly contradictory interpretations of Disney’s positions. But Swift shows that these views aren’t as contradictory as they might first appear. It’s an attempt to unite rather than divide — a pursuit of consensus and a welcoming mainstream that anti-woke critics might find hard to challenge.

An observation made by a YouTube user. (YouTube)

“Go Woke, Go Broke”?

“Go woke, go broke” slogans, in my view, have not yet proven true. Please note that I am writing from an observational perspective, without political bias. I believe that those criticisms Disney often faces are not an existential threat, but rather a natural response to changing times, shifting perspectives, and the challenges of navigating these changes. Just as Swift transitioned from the image of a wholesome country singer to the edgier persona of her “Reputation” album, and now integrates all her facets, I see no contradiction in Disney maintaining their classic fairy tale image while for example also offering a more “adult” STAR category on Disney+. Swift has experienced various transformations throughout her career, also moving between genres like pop, country, indie, folk, and alternative rock. I firmly believe that similar to the brand connotation surrounding Taylor Swift, Disney will also manage to successfully evolve while still honoring and capitalizing on its roots.

“Swift’s journey from country sweetheart to pop icon is a masterclass in evolution. She hasn’t abandoned her roots, but she’s embraced change, a key factor in successful brands. This adaptability allows her to connect with new fans and expand her community (…). (…) It’s not just about financial gain; it’s about creating real connection, fostering shared values, and building a community that thrives on shared experiences” says this LinkedIn post I found quite fitting and inspiring.

I feel that much of what we encounter on the internet is subject to “false balancing”, where heavily supported comments such as “I’m canceling my Disney+” in response to Taylor Swift advertising on Disney+ appear louder than those who choose not to engage on social media, quietly enjoying it instead. And although Taylor Swift’s fans are generally seen as predominantly Democratic or left-leaning, there is also a significant number of conservative fans within her following. This once again suggests that Swift’s ability to unite conflicting views that Disney often struggles with could have a positive spillover effect on the company.

Down To Business

I am a numbers guy as well, so I can almost literally sense readers dismissing this article as esoteric. But for strategic and long-term brand building, I believe storytelling is what makes brands like Disney successful in the long run. As I mention in my bio, I am a proponent of integrating both number crunching and storytelling into company valuation. While this article may have leaned more heavily toward the latter, I want to conclude by focusing on the hard facts.

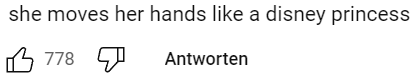

Disney+ has recently come close to finally turning profitable. Besides cost-cutting measures, this can be attributed to rising ARPU, which Iger prioritized over subscriber growth. The move toward profitability was well-received by shareholders. The chart below clearly shows that ARPU has been increased much more aggressively than analysts had expected a year ago, while user numbers have seen contraction or stagnation instead of growth. A positive note is that the decline appears to have reached a bottom, despite continued ARPU increases, leading me to expect rising subscriber numbers again, not least partly attributable to the Swift effect.

Author | Data: FactSet, Disney

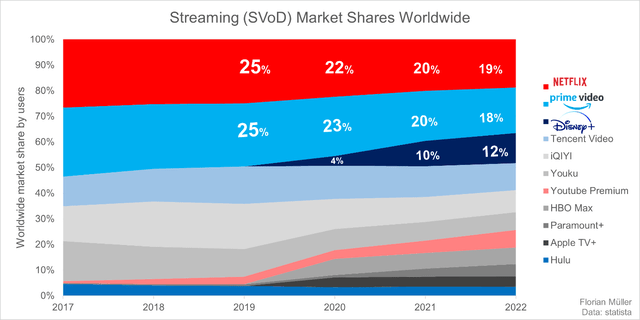

Disney+ remains a significant force in the streaming market, as illustrated by a chart from an older Disney analysis of mine below. On a less encouraging note, Disney+ is not just a new growth story. It is also expected to compensate for the naturally declining revenue and profits from linear television and third-party licensing. The company’s currently highly profitable “best horse in the stable” however is the Experiences segment, which includes its theme parks.

Author | Data: Statista

DIS Valuation Needs Some Imagination

I do not consider Disney’s current valuation as cheap, given its forward P/E in the mid-twenties and a forward Price to Sales ratio of 2.3. From a risk perspective, I estimated in my previous analysis that Disney should be valued at P/Es below 20, translating to Price/Sales below 2, assuming net margins of at least 10% would be reached again soon. Back then, I focused on Price/Sales rather than P/E because Disney lacked a stable P/E history due to the COVID disruptions that hit its theme parks particularly hard. This made the P/S ratio a more reliable measure, offering a clearer view of how investors quickly overlooked this outlier. To summarize this valuation section, it appears Disney is not cheap but at best close to fair value. However, I am bullish about its operational long-term performance and expect Disney to quickly grow into this valuation, reinforcing my confidence in Disney as a significant long-term holding in my portfolio.

What My Thesis Missed Out On

In conclusion, here are brief comments on important Disney-related topics that I didn’t cover in this analysis:

- Proxy Fight: Iger remains at the helm, subject to further company information.

- Shareholder Returns: Disney has increased its ambitions through dividend payments and share repurchases, which I find relatively insignificant. Personally, I would have preferred if the money stayed within the company until it became more stable.

- Interest Burden: The peak should have been reached, with interest-bearing debt being reduced and interest rates likely having peaked, with prospects of rate cuts having gained traction.

- Once profitable, I would like to see further growth ambitions with Disney+.

- High park investments are key to solidifying and sustainably maintaining Disney’s most profitable and significant segment.

Final Remarks

Integrating Taylor Swift’s Eras Tour into Disney+ was, in my view, an important strategic move that will pay off in multiple ways. On one hand, I expect the Swift effect to be strong enough to attract several million new subscribers to the platform, and given the ongoing Eras Tour, which is only halfway through, as well as the renewed hype with Swift’s new album, the Swift effect is far from over. We’re talking about several million potential new subscribers, which admittedly may not move the needle significantly for a company as large as Disney, but it’s still a relevant piece that I wanted to highlight in this analysis, including the broader effect on Disney’s brand identity. This reaffirms Disney as a long-term anchor investment in my portfolio, one whose comeback story you need to believe in, especially since the valuation is at best fair but not remarkably cheap.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.