Summary:

- Broadcom’s AI revenue is expected to exceed $10B this fiscal year, benefiting from the AI growth spurt.

- AVGO’s valuation has also surged well above its long-term average, behooving caution.

- AI revenue is expected to comprise about 20% of Broadcom’s revenue base, not the majority.

- Investors must assess AVGO stock carefully as it’s not a pure-play AI stock.

- While Broadcom is a top-notch semiconductor company, AVGO seems too expensive to turn bullish now.

JHVEPhoto

Broadcom Goes All In On AI

Broadcom Inc. (NASDAQ:AVGO) investors have witnessed an extended consolidation since AVGO stock topped out at the $1,440 level in March 2024. Buyers have failed to muster more robust buying momentum over the past eight weeks. Accordingly, Broadcom reported its earnings release in March 2024. Broadcom also delivered its AI conference called “Enabling AI Infrastructure” in the same month. While Broadcom’s first fiscal-quarter earnings release and guidance were robust, AVGO suffered a post-earnings decline. Despite that, Broadcom’s AI event also bolstered Wall Street’s confidence in Broadcom’s growing AI portfolio opportunities. As a result, analysts have remained relatively sanguine about Broadcom’s AI growth inflection, even as Broadcom navigates headwinds in other areas. I highlighted my caution on AVGO even though it has continued to outperform my expectations. Therefore, AVGO buyers’ ability to defy gravity has impressed me.

Broadcom is a semiconductor bellwether, closely watched by investors and analysts for deep insights into the health of the semiconductor value chain. The company has a broad portfolio comprising “critical markets such as cloud, data center, networking, broadband, wireless, storage, industrial, and enterprise software.” Broadcom’s acquisition of VMware has augmented the company’s enterprise software opportunities. Broadcom is also expected to fully integrate VMware into its operations by the end of this year, lowering the execution headwinds from the next fiscal year.

I believe AVGO stock’s surge over the past year is mainly driven by the growth inflection of AI revenue within Broadcom’s well-diversified portfolio. Accordingly, AVGO has participated in the AI growth spurt, rising more than 110% in total returns over the past year. Broadcom anticipates AI revenue to exceed $10B this fiscal year, up from its previous estimates of $8B. In addition, it’s also expected to account for 35% of Broadcom’s semiconductor revenue for 2024, up from a previous forecast of 25%.

Consequently, Broadcom has delivered substantial confidence for investors that its AI revenue could broaden, providing a much-needed lift for less tepid growth in its enterprise and consumer segments. Despite that, it’s also critical for investors to note that Broadcom guided for $50B in total revenue for FY2024. Therefore, AI revenue is expected to account for about 20% of Broadcom’s total revenue base. Hence, investors need to carefully assess Broadcom’s AI growth drivers, as they aren’t expected to account for most of AVGO’s valuation in the near term.

AVGO Stock Is Expensive

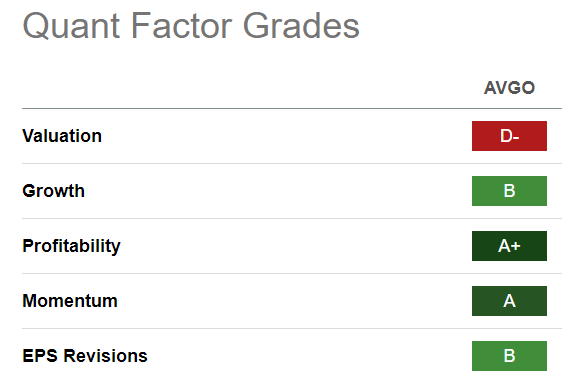

AVGO Quant Grades (Seeking Alpha)

Despite that, the market has markedly re-rated AVGO’s valuation in anticipation of its AI growth spurt. As seen above, AVGO is assigned a premium “D-” valuation grade against an overall growth grade of “B.” AVGO stock’s forward adjusted EBITDA multiple of 20.5x is well above its 10Y average of 11.5x, reflecting significant optimism.

Sure, AVGO bulls could argue that AI revenue comprised less than 5% of semiconductor revenue before 2022. As a result, investors should assess Broadcom’s AI prospects based on whether they are sustainable in the medium term.

Broadcom’s AI investor event demonstrated its AI prowess in merchant networking solutions and custom AI accelerator engagements. Broadcom reminded investors that its Ethernet AI infrastructure is critical to facilitating AI at a scale, comparing constructively with better economics against InfiniBand.

In addition, Broadcom added another strategic AI customer (possibly ByteDance) for consumer AI. Broadcom highlighted that “large-scale consumer AI companies prefer custom AI accelerators due to their efficiency and cost-effectiveness.” Consequently, Broadcom demonstrated its ability to land critical and significant consumer AI customers, underscoring the value of its “deep, strategic, and multi-year engagements.” Coupled with Broadcom’s assessment of a “limited number of key customers worldwide in the consumer AI market,” it should strengthen Broadcom’s value proposition against smaller peers.

Is AVGO Stock A Buy, Sell, Or Hold?

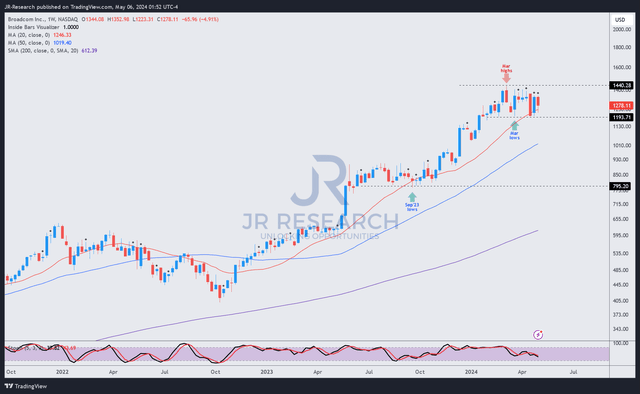

AVGO price chart (weekly, medium-term, adjusted for dividends) (TradingView)

AVGO’s price chart doesn’t lie. The market is confident in the wide-moat semiconductor company’s ability to deliver on its AI premise. As a result, dip-buyers robustly defended steep pullbacks over the past year.

I have acknowledged that my previous caution on AVGO hasn’t paid off. Therefore, I concluded that I missed the most attractive growth phase in AVGO’s rally over the past year, which bottomed out resoundingly in October 2022.

However, I’m also wary about turning bullish on AVGO now, knowing that the market has likely reflected significant optimism in AVGO. It’s crucial to consider Broadcom’s AI revenue, which is still expected to form 20% of its total revenue base in FY2024. As a result, we mustn’t expect AVGO to be valued much higher unless Broadcom management can guide more optimistically.

Despite that, it doesn’t mean investors should short or cut their AVGO exposure significantly, as I believe Broadcom remains one of the best semiconductor stocks that money can buy.

Therefore, I will patiently wait for a possible entry opportunity between the $800 to $1,000 level to consider getting in. For now, I believe AVGO remains too expensive to justify its AI growth inflection.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!