Summary:

- AOS reported strong Q1-22 earnings, beating both EPS and revenue estimates.

- Company management cited inflation-related pricing impacts, exemplifying its ability to pass on costs to customers.

- Geographic revenue mix continues to improve, citing robust demand outside of North America.

- AOS continues to repurchase shares which should provide a valuation buffer in the near term.

- I continue to hold the belief that AOS shares are undervalued, and assign a fair share price of $64.74, representing a ~9% upside opportunity.

HMVart/E+ via Getty Images

Revisiting My Prior Analysis

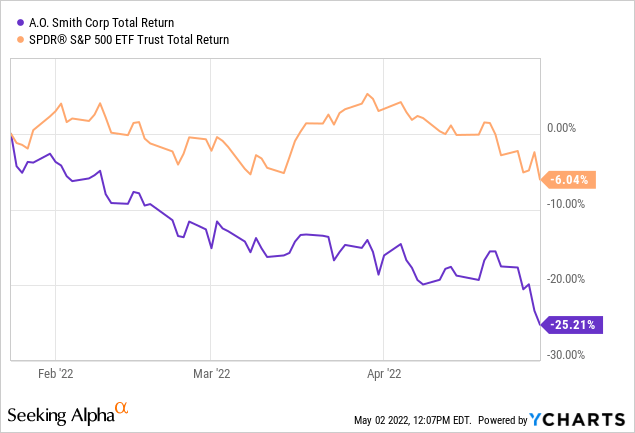

On 1/24/22, I wrote an article in which I elaborated on the growth in retail construction being a strong catalyst for A.O. Smith (NYSE:AOS) shares. I strongly recommend readers take a look at that (linked here) before delving into my analysis here. Unfortunately, the stock has slumped ever since, as shown below.

AOS shares have underperformed the market since my publication by a healthy margin. While my timing was wrong, I still hold the belief that shares are undervalued at current levels, especially after the strong Q1-22 earnings that the company released last week. According to my DCF model, I believe that AOS shares have a fair share price of $64.74, representing a 9% upside opportunity at current levels.

Strong Q1-22 Earnings

AOS released strong Q1-22 earnings last week, beating revenue estimates by $10.65M and GAAP Actual EPS estimates by $.05. Y/Y, revenue increased 27% with its North American segment growing 32% and “rest of world” growing 15%. While growth was less outside of its North American segment, the company is continuing to expand its reach in other countries. This should act as a tailwind to AOS’s top-line growth in the coming years as the company expands elsewhere. Margins were strong due to favorable pricing for water heaters. This shows the company’s strong pricing power in the face of persistent inflation.

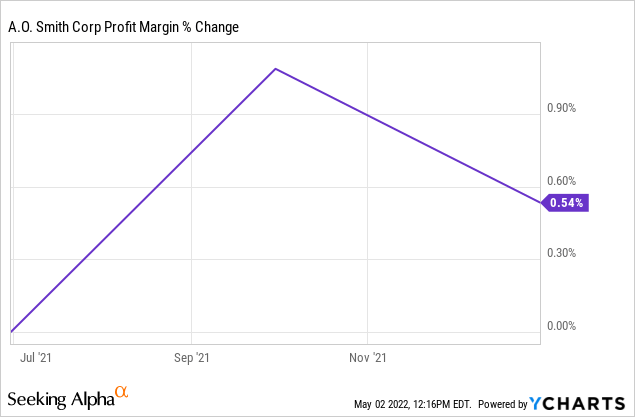

As you can see, AOS has managed to increase its profit margin .54% Y/Y, mitigating higher inflation-related costs and passing them on to the consumer.

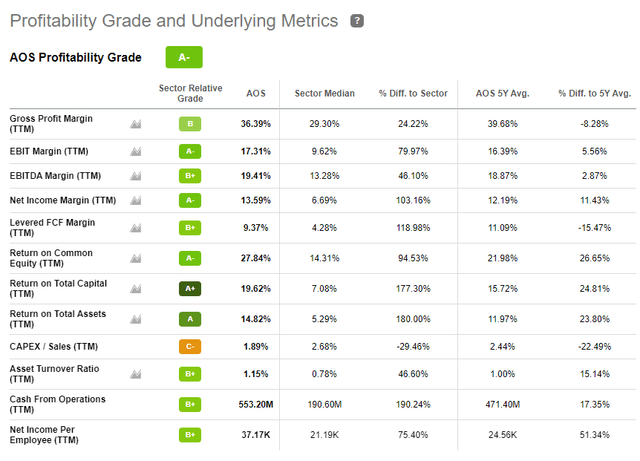

Seeking Alpha seems to agree, rating AOS’s profitability at an “A-.”

Seeking Alpha Profitability Grade (AOS) (Seeking Alpha )

Notably, the company has a 9.37% levered FCF margin, 17.31% EBIT margin, and 13.59% net income margin.

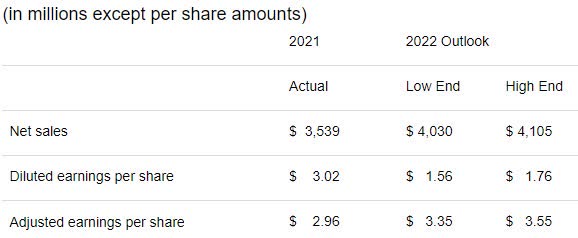

In terms of guidance, the company’s revenue and EPS outlook can be found below.

Company Outlook (seekingalpha.com/news/3828714-ao-smith-sees-a-drop-in-trade-after-investors-sell-off-post-q1-revenue-eps-beat)

The company expects revenue growth of 14% in 2022 on the low end and 16% on the high end.

Returning Capital To Shareholders

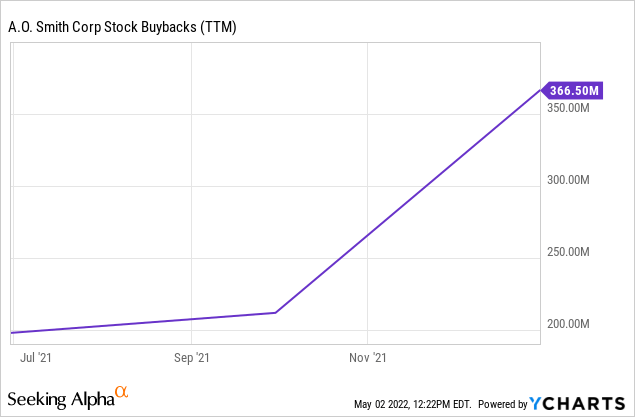

Beyond AOS’s $1.12 dividend/share (representing a 1.92% FWD yield), AOS is also actively repurchasing shares. In Q1-22, the company repurchased 1.49M shares, representing a total $107.9M of repurchases.

Over the past 12 months, the company has repurchased $366.50M worth of shares, continuing to support its shareholder friendly initiatives.

Looking forward, through 2022, the company expects to spend ~$400M on repurchases, representing ~4.5% of the company’s current market cap. This will provide a valuation buffer in the near term for shareholders. Under the company’s current program, it expects to repurchase an additional 5.5M total shares.

AOS Valuation

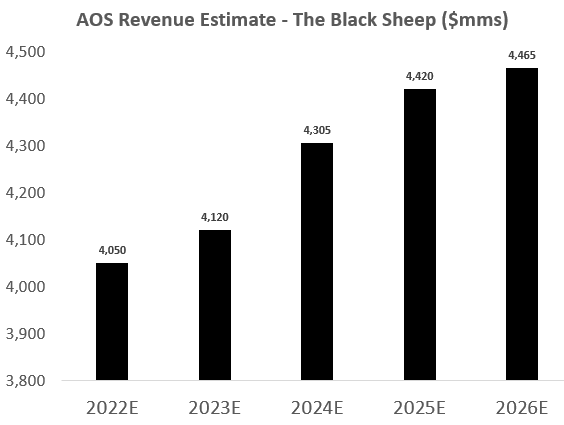

My valuation for AOS is driven by my optimistic top-line revenue forecast which can be found below.

AOS Revenue Estimates (Image made by author using own estimates )

For my 2022 estimate, I split the difference between the company’s low and high-end outlook. For 2023-2026, my estimates are based on my belief that the residential construction market will continue to flourish, and every home will need a water heater. AOS owns a large part (50%) of this market, so the growth in retail construction will be a tailwind for the company’s demand.

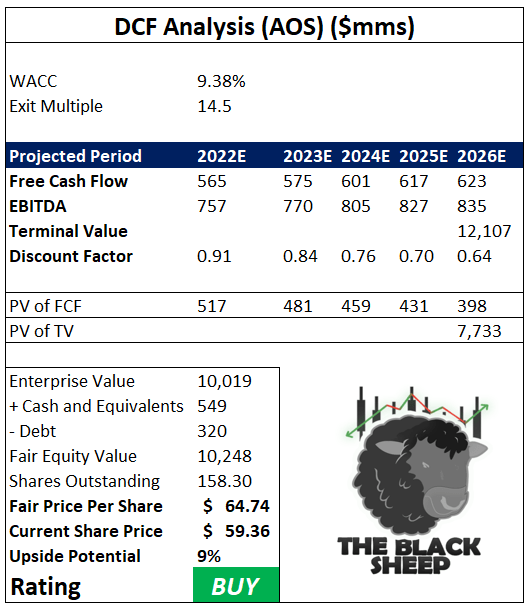

In terms of my free cash flow and EBITDA forecasts, they can be found in my DCF model below.

AOS DCF Model (Image made by author using own estimates )

I assume a 9.48% WACC, 14.5x exit multiple on year-5 EBITDA of $835M, and arrive at a terminal value of $12.107B. After discounting/summing all cash flows and the terminal value, subtracting net debt, and dividing by shares outstanding I arrive at a fair equity value of $64.74/share. This represents a 9% upside opportunity from current levels.

Strong Balance Sheet

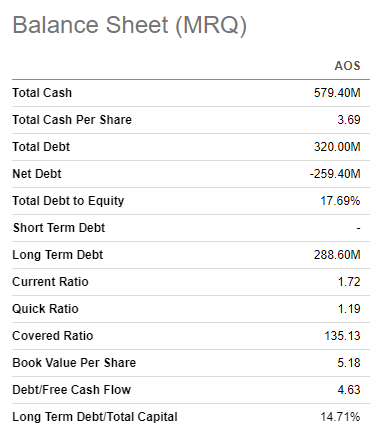

Outlined below are some of AOS’s important balance sheet metrics.

Important Balance Sheet Metrics – AOS (Seeking Alpha Peers Tool )

Overall, AOS’s financial standing is strong. AOS has total cash of $579.40M, measuring out to cash of $3.69/share. AOS has the ability to pay off its total debt load of $320M and have $259.40M to spare, as shown by its net debt of -$259.40M. The company has a current ratio and quick ratio greater than one, with ample liquidity to meet its short-term financial obligations. Most of this cash can be used to repurchase stock/engage in acquisitions, however, as the company’s entire debt load is long-term and non-current.

Final Thoughts

Overall, I continue to hold the belief that AOS shares are undervalued at current levels. As sales grow, the company is able to maintain margins, generate free cash flow, and return excess capital to shareholders. Operations also continue to expand outside of North America which will provide tailwinds for future top-line growth. Given my estimates and future outlook for the company, my DCF model shows that AOS shares are currently 9% undervalued. I assign a “buy” to shares at current levels as a result.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.